Markets Brief: What to Watch in the November Jobs Report

Forecasts call for a modest slowing in hiring, but investors should keep an eye on the wage data.

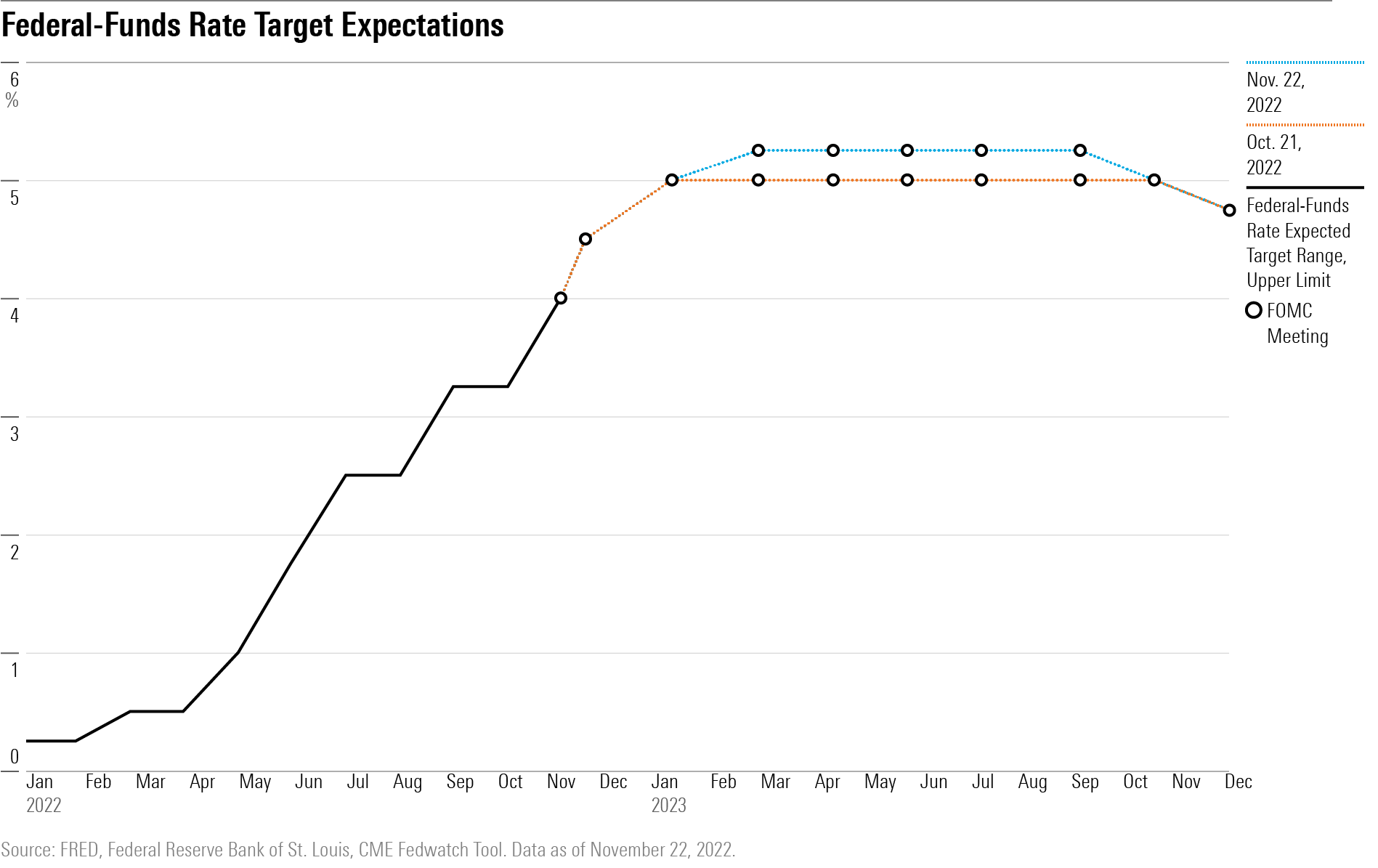

In recent weeks, both stocks and bonds have seen some relief from this year’s brutal bear markets, thanks in large part to expectations that the Federal Reserve will slow down the pace of aggressive interest rate increases when officials next meet to set policy in December.

