Crypto’s Crash Reinforces Old Lessons for Fund Investors

What we found when we looked at the damage cryptocurrencies’ catastrophic 2022 had on certain mutual funds we cover.

When cryptocurrencies cratered in 2022, they left their mark on some mutual funds that invested directly or indirectly in digital coins, trading platforms, or banks with crypto clients.

But the extent of the crypto damage [1] depends on how eagerly the funds jumped on the decentralized finance bandwagon, according to our analysis.

We looked at some of the biggest crypto investors among funds covered by Morningstar analysts to understand the impact. We found a big difference between funds whose crypto stakes were measured and built as part of established investment philosophies and diversified portfolios—and those that seemed to throw caution and prudence to the wind.

Most Funds Were Cautious When Investing in Crypto

Most diversified mutual funds with crypto exposure kept it small, which helped as crypto stocks imploded in 2022.

We searched the holdings of U.S.-based active equity funds for those known to have crypto-related businesses or whose business descriptions contained keywords like “cryptocurrency,” “digital asset,” “bitcoin,” or “ethereum.” We also searched for funds benchmarked to bitcoin and ethereum indexes to capture several exchange-traded funds and trusts offering direct crypto exposure.

Crypto holdings appeared in strategies spanning the market capitalization, value/growth, and Morningstar Analyst Rating spectra, though they tended to concentrate in growth-oriented strategies.

Of those that met our criteria for crypto holdings, a couple with Morningstar Analyst Ratings of Gold and strong investment processes stood out for their unique and modest positions in this new, wild asset class.

