Bond Market Crashes, Newly Undervalued Stocks, and Vanguard Upgrades You Need to Know

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week, we take a closer look at newly undervalued stocks, top wealth creators in the fund industry, Vanguard fund upgrades, capital gains distributions, and new environmental. social, and governance rules for retirees.

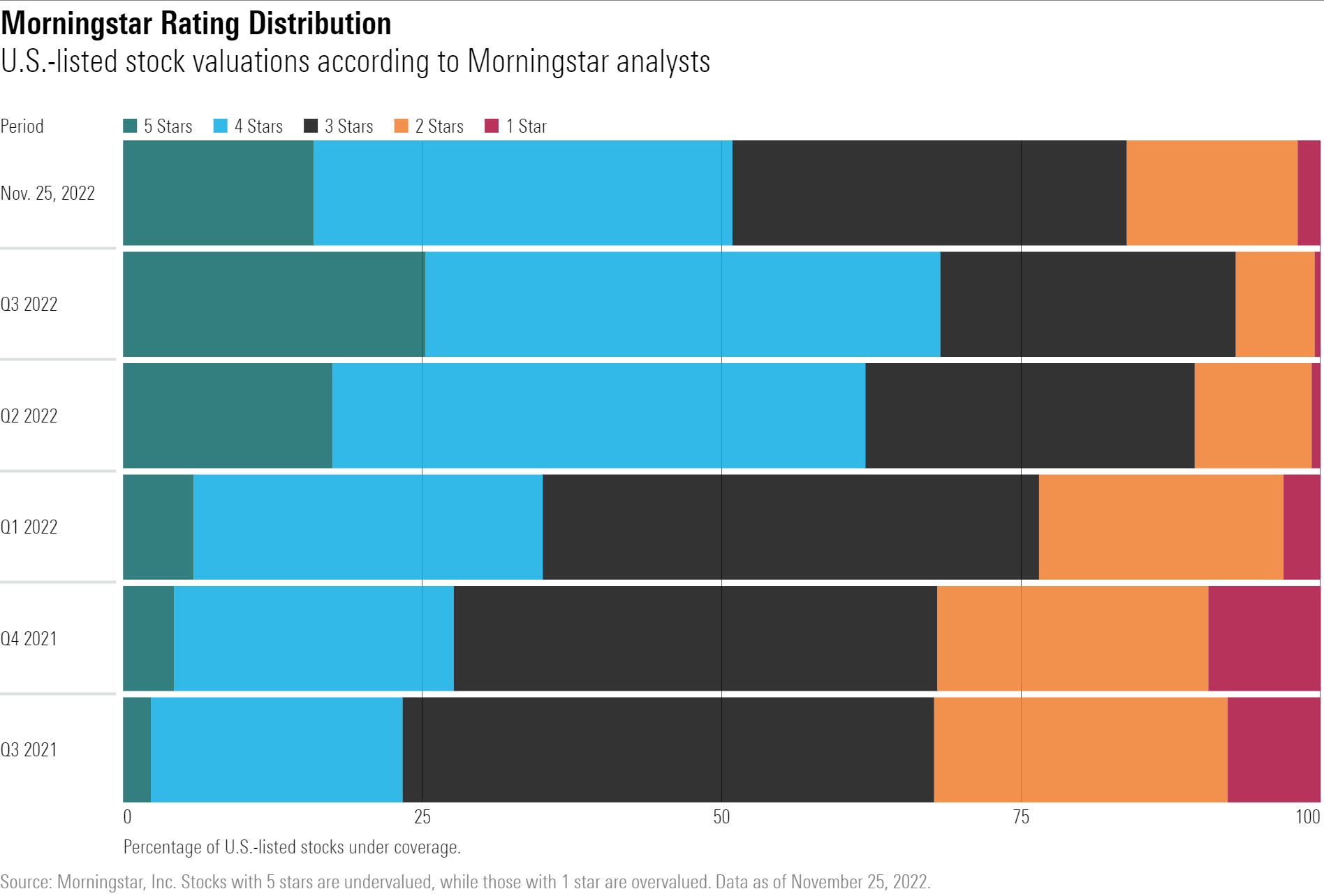

Chart of the Week

While the market has stabilized in recent weeks, stocks including Airbnb and Palo Alto Networks have fallen into undervalued territory.

