Should You Hit Pause on a 401(k) That’s Losing Money?

It might be tempting to put contributions on hold, but sticking with it is a better strategy.

Investors are understandably shaken by this year’s bear market. Stocks are on track for their worst year since the global financial crisis in 2008, bonds are suffering double-digit losses, and inflation is cutting into consumers’ purchasing power. Amid this dismal backdrop, employees saving for retirement through a tax-advantaged savings plan such as a 401(k) might feel like they’re throwing good money after bad. I’ve heard many comments from investors wondering if they should hit the pause button on contributions until the market settles down.

This approach sounds tempting. If you’re planning to go for a walk in rainy weather, the thinking goes, why not at least wait until the most torrential rain subsides? But the weather analogy only goes so far. With investing, it’s better to stick with it instead of waiting for conditions to improve.

Running the Numbers

To test how a “wait and see” approach would have fared compared with continuing to invest, I looked at three different market downturns: The early 2000s dot-com bubble, the 2008 market downturn, and the coronavirus-driven decline in early 2020.

In each case, I looked at results under two different scenarios: An investor who started saving $500 per month and continued to do so, and another investor who stopped saving until the market started to improve. I assumed all contributions were invested in stocks.

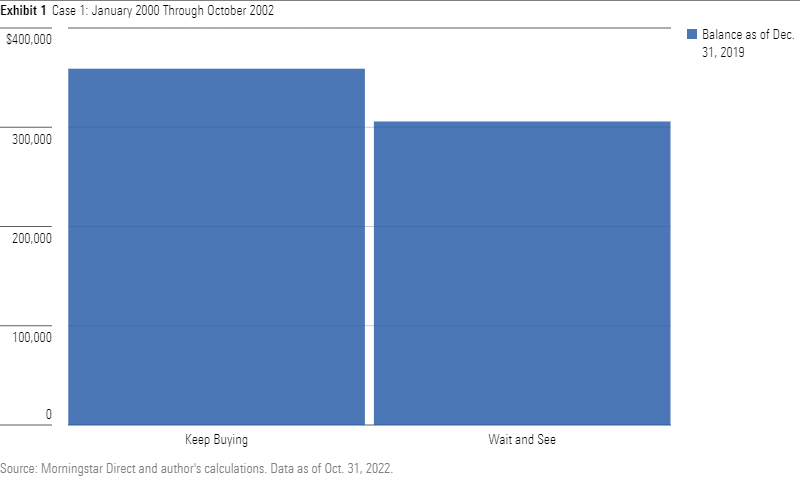

Case 1: January 2000 Through October 2002

After an exuberant bull market during most of the 1990s, the new decade started on a brutal note. As previously high-flying technology stocks crashed back to earth, stocks suffered cumulative losses of about 33% from early 2000 through October 2002.

An investor who started investing $500 per month in January 2000 and kept doing that even throughout the turmoil early in the decade would have ended up with about $359,000 20 years later. The “wait and see” investor, on the other hand, would have finished with about $306,000. I included the $500 monthly amounts that weren’t invested in the final total, but kept the dollar value flat for those assets.