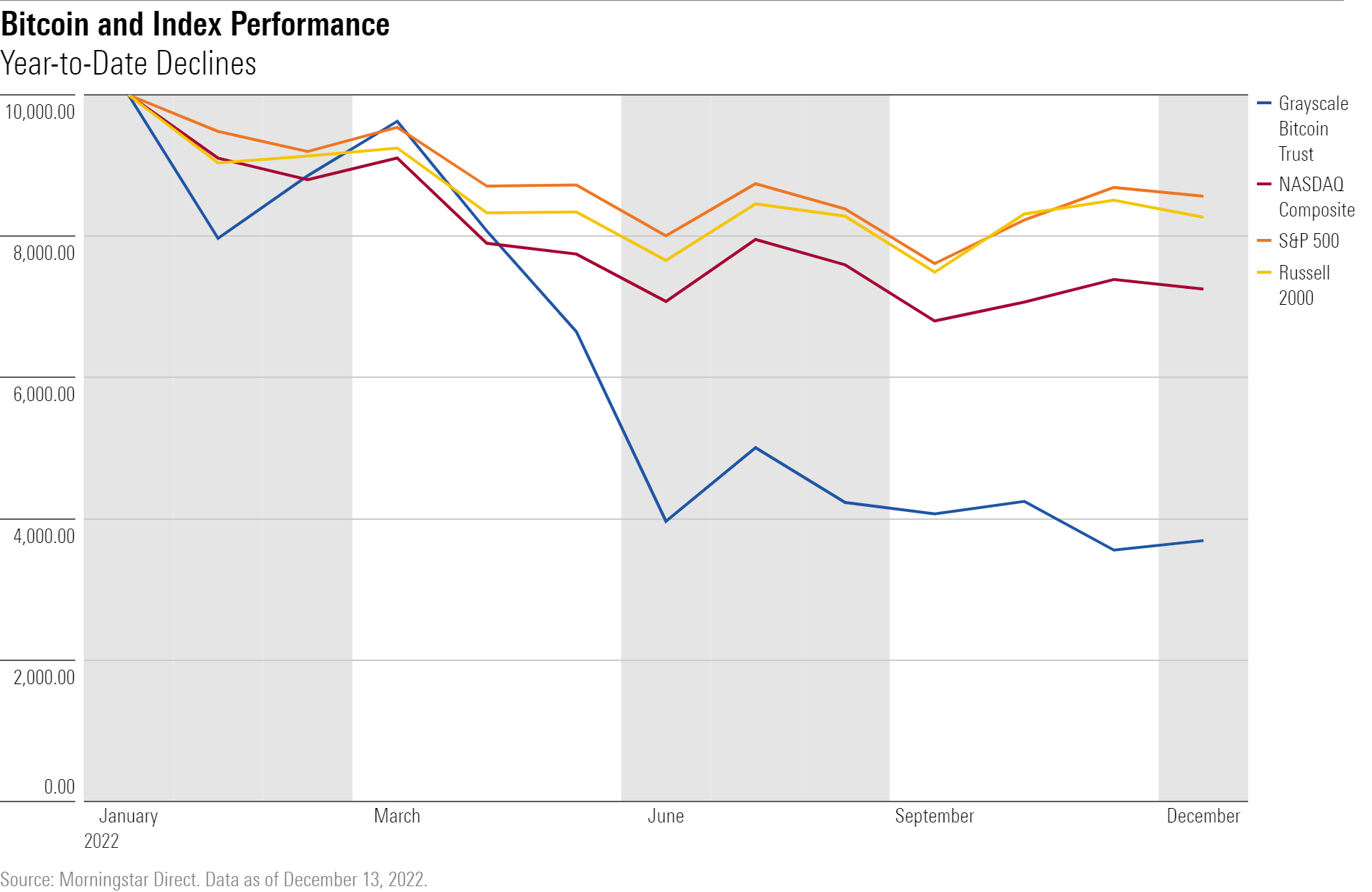

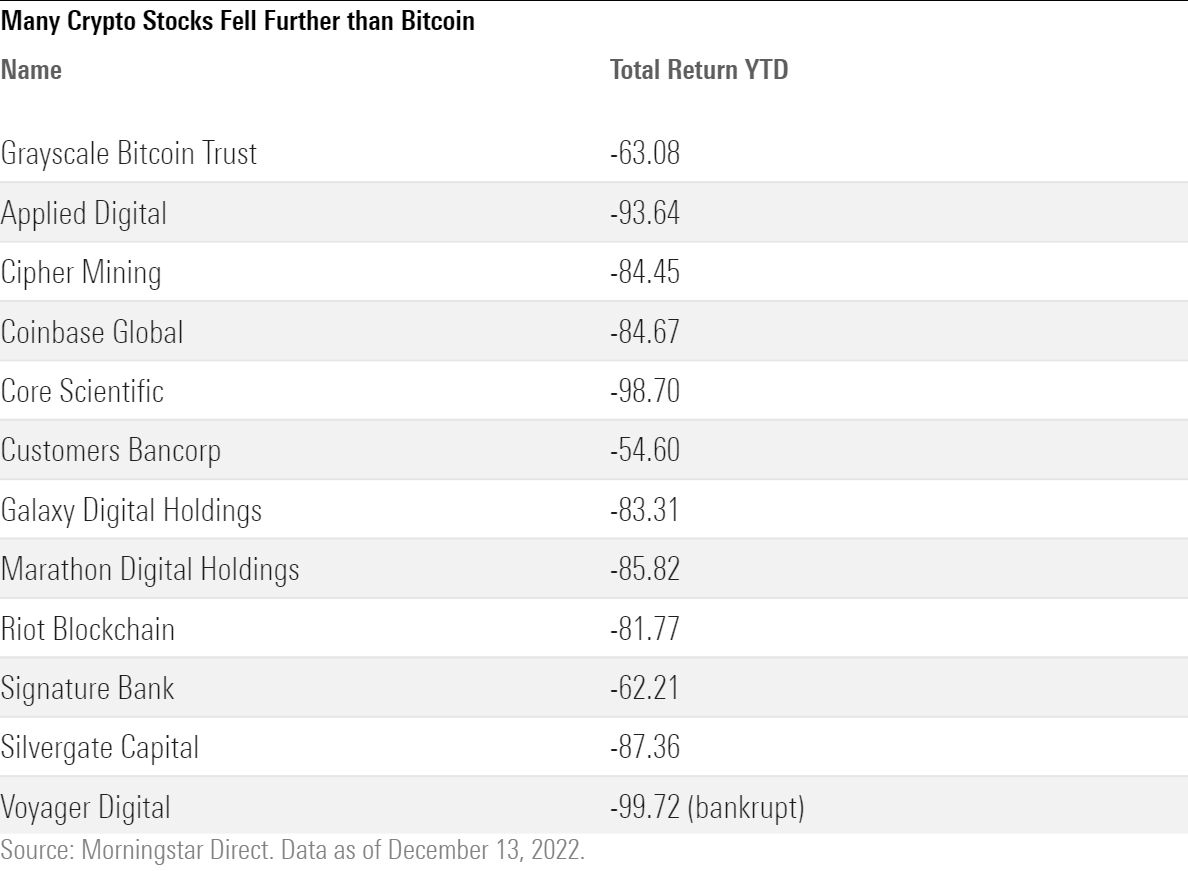

- Morgan Stanley Institutional Discovery MACGX had the largest crypto stake among Gold-rated offerings in 2022, with small positions in Grayscale Bitcoin Trust GBTC, a private bitcoin fund, and bitcoin miner Cipher Mining CIFR. Their combined weighting, however, amounted to less than 1% of assets as of September 2022. While the small holdings’ respective 63% and 85% losses for the year through Dec. 13, 2022, hurt, the concentrated 36-stock portfolio had bigger problems. Rising rates punished the fund’s tech and high-growth stocks, leading to a 59% decline so far in 2022, 36 percentage points worse than the Russell Mid Cap Growth Index’s plunge and trailing 99% of other mid-cap growth Morningstar Category funds.

