How a New Retiree Can Confront Market Turbulence

A 72-year-old retired engineer seeks a review of her withdrawal rate and her portfolio positioning.

Editor’s Note: This portfolio makeover is from 2022. Keep in mind that the current market environment may be different than when this makeover was executed.

Gina is experiencing serious market volatility for the first time during her retirement, and it doesn’t feel great.

At 72, this biomedical engineer has been retired for about seven years. She was laid off at 65 and planned to look for another job at that time, but caring for her mother sidetracked her from the job hunt. Her mother passed away in 2019, but then the coronavirus came on strong, putting a new job out of the question. Gina now considers herself fully retired and spends her time with two great passions she didn’t have a chance to pursue during her working years: writing and sculpting.

Gina has amassed a solid portfolio of about $2.5 million. But her parents were both long-lived—92 and 99—so Gina is concerned about the prospect of outliving her nest egg, particularly now that both stocks and bonds have logged losses in 2022 and her portfolio has taken a hit. She’s also concerned about escalating costs, particularly on her apartment rental in a major city center in the Pacific Northwest. She loves her place and has lived there 20 years. Gina considers it an ideal spot for her retirement, in that she can access shops, restaurants, and her art classes by walking or via public transit. Yet she notes that it’s by far the biggest part of her budget, and she’s concerned about further rent increases.

She wrote seeking a second opinion on her portfolio and her plan. “I would love your input on any further diversification you think would improve my asset allocation and better use of the cash I’m holding,” she wrote. In addition, Gina has contemplated an annuity purchase to cover some of her living expenses, but she has questions about the prudence of such a big move. “I’m not sure if that makes sense with interest rates going up, my current net worth, inflation, and the pretty large amount of initial premium that would be required,” she wrote.

