Practice Made Perfect: How Advisors Can Solve the Capacity Problem

Here’s how to grow your practice without sacrificing excellent service to clients.

The biggest problem the best advisors face is capacity. Providing excellent service to clients takes time. Excellent service, in return, attracts more clients—resulting in the need to find more time! How can advisors add capacity without compromising service or working 80 hours a week? Simply adding staff is not always the appropriate solution. The best approach depends on the firm and its situation. Just as there’s no one-size-fits-all financial plan, there’s not a single course toward a more perfect practice.

We’ll tackle these issues in my new column, “Practice Made Perfect.” I’ll admit that it’s impossible to make a perfect practice, but “Practice Made Better” isn’t as catchy! In each column, I’ll take an in-depth look at a financial advisory practice and recommend changes the principals can make to improve the firm’s efficiency and capacity.

The firms I will work with are those I would be comfortable investing my money with. My goal is to help them help more clients while doing it well.

If you’d like your firm to be a future Practice Made Perfect subject, please drop me a line at sheryl.rowling@morningstar.com.

For the first Practice Made Perfect, I chose BCR Wealth Strategies. The Birmingham, Alabama-area firm has been on my radar for a long time. I had a general sense of its practices and policies, but I admit I was blown away when I first interviewed the team for this column. BCR seemed to check all the boxes. My initial thought: How could I possibly find ways to help them perfect an already well-run practice?

But with success comes challenges. BCR wants to become even more efficient, so it can add more clients without compromising quality or service—and without adding more work hours to the firm’s principals. The firm asked me for help. After talking with the team and studying the firm’s operations, I have a few ideas. But first, let’s get to know BCR Wealth Strategies.

Meet the Firm: BCR Wealth Strategies

Founded in 1995, BCR offers comprehensive financial planning and tax-efficient investment management on a fee-only basis. The firm prides itself on personalized, attentive service as part of its “Your Plan to Succeed” process.

The leader of the firm is CEO and majority shareholder Marshall Rathmell, CFP, CPA/PFS. He is the successor to the firm’s founder. Rathmell’s team includes a lead advisor, a relationship manager, two financial planning analysts, an investment analyst, two operations specialists, an office manager, and a part-time virtual assistant. Among this group are two partners and a four-person leadership team.

In addition, an advisor in New Jersey runs his own “mini-practice,” and another advisor is nearing retirement. There are also two financial planning and operations interns.

Most BCR employees work regular hours, with standard vacation time. Rathmell says he works about 60-70 hours per week and takes two to three weeks of vacation per year (although Rathmell does admit he works during his vacations). Having young kids, Rathmell has lots of energy and loves the pace of work and family life. He also finds time for running, camping, and doing charity work.

Assets Under Management and Fee Structure

BCR invests about $350 million for about 300 households. Portfolios also include outside accounts, such as 401(k)s, that are integrated through Morningstar ByAllAccounts. BCR negotiated a favorable cost of custody with BNY Mellon’s Pershing, where the majority of its clients’ investment assets are held.

Management fees are billed quarterly in advance and are based on portfolio size, starting at 1.25% and dipping down to 0.5% for portfolios greater than $25 million. About 85% of clients are covered within three fee schedules. The firm has a minimum annual billing of $6,250 for new clients but will make limited time exceptions for young clients with high potential and aspirations.

Back Office

BCR uses software to better ensure quality and consistency across the firm, including:

- Orion (portfolio accounting, reporting, rebalancing)

- Citrix (encrypted file sharing)

- Morningstar ByAllAccounts (outside accounts integration)

- MoneyGuidePro (financial planning)

- Redtail (client-relationship management)

- Morningstar (research and analysis)

- Fi360 (research and analysis)

- DFA’s Returns Web and other tools (research and analysis)

- Advisor Websites (website design)

The team is investigating programs for tax planning and calendar scheduling. Another issue identified by Rathmell is the need to implement the client portal at Orion, so that clients have access to documents and can see their entire portfolio in one place.