- PRIMECAP Odyssey Aggressive Growth POAGX was one of the few strategies to own Galaxy Digital Holdings BRPHF, a crypto trading, mining, asset management, and advisory firm. Its tiny stake in Galaxy—less than 0.1% of assets—limited the damage from its 83% loss. Indeed, the Gold-rated fund’s 21% decline was 4.0 percentage points shallower than Russell Mid Cap Growth’s and ranked better than 70% of mid-cap growth funds owing to a large stake in value stocks that lost less than growth equities.

- A look at other crypto owners: Many top crypto owners got their exposure through Signature Bank SBNY, a regional bank that also was one of the few regulated U.S. institutions to accept deposits from crypto exchanges, stablecoin issuers, and bitcoin miners. These clients helped fuel the bank’s rapid growth in recent years and now account for about one fourth of its $103 billion deposit base. Silver-rated Virtus Ceredex Mid-Cap Value Equity’s SMVTX stake in Signature Bank at the end of 2022′s third quarter—2.3% of assets—was the biggest, but Neutral-rated Touchstone Mid Cap Value TCVAX and several Parnassus offerings with ratings from Neutral to Silver (including Parnassus Mid Cap PFPMX, Parnassus Mid Cap Growth PARNX, and Parnassus Endeavor PARWX) each had nearly 2.0% of assets in the bank.

Which Fund Owned the Most Crypto?

Emerald Finance & Banking Innovation HSSAX went all in on crypto.

