U.S. Fund Flows: Investors Bail in 2022

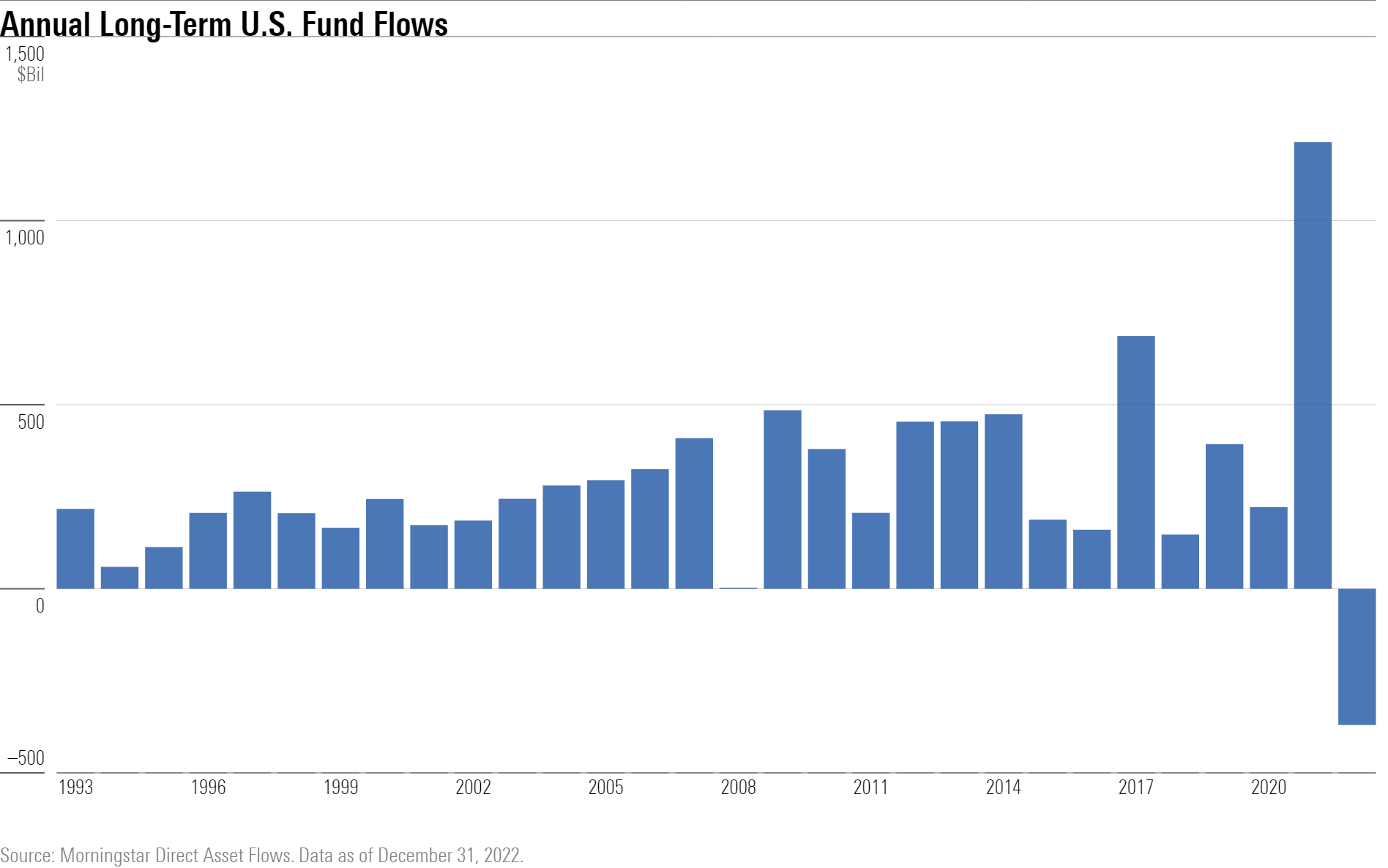

Funds suffered their first calendar year of outflows since Morningstar started tracking, a total of $370 billion.

U.S. funds had outflows of roughly $86 billion in December, cementing their first calendar year of outflows since Morningstar began tracking data in 1993. U.S. funds shed $370 billion in 2022, with six of 10 category groups suffering outflows—another first.

