Which Sustainable-Investing Approach Is Right for Your Clients?

The Morningstar framework can help you better understand this area.

This article is part of a series providing a framework for incorporating sustainable investing into your advisory practice.

This year marks the 10-year anniversary of my financial-planning career. As I look back at the last decade, I see that the sustainable-investing industry has grown dramatically, both in volume of assets managed as well as public awareness of sustainable investments as an alternative to dominant investment models that do not consider negative externalities causing direct and indirect harm to people and the planet. However, the efficacy and limitations of sustainable investing as a market-based solution to address these global issues is a conversation I have often with advisors and nonadvisors. There is a wide and growing menu of public and private sustainable investments—but how can advisors differentiate these products in a meaningful way?

What Is Sustainable Investing?

I’m using the term “sustainable investing” to encompass three commonly used terms: ESG (short for “environmental, social, and governance”), socially responsible investing, and impact investing. Unfortunately, these terms aren’t used in a standard way within the investment industry. “ESG” investing integrates research and data representing environmental, social, and governance indicators of company practices, as long-term material economic risks, to guide security selection and portfolio construction. “Socially responsible investing,” or “SRI,” focuses on excluding or including certain industries based on the ethical or moral values of investors. Shareholder engagement and proxy voting are other key features of SRI-based strategies. “Impact investing” traditionally refers to private sector investments outside of public markets, such as direct investments to benefit specific communities, small businesses, and burgeoning industries. Impact investing can also refer to public investments, with a focus on positive outcomes to the environment and society.

You can say that ESG data looks back, SRI focuses on present action, and impact investing aims to influence what’s possible in the future. “Sustainable investing” can mean one of those tools or any combination of the three.

What Is Greenwashing?

One consequence of a lack of standardization in terminology is different conceptions among investment professionals and the public of what sustainable investing is—which has fostered distrust of investment products and strategies that claim to be “sustainable,” “social,” or “green.” “Greenwashing” describes practices that falsely claim to be sustainable. The term is akin to “pinkwashing,” the practice of using gender-based marketing—and usually the color pink—to superficially or falsely support women. You can think of “______washing” as painting a thin, glossy finish in order to mislead. Still, the term “greenwashing” also fails to define what the standards for being “green” are. In reality, sustainable investments use a mix of strategies, each with its own set of practices and theory of change.

Differentiating Sustainable-Investment Approaches Using the Morningstar Sustainable-Investing Framework

When I speak with advisors and investors with a basic awareness of sustainable investing, many know the difference between two dominant approaches: divestment and shareholder advocacy. Divestment is the opposite of investment and in practice means excluding a company, industry, or another category of investments from one’s portfolio. Shareholder advocacy is the act of owning shares of a company with the goal of influencing its practices. However, outside and within divestment and shareholder advocacy, there are other approaches used by sustainable-investment managers and they may also employ one or more of these approaches at a time. I believe this is one of the biggest areas of confusion—and source of potential criticism of sustainable-investment products—for advisors and their clients.

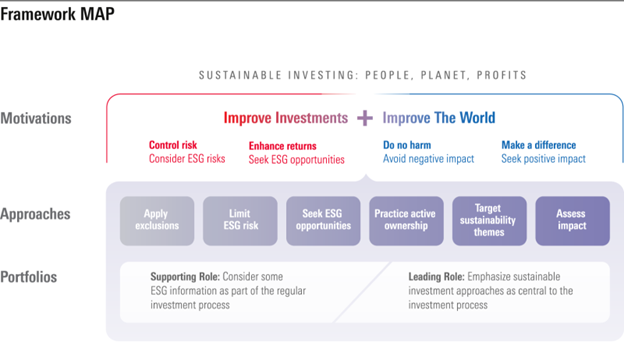

One tool that I’ve found helpful in differentiating sustainable-investment approaches is the Morningstar Sustainable-Investing Framework, represented in the Framework MAP (Motivations, Approaches, and Portfolios) below:

Source: Morningstar. (2022) “The Morningstar Sustainable-Investing Framework.”

