As COP27 Focuses on Financing Climate Transition, Options for Climate Fund Investors Widen

The number of climate funds has reached a record high of 1,140 globally.

Climate summit COP27, which is happening now, is an opportunity to step up climate finance and discuss partnerships between the private sector, governments, and investors to fully operationalize the Paris Agreement to limit global warming to 1.5˚C.

This work is critical, but the scale of capital needed for the transition is significant.

Mark Carney, special U.N. envoy for climate action and former Bank of England governor, calls the move to net zero the “greatest commercial opportunity of our time.” Yet that transition also means investors must take steps to protect their portfolios from climate risks: Some investments will be disadvantaged in the transition to net zero, while others will find themselves vulnerable to physical risks from extreme events caused by climate change.

Fund investors have a burgeoning number of choices to invest in climate-change-related opportunities, as well as to mitigate climate risk in their portfolios.

In this article, portions of which were published earlier this year, we dive into the global climate-focused fund landscape. We explore the mix of offerings available to investors as they seek to decarbonize their investments and help finance the transition to a low-carbon economy.

Though the Rate of Climate Fund Launches Has Slowed, Repurposed Funds Increase

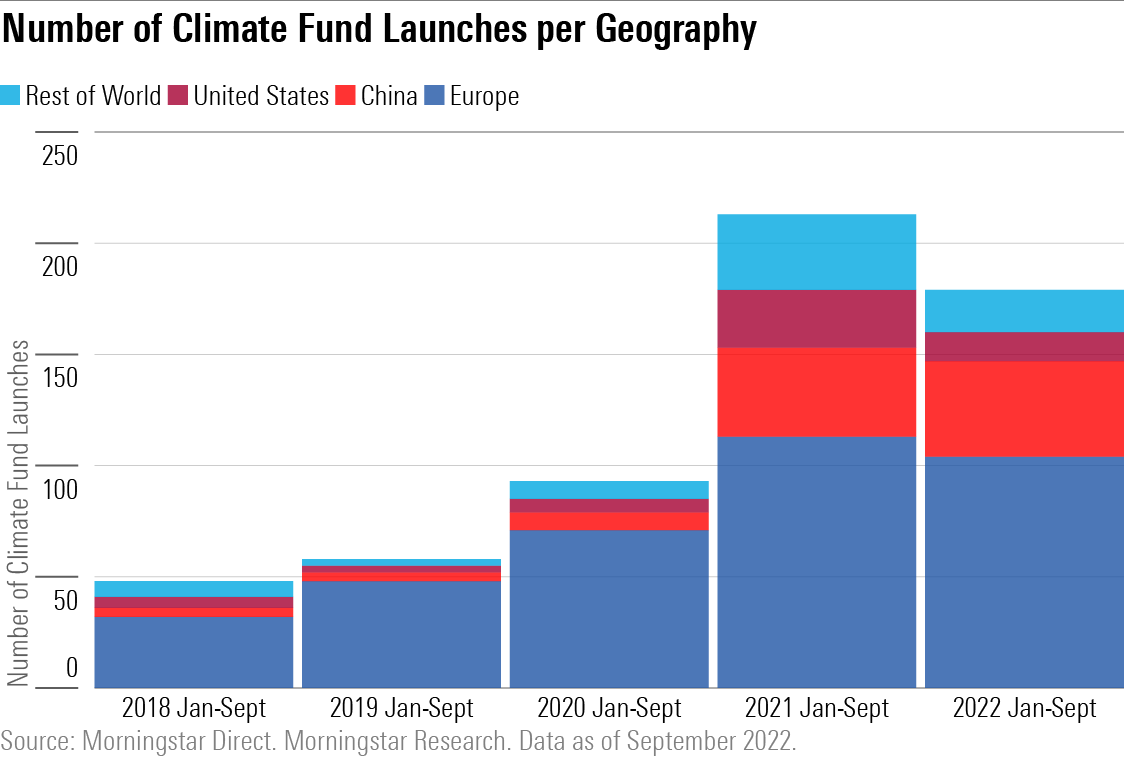

The menu of options for climate-focused investors across the globe expanded significantly during the first nine months of 2022.