Glossary Term of the Week

Bond

A bond is an investment that pays a fixed rate of return through interest or dividend income. They’re often used to balance equity risk, provide income, and hedge against inflation.

See Morningstar’s Investing Definitions and Financial Terms for the full definition.

Check out Carole Hodorowicz’s article on bonds from Morningstar’s The Short Answer series:

In a time of rising interest rates and inflation, here’s what you need to know about what buying bonds can do for your portfolio.

What to Watch

3 Ways to Manage Capital Gains Distributions in 2022

Despite poor returns for most funds this year, many are distributing capital gains.

Articles We Love

4 Takeaways on the New ESG Rule for Retirement Plans

Plans should treat sustainability as any other relevant factor, based on the fiduciary standards of prudence and loyalty.

The U.S. Labor Department finalized a rule last week that will remove barriers, real and perceived, to environmental, social, and governance investing in retirement plans governed under the Employee Retirement Income Security Act of 1974, or Erisa.

Called “Prudence and Loyalty In Selecting Plan Investments and Exercising Shareholder Rights,” the new rule replaces two hastily drawn rules rushed to the finish line at the end of the Trump administration. Those rules were widely interpreted as discouraging retirement plan fiduciaries from considering ESG factors and from exercising shareholder rights.

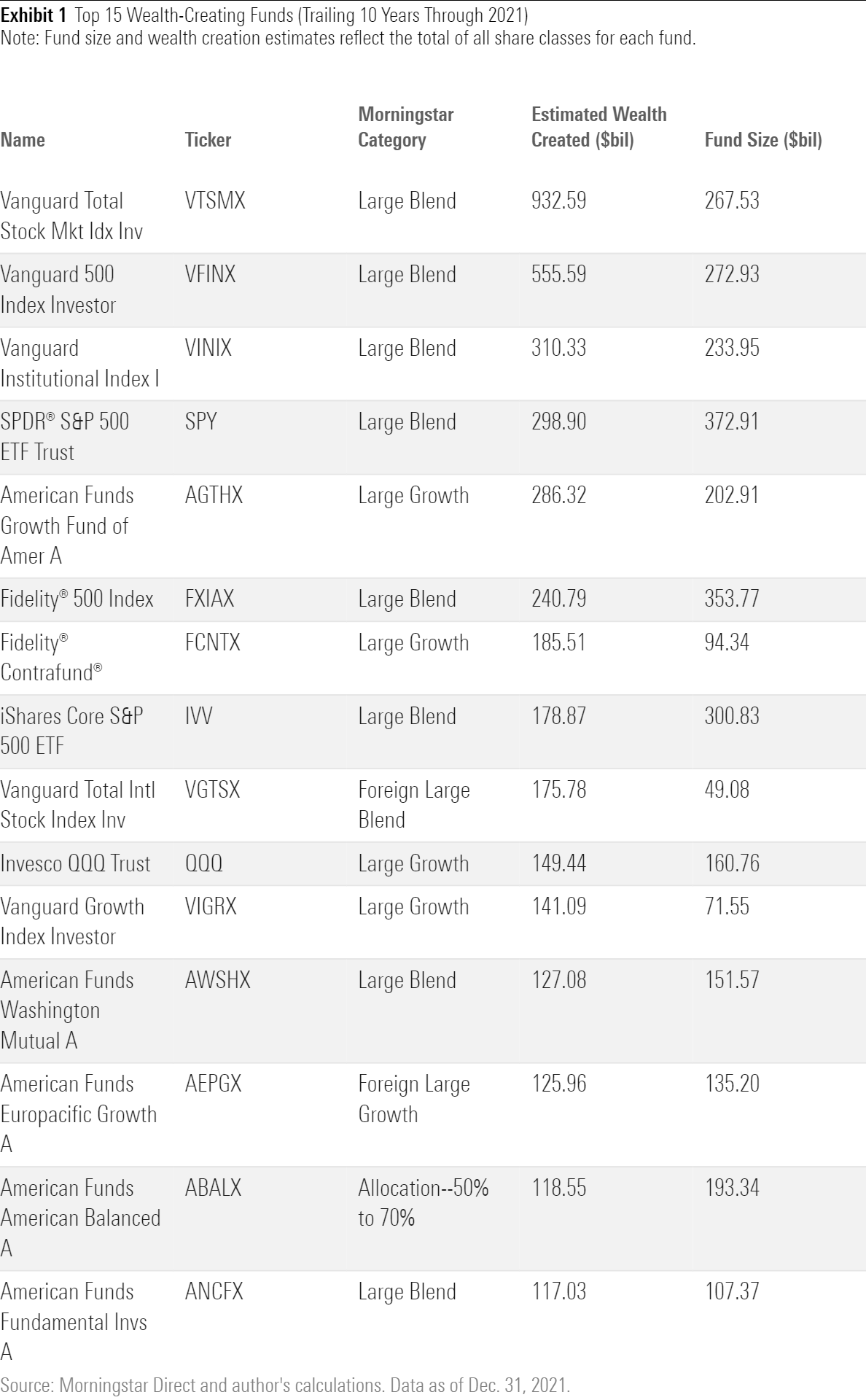

15 Top Wealth Creators in the Fund Industry

These mutual funds and ETFs have generated the most value for shareholders in dollar terms

To get a better sense of which funds have created the most value in dollar terms, wealth creation is a better measure. To home in on this, I ranked Morningstar’s database of U.S.-based mutual funds and exchange-traded funds, focusing on those that had the biggest increase in asset size over the 10-year period ended in 2021 after subtracting out total inflows and outflows over the same period. The resulting number reflects how much growth a fund has created from market appreciation in dollars.

Russ Kinnel highlights three funds you won’t want to miss.

These Vanguard funds earn a Morningstar Analyst Rating of Silver or Gold.