The Morningstar Sustainable-Investing Framework identifies six distinct approaches along a continuum, from avoiding negative outcomes to advancing positive outcomes:

- Applying Exclusions: Refers to excluding issuers based on certain products/services, an industry, or certain corporate behaviors, like major controversies.

- Limiting ESG Risk: Refers to using ESG information, usually in the form of ESG ratings of companies, to assess material ESG risks as part of the overall assessment of risk.

- Seeking ESG Opportunities: Refers to using ESG information to identify companies that are sustainability leaders, often by industry or sector, to identify improving companies or those that are using sustainability to establish or enhance a competitive advantage.

- Practicing Active Ownership: Refers to seeking positive ESG outcomes via active ownership activities, primarily made possible because asset managers are shareholders in public companies. These activities may include the two approaches below.

- Targeting Sustainability Themes: Refers to identifying investments that stand to benefit from the long-term trend toward greater sustainability in the way we live and work.

- Assessing Impact: Refers to integrating impact assessments into security selection and portfolio construction.

“Applying Exclusions” and “Limiting ESG Risk” refer most closely to divestment yet differ on the types of data being used to make divestment decisions. These approaches can also be described as negative or exclusionary screening because data is being used to make decisions on what to exclude from the portfolio. “Seeking ESG Opportunities” also uses data but instead can be described as positive or inclusionary screening, because data is being used to make decisions on what to include in the portfolio. “Practicing Active Ownership” refers to shareholder advocacy. “Targeting Sustainability Themes” may include targeting investments in renewable energy, clean water, or gender equity. The strategy of “Assessing Impact” also uses data on company practices to guide investment decisions but focuses on the results of those practices in relation to an impact framework, typically the United Nations Sustainable Development Goals, benchmarks such as reduction of greenhouse gas emissions, targets set by the Science Based Targets initiative, or goals such as number of affordable housing units built.

The explicit premise of the framework is that sustainable investing’s primary focus is shareholder return on investment—and it underlines the importance of aligning business practices with sustainable environmental, social, and corporate governance practices to mitigate long-term economic risks that stem from unmitigated extraction.

Differentiating Sustainable-Investment Approaches Using the Social Movement Investing Framework

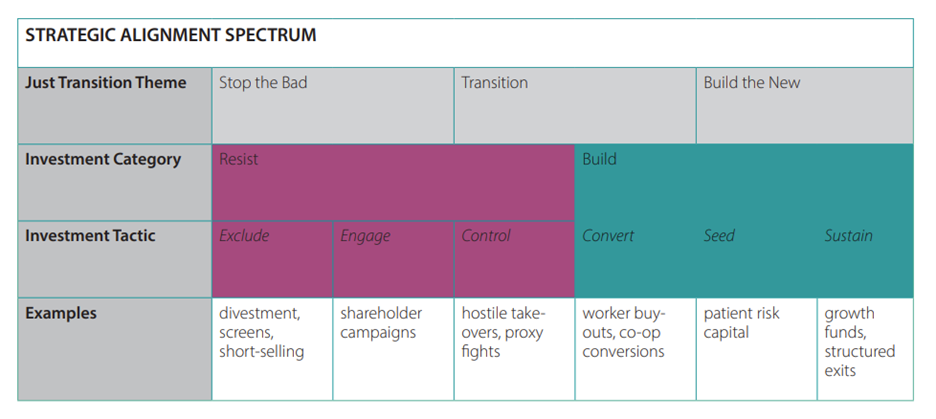

Another tool that has helped me differentiate sustainable-investment approaches was created by the Center for Economic Democracy and published in its report Social Movement Investing: A Guide to Capital Strategies for Community Power. Social movement investing is a continuum of approaches ranging from divestment and shareholder advocacy (“Resist”) to targeting long-term impact aligned with social movements (“Build”), as represented in the Strategic Alignment Spectrum below:

Source: Center for Economic Democracy. (2022). Social Movement Investing: A Guide to Capital Strategies for Community Power, p. 45.