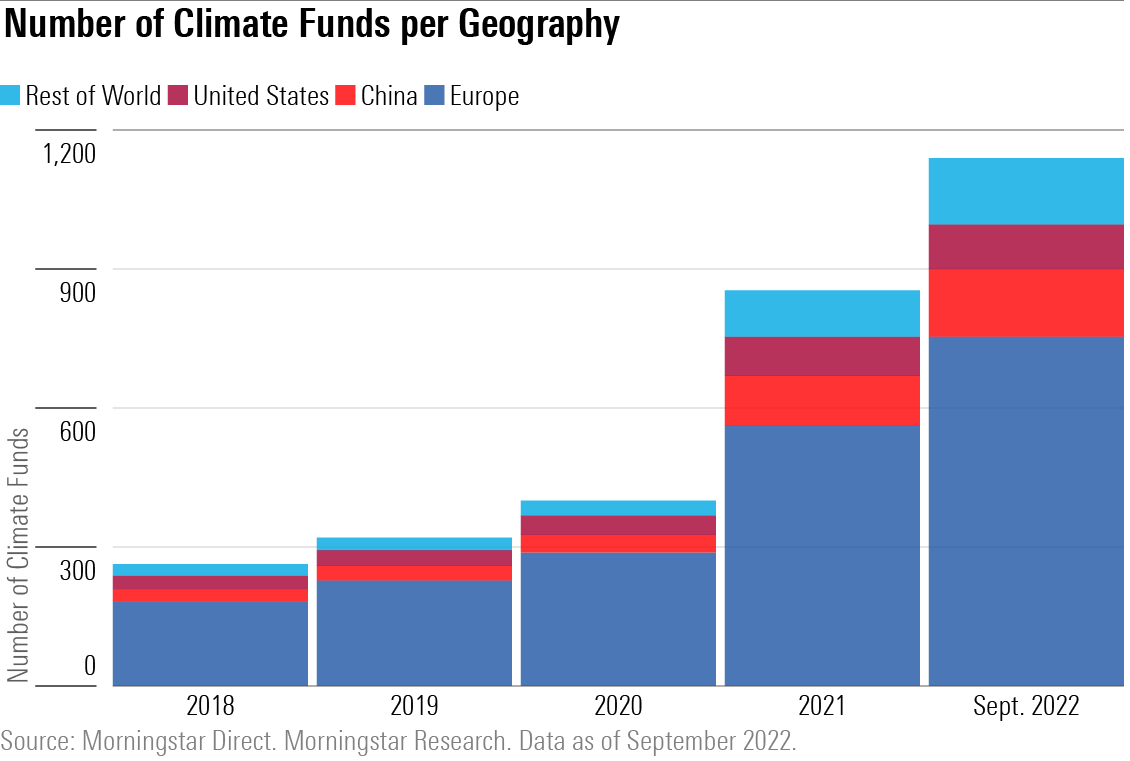

The number of mutual funds and exchange-traded funds focused on a climate-related theme globally reached a record high of 1,140 at the end of September, compared with 860 funds at the end of last year.

This 32% growth stemmed from continued strong product development. Investors have consistently pushed asset managers to develop new approaches to manage climate risks in portfolios, take advantage of opportunities arising from the transition, and contribute to the reduction of real-world emissions.

Though the number of launches so far in 2022 is fewer than the number seen in the same period last year, more funds have been repurposed this year. At least 100 funds, predominantly in Europe, have switched mandates to adopt a climate-focused strategy or added Paris Agreement-aligned emission reduction targets. The numbers of both new launches and repurposed funds are likely to be revised upward in coming months as we identify additional qualifiers.

