3 Successful, Distinct Flavors of Model Portfolios

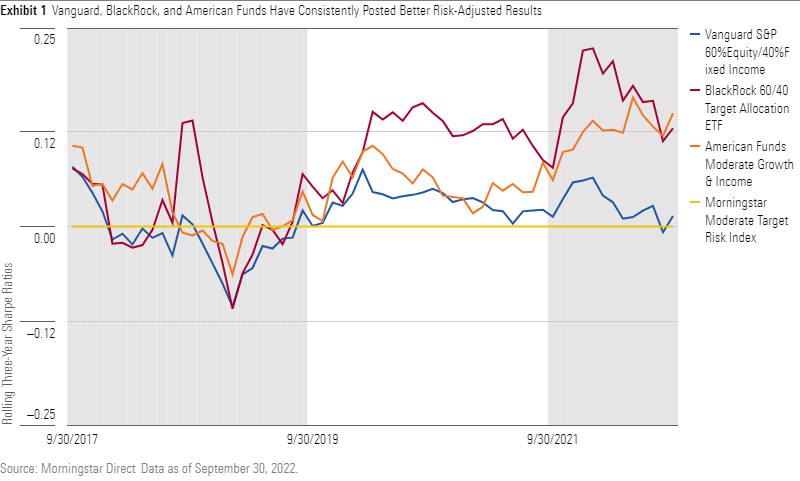

The model portfolios of Vanguard, BlackRock, and American Funds play to their respective strengths.

Growing financial advisor demand has fueled a recent model portfolio surge. Morningstar’s U.S. model portfolio database, which launched in 2019, now has more than 2,600 individual model portfolios. Asset managers and investment strategists have been the most prolific purveyors of the new investment vehicle and continue to commit investment and distribution resources to models.

This article looks at model series from three firms that have taken different approaches but have found early success by applying their existing strengths to the new vehicle.

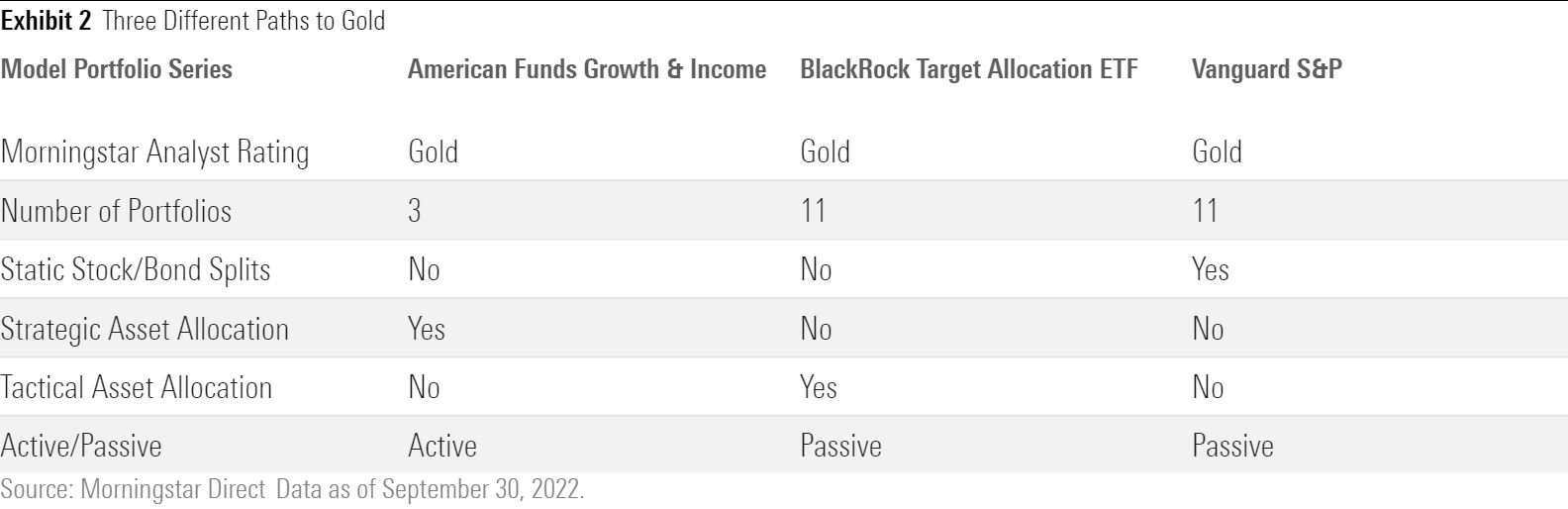

Vanguard’s models, for example, emphasize broadly diversified, low-cost, all-index-fund portfolios. BlackRock similarly uses its cheap, passive iShares exchange-traded funds to keep costs down, while allowing a model portfolio team to make tactical allocation shifts. American Funds’ parent Capital Group relies on its signature active approach and lets proven asset-class specialists drive the allocations where they see fit. Exhibit 2 details the differences between the three behemoths.