The November jobs report, due out Friday, is the next test of that thesis.

Forecasts for the jobs report center around a continued solid pace of hiring, even if the gains are smaller than in recent months. But when it comes to how the stock and bond markets respond, the devil may be in the details.

That’s especially the case when it comes to what the November jobs report shows on the wages front, where continued upward pressure could make it still harder for inflation to come down.

November Jobs Consensus Forecast Summary:

- Nonfarm payroll growth: 220,000

- Unemployment rate: 3.8%

While a November jobs report that comes in stronger than the consensus forecast wouldn’t necessarily derail a shift by the Fed to smaller rate hikes—especially since the monthly data is notoriously volatile—it could pull the rug out from the current rally in stocks. The Morningstar US Market Index has bounced roughly 12% from it’s late-September bear market lows. Bonds, too, have rallied with longer-term yields falling from multi-year highs.

In the background, investors are expecting the Fed to raise the federal-funds rate by 0.50 percentage points in December from the current target rate of 3.75%-4.0%. Bolstering that outlook, the minutes from the most recent Fed meeting, released last week, showed that Fed officials are looking to slow down the pace of rate hikes “soon.”

Then by early next year, the Fed is expected to pause its rate hikes in order to give its tightening measures time to work through the economy and assess the degree to which inflation comes down.

