What Makes Market-Value Weighting Work for Bond Investing?

Alternative-weighting methods deliver different risk/return profiles.

Most investors reach for a broad, market-value-weighted bond fund to fill the bond portion of their portfolio. While no weighting approach is perfect, market-value weighting often provides the most straightforward and affordable option.

Still, could market-value weighting be improved upon? Particularly in the fixed-income market, where many of its underlying assumptions might be on shakier ground, the market seems to think so. The number and asset base of index-tracking bond funds using alternative approaches to weight their holdings have steadily increased in the past few years.

However, rather than some type of magical cure-alls, most tend to repackage risk factors such as credit quality and duration. Thus, investors need to understand if, where, and when they might want to pick up these different risks before jumping on board.

Market-Cap Weighting Isn’t Perfect …

Market-value-weighted bond indexes have some big advantages. Weights automatically adjust to price changes, and these portfolios often lean toward the largest and most liquid bonds. All else equal, these features lead to lower transaction costs for funds tracking market-value-weighted indexes. Their relatively simple nature also means they’re easily replicated, so competition is intense, and fees tend to rank among the lowest around.

Lower trading costs and expense ratios have historically helped broad market-value-weighted portfolios outperform many of their category peers. However, the efficacy of weighting bonds by their market value rests on two assumptions: The market has access to all relevant information, and prices fully reflect that information.

Certain features of the fixed-income market can weaken these assumptions. Information that’s important to bond prices isn’t always distributed quickly to all investors, high transaction costs on some bonds may discourage trading, and structural quirks can affect prices in certain parts of the market.

Unlike the stock market, bonds don’t have centralized exchanges that broadcast the latest prices. The majority of trades occur in a broker/dealer network where traders often source liquidity by making requests for quotes. This fragmented structure makes it difficult for market participants to know the latest price on any given bond, so prices will likely take longer to reflect a bond’s true underlying value. Traders may encounter more frictions to match orders in this system, which can add to trading costs.

The sheer size and diversity of the bond market also plays a role. Most companies have one or two stock share classes that trade on an exchange, but there’s no limit to the number of bonds they can issue. Bonds from a single company can also vary across maturities, coupon rates, and credit ratings. And the composition of the market changes constantly as companies issue new bonds when financing needs arise. This results in a massive number of tradable bonds, which decreases their trading frequency and concentrates trading activity among the most liquid issues.

Certain structural quirks in the fixed-income market can drive prices away from a bond’s fair value. Some investors may not be allowed to own high-yield bonds, or they may prefer to avoid that segment of the market. Those preferences can lead to forced selling that pushes prices lower when BBB rated bonds get downgraded from investment-grade to high-yield status. Aside from downgraded bonds, yield-chasing behavior in the high-yield market can also push prices above bonds’ intrinsic value, creating further inefficiencies in pricing.

All in all, market-value weighting becomes less effective when it’s deployed on riskier and less liquid segments of the bond market. The cost advantages may not be enough to make up for these inefficiencies. Active managers with more flexibility and fundamental research capabilities have usually dominated these corners of the fixed-income market, such as emerging-markets debt or high-yield bonds.

… But Does Alternative Weighting Solve the Problem?

Alternatively weighted bond indexes promise better performance than market-value-weighted benchmarks. But there’s no magic at work. Risk factors such as credit quality and duration often explain a majority of their outperformance. Benefiting from these risks can be difficult and requires patience. They may underperform the market for extended periods of time and can take years (if not longer) to pay off.