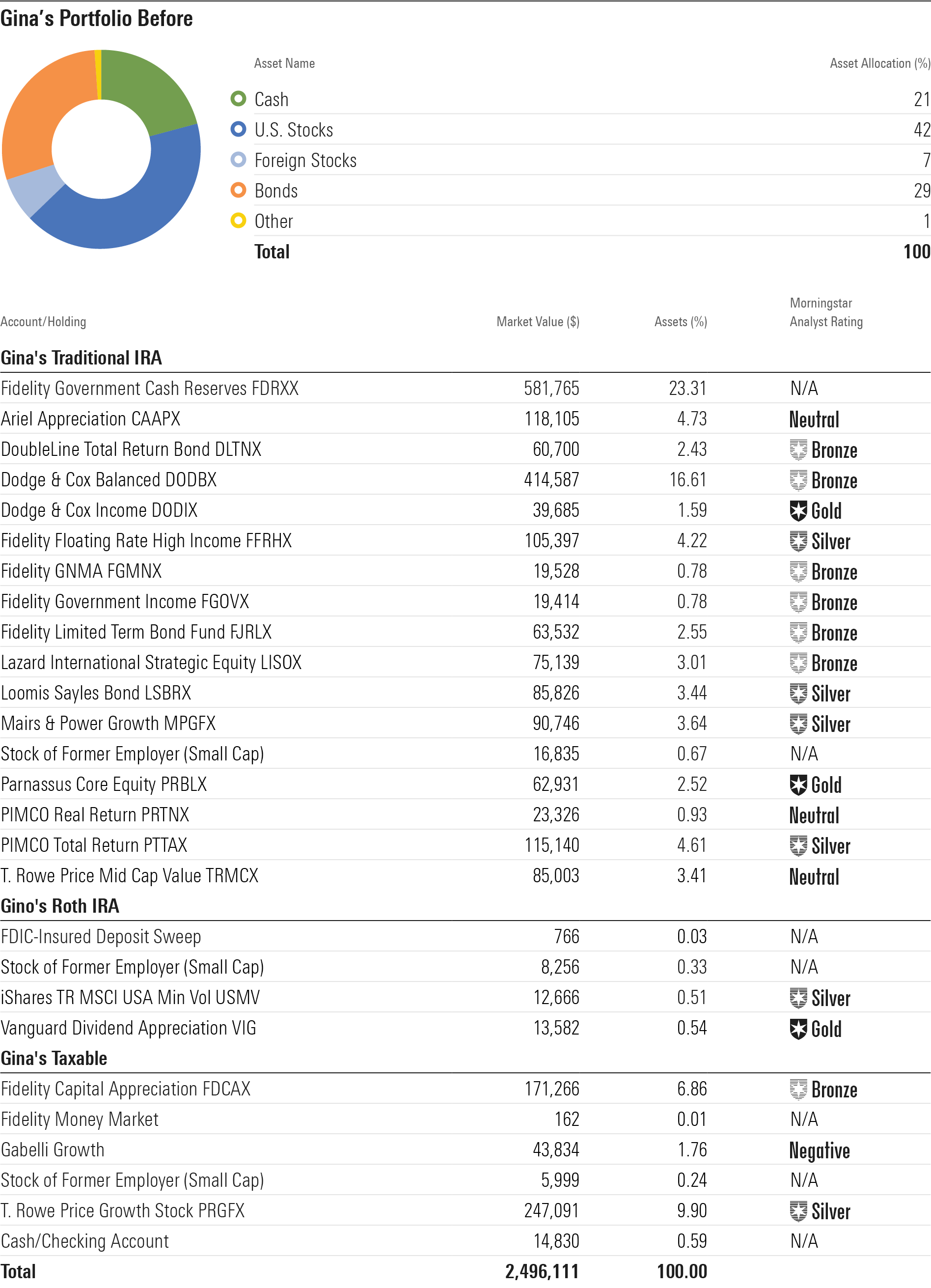

The Before Portfolio

The bulk of Gina’s $2.5 million portfolio is in her traditional IRA, which she rolled over from her previous employer’s retirement plan upon leaving the firm. She has smaller Roth IRA and taxable brokerage accounts. Her largest holding in her traditional IRA is a cash account—nearly $600,000 currently. That and an array of bond holdings—nine in all—mean that Gina’s IRA skews to the conservative and, because it’s her largest account, so does the total portfolio. Her “Before” asset allocation on the total portfolio is 49% stocks, 29% bonds, and 21% cash.

Gina has chosen some excellent investments: Nearly all of her holdings receive Morningstar Medalist ratings from our analysts. But a handful don’t: Gabelli Growth GABGX, for example, which is a holding in her taxable account, currently earns a Morningstar Analyst Rating of Negative, in large part because of its high expense ratio. T. Rowe Price Mid-Cap Value TRMCX, a onetime standout, is rated Neutral thanks to the recent appointment of a new and untested manager. Ariel Appreciation CAAPX is also rated Neutral.

Gina owns mainly mutual funds, but she also has small positions in the stock of her former employer—a small cap—across multiple accounts. Overall, her portfolio leans toward the growth side of the Morningstar Style Box, and she has limited value exposure.

Gina is well covered from the standpoint of long-term care, noting that she has three separate policies.

