Have an Annuity? Consider Investing More Aggressively

Annuitizing is just the first step in seeking the potential benefits of guaranteed lifetime income.

Researchers (including us) often find that retirees can benefit from partial allocations to annuities. But what should be done with the rest of the portfolio after the annuity has been purchased?

Most of the time, the remainder should be invested more aggressively because annuities typically fall into the fixed-income asset class. This point applies to all income-focused annuities, namely, income annuities (for example, a single premium immediate annuity, or SPIA) and deferred annuities with a guaranteed living withdrawal benefit, or GLWB, feature. I am not talking about accumulation-focused annuities here, though some of the same points may apply.

It is very important for retirees to estimate an annuity’s fixed-income asset-class exposure and periodically rebalance their investment portfolio accordingly, as not doing so can lead to worse outcomes in retirement.

Estimate an Annuity’s Fixed-Income Exposure and Rebalance the Portfolio Accordingly

Retirees typically buy annuities to get lifetime-guaranteed income, which generally acts like assets in the fixed-income asset class. Some examples include fixed SPIAs, fixed deferred income annuities, and fixed indexed annuities with a GLWB. Variable deferred annuities with a GLWB also provide some fixed-income asset-class exposure because of the guaranteed withdrawal benefit stream.

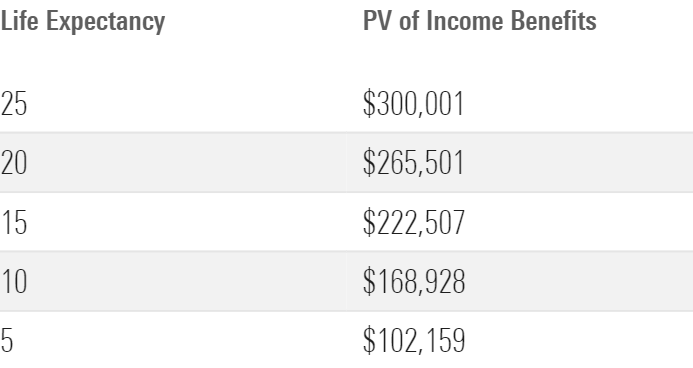

A straightforward way to determine how much fixed-income-like exposure the annuity provides is to treat the present value of income benefits as a bond. The time horizon for the present value calculation should be life expectancy.

Regarding deferred annuities with a GLWB, if the present value of income benefits is less than the account balance, then I would consider the remainder as equity asset-class exposure if it is a variable annuity or fixed-income asset-class exposure if it is a fixed annuity.

The table below shows the fixed-income asset-class exposure provided by an annuity, assuming a 4.5% discount rate and a $19,806 per year annuity benefit (this would be the payment from the income annuity or the GLWB).

A note on the discount rate for the technically minded: Annuities are comparable to low-risk bonds, so one could use the AAA seasoned bond yield or Treasury yields to discount future annuity cash flows.

The next step is to rebalance the portfolio. To do this, I count the present value of income benefits from the annuity as part of the overall portfolio’s fixed-income exposure. I then solve for how aggressively the nonannuity portion of the portfolio should be invested such that the overall target equity/risk level is met.

For example, assume that the total portfolio is worth $1 million and that the fixed-income asset-class exposure from the annuity is $300,000. If the overall target equity level is 40%, then the nonannuity portion of the portfolio should have a 57.14% allocation to equities. This is because 57.14% * $700,000 = $400,000, or 40% of the total portfolio.

Invest More Aggressively to Effectively Use Annuity Strategies

Why is what I outlined above important? Well, to help realize the potential benefits of using an annuity, retirees should consider investing more aggressively than they otherwise would. If they do not, they run the risk of maintaining too high of an exposure to bondlike assets, potentially leaving less wealth to fund expenses later in retirement.

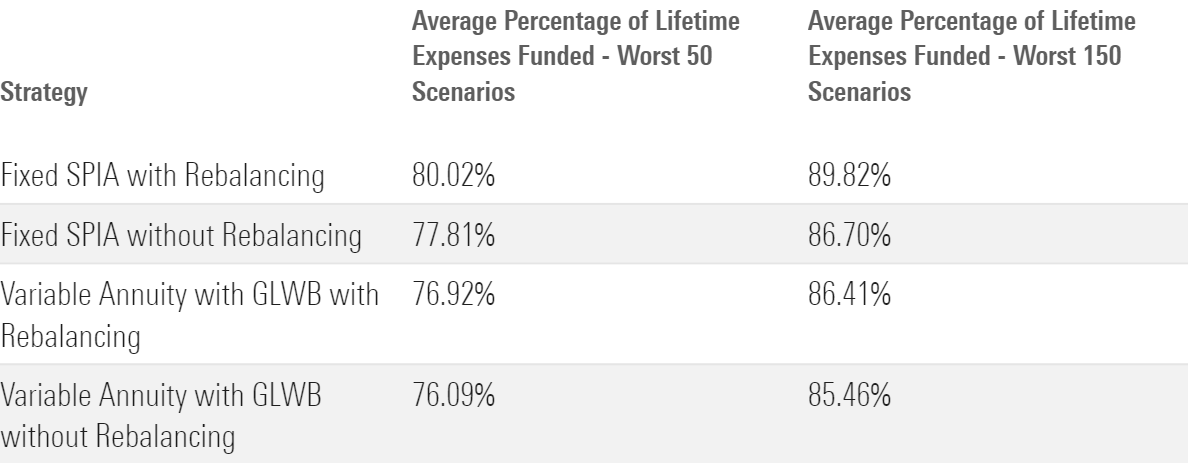

The table below shows a comparison of the average percentage of lifetime expenses funded with and without annual rebalancing. More detail about the metric and analysis are available in my report on lifetime income strategies.

The results show that estimating an annuity’s fixed-income asset-class exposure and rebalancing the investment portfolio accordingly leads to a higher percentage of expenses being funded in our projection.

Failing to adjust the rest of the portfolio after an annuity purchase can lead to worse projected outcomes in retirement than skipping annuities altogether. Annuitization can be valuable, but annuities must be part of a coherent, holistic product allocation strategy to help maximize their potential benefit to retirees.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)