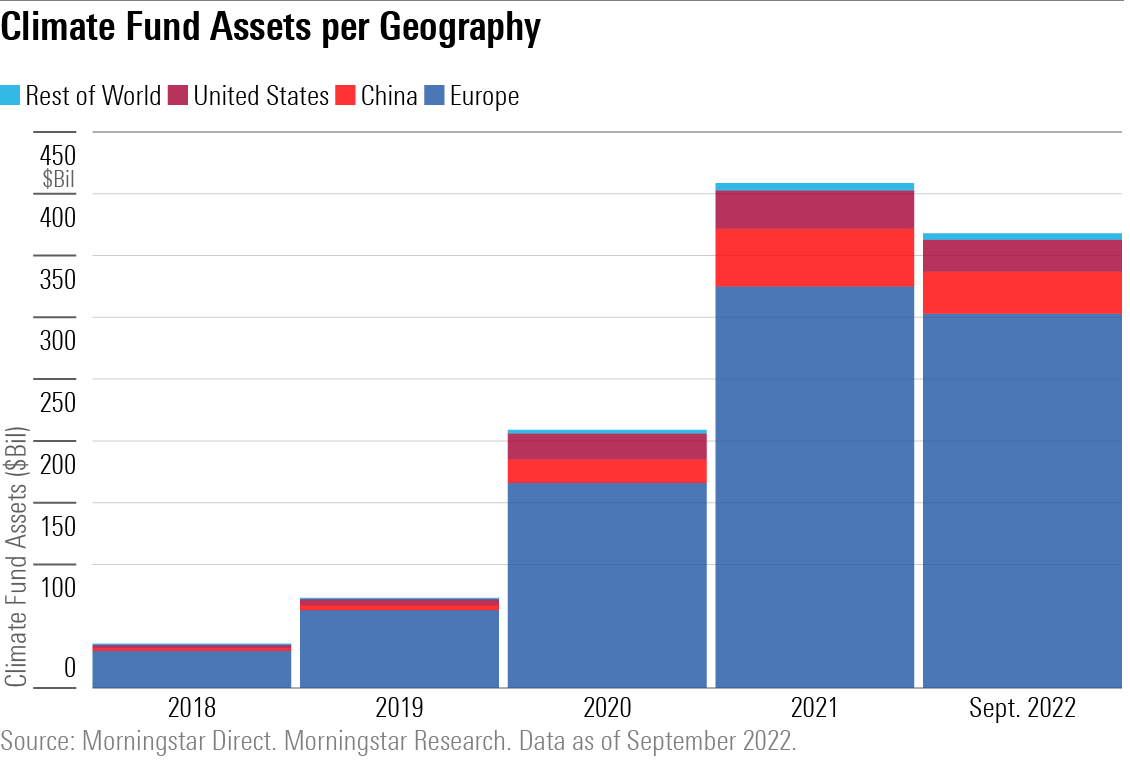

In terms of assets under management, falling stock markets, lower inflows, and the strong dollar drove global U.S.-dollar-denominated assets in climate-themed funds down almost 10% in the nine months through September 2022 to $368 billion. China experienced the largest drop (27.4%), followed by the United States (15.7%), while Europe shed 6.5%.

It’s worth pointing out that this analysis differs depending on the currency used for the calculation. In U.S.-dollar-denominated terms, European assets fell to $303 billion from $325 billion during the first nine months of 2022; in euros, European assets rose by 7.6% to EUR 309 billion from EUR 287 billion over the same period. In yuan-renminbi terms, Chinese assets still fell, by 14.3%.

Climate funds have not been immune to the challenging macro environment, but have exhibited resilience, in aggregate. For context, global fund assets shrunk by 24% in dollar terms over the first nine months of the year.

Unsurprisingly given its greater commitment to a climate agenda, Europe remains the largest and most diverse climate funds market. China is the second-largest climate funds market, having overtaken the United States last year.