Like the Morningstar Framework MAP, the CED Strategic Alignment Spectrum identifies six distinct approaches (that is, investment tactics or capital strategies), along a continuum from avoiding negative outcomes to advancing positive outcomes:

- Exclude: Describes screened investments, divestment efforts, and short sales that make profits by betting against the future value of harmful companies. SMI counts exclusion tactics as SMI strategies if they are executed in direct coordination with movements.

- Engage: Describes corporate engagement and shareholder activism seeking to influence corporate practices and policies by introducing resolutions and public action as shareholders.

- Control: Describes a type of investing aimed at overtaking corporate governance that is rarely seen outside of the maneuvering of large capital-holders for financial gain but has potential application of social movement goals.

- Convert: Describes the facilitation of voluntary sales or transfers of businesses or assets to workers and other stakeholders in historically oppressed communities.

- Seed: Describes the provision of investment capital to restorative enterprises, including funds and infrastructure, at early stages of growth.

- Sustain: Describes the provision of investment capital to restorative enterprises at later stages of growth and offering liquidity for values-aligned structured exits.

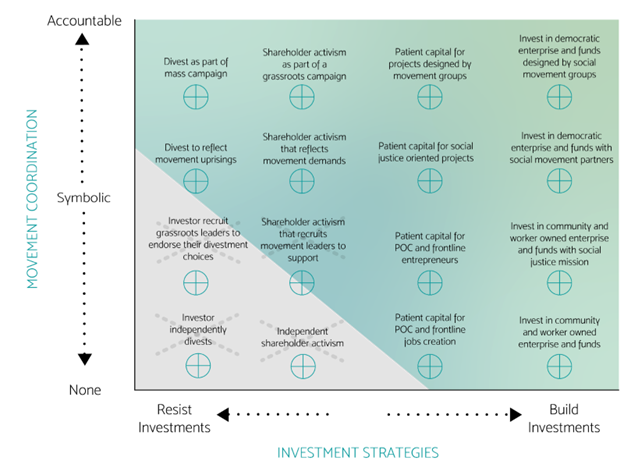

A unique aspect of SMI is its explicit inclusion and analysis of private market investments, such as Community Development Financial Institution loans and worker-owned cooperatives, within their own investment category (”Build”). The explicit premise of SMI is that purely market-based solutions are limited in their ability to foster structural change—and it underlines the importance of organizing to shape culture, laws, and institutions. This key factor is visualized in CED’s Movement Alignment Map, which situates an investment across two axes: 1) its place on the Strategic Alignment Spectrum, from “Exclude” to “Sustain,” and 2) its level of coordination with social movements, from no coordination to full accountability.

Movement Alignment Map

Source: Center for Economic Democracy. (2022). Social Movement Investing: A Guide to Capital Strategies for Community Power, p. 52.

How to Apply These Frameworks

Both Morningstar and the Center for Economic Democracy’s frameworks described above differentiate the varied approaches, tactics, and strategies often used within sustainable-investment-focused funds, products, and policies. The next step is to apply them to your evaluation of sustainable investments. One way to accomplish this is to have these frameworks on hand to reference as you recognize the key terms used in the disclosure materials for investments, such as fact sheets, prospectuses, proxy statements, and shareholder reports. As you conduct your research and due diligence process on investments for your clients, note which approach(es) the investment is/are using—and how. Develop questions to ask sustainable-investment managers if their approaches are unclear. You may even start an advisor study group to evaluate sustainable-investment options using these frameworks. You can also share these frameworks with your due diligence team or the investment committee at your firm to help evaluate sustainable-investment options. These frameworks provide a strong foundation and shared language for advisors, investors, and fund managers to engage with sustainable-investment strategies, and with each other, in a meaningful way. I’m excited for even more-robust conversations to build on this work.

Having multiple frameworks for sustainable investing may seem confusing at first. But I encourage you to familiarize yourself with the ones above, and others. Comparing and contrasting multiple frameworks helps us learn—and ultimately deepens our understanding of sustainable investing as a spectrum of distinct, complementary, and evolving strategies.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3J75DKCBIZCTJMRFWSSJSHHCJ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)