Billing is done along with quarterly reporting. Orion provides the reports, but the firm adds in the billing and sends them directly to clients. (Orion can provide this service but offers local postage only.) This process takes about three days per quarter.

The firm does not use risk-tolerance software nor does it outsource any tasks.

The team emphasizes use of software. One internal mantra is, “If it’s not in Redtail, it didn’t happen.”

Client Services

The firm’s policy is for staff to respond to clients’ inquiries within two hours. If more time is needed to answer a question, the client at least has been acknowledged.

BCR regularly communicates with clients. In addition to quarterly reports, the firm sends newsletters, calls clients at least quarterly, holds annual meetings, sends personalized holiday and birthday cards, gives an annual gift (such as a nice umbrella or blanket), and hosts client-appreciation events. The firm plans to offer webinars.

Marketing

Most new business comes through referrals from clients and other professionals. Some new clients come by way of networking, promotion, and social media.

Although the firm does not have a formal client acceptance checklist, BCR seeks clients who value advice and prefer to delegate investment management.

Financial Planning

There is no charge for financial planning for investment-management clients. The firm’s policy is to provide basic recommendations before onboarding any investments. Once a prospect becomes a client and onboarding is complete, a comprehensive financial plan is presented to the client via MoneyGuidePro.

Investing

BCR follows Modern Portfolio Theory and seeks to earn tax-efficient returns that are appropriate for the risk the client is willing to take.

BCR’s 10 investment models are developed in-house, using multiple resources including Morningstar, Fi360, and DFA tools. Models generally range from 40% equities/60% bonds to 100% equities, with intermediate steps at 10% intervals (although some models have 5% intervals). The models are implemented with low-cost mutual funds and exchange-traded funds. The strategy is evidence-based, using providers such as DFA, BlackRock, Vanguard, and Avantis.

Once determined, the strategy is documented with an investment policy statement.

The trading process relies on Orion’s rebalancing tool, Eclipse. Each trade goes through three stages involving a different person at the firm: trade proposal, initial review, and final review.

Security

BCR checks all the boxes for security. The firm uses encrypted file sharing. It has both a succession plan and a continuity plan. It also has errors and omissions insurance.

Employee Benefits

Employees are provided standard benefits, including sick time, vacation, health insurance, bonuses, and a 401(k) plan. New employees are found primarily through the University of Alabama’s financial planning program and through recruiters.

Revenue

Revenue growth was fairly flat from 2019 to 2020 but increased a hefty 27.6% from 2020 to 2021. First-quarter 2022 revenue was up more than 17% from 2020′s average.

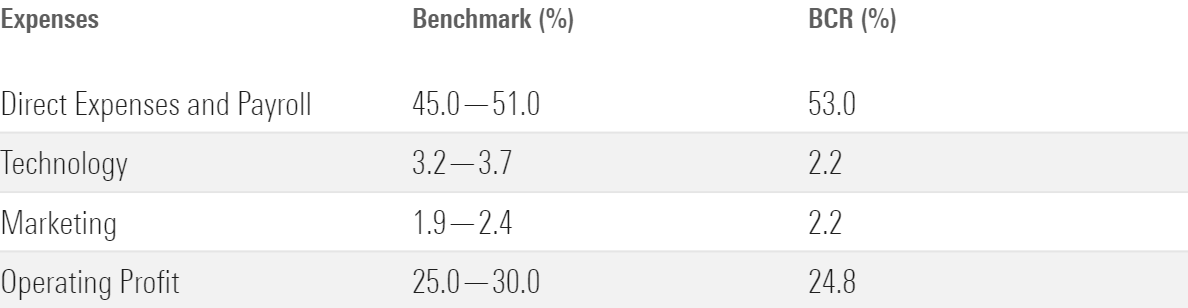

Expenses

BCR’s expenses are in line with firms of similar size and revenue. In the table below, we compare BCR’s expenses as a percentage of revenue, based on its 2021 financial statements, with those listed in the Investment News Pricing and Profitability Study—2020 Update. I expect the firm’s 2022 results will compare favorably with those of 2021, as well as its benchmarks.