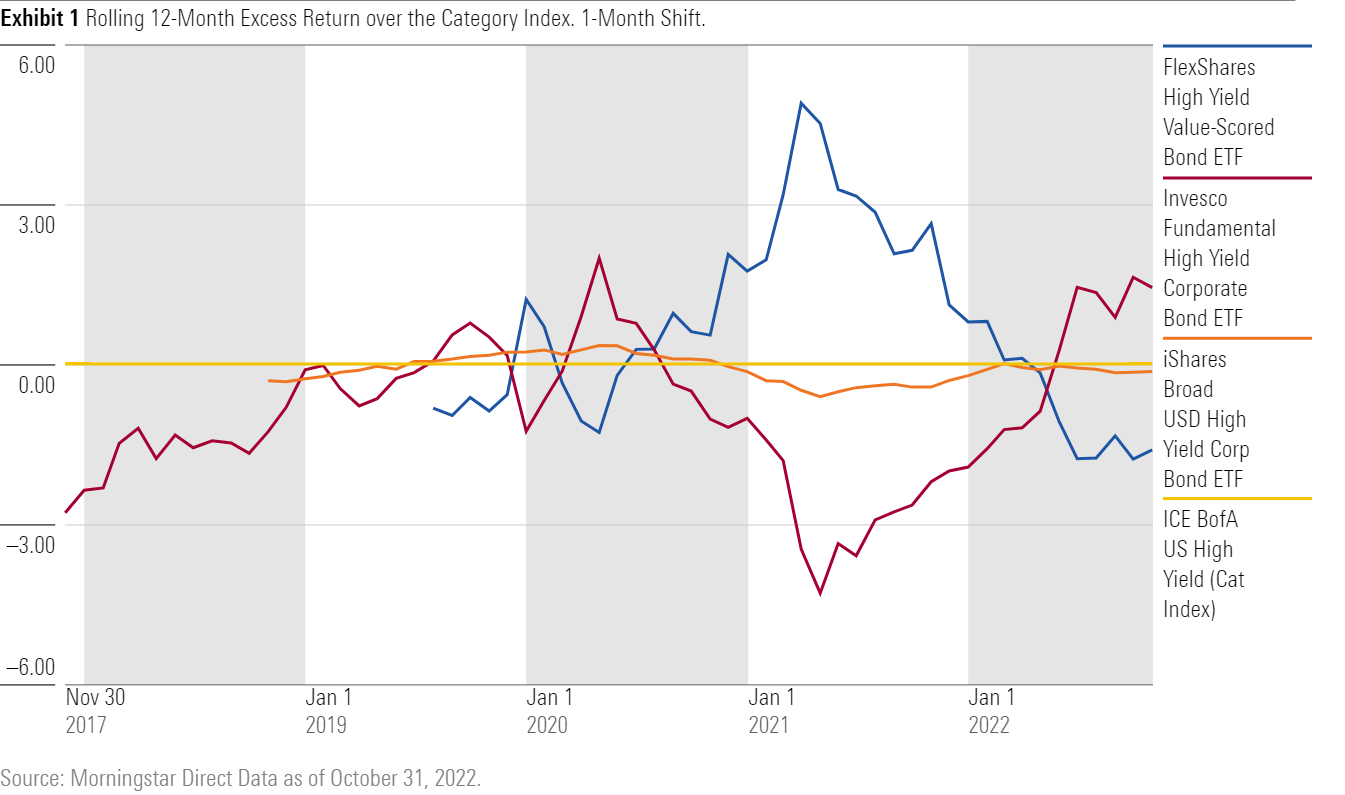

Exhibit 1 shows the excess returns of two alternatively weighted exchange-traded funds versus their category index in the high-yield bond Morningstar Category. FlexShares High Yield Value-Scored Bond ETF HYGV and Invesco Fundamental High Yield Corporate Bond ETF PHB are popular choices for investors, with both nearing $1 billion in assets. Yet their approaches couldn’t be more different, as their opposing performance patterns demonstrate.

HYGV leverages an optimizer to maximize exposure to bonds with attractive valuations based on the index’s scoring system. For each security, the index assigns a value score and a credit score. The value score is based on its valuation, credit spread, and issuer solvency. The credit score incorporates the issuer’s management efficiency, profitability, and solvency. The index excludes bonds ranking in the bottom 10% by credit score with the hopes of filtering out bonds at risk of default. The optimizer then maximizes the fund’s total value score, subject to constraints. The resulting portfolio carries higher credit risk than its category index, overweighting bonds rated CCC by 10%, as of October 2022.

PHB leans toward the other side of the credit risk spectrum, using issuer-level financial metrics to tilt away from riskier bonds. For each issuer, the fund calculates their sales, cash flow, dividends, and book value as a percentage of the total aggregate figures for all issuers in the universe. The four ratios are then averaged into a single composite score for each issuer, which determines their weight in the portfolio. This process tilts the fund toward companies with strong cash flow and stable businesses, which should improve their ability to repay debts.

PHB only invests in two bonds per issuer and neglects debt measurements—quirks that ultimately erode its advantage over the category index. But its performance still reflects a quality tilt. For instance, PHB outperformed the category index and HYGV during the coronavirus-driven shock in March 2020. It then lagged during the recovery period and as credit spreads rapidly compressed during the rest of 2020 through mid-2021. Similarly, the fund tends to outperform the category index when HYGV underperforms, and vice versa.

Neither have managed to deliver consistent outperformance against the category index, however. PHB exhibited slightly lower volatility than the category index but lagged it by nearly 3 percentage points annualized from its 2007 inception through October 2022. On the other hand, HYGV beat the category index by 4 basis points annualized from its 2018 inception through October 2022 but with higher volatility.

Where to Go From Here?

It’s important to realize alternative-weighting methods are not an all-in-one solution; rather, they simply deliver different risk/return profiles. Performance patterns highlight the nascent trade-off with alternative weighting where deviating from the broader market results in more uncertainty. Active risk is not inherently good or bad. Sometimes they pay off, sometimes they don’t. Investors should weigh the pros and cons of alternatively weighted funds against a market-cap-weighted portfolio within the context of their own risk tolerance and time horizon. Bear in mind, however, that many of these funds screen their holdings instead of just applying a different weighting scheme to the entire market. These filters add to the active risk taken by these funds. One way or another, investors should expect different returns than they would receive from a market-cap-weighted peer.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)