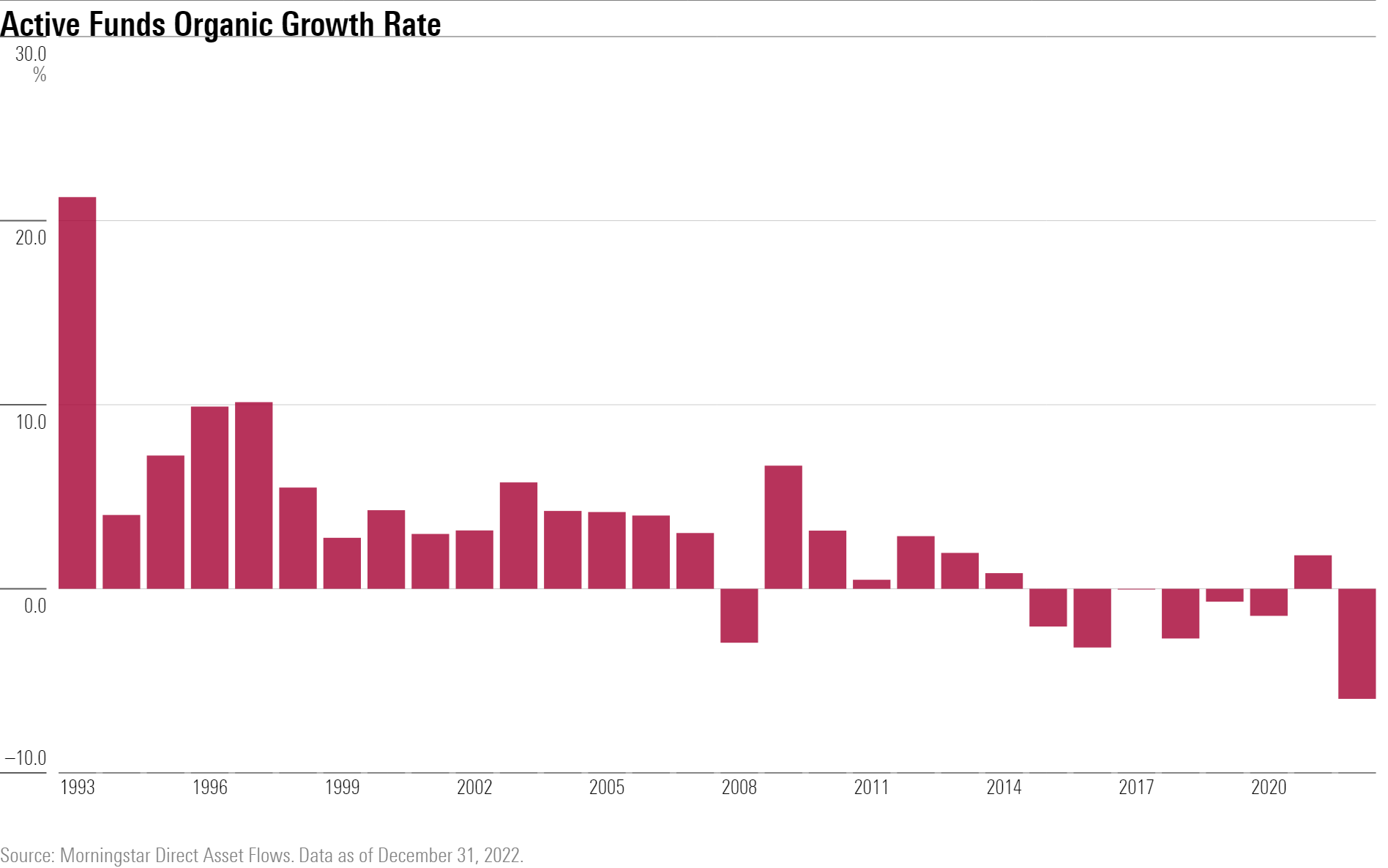

Active Funds Suffered in 2022, While Passive Funds Were Unscathed

Actively managed funds bled an incredible $926 billion in 2022, roughly triple their second-worst calendar-year outflow in 2018. It equated to their worst year on an organic growth basis as they shrank by roughly 6%. Passive funds collected $556 billion in 2022, an impressive total but down about 42% from 2021′s record haul of nearly $1 trillion.