We used similar portfolios from the allocation—50% to 70% equity Morningstar Category to compare model portfolio and return data from each firm: American Funds Moderate Growth & Income, BlackRock 60/40 Target Allocation ETF, and Vanguard S&P 60% Equity/40% Fixed Income.

American Funds Growth & Income Series

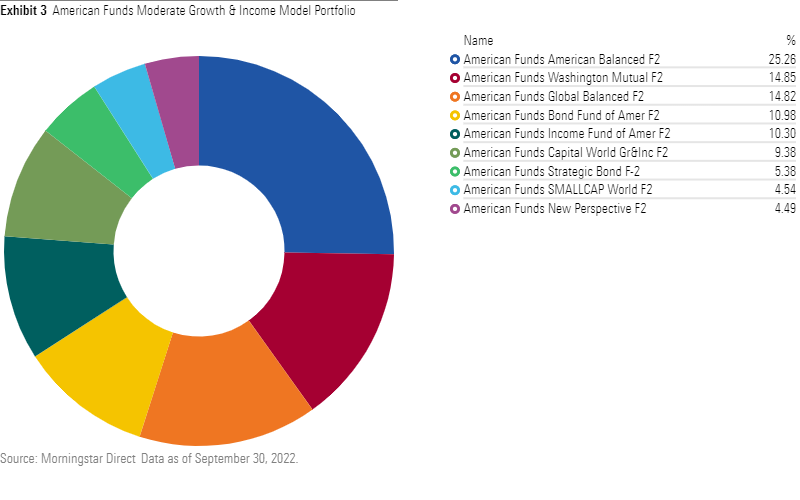

This series’ three multi-asset portfolios cover different risk profiles: moderately conservative (30%-50% equity), moderate (50%-70% equity), and moderately aggressive (70%-85% equity). Instead of making top-down asset-allocation calls, an eight-person oversight committee focuses on objectives such as “income” (steady dividend-payers and fixed income) and “growth” (stocks with significant upside potential but elevated risk). This produces different portfolios across the series, with the more-conservative strategies leaning into more-durable, income-oriented equities and the more-aggressive portfolios favoring higher-multiple growth stocks.

The series’ underlying strategies determine positioning. The stock and bond managers of American Funds American Balanced and American Funds Global Balanced guide their allocations into the most attractive opportunities, regardless of asset class. The asset-class-specific strategies also have considerable leeway. Global, go-anywhere stock strategies like American Funds Capital World Growth and Income let their analyst teams determine the U.S./non-U.S. stock split.