A Range of Approaches to Climate Solutions

We view the climate fund universe through the lens of five mutually exclusive categories: Low Carbon, Climate Conscious, Green Bond, Climate Solutions, and Clean Energy/Tech. You can read more about our approach to these categories in our previous article.

So far in 2022, asset managers, particularly in Europe, have focused their product development efforts on Climate-Conscious funds, which represented 37% of all climate fund launches, followed by Climate Solutions funds (31%) and Clean Energy/Tech funds (17%).

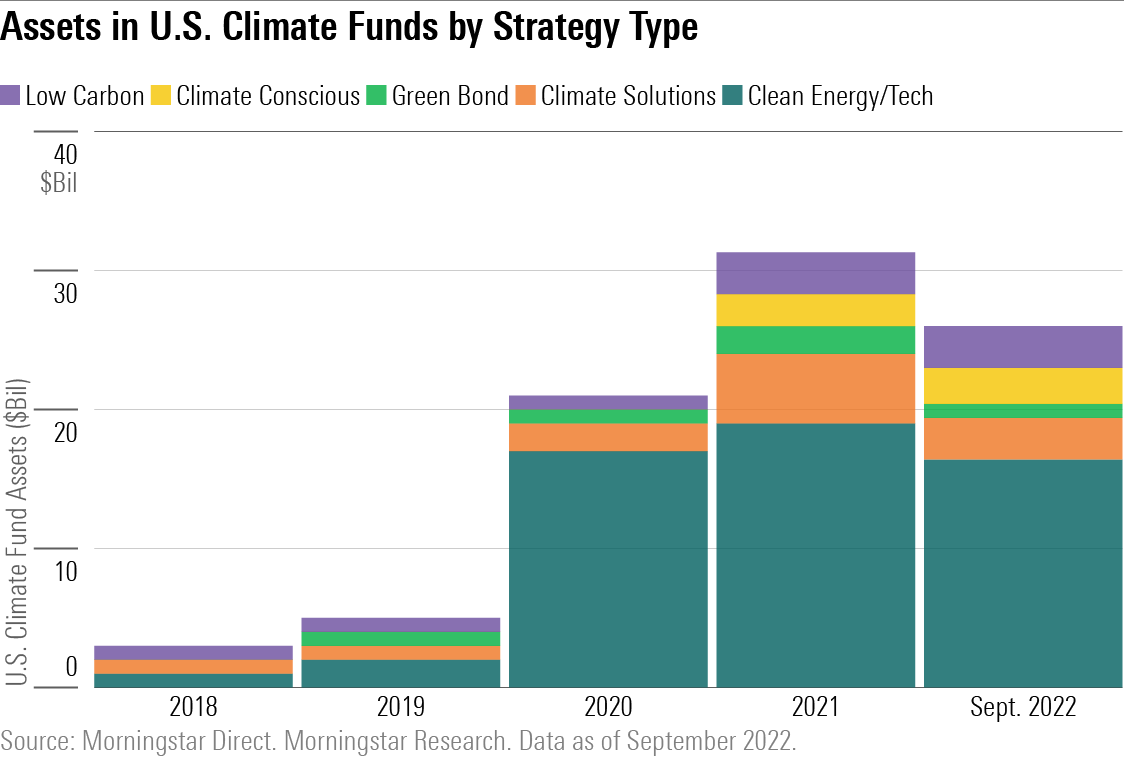

Climate-Conscious and Climate Solutions strategies have grown the fastest in the past couple of years, now accounting for 34% and 23% of global climate fund assets, respectively. Still, Clean Energy/Tech remains the dominant climate strategy outside of Europe.

United States

In the U.S., assets in the most popular climate funds, namely Clean Energy/Tech funds, were 15% lower in September relative to December 2021, at $16.4 billion, mainly due to falling valuations. In comparison, the S&P Global Clean Energy and Nasdaq Clean Edge Green Energy, the indexes tracked by the two largest clean energy ETFs, dropped by 9% and 16% over the period, respectively.