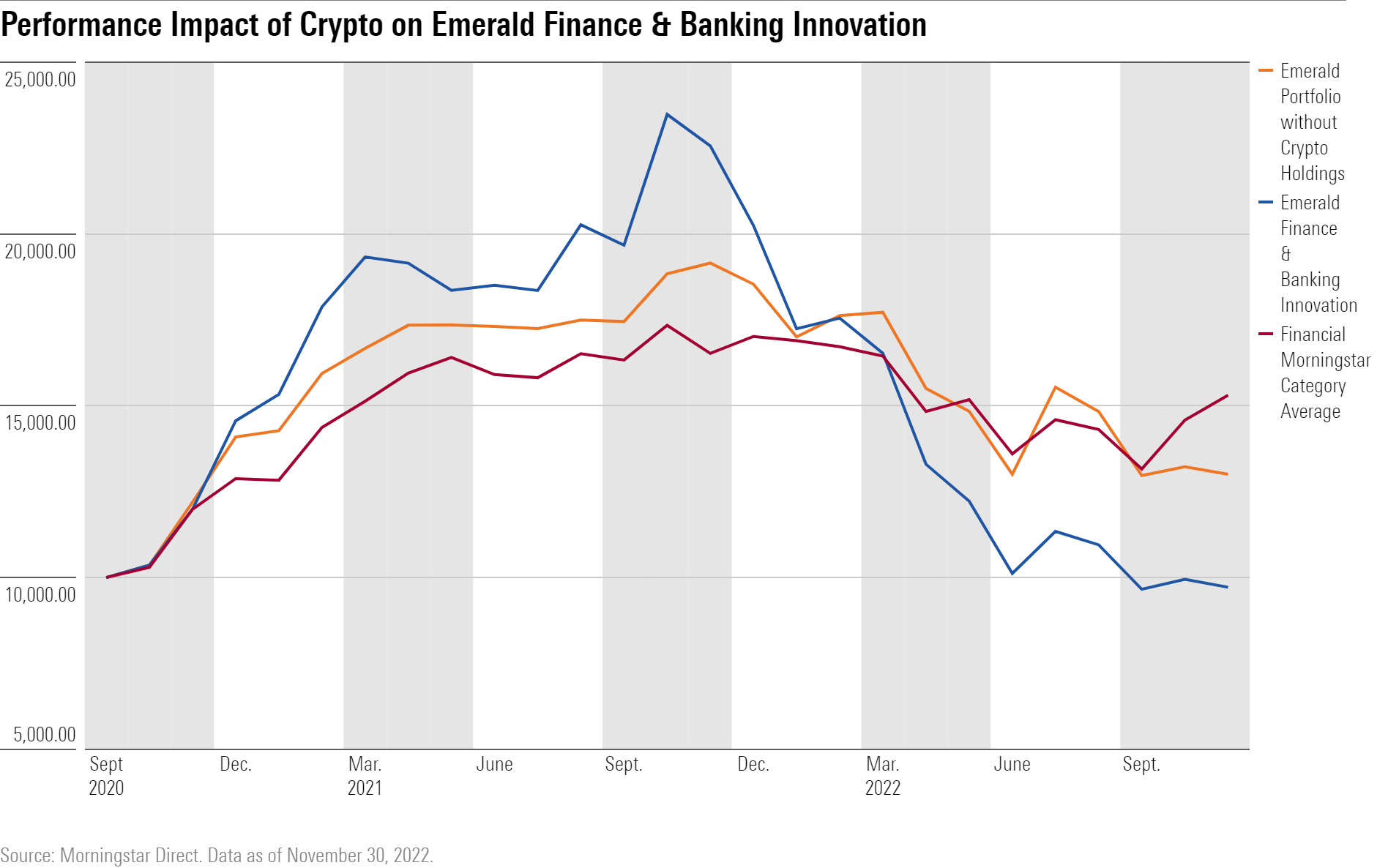

Since 1997, Emerald Banking & Finance kept between 70% and 80% of its assets in staid, small- and micro-cap regional banks. Longtime managers Kenneth Mertz and Steven Russell relied on extensive management team interviews and valuation models to estimate cash flows, earnings, target prices, and downside risks. But starting in late 2020, they grew more venturesome and built one of the largest crypto stakes of any strategy that Morningstar covers. In 2022, the fund changed its name to Emerald Finance & Banking Innovation to reflect its new crypto emphasis.

The managers had often mixed small helpings of REITs, financial technology, insurance, and even gold mining stocks with their regional bank picks. Still, Morningstar concluded the managers had moved outside of their circle of competence and downgraded the strategy’s People Pillar rating to Average, its Process rating to Below Average, and its overall analyst rating to Neutral from Bronze in April 2021.

When crypto peaked in 2021′s fourth quarter, the fund had at least 30% of its nearly $350 million in assets in crypto and 50% in traditional regional banks. Furthermore, the strategy had nearly 5% of assets in direct bets on the price of bitcoin and ethereum at their peak earlier that year. These moves followed several years of regional bank underperformance and coincided with crypto’s explosive gains and increased media attention.

The fund’s timing could hardly have been worse. The shift looked brilliant for a while. In 2021 crypto provided a strong tailwind. Crypto trading firm Voyager Digital VYGVQ, which swelled to 7.5% of assets early that year, gained 220%, helping propel the fund to a 39% annual gain. Recent losses have more than offset those gains. Indeed, if the strategy had not changed its September 2020 portfolio—the last month before crypto first appeared in it—and rebalanced quarterly, it would have gained 30.0% cumulatively through November 2022, instead of losing 2.8%.

That makes the fund’s 54.6% loss for the year through Dec. 13, 2022, especially painful. It was the worst among financial sector funds and the fifth worst out of more the 2,300 strategies that Morningstar covers. Crypto was the culprit. Bitcoin miners Riot Blockchain RIOT and Marathon Digital Holdings MARA; digital infrastructure firms Applied Digital APLD and Core Scientific CORZ; as well as Galaxy Digital each dropped at least 80%. Former top holding Voyager Digital went bankrupt. Big positions in regional banks with crypto capabilities, such as Signature Bank, Silvergate Capital SI, and Customers Bancorp CUBI also sold off. A position in Grayscale Bitcoin Trust didn’t help.

2 Key Takeaways From These Crypto Holders’ Experiences

Emerald Finance & Banking Innovation, whose assets have dwindled to $91 million, lost about twice as much as the average small-growth fund and four times as much as the average financial category peer during the same period. We can learn from its and other crypto holders’ experience, though.

Two lessons stand out:

1. Straying from your circle of competence can be costly.

Emerald Finance & Banking Innovation’s managers had spent decades honing a competitive edge by building contacts in small regional banks and developing a valuation-focused and risk-aware approach for investing in them. They didn’t have those advantages in the crypto universe, where Emerald had few personal connections and standard valuation methodologies had little to no applicability. Cryptocurrencies don’t produce any cash flows to analyze, so they’re only worth what the next buyer is willing to pay for them. That’s difficult to predict accurately and reliably, particularly in a nascent, volatile asset class. That uncertainty extends to many crypto-related businesses’ whose cash flows and earnings depend on cryptocurrency prices. Trading platforms and cryptocurrency miners can become more profitable as prices and activity increase and less so when they fall.

Investors in Emerald Finance & Banking Innovation would have been better off had the managers stuck with their historical focus on regional banks, rather than chasing short-term performance in crypto.

2. Mind the cryptocurrency risk.

Emerald’s huge crypto stake left it vulnerable in a downturn. Other top crypto holders suffered less because they made much smaller bets. Touchstone Mid Cap Value and PRIMECAP Odyssey Aggressive Growth, for instance, held up relatively well versus their respective indexes, despite owning losing crypto holdings. This is testimony to a timeless investing truth: Know what you own and its attendant risks; then size your portfolio positions accordingly.

[1] https://www.morningstar.com/articles/1124629/will-ftxs-collapse-prove-to-be-the-big-one

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c68a6746-dc31-465f-b144-7ec565088c67.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)