November Jobs Report Forecasts

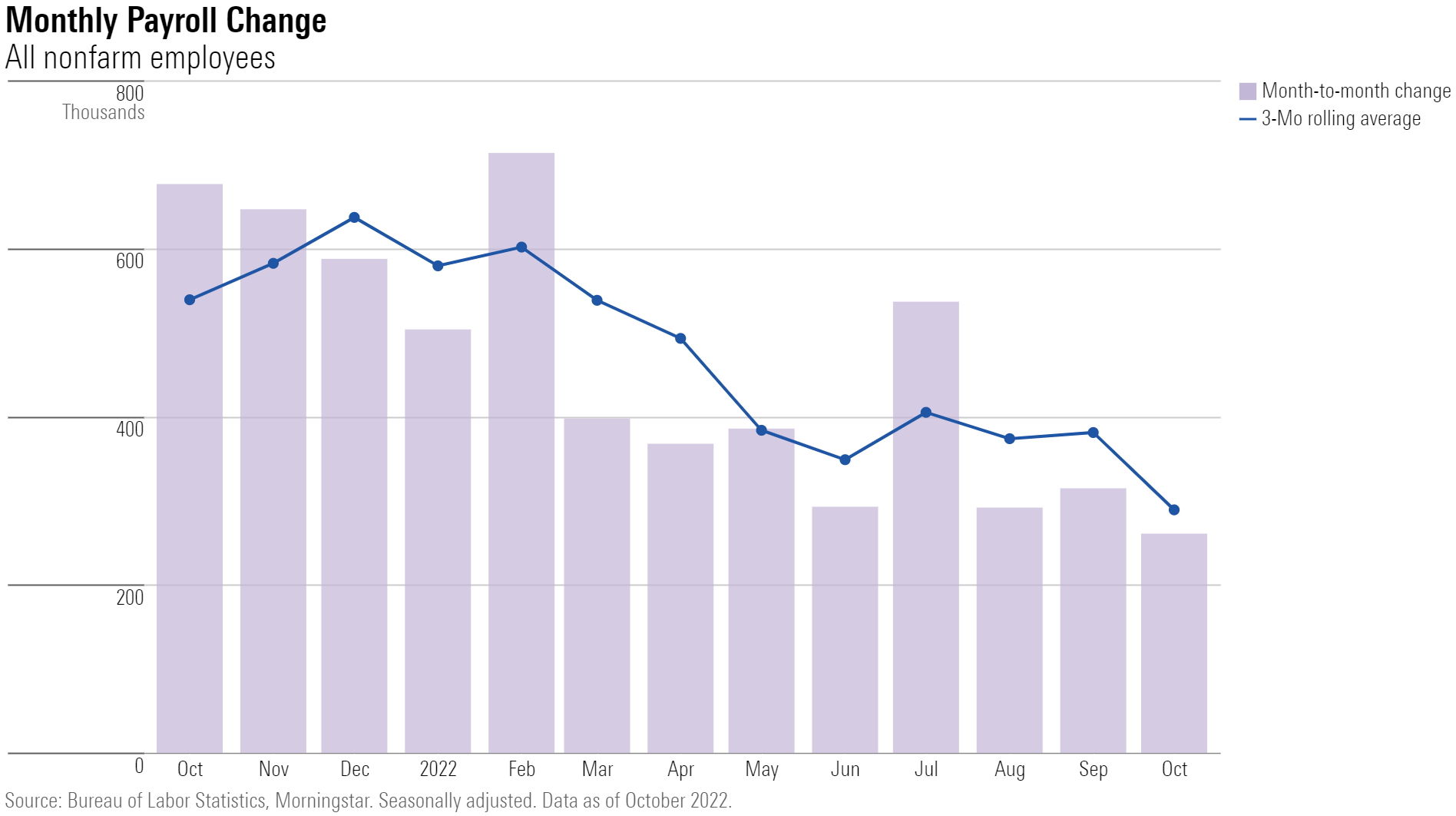

Economists are predicting another solid month for job gains. Nonfarm payroll employment is expected to post an increase of 220,000 for November, according to FactSet’s consensus. That would follow an increase of 261,000 for October and 315,000 in September.

Forecasts call for the unemployment rate to tick higher in the November jobs report. Expectations center on a rise to 3.8% from 3.7% in October, which would be the highlight level for the jobless rate since February. In November 2021, the unemployment rate stood at 4.2%.

November Jobs Report:

- Is the trend for job growth slowing?

- Are wage pressures easing?

- Workforce size: Are workers coming back?

Economists warn against reading too much into any single month’s jobs report. The data is volatile and there are often significant revisions to readings from prior months. For this reason, most focus more on trends in the data over multiple months, such as three-month rolling averages. If payrolls come in as expected, the three-month moving average for payroll gains would clock in at roughly 265,000. That’s down from north of 350,000 per month in June.

“The trend is very clear,” says Jeffrey Roach, chief economist at LPL Financial. “The labor market is clearly slowing, and in a nice gradual fashion.”

Still, Preston Caldwell, Morningstar’s chief U.S. economist, notes that the average monthly increase in nonfarm payroll employment was 190,000 in the five years before the pandemic. “This would be a more normal pace of job growth in a moderate economic expansion,” he says. However, “the Fed is aiming to slow things down a bit further than that.”

Here are two other key areas of focus:

Wage Growth

“It’s all about wage growth” says Kristina Hooper, chief global market strategist at Invesco. “It’s the stickiest part of inflation and arguably one of the most concerning data points to the Fed right now.”

As a result, Hooper says she is “laser-focused” on average hourly earnings.

In October, average hourly earnings rose 0.4%, an uptick from a 0.3% increase in September. When measured on a year-over-year basis, wages showed a slight deceleration. Average hourly earnings rose by 4.7% over the past year through October, down from the 5.0% annual increase registered in September.

“We got a little bit of an easing last month, and need to see a continuation of that trajectory,” Hooper says.

Labor Force Trends

LPL’s Roach says that in addition to the wage numbers, where he will be paying close attention to services sector wages, he is watching the data sets that capture workers entering the labor market and looking for work.

“We still have a vast amount of people that are out of the labor force but were in the labor market in 2020 before the pandemic,” he says.

As of October, the labor force participation rate stood at 62.2% and the employment-population ratio was 60.0%, both having shown little change over the course of 2022. Both are down 1.2 percentage points from February 2020.

While some portion of people who left the labor market may have retired or left for other reasons, the degree to which those workers come back will play a role in how quickly the job market loosens up, and in turns, eases the upward pressure on wages, Roach says. Roach adds that among different age groups, seeing workers in the 35-45 age range come back to the labor market could be key.

When it comes to the overall state of the labor market, “we want to see it cool down in order to provide some softening of the economy, and at the same time, we want to see a greater labor force participation rate.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)