Compounding the lower price effect, Clean Energy/Tech funds bled $430 million in the first nine months of the year as investors favored traditional energy companies amid record oil and gas prices. In comparison, Clean Energy/Tech funds registered $6.9 billion of inflows over the same period in 2021.

Climate Conscious strategies, which made their debut in the U.S. only last year, was the only group that grew this year to $2.6 billion in assets at the end of September, from $2.3 billion nine months ago.

Meanwhile, product development activity slowed down, with only 13 new climate-themed products so far this year—half of last year’s number over the same period. But investors can expect more new offerings to come to market following the implementation of the Inflation Reduction Act, which is designed to spur investment in clean energy and electric vehicles.

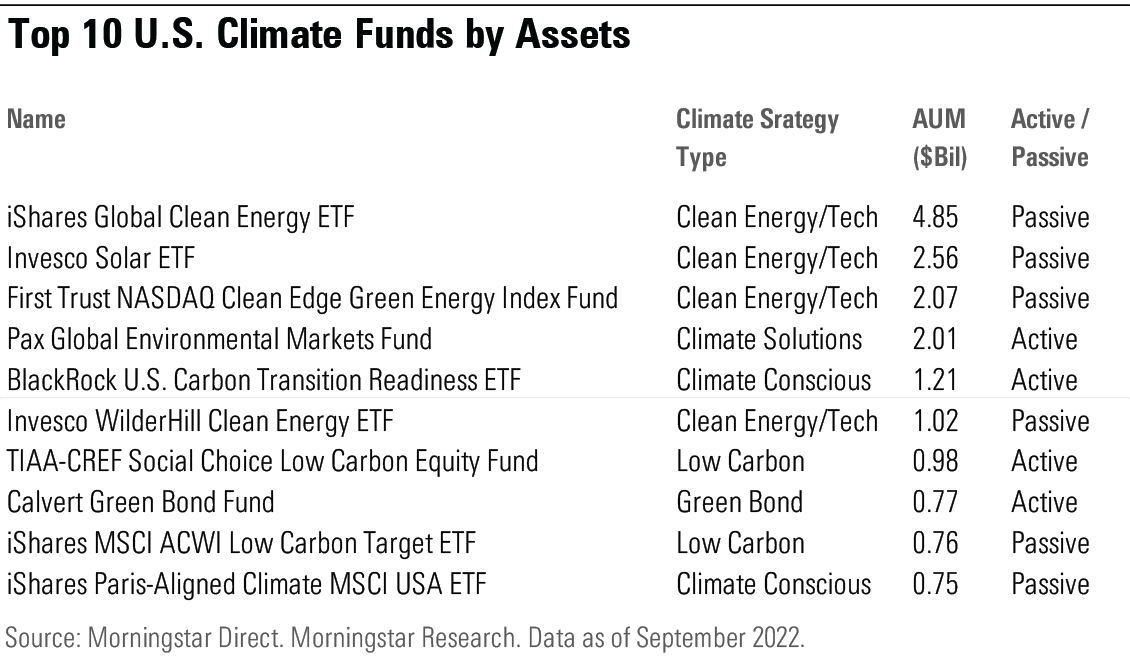

The exhibit below shows the 10 largest climate funds in the U.S. at the end of September.

The list of the top 10 U.S. climate funds is fairly diversified, with four Clean Energy/Tech passive funds, two Climate Conscious ETFs, two Low Carbon strategies, one Climate Solutions fund and one Green Bond offering.

Europe

2020 and 2021 were pivotal years for sustainable investing in Europe with the rollout of two groundbreaking classification and disclosure regulatory frameworks as part of the European Union’s Action Plan on Sustainable Finance: the EU Taxonomy and the Sustainable Finance Disclosure Regulation. Both initiatives had a ripple effect across multiple areas, including climate investing. The number of European climate-themed funds has tripled over the past couple of years, reaching 754 at the end of September 2022.

