Which Fund Companies Are Getting Upgraded?

A look at how the trends over the past 12 months have affected Fidelity, Vanguard, and more.

As chair of Morningstar’s North America ratings committees, I see trends emerge as fund companies earn downgrades or upgrades. For me, the best way to draw macro conclusions about a fund company is by observing these micro-level changes.

That’s particularly true at an asset-class level, as fund companies are typically divided up into bond, stock, and allocation departments. Funds within those groups often share analysts, traders, portfolio managers, and chief investment officers. Some fund companies are more like a bunch of separate silos dedicated to just one or two funds, but they’re the exception rather than the rule.

So, let’s catch up on some of the biggest fund companies by looking at upgrades and downgrades of the People and Process Pillars from the past 12 months. I also provide the overall breakdown of pillar ratings, which are even more important than the trend. I’ll start with the fund companies that had the most interesting changes. In tallying these changes, I lumped together all funds tied to a given management team. (For example, a target-date fund’s pillar change represents a change made to one fund rather than to 15 funds.) In addition, I excluded passive funds.

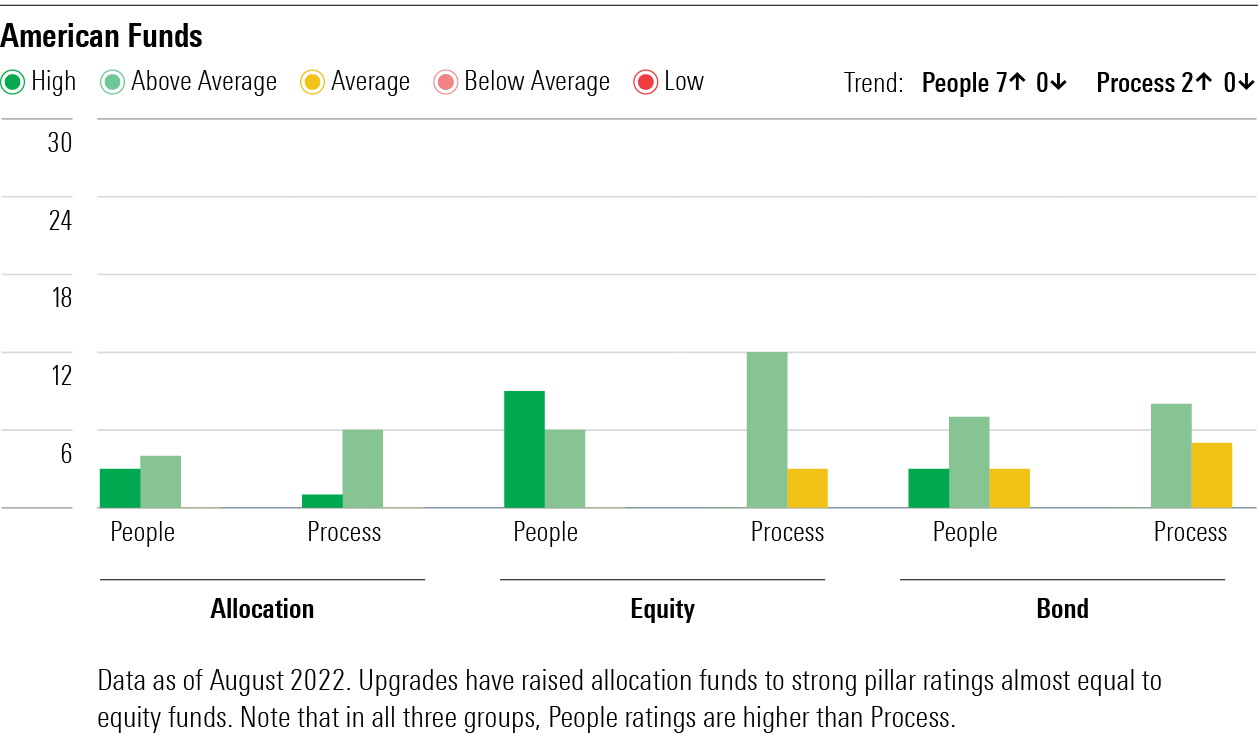

American Funds

The rule of thumb for American Funds used to be buy its stock funds, skip the bond funds, and be choosy with the allocation funds. Not so much anymore. Its equity funds still rate the highest, but its bond and allocation funds have really gained ground.

Our analysts have upgraded many of American Funds’ allocation funds in recent years. The firm’s approach used to be to combine a stock and a bond sleeve without a lot of resources devoted to deciding the allocation between them. That issue became more glaring when American came out with target-date funds, which combine many funds and gradually shift weights along a glide path toward retirement. We weren’t fans of American’s minimalist approach, but since then, the firm has added some excellent asset allocators and built up its research around allocation so that the allocation funds have been steadily upgraded in recent years.

