Why the November Jobs Report Is Raising Inflation Concerns, Again

Strong wage growth, payrolls may not bode well for the fight against inflation.

While investors have been growing more optimistic that the Federal Reserve will slow its aggressive pace of interest-rate increases, continuing strength in the jobs market suggests there’s lots more work to be done to slow the economy and push inflation lower.

That could mean interest rates need to stay higher for longer if progress doesn’t start to come soon on both a cooling of the economy and inflation.

The November jobs report showed a faster pace of hiring than had been expected, and potentially more worrisome to Fed officials, a pickup in wages that could keep the fire burning under still-hot inflation rates.

“The large uptick in wage growth was the most important news from today’s jobs report,” says Preston Caldwell, chief U.S. economist at Morningstar. “It’s concerning from the standpoint of the battle against high inflation.”

Against this backdrop, markets see the Fed on track for another 0.50-percentage-point increase in the federal-funds rate this month. While that would represent a slowing from the four consecutive 0.75-percentage-point hikes engineered this year, it’s still an aggressive tightening of monetary policy by historical standards.

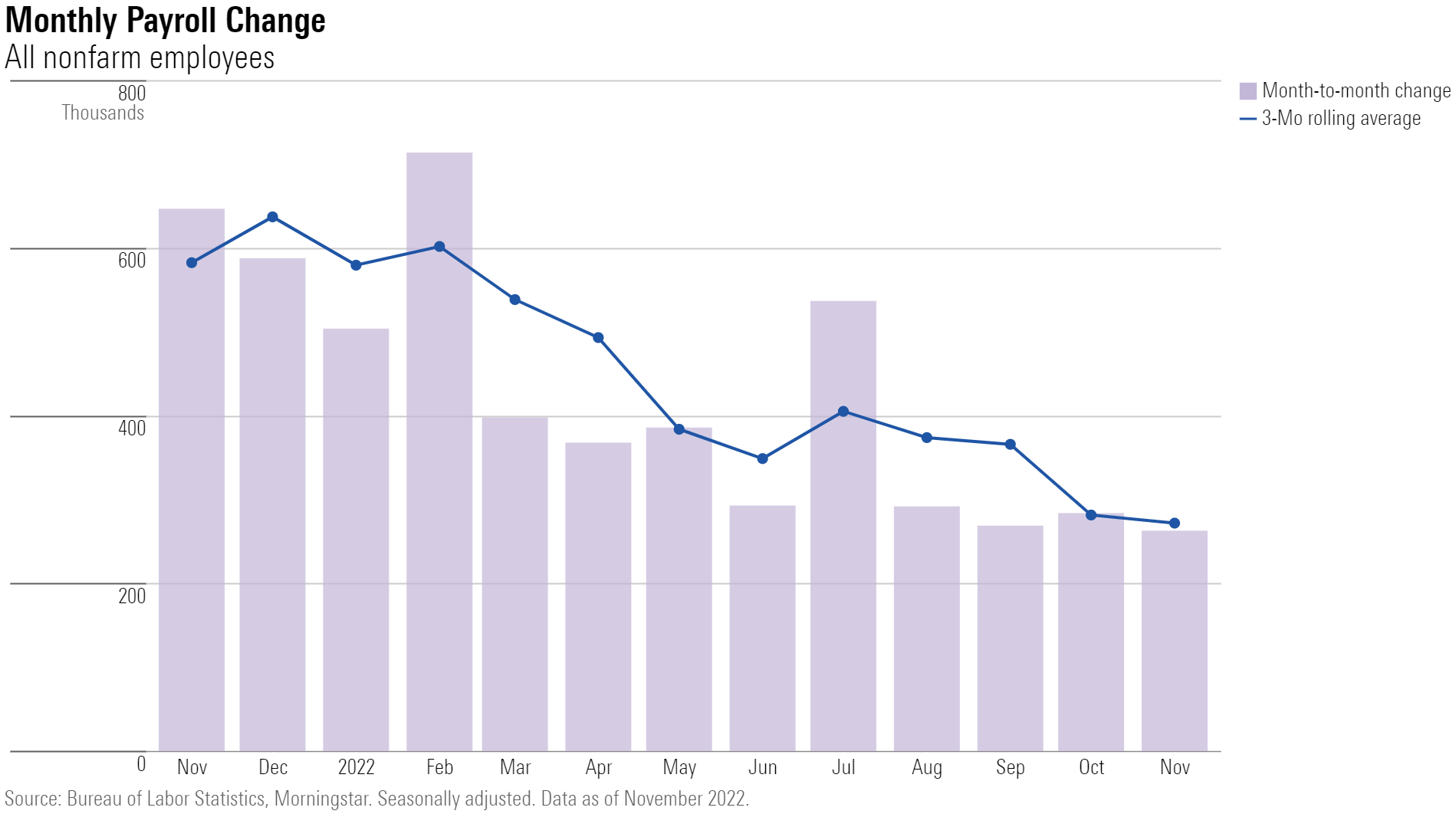

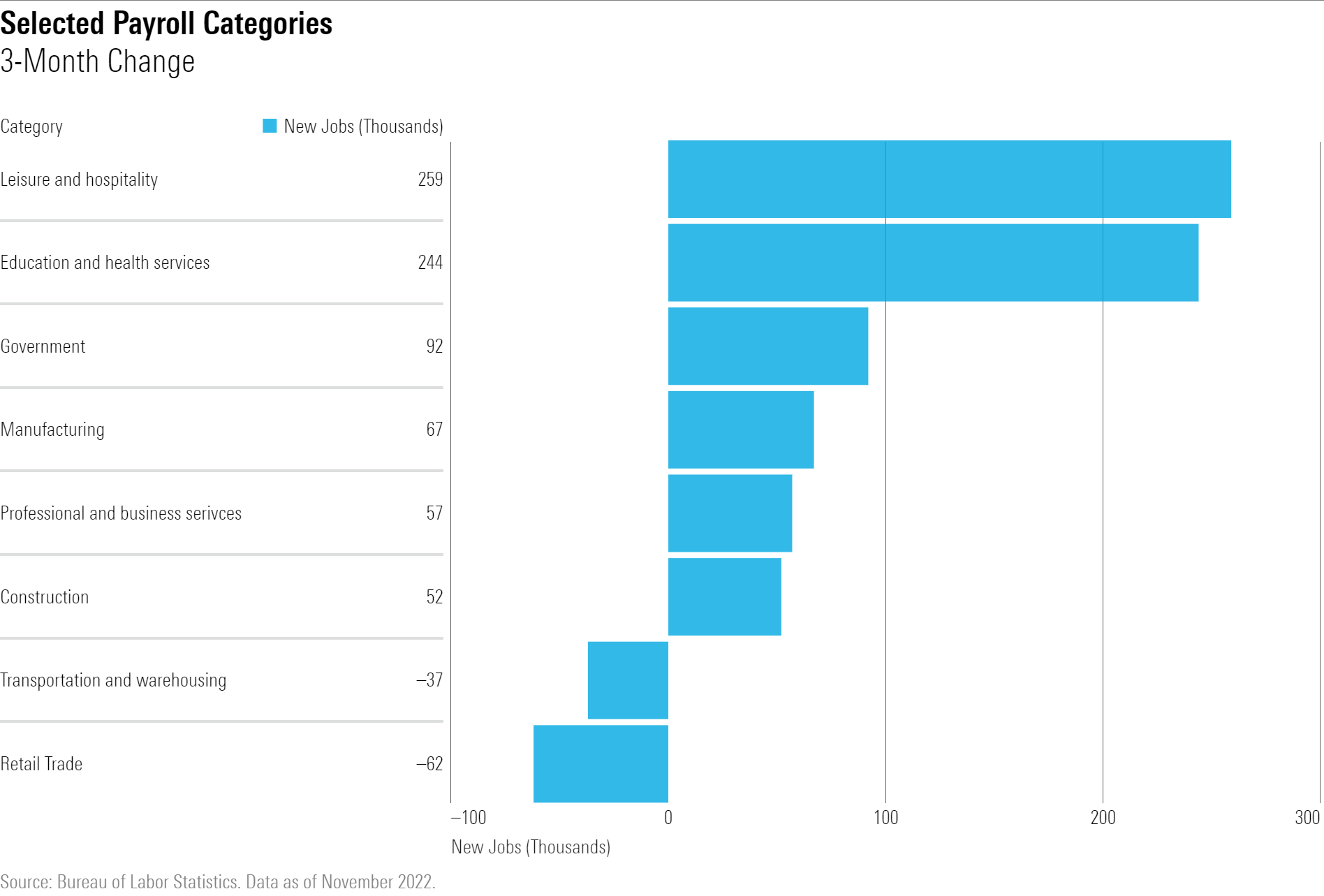

The November jobs report from the Bureau of Labor Statistics showed total nonfarm payroll employment rose by 263,000, well above consensus expectations for a 200,000 increase. Job gains were driven by leisure and hospitality, healthcare, and government.

“The headline nonfarm payroll data showed strong employment gains,” Caldwell says.

However, Caldwell notes that the household survey portion of the jobs report—which is the dataset used to calculate the unemployment rate but not nonfarm payroll changes—showed employment falling by 140,000. “Indeed, over the last six months, while nonfarm payroll employment has grown by a robust 1.3%, household survey employment has been flat,” Caldwell says. “Actual job growth has likely been somewhere between the two data series.”