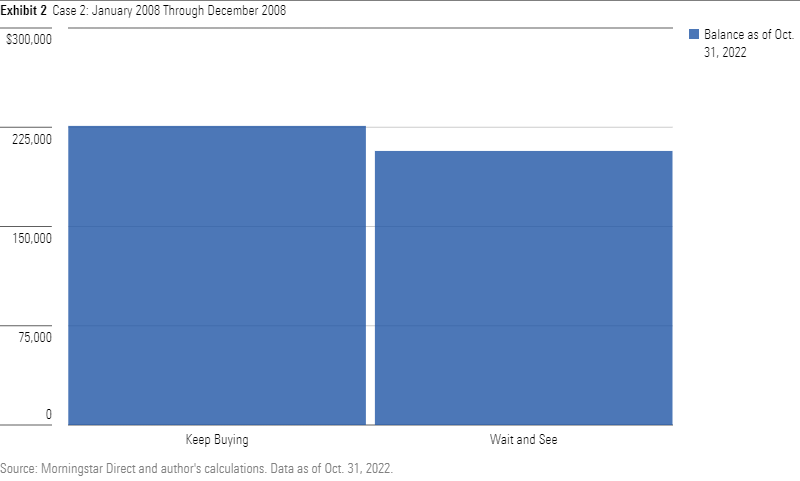

Case 2: January Through December 2008

The market downturn in 2008 amid the global financial crisis and recession was the second-worst calendar year for equity investors in recent market history, with the market’s 37% drop surpassed only by the 43% downturn in 1931. An investor who started investing $500 per month in January 2008 and continued making consistent monthly investments would have ended up with about $226,000 by Oct. 31, 2022—even after the heavy losses so far in 2022. An investor who skipped out on making contributions until January 2009 would have ended up with about $207,000 as of the same date, including $6,000 from the skipped monthly investment amounts.

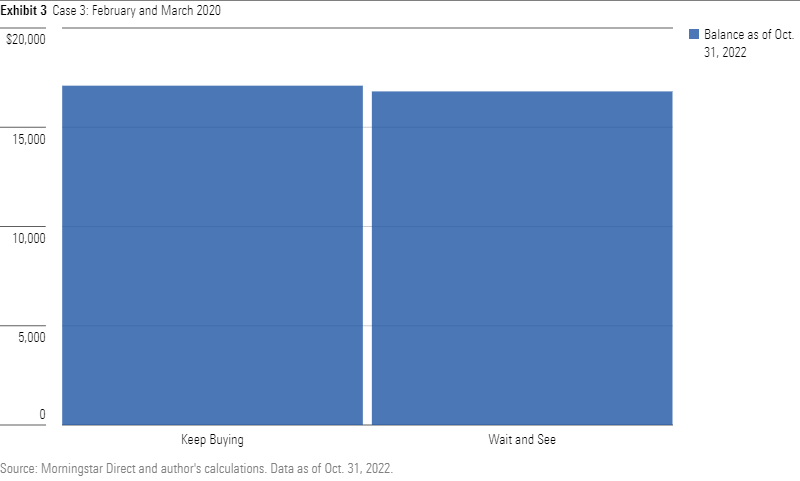

Case 3: February and March 2020

The COVID-19-driven market downturn in early 2020 was unusually swift and severe. Broad stock market indexes shed about 34% of their value from Feb. 19, 2020 until the market started rebounding roughly a month later. After this sharp downturn, the rebound was even more impressive, with stocks posting gains of 28.7% during 2021. As a result, the “keep buying” investor would have still ended up slightly ahead by the end of October 2022, even after suffering through this year’s market downturn.

Why Investors Shouldn’t Give Up

The examples above assume a portfolio that started at the beginning of a bear market. Investors who already started contributing to a 401(k) would have had a more difficult time on paper, but the same principle applies: Putting contributions on hold while a 401(k) is losing money leaves you with fewer dollars that can benefit from an eventual rebound.

The examples above make a pretty strong case for just sticking with the plan, even during a bear market. But these examples probably overstate the results for “wait and see” investors because they assume that investors somehow knew ahead of time when the market was going to start recovering. In reality, it’s impossible to predict when the turnaround will happen. Bad news usually isn’t unrelenting, and even during the worst bear markets, there are sometimes days, weeks, or months with positive returns. In July 2022, for example, the market posted gains of 9.4%, but the rally was short-lived, with losses following soon after.

Not only is it tough to get the timing right for a market recovery, but keeping money on the sidelines means betting against the odds. Statistically speaking, the market goes up more than it goes down. Watching a 401(k) lose money isn’t fun to live through, but things eventually turn around.

Finally, don’t forget about the tax breaks from contributing to a 401(k). Contributions to a tax-deferred retirement plan reduce adjustable gross income, which can help lessen the sting from negative returns. And it always makes sense to contribute at least enough to take advantage of any company match, even when your 401(k) is losing money in the short term.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)