Is There a Right Way to Weight Stocks?

ETFs’ different approaches to weighting stocks have their pros and cons.

There’s a lot to love about market-cap-weighted indexes. These humble strategies assign weights based on market prices—prices that are thought to accurately reflect all known information about the index’s stocks. It’s a simple technique that underlies many of the most popular index-tracking exchange-traded funds, and it comes with a big benefit. Very little turnover and trading costs are required to maintain these indexes because weights automatically adjust to price movements.

Despite those benefits, some indexes ignore market prices and use different targets or metrics to weight their constituents. Some of these alternatively weighted indexes equally weight stocks, while others assign allocations based on fundamental metrics, such as dividends, sales, or book value. In doing so, they’re betting that the market has made an error in assessing stocks’ true underlying value.

Given those differences, market-cap-weighted indexes and alternatively weighted indexes appear to be at odds with each other. One must be “right” and the other “wrong.” But reality is not that black and white. Each has their pros and cons.

Foolish Wisdom

Weighting stocks by market cap is often supported by the idea that the market quickly and accurately incorporates all known information into stock prices. If that were true, each stock’s market price should accurately reflect its underlying value.

Conceptually, that theory holds up even when individuals, on their own, poorly judge a stock’s value. Thousands, if not millions, of investors can collectively arrive at a stock’s correct value if their individual assessments are well-informed and unrelated to each other.

That idea is best exemplified in an account from British polymath Sir Francis Galton. Galton was visiting a local fair when he noticed a contest inviting locals to guess the weight of an ox on display. After the contest, Galton analyzed the estimates and made an astonishing discovery. While the individual estimates varied widely, the median of those guesses landed within 1 percentage point of the ox’s true weight.

Galton hypothesized that while many individuals made poor judgments, guessing either too high or too low, the low estimates canceled out the high estimates, and the median value of all guesses landed near the animal’s true weight.

It isn’t difficult to extrapolate Galton’s observation to financial markets. Investors exercise their estimates of a company’s value through their decisions to buy or sell its shares. Individually, investors may make poor estimates of a stock’s true value, causing them to buy too high or sell too low. But the collective trading of thousands, if not millions, of investors means that those willing to buy at a higher price should be balanced by those demanding a lower price, creating a balancing mechanism much like the one Galton documented.

Ignore the Crowd?

If the market’s balancing mechanism functions correctly, then most stock prices should accurately reflect a company’s underlying value. And indexes that weight stocks by their price, or market cap, should be nearly impossible to beat because those weights reflect all known information. Investors are likely better off reducing their fees and trading costs while the market does the heavy lifting. Taking that thought one step further, alternatively weighted indexes should underperform the market because they are betting against those prices.

Unfortunately, that last point hasn’t held up historically. From July 1996 through September 2022, the Russell RAFI U.S. Large Cap Index—a fundamentals-weighted index that’s tracked by Schwab Fundamental U.S. Large Company ETF FNDX—beat the Morningstar US Large-Mid Cap Index by almost 1.8 percentage points per year, and it turned in a higher risk-adjusted return as well. From that perspective, it has been anything but disadvantaged.

Almost the entire performance gap between those two indexes can be explained by how they weight their constituents. Each holds a similar set of large- and mid-cap stocks listed on U.S. exchanges. The former assigns weights using a combination of fundamental metrics, including leverage-adjusted sales, retained cash flow, and dividends plus buybacks, while the latter uses market prices.

The fundamental index has an advantage hiding in plain sight. Compared with the market-cap-weighted index, it will naturally designate smaller weights to the largest and most expensive stocks in the market. That means it places greater emphasis on smaller stocks trading at lower multiples, two characteristics that have historically outperformed the market.

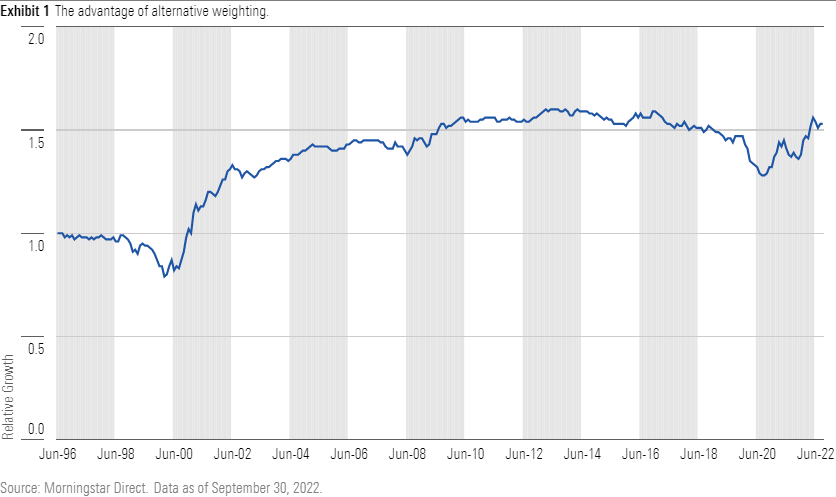

Exhibit 1 paints a more detailed picture of the fundamental index’s performance. It charts the Russell RAFI US Large Cap Index’s growth relative to the Morningstar US Large-Mid Cap Index. An upward sloping line means the Russell RAFI index outperformed, while a downward sloping line indicates the opposite.

The fundamental index’s outperformance is tied to three distinct episodes. It outperformed from March 2000 through December 2006, then it took a break during the global financial crisis before briefly beating the market again between March 2009 and June 2010. And it recently started showing some signs of life, outperforming the market from October 2020 through September 2022.

Each of those three periods shares two common traits. Value stocks outperformed the market in each instance, and all three stretches started after stock prices had reached extreme levels. Exorbitantly high prices characterized the late 1990s and late 2010s, while prices were incredibly depressed following the global financial crisis in early 2009.

Those similarities highlight a flaw in Galton’s elegant pricing mechanism. His account contains two assumptions that need to hold for the market to arrive at accurate prices. Investors need access to information, and that information must inform a wide range of opinions regarding a stock’s share price. A violation of either assumption will likely lead to inaccurate stock prices.

That insight helps distinguish between the advantages and disadvantages of each index. Low-cost ETFs tracking market-cap-weighted indexes have the advantage when information flows free, and that information supports a wide range of opinions. But the accuracy of market prices will break down when emotions take over and lead to one-way thinking. Investors, as a group, can collectively become greedy and buy when prices are expensive, or they may get spooked by declining prices and sell when shares are cheap. In these situations, one-way thinking pushes stock prices further away from their true underlying value without a justifiable reason. In such circumstances, alternatively weighted indexes that ignore those emotionally driven prices are more likely to provide an edge.

The answer to the title of this article is therefore a decisive “No.” Market-cap-weighted indexes and alternatively weighted indexes will travel different paths. Neither one is perfect. But all else equal, both should work well over the long run.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)