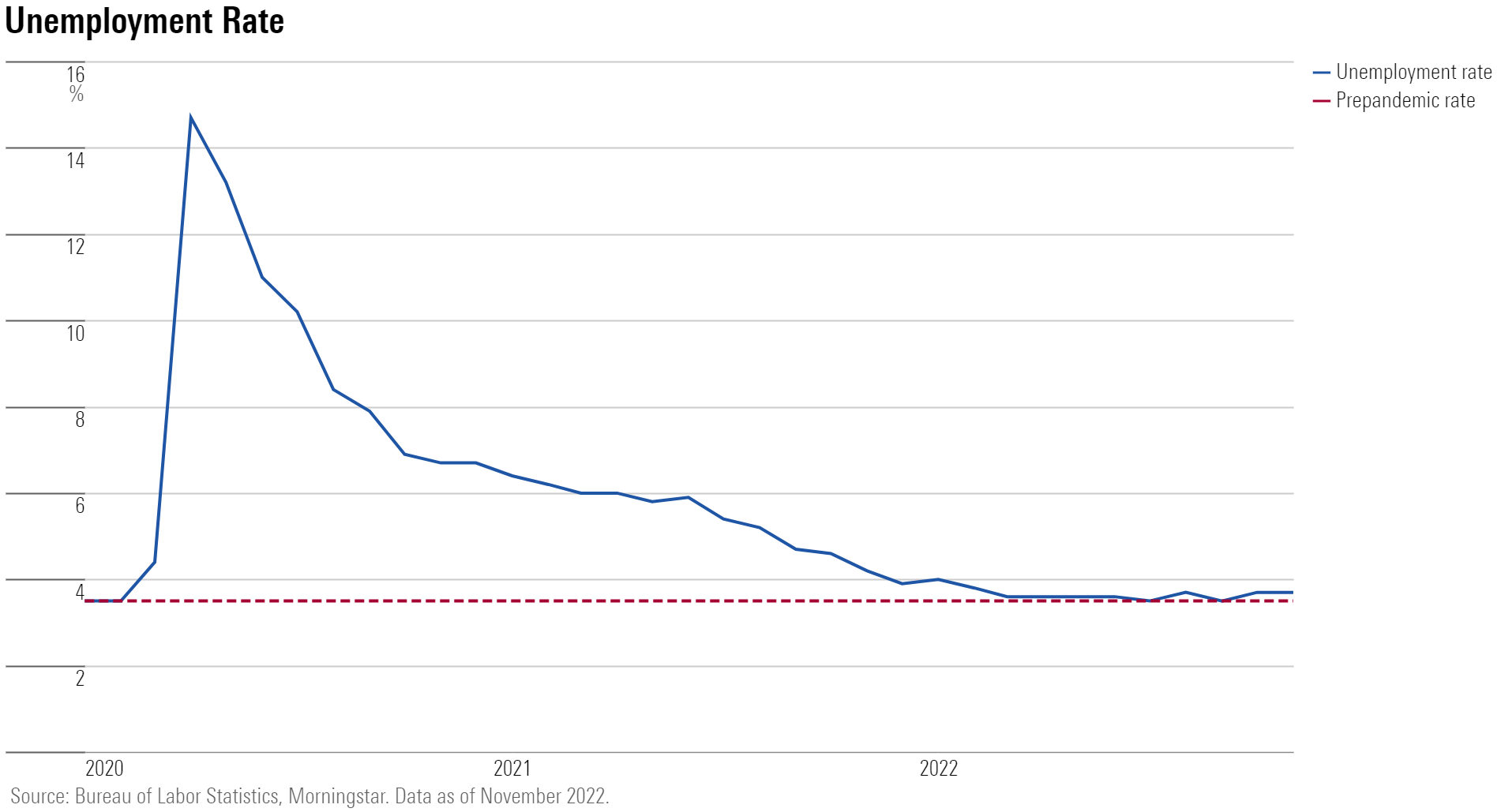

The unemployment rate was unchanged in November from the prior month at 3.7%, the Labor Department reported.