BCR’s Top Challenge: Prep for Future Growth

BCR is a well-run firm that goes above and beyond for its clients. BCR wants to continue to grow but is concerned about maintaining its high level of service and putting too much pressure on its team.

Rathmell is in his early 40s and brings energy to the job he loves. But when I joined the Zoom meeting to interview him, I was surprised to learn that he had COVID-19 but that he had not wanted to cancel on me “just because I am sick.”

Although Rathmell thrives on hard work, this level of energy cannot be relied upon years down the road. This is the top issue facing BCR. The time to prepare for the future is now. To maintain its high level of excellence into future decades as it grows, I recommend that the firm:

- Hire in advance of need.

- Delegate more effectively.

- Continue to wisely purchase and use software.

- Evaluate client profitability.

How “Prehiring” Leads to Growth

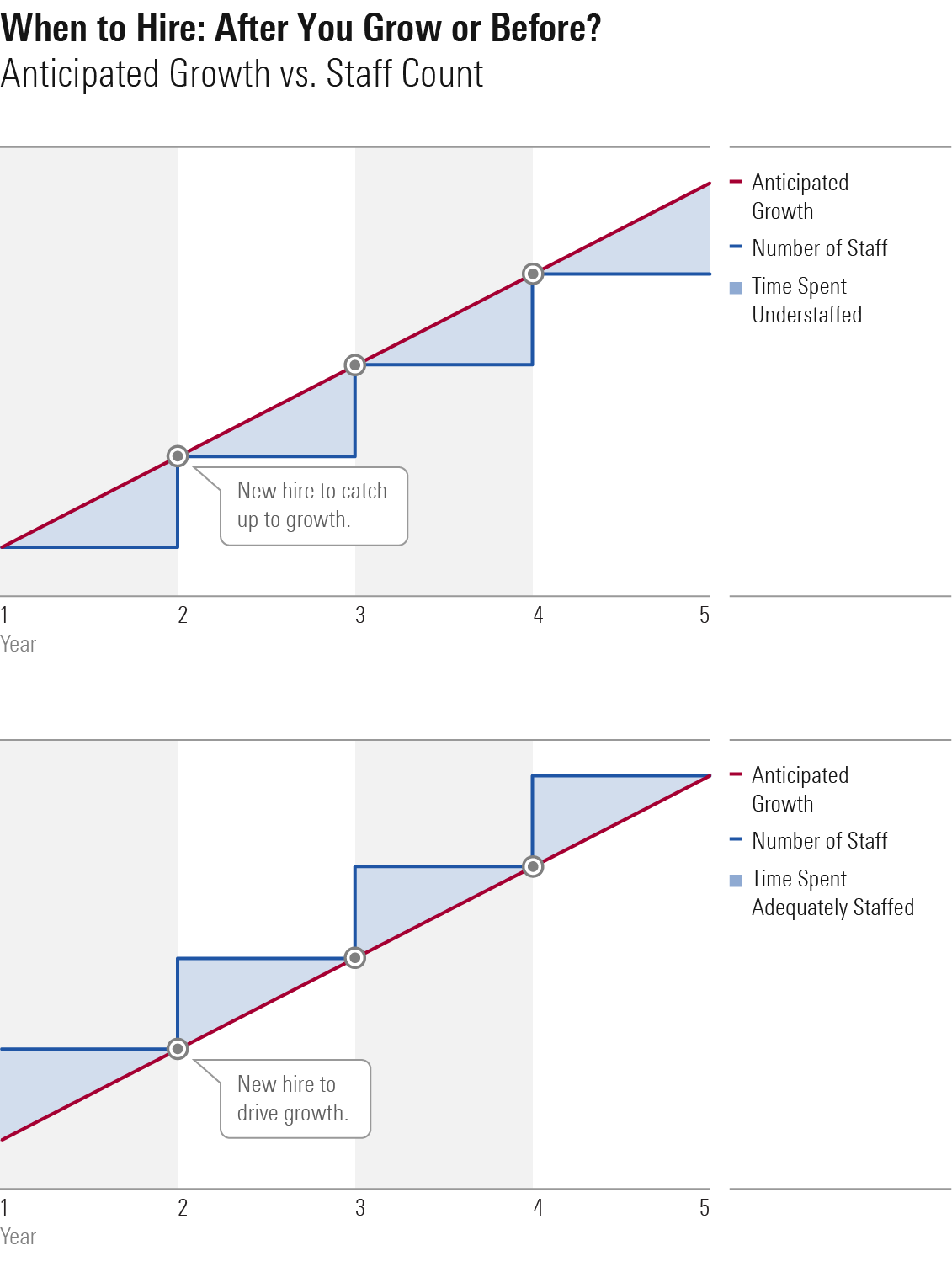

For a growing business, staffing needs tend to increase gradually until suddenly, a firm is overworked and short-staffed. It’s easy to understand how this happens. Why hire a full-time employee when only a few extra hours a week are needed to be filled? But waiting until capacity is stretched is the exact wrong time to hire. Why? Because, as shown in the first diagram below, the firm will be understaffed most of the time. Theoretically, it will be fully staffed upon hiring a new employee. In reality, as we all know, it takes time for a new employee to be trained and integrated into the practice. Thus, a growing firm that hires only when there is a dire need will constantly be playing catchup.

A better approach is to hire before the need arises. Think of it as “prehiring.” You’re getting a jump on meeting the future staffing needs of a growing firm and will always be adequately staffed. This will allow you to continually offer the full provision of your client services while allowing flexibility for vacations and sick time. The second diagram below shows the impact of prehiring.