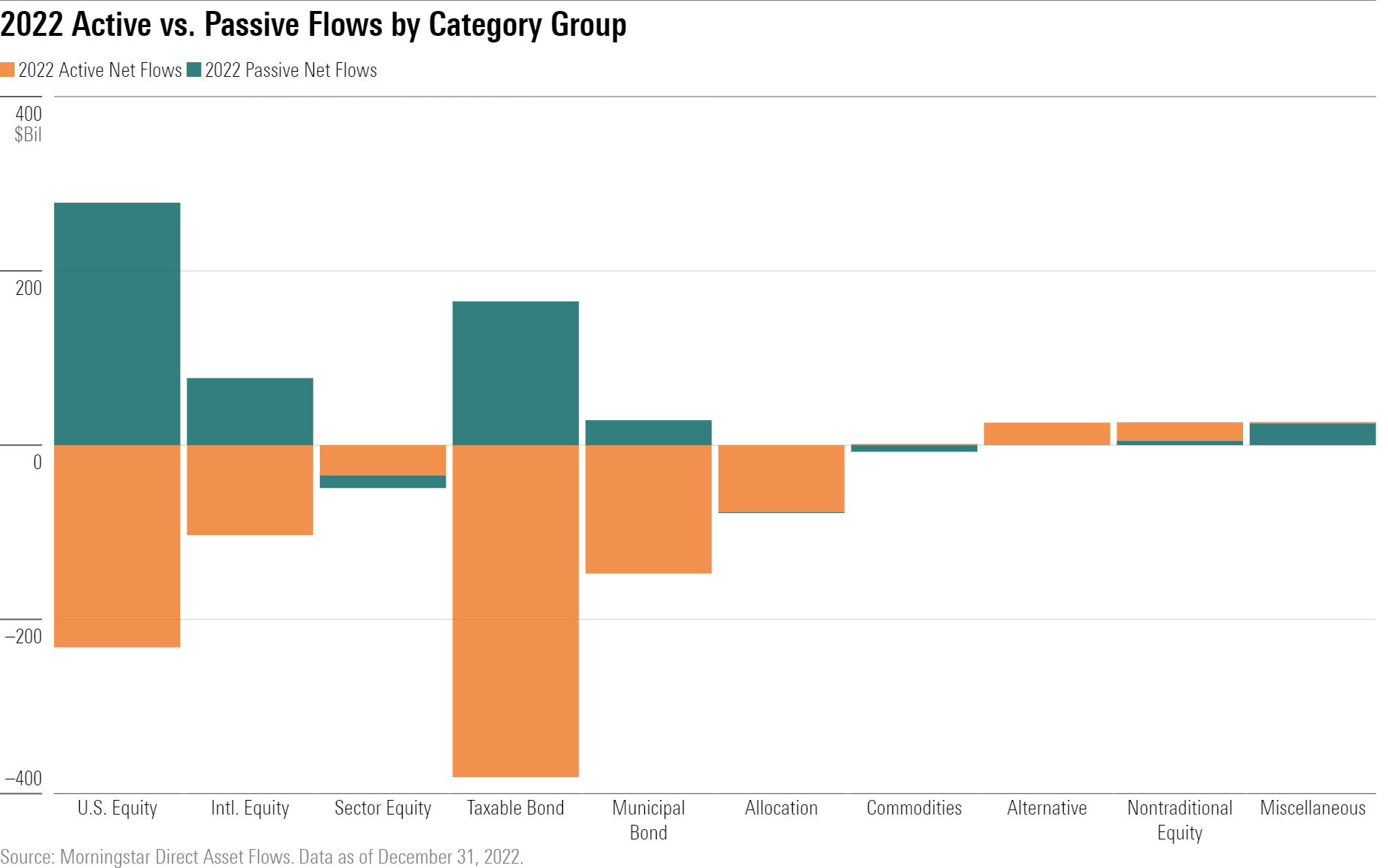

Passives Are Winning Over Investors Across the Board

Except for niche category groups, passive funds fared much better than active ones in 2022. The fact that passive taxable- and municipal-bond funds experienced inflows as their active counterparts suffered their worst year ever speaks to the magnetism of index-tracking funds in today’s market. Investors appear to be buying passive funds in both good times and bad.