Assets, however, dropped by 6.5% in the first nine months of the year to $303 billion, after doubling in 2021. The worst-hit strategies were in the Climate Solutions category, which also experienced the biggest decline in inflows so far this year. Climate Solutions funds attracted just $3.8 billion in the first nine months of 2022, compared with $25.2 billion over the same period last year. Still, Climate Solutions remains the second most popular strategy in Europe, after Climate Conscious.

Meanwhile, assets in Climate Conscious strategies kept rising. Funds that tilt toward companies that are better positioned for the transition to a low-carbon economy attracted $30 billion in the first nine months of the year, more than the category’s inflows for all of 2021. This new money drove assets in Climate Conscious products to a new high of $120 billion at the end of September.

Strong flows into Climate Conscious funds were also accompanied by rapid product development, with 54 new offerings and 47 repurposed funds debuting so far this year. Climate Conscious funds represented more than half of new climate fund launches in Europe.

Among the 10 largest climate funds in Europe, three are strong examples of passive ESG funds that have successfully switched to climate-transition benchmarks: iShares MSCI USA ESG Enhanced ETF, BlackRock ACS Climate Transition World Equity Fund, and Handelsbanken Global Index Criteria.

Climate-transition and Paris-aligned benchmarks are newly created EU climate benchmarks designed to consider climate risks and opportunities, and to match the transition to a climate-resilient economy by ensuring a yearly decarbonization target of at least 7%. This rate reflects the decarbonization trajectory of the Intergovernmental Panel on Climate Change’s 1.5˚C scenario.

China

China experienced triple-digit growth in 2020 and 2021, resulting in the country overtaking the U.S. as the world’s second-largest climate funds market. This rapid expansion was driven by the heightened focus on climate change and other environmental issues in the Chinese government’s agenda for economic transformation.

However, this year, Chinese climate funds saw their assets drop by 27% to $34 billion in September due to falling market valuations as well as the appreciation of the U.S. dollar.

The most popular strategy, namely Clean Energy/Tech, suffered the most from both outflows and lower valuations, in absolute terms, registering a decline in assets of 22%. However, product development in China remained strong, with 43 climate-themed products launched in the first nine months of 2022.

Which Climate Funds Are Right for You?

The choice of one type over another largely depends on an investor’s investment goals, risk appetite, and preferences. For example:

- Investors who are concerned about the risks to their investments posed by climate change can look to low-carbon funds to decarbonize their portfolio. These vehicles are oriented primarily toward mitigating climate-related risks.

- Investors concerned about climate-related risks who want to invest in opportunities that may benefit from the transition to a low-carbon economy can turn to Climate-Conscious funds. They typically exhibit low carbon risk and low fossil fuels exposure, with the added benefit of higher carbon solutions involvement.

- Investors who want to direct capital to climate-change solutions can look to Climate Solutions and Clean Energy/Tech strategies. Because of their narrower market exposure and bias toward mid-caps and small caps, these funds represent more-volatile investments.

- Investors who want to orient their fixed-income exposure toward climate solutions may find Green-Bond funds a good fit. Investors should be aware that the projects financed by Green Bonds are indeed providing green solutions, but Green-Bond issuers may be heavy carbon emitters that are transitioning to lower-carbon activities.

Climate-aware investors can also take an all-of-the-above approach. To address climate risk in core equity holdings, investors can use Low Carbon or Climate-Conscious funds, or opt for more broadly based funds with low-carbon or climate-conscious features. They can make green bonds a central part of their fixed-income exposure, either via dedicated Green-Bond funds or more broadly based sustainable bond funds that invest a portion of their portfolios in green bonds. And they can dedicate a portion of their investments to Climate Solutions or Clean Energy/Tech funds as a way to help finance the transition to net zero.

As COP27 continues to dominate the news, it will likely spark even more investor interest in addressing climate change in their portfolios, both to mitigate climate risk and to invest in climate solutions. With so many climate-aware fund options, understanding the range of strategies is an important first step in positioning portfolios to align with net zero goals.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)