One objection some employers have to prehiring is cost. If you hire before there’s a need, your costs will be higher and your profit will be lower. In my opinion, this strategy is not a cost increase; it is an investment. The risks of being understaffed include employee burnout, mistakes, and gaps in client service. And although I am a big proponent of making a profit, the relative cost of adding an employee is minor compared with the revenues generated by extra growth. I always emphasize focusing on growth in revenue over reduction of expenses.

In BCR’s case, the firm knew it needed to add staff, but with job-seekers being scarce they hadn’t had success. I showed the firm that by adding only $500,000 of annual revenue from new clients, hiring an additional $100,000 employee would still enable the firm to maintain or grow its profit margin percentage after the other variable costs.

BCR listened to me and put a greater focus on finding the right people. The firm immediately hired two qualified financial planning analysts and a relationship manager.

Because it isn’t always easy to find high-quality candidates, and to expand the diversity of its talent pool, I also recommended that BCR expand its searches beyond local universities and recruiters. I told the firm to post open positions on social media, advertise with the Financial Planning Association and other professional organizations, and broaden its search to universities nationwide with financial planning programs. Finally, engaging an executive search firm can often succeed when the do-it-yourself methods fail. I recommend all firms recruit this way.

Delegate, Delegate, Delegate

Hiring enough employees is only part of the equation. To truly help grow the firm, employees must be used effectively. In other words, work must be properly delegated to employees.

For principals who are used to doing everything themselves, delegation is difficult. After all, it is always quicker and easier to handle tasks personally. Unfortunately, this can lead to overworked, stressed-out principals and ultimately result in lack of capacity. So, as painful as training, reviewing, and correcting can be, delegation is essential to growth. Time spent on delegation now will turn into saved time in the long run.

Effective delegation can enhance quality control as well as allow backup functionality. The goal, as discussed in Michael Gerber’s book “The E-Myth Revisited” is to create a business that can operate without any one person. Without this, the principals will not be able to comfortably take any time off.