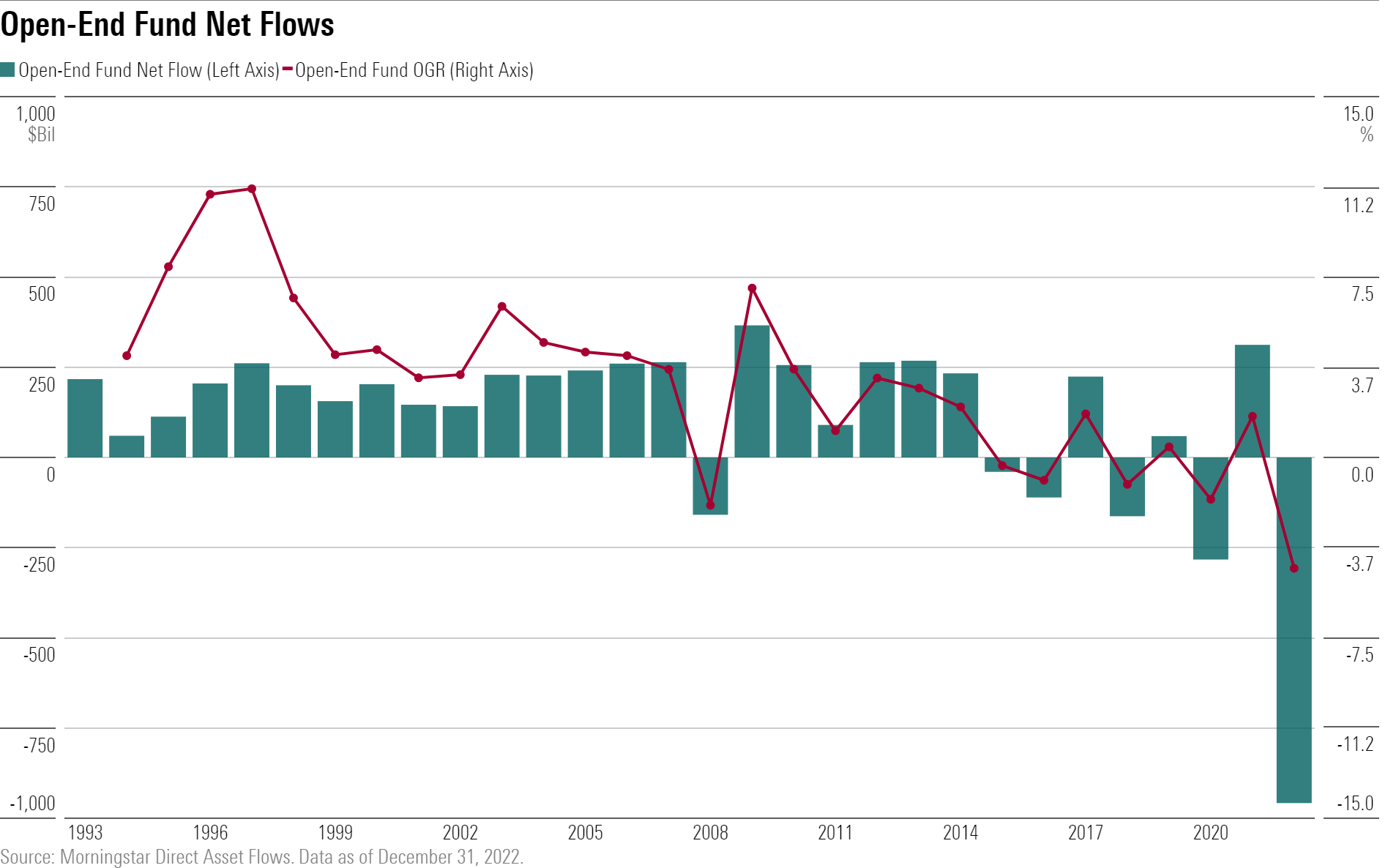

Historic Outflows for Open-End Funds

Open-end funds shed about $958 billion in 2022. That marked their worst calendar year of outflows ever and translated into a negative 4.6% organic growth rate—also a record. Much of that is owed to the struggles of active funds, which hold more than 70% of open-end assets.