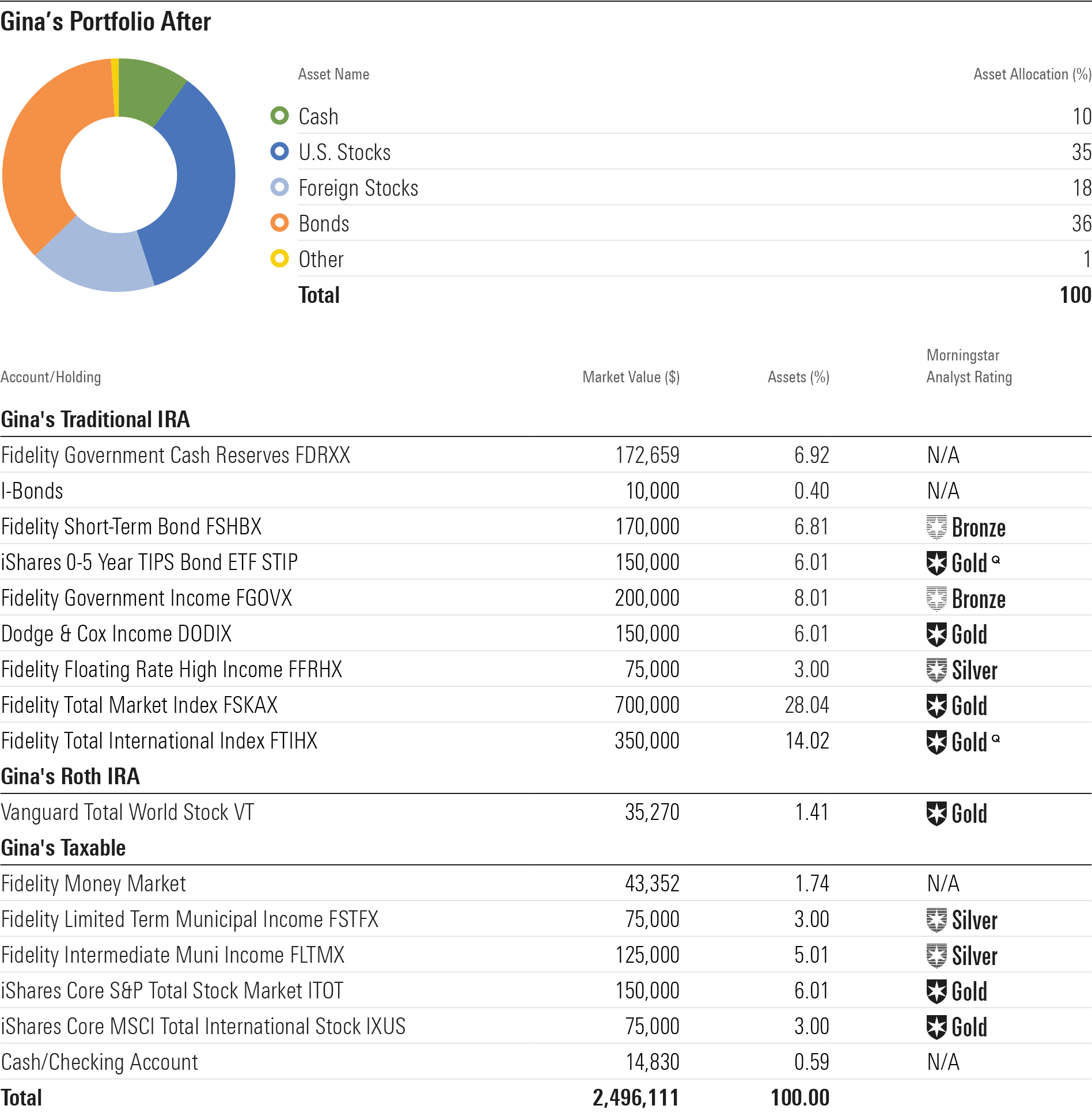

The After Portfolio

Given that outliving her assets is a big concern of Gina’s, job number one is to assess whether her current spending is sustainable. She notes that she needs $103,000 a year from her portfolio, in addition to Social Security, to live, pay her taxes, take classes, and buy art supplies. That translates into a 4.1% withdrawal rate given her aggregate portfolio balance of $2.5 million. That’s a reasonable percentage given that her portfolio balance has fallen this year, so her withdrawal percentage is calculated on a balance that has already declined, as well as the fact that she’s 72 and not just embarking on retirement.

Because Gina is concerned about the possibility of outliving her assets, a basic annuity could help provide her with peace of mind. Steering $300,000 into an immediate annuity, for example, would deliver roughly $25,000 in annual income for the rest of Gina’s lifetime. That would take her withdrawal rate on her remaining portfolio down to 3.6%. Gina could use her nondiscretionary income needs as a starting point when deciding how much to annuitize: Of the $103,000 she’s currently withdrawing, how much of that income goes to basic living expenses?

Alternatively, Gina could consider a deferred income annuity to supply her living expenses later in life if her portfolio value has dwindled. For example, such an annuity purchased with $100,000 today would begin paying her about $32,400 a year at age 85. Yet Gina rightly points out that a risk factor with any annuity purchase, especially a deferred annuity, is that inflation will take a bite out of the purchasing power of that income stream. On the plus side, her Social Security income is nicely buffered against inflation, and her investment portfolio includes a decent defense against inflation in the form of substantial equity exposure. Additionally, Gina could consider purchasing an apartment in lieu of renting, the better to stabilize her living expenses, but of course that’s first and foremost a personal decision rather than a financial one.

Whether she chooses to purchase an annuity or not, Gina’s portfolio can be better organized to meet her distribution goals while also positioning itself for long-term growth. She has far too much cash in her IRA currently, particularly given the headwind of inflation. The fact that both stocks and bond have fallen this year provides a great time to reposition that account.

Within her IRA, I left roughly two years’ worth of (current) required minimum distributions in her cash account, then another eight years’ worth of RMDs into her bond holdings. With 10 years’ worth of anticipated portfolio withdrawals staked in cash and bonds, the remainder of Gina’s portfolio can reasonably go into a globally diversified equity portfolio. I retained several of her bond holdings and added positions in a short-term bond fund and a short-term Treasury Inflation-Protected Securities exchange-traded fund. Gina can also take advantage of the sizable inflation adjustments on offer to build out a position in I Bonds. I jettisoned Dodge & Cox Balanced DODBX; while it’s a fine option, holding discrete stock and bond holdings will make it simpler for Gina to determine where to go for cash when she needs it. For equity exposure, I employed two plain-vanilla, low-cost index funds. That way she won’t have to worry about manager changes or style changes in her holdings. I boosted her non-U.S. exposure as a percentage of her total equity allocation.

Within Gina’s taxable account, I used a similar three-bucket framework to help supply cash flow needs above and beyond the living expenses that her RMDs supply. Given that she’s actively tapping that account for living expenses, it should include cash and a portfolio of short- and intermediate-term bonds to serve as next-line reserves. I used municipal-bond funds to reduce the drag of taxes. In this portion of the portfolio, I omitted TIPS because of their poor tax efficiency.

Because Gina’s Roth IRA would likely be the last that she would tap for living expenses and the mostly likely to be passed to her nieces and nephews, it can be invested quite aggressively. Given that it’s a fairly small share of her portfolio, a globally diversified equity ETF makes sense.

The After portfolio has fewer holdings and de-emphasizes active management, so Gina should find it simple to determine where to go for cash on a year-to-year basis. In a strong year for stocks, for example, she can trim her equity exposure to supply living expenses. And in a weak year for both stocks and bonds, like 2022, cash and high-quality short-term bonds will tend to hold up better than the rest of the portfolio and therefore will be her best source of funds. If interest rates continue to trend higher, she may be able to pull a healthy share of her income needs from bonds.

Note: Names and other potentially identifying details in the makeovers have been changed to protect the investors’ privacy. Makeovers are not intended to be individualized investment advice, but rather to be illustrations of possible portfolio strategies that investors should consider in the full context of their own financial situations.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)