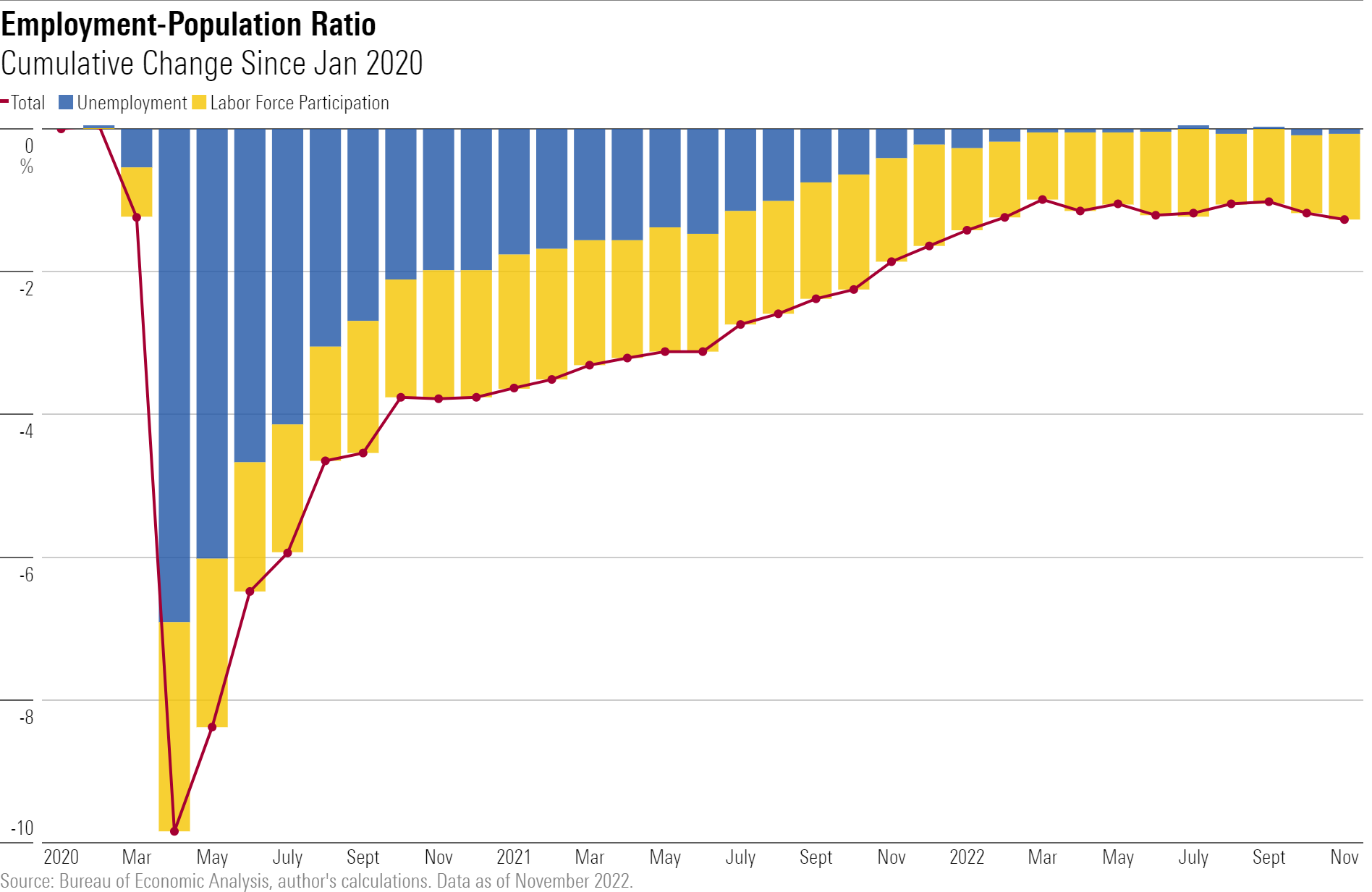

Caldwell says that the labor force participation rate has been disappointingly flat since the start of this year, “and has even ticked down in recent months.”

If the household survey is underestimating job gains, as implied by the strong payroll gains, then labor force participation gains have likely been underestimated, according to Caldwell. That’s because the household survey is used to calculate both the labor force participation rate and the unemployment rate.