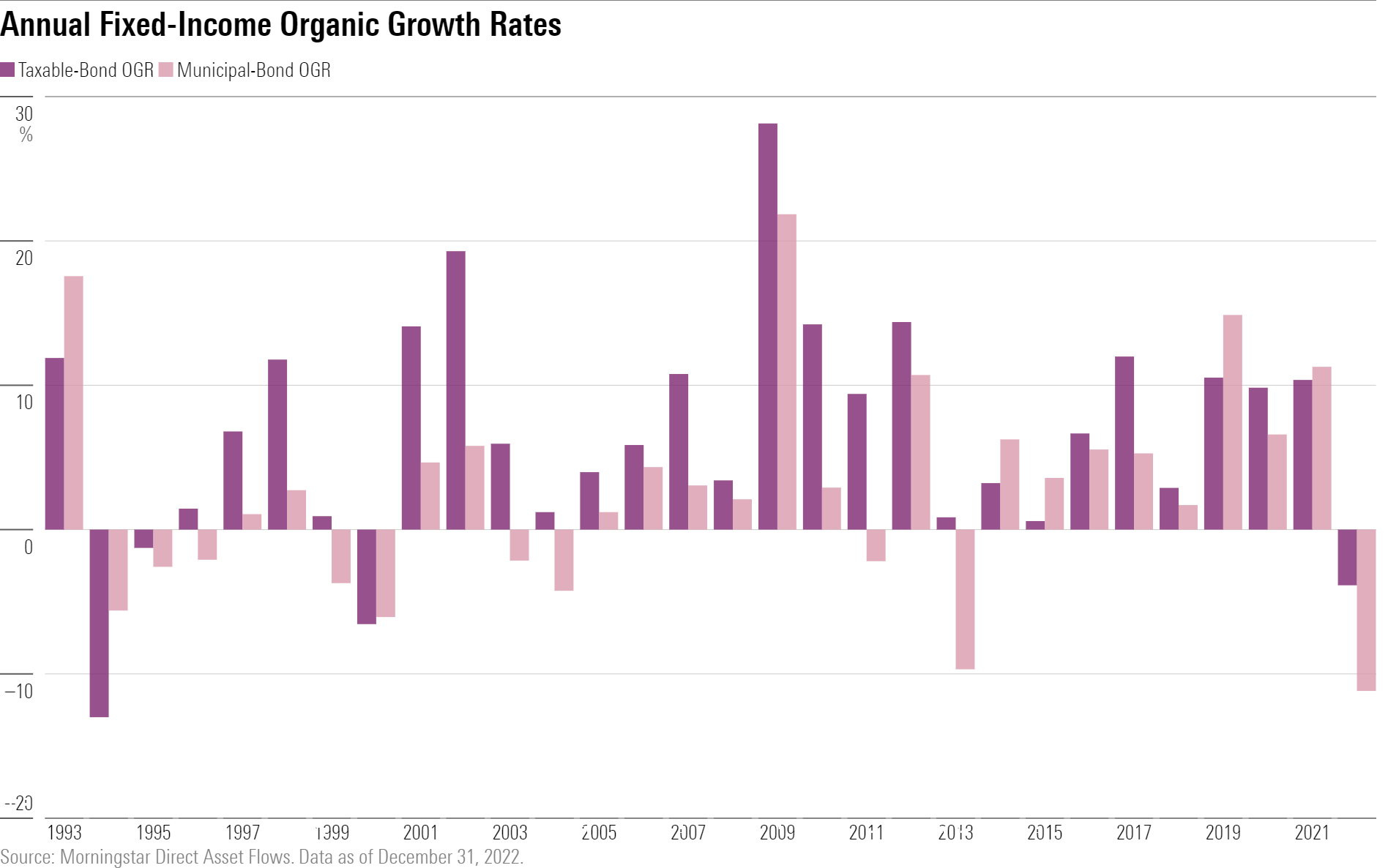

Bleeding Bond Funds

Many broad bond indexes posted record annual losses in 2022. Investors noticed. They pulled a record $216 billion from taxable-bond and $119 billion from municipal-bond funds during the year, both of which translated into their worst organic growth rates in at least two decades. Active bond funds bore the brunt of the outflows, shedding $529 billion.