- Vanguard Short-Term Inflation-Protected Securities Index VTAPX

- Vanguard Extended Market Index VEXAX

- Vanguard Global Wellesley Income VGYAX

Stocks, Funds, and Exchange-Traded Funds

Top articles

Why Berkshire Hathaway Stock Is a Buy

We believe that Berkshire Hathaway BRK.A/BRK.B, owing to its diversification and lower overall risk profile, offers one of the better risk-adjusted return profiles in the financial-services sector and remains a generally solid candidate for downside protection during market selloffs.

The Diversification Strategy That’s Older Than Target-Date Funds

Target-risk strategies are worth reconsidering in light of evolving investor demands. These precursors to target-date portfolios have gained new life as the strategy of choice in the fast-growing model-portfolio market.

Are Growth Stocks Worth a Look in 2023?

After several years of spectacular gains, U.S. growth stocks abruptly reversed course in 2021. Small-growth companies peaked that January, while their large-growth counterparts remained strong for an additional several months. When autumn arrived, however, blue chips also succumbed. For the 12 months from October 2021 through September 2022, the two groups fell together, with small-growth stocks dropping 35.7% and their large-growth cousins 39.4%.

Missed Us?

Check out our investing specialists on LinkedIn:

Sentiment in both the bond and stock markets has been improving lately. Does that mean the worst is behind us? Tom Lauricella takes a closer look in this week’s markets newsletter:

Well, it’s feeling a lot like 2022 is the 2020 of investing years for both stocks and bonds—and especially bonds. (We’ll put aside what that means for a 2021/2023 comparison for now.)

However, sentiment in both the bond and stock markets has been feeling a little bit better lately. The stock market is still down 17% this year, but hey, it’s up about 12% from the bottom. So, is the worst over? I took a look at three signs to watch that could offer some clarity on whether stocks have seen their worst. (And while you’re checking out this story, you’ll see it’s part of our regular Monday Markets Brief series, designed to catch you up on which stocks have been posting big moves and key upcoming events for the market.)

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)