Worrisome Wage Gains for Inflation

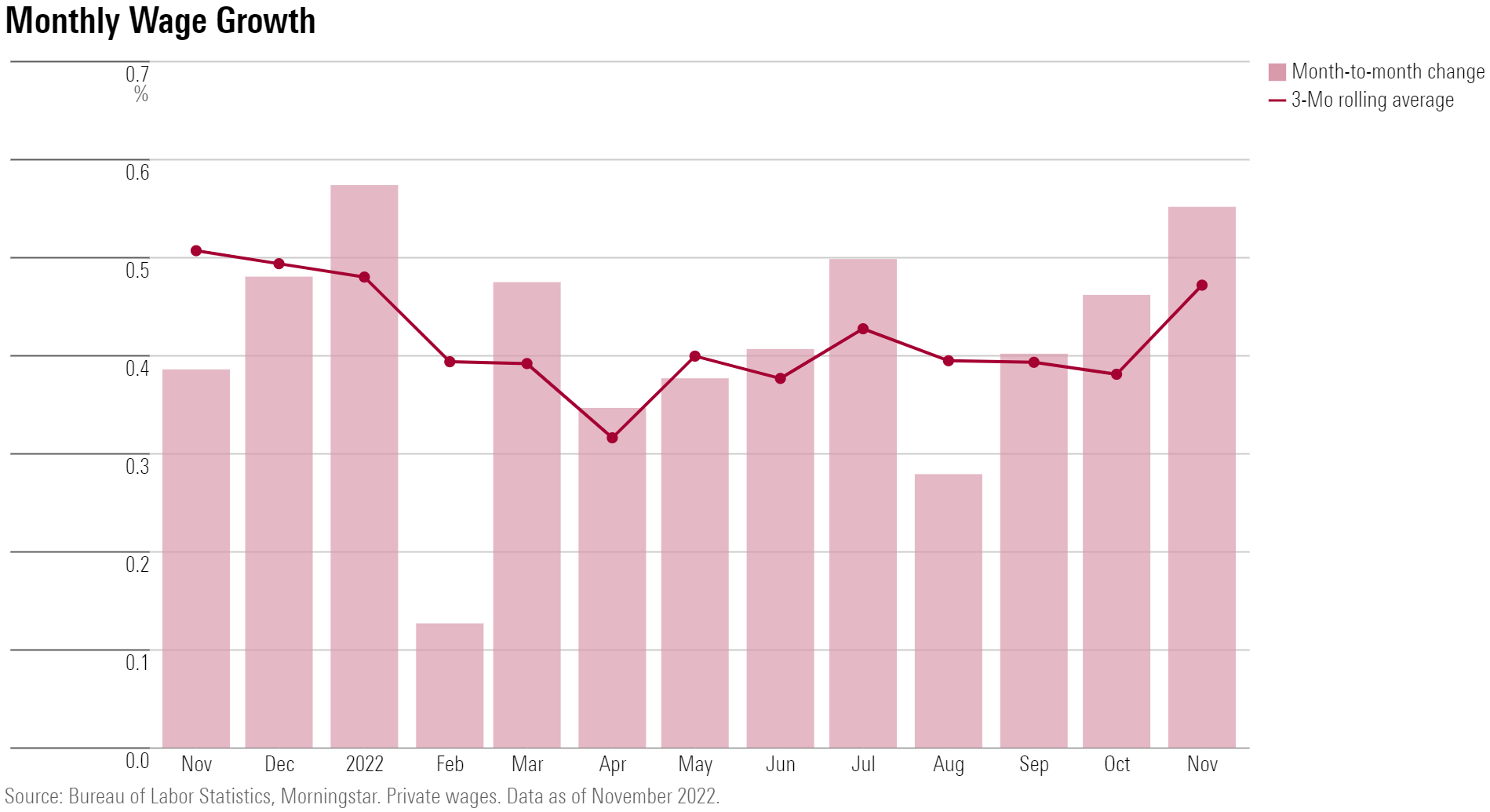

Wages rose substantially in November, growing 0.55% from month-ago levels.

Wage growth previously looked like it was returning to normal, Caldwell says, but the new numbers are much higher. “This raises the specter of excessive wage growth, which could fuel continued high inflation.”

“Previously, we thought wages grew at a 3.9% annual rate in the three months ending in October,” Caldwell says. “Thanks to revisions and a large increase in the latest month, we now see a 5.8% annual growth rate in the three months ending in November.”

Some Hints of a Slowdown

At the industry level, job losses are starting to materialize in some industries.

Retail employment fell 0.4% in the last three months, and transportation by 0.6%. “This reflects the slowdown in consumer spending on goods,” Caldwell says.

At the same time, he says, “the downturn in housing has yet to materialize in employment figures, as construction and real estate employment has continued to move up. That is very likely to change in the coming months.”

Hiring in consumer services industries has continued at a rapid pace recently, with employment at restaurants up 1.5% in the last three months. “With consumers’ return to normal getting close to completion, this is likely to slow,” Caldwell says.