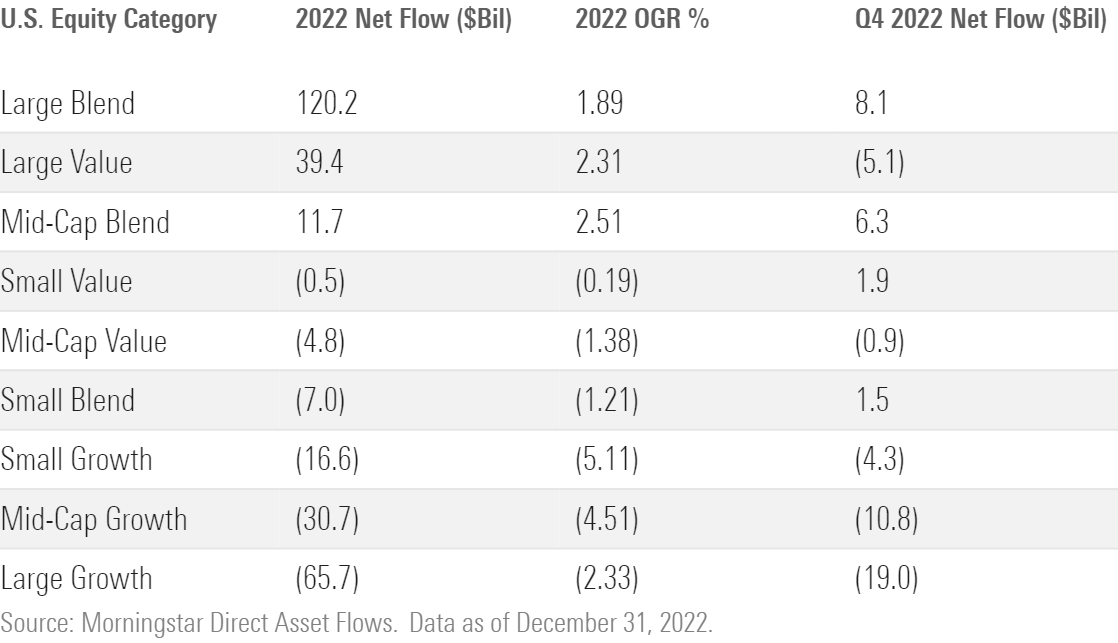

U.S. Equity Funds Have Mixed Showing in 2022

U.S. equity funds remained relatively resilient in 2022 despite poor market returns. They gathered about $46 billion during the year, led by passive large-blend funds’ $144 billion haul. That offset outflows from the other categories, save for large value and mid-cap blend funds, which had good showings, too. Investors redeemed most heavily from growth-oriented funds in 2022.

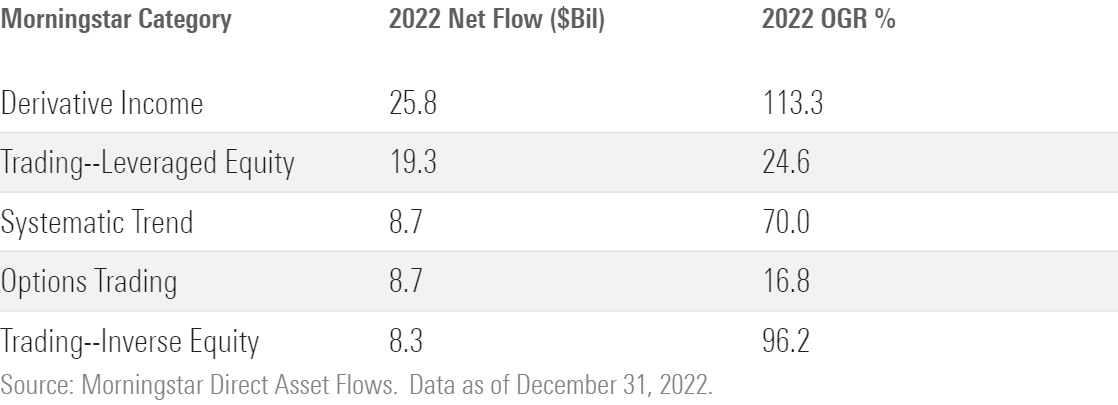

These Specialty Segments Shone Amid the Carnage

Not all funds suffered in 2022. Derivative income funds, which often use covered call strategies, became a popular source of yield. Leveraged long- and short-equity funds saw increased demand as some investors pursued riskier strategies. Systematic trend and options trading funds also had strong years.