When I recommended this book to Rathmell, he said he had read it. He has since reread it with the team members, and they have agreed that it will help everyone grow in their careers with BCR.

Through more effective delegation, Rathmell should be able to limit his work time to 40 hours per week. Because Marshall likes working more hours, he can certainly continue to do so, but the extra hours can be spent on discretionary work such as networking, continuing education, and client interaction.

I should note that delegation doesn’t just involve internal employees. Tasks can be delegated to outside providers, too. For example, some compliance duties could be performed by a compliance consultant, or business development/marketing services could be supplemented by an outside firm.

Whether delegation is internal or external, the key questions principals must ask themselves for each task are:

- Must this task be done?

- If yes, must it be done by me?

BCR also modified its trading procedures. Instead of Rathmell approving every trade, senior advisors now approve routine trades. Rathmell’s approval is required only for trades deemed exceptional.

With the entire firm diving into “The E-Myth Revisited,” BCR has also streamlined other processes while empowering team members to expand personal responsibilities. Rathmell has worked with Client Wise for several years for coaching on team and industry knowledge, but he decided that he will be going a step further in the coming year by also hiring Stewart Leadership to coach him on being a better CEO and leader.

Stay on Top of Software

For BCR, hiring to avoid staffing shortfalls and learning how to effectively delegate responsibilities to staff will put the firm well on its way to a prosperous future. BCR should have little trouble maintaining its high level of excellence as it adds clients.

However, BCR expressed other concerns to me, namely that it had gaps in its software usage. I often tell advisors that when considering adding software, they should focus on the biggest pain points first. BCR is already highly automated, but anything that adds efficiency should absolutely be considered. Michael Kitces says that he is willing to spend $100 on software to save one minute a day. Still, I would rate BCR’s gaps as minor. BCR is already taking advantage of almost every type of wealth-management-related software available.

But Rathmell was eager to find an appropriate tax-planning solution. As a CPA, I am a fan of BNA Tax Planner as a stand-alone program or Lacerte Planner as an add-on to Lacerte’s tax-preparation software. BCR decided to go with Holistiplan. This program offers tax planning as well as analysis of key metrics from clients’ tax returns to identify tax-saving opportunities.

Find Ways to Be More Profitable

There is a thin line between what is a fair profit and what is excessive. Although BCR earns a reasonable profit, as a percentage of gross revenue, it is on the low side of average (see above). BCR has a minimum annual fee of $6,250 for new clients. When we analyzed its 2021 overhead and payroll costs, BCR’s cost per portfolio was more than $6,400. It is clear that the firm’s minimum fee needs to be increased periodically.

It is also important to regularly review the firm’s client mix. Rathmell was already familiar with the need to do this. However, like the minimum fee, I had a feeling that this review had not been addressed recently. I recommended BCR divide clients into four groups:

1) Low fees, low effort

2) Low fees, high effort

3) High fees, low effort

4) High fees, high effort

Clearly, category 3 clients are most desirable. (These are the clients you should focus referral efforts on.) Category 2 clients are those that should be released. They sap profitability and take time away from other clients. How do you release low fees/high effort clients without generating bad will? Either refer them out to a more appropriate firm or raise your prices. If the client is willing to pay higher prices, they would move from category 2 to category 4!

I recommended that BCR reconsider its practice of providing an initial financial plan at no cost. Although it could be a good marketing point, I have found that it makes sense to charge for initial plans. Clients who are willing to pay for a plan tend to value the advice more and demonstrate that they value professional advice.

BCR Is Positioned for Growth

BCR is a great firm that provides excellent service to clients by putting their interests first. With a few tweaks, BCR can be positioned for more growth, enabling more clients to be served by their expertise. With these changes, BCR should be well-positioned to continue to add clients and grow its business without sacrificing its excellent service and overburdening the team.

Would you like your firm to be considered for the next Practice Made Perfect analysis? We are looking for other high-quality firms in need of advice to get to the next level! Please email me at sheryl.rowling@morningstar.com.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)