Continued Fed Rate Hikes Expected

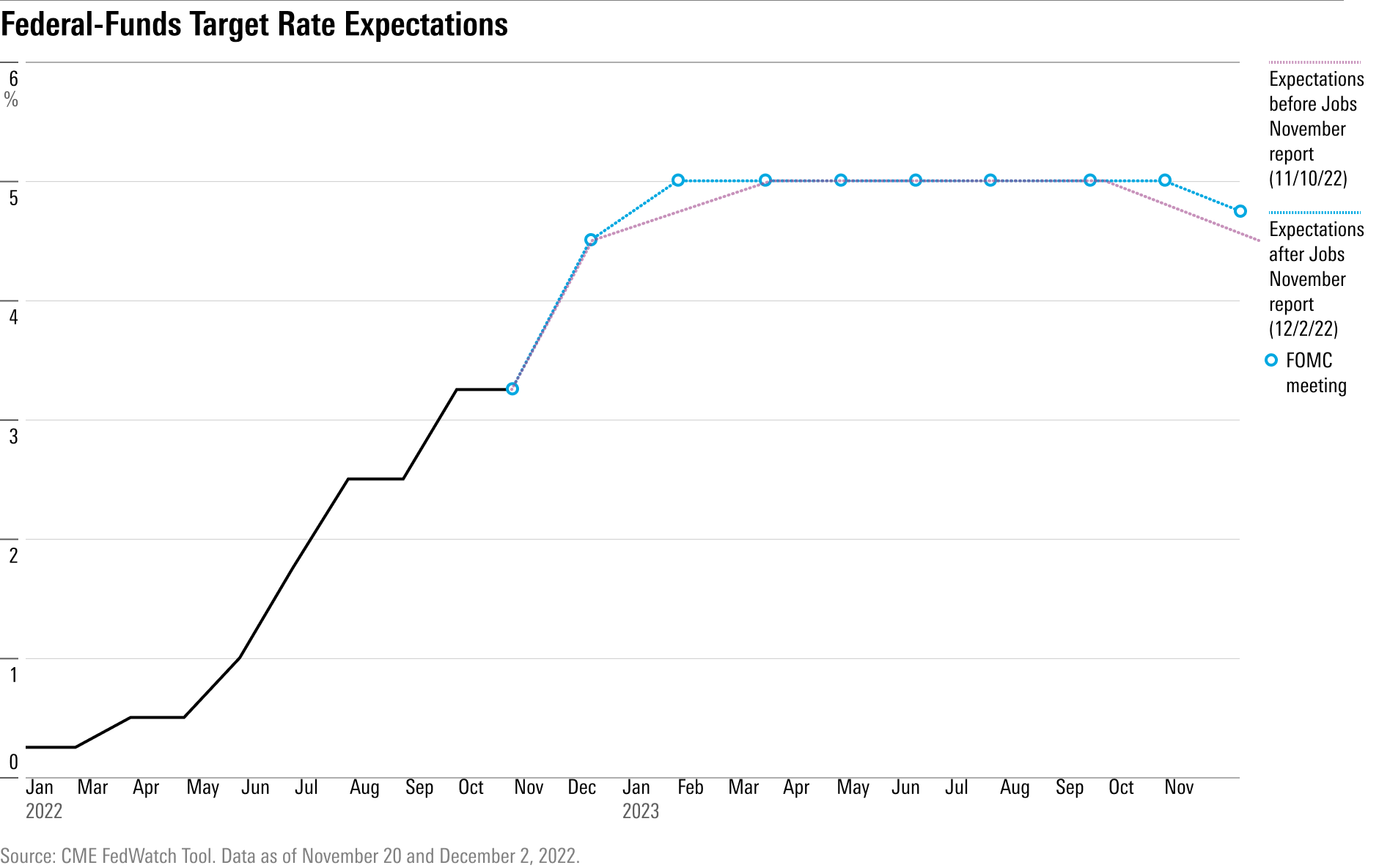

Against the backdrop of the news of a still-strong labor market, Caldwell still expects the Fed to raise the federal-funds rate by 0.50% at its upcoming December meeting, a slowdown from the four 0.75-percentage-point hikes seen earlier this year.

The latest jobs data also solidified the bond market’s expectations for a 0.50-percentage-point increase this month. After the report’s release, 79% of the futures market now expects the target rate to reach an upper limit of 4.50% at the December meeting, according to the CME FedWatch Tool. A month ago, the market was split, with just 52% of participants expecting a 0.50-percentage-point hike, and 42% seeing a fifth 0.75-percentage-point rise as most likely.

Expectations for where the federal-funds rate will be months down the road also rose following the release of the report. The majority of market participants now expect the federal-funds rate to reach 5.0% by January 2023 and stay there through October. A month ago, most expected that the Fed would start lowering the rate after its September 2023 meeting.

Caldwell says his expectations for December could change if there’s an alarming increase in the next Consumer Price Index report. “Still, if the trend in today’s report of higher wage growth persists, it will contribute to inflationary pressure and induce the Fed to keep rates higher for longer,” he says.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)