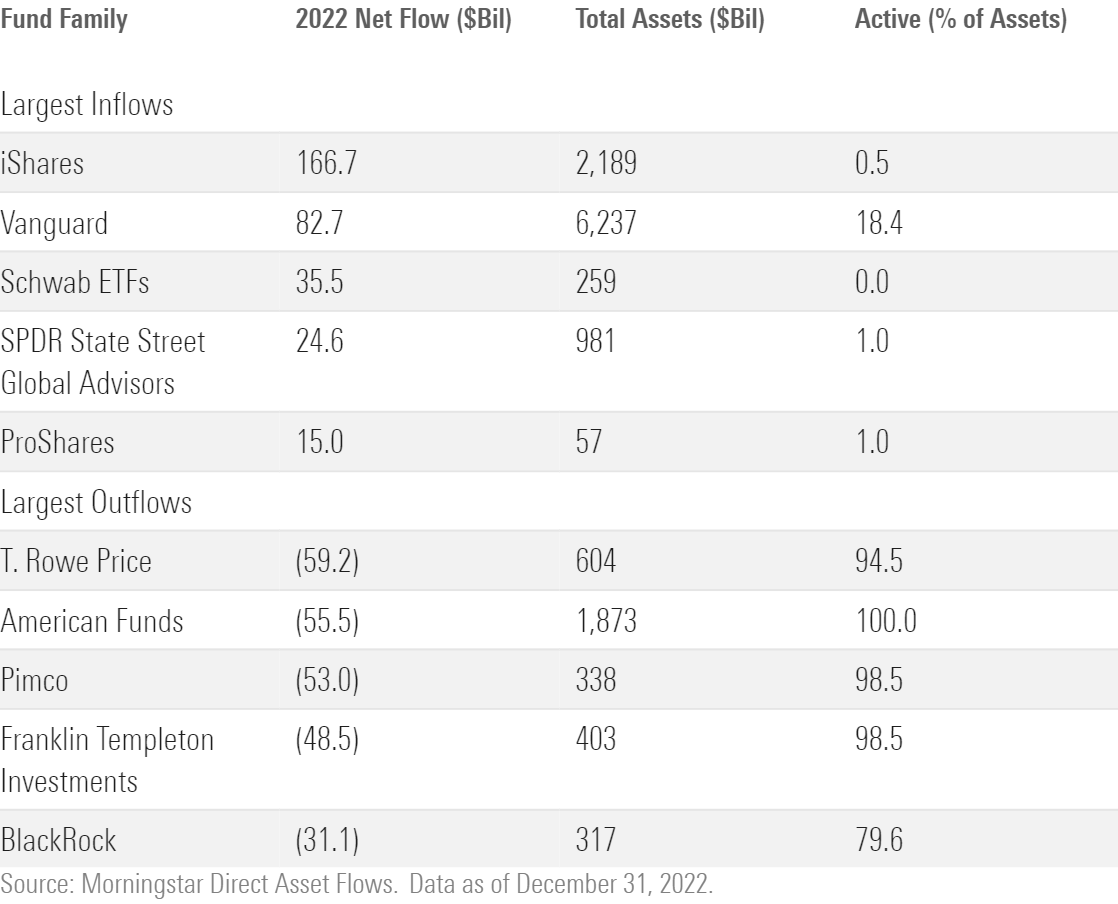

Passive Providers Clean Up

For most firms in 2022, the direction of flows depended on the kind of funds they offer. Those that focus on dirt-cheap index funds—like iShares, Vanguard, and Schwab ETFs—continued to dominate the flows league table. Meanwhile, shops known for active investing suffered heavy outflows, particularly those with hefty bond strategies on their rosters.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for December 2022. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)