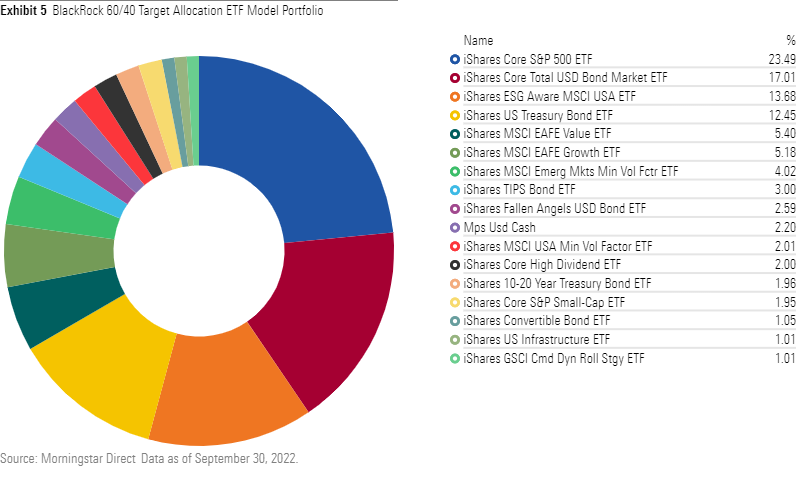

BlackRock Target Allocation ETF Series

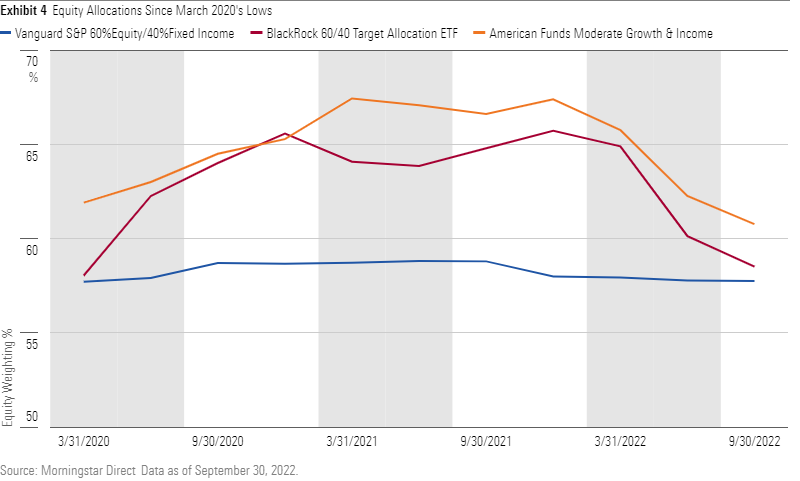

BlackRock’s model portfolio team manages this series of 11 portfolios that range from 100% stocks to nearly all bonds. The team can change those target allocations by up to 5 percentage points, though. For instance, the team lowered the helpings of iShares ESG Aware MSCI USA ETF and iShares ESG Aware MSCI Emerging Markets ETF in most portfolios in May 2022 to adopt a more defensive stance during market turmoil. Exhibit 4 highlights how the overall stock allocation has changed since March 2020′s lows versus the relevant American Funds and Vanguard peers.

The team also added iShares MSCI USA Value Factor ETF, a sector-neutral ETF, in May 2020 when it concluded value would outperform as markets recovered from the pandemic lockdown-induced bear market. Later, when the specter of rising rates appeared, the team pivoted to more-traditional value-oriented options like iShares Core High Dividend ETF and iShares S&P Small-Cap 600 Value ETF.

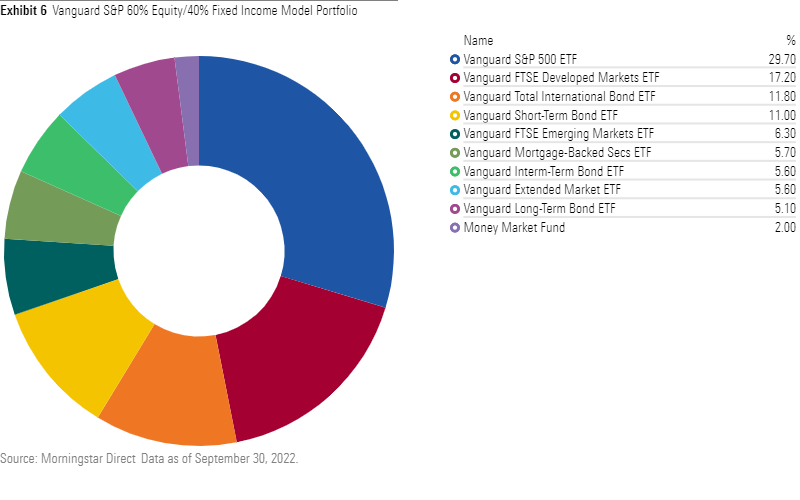

Vanguard S&P Series

The Vanguard S&P series is straightforward and effective. Like BlackRock, it includes 11 portfolios with varying equity weights. Yet the stock/bond and U.S./non-U.S. splits for the portfolios stay mostly the same apart from changes driven by market movements between rebalancings. Vanguard doesn’t make tactical allocation calls—it offers consistent exposure to a strategic plan throughout market environments.

While not as simple as its Vanguard CORE sibling (which holds just four ETFs), the S&P series uses low-cost, diversified Vanguard ETFs. It uses four stock funds: two each focused on U.S. (Vanguard S&P 500 ETF and Vanguard Extended Market ETF) and non-U.S. equities (Vanguard FTSE Developed Markets ETF and Vanguard FTSE Emerging Markets ETF). The bond sleeve isn’t cumbersome to implement, it relies on Vanguard Total International Bond ETF for foreign bonds and four ETFs covering mortgage-backed securities and long-, intermediate-, and short-term bonds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/cfa8a92a-3493-4cb4-80ba-e3af514136a0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cfa8a92a-3493-4cb4-80ba-e3af514136a0.jpg)