American’s target-date funds now earn High ratings for both the People and Process Pillars. Other of its allocation funds earn High People ratings and Above Average Process ratings. It’s great to see that progress. Morningstar associate director Tom Nations wrote: “In January 2020, American Funds’ parent Capital Group created the Target Date Solutions Committee to oversee this series and enhance its quantitative capabilities. This foundational work produced sensible changes to the glide path in April 2021 after extensive research. Series leaders Michelle Black and Brad Vogt moved to increase the series’ geographic flexibility in its equity sleeve by trimming several region-specific strategies for more global, go-anywhere funds. As such, Black and Vogt entrust the bottom-up stock-pickers in strategies like American Funds New Perspective ANWPX, whose allocation to non-U.S. stocks has ranged from 40% to 53% over the past decade, to methodically steer the series into the best opportunities.”

Likewise, the firm’s fixed-income funds have improved significantly. They had suffered from flaws in risk management and macro positioning because they had been run in sleeves. But American tore up that model and brought in some skilled investors and better risk management to elevate the funds. We upgraded three bond funds’ People ratings to High, and a fourth saw its Process rating also raised.

I realize it looks a bit odd to have nothing but upgrades, but that’s only true for the past year. We downgraded a couple of equity funds two years ago when they were hit with some abrupt personnel departures.

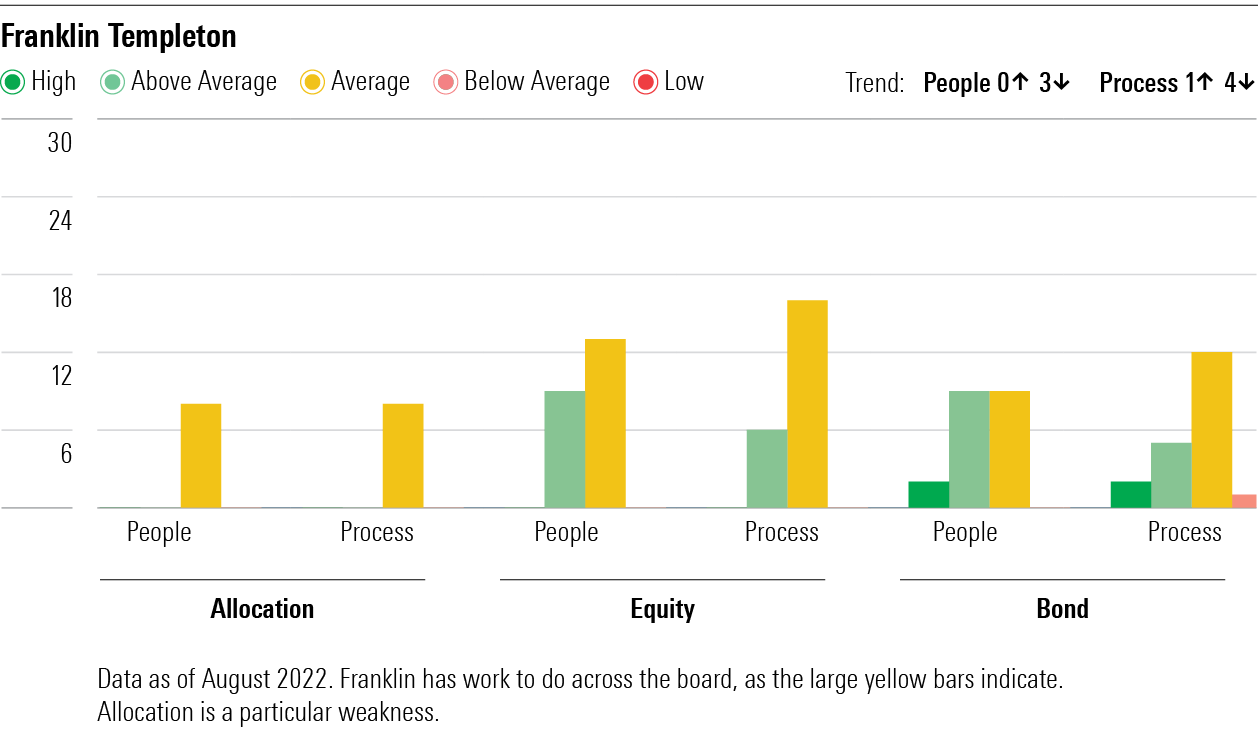

Franklin Templeton

Franklin Templeton saw eight pillar changes; seven were downgrades. Ouch! Three equity funds earned pillar downgrades, two bond funds had both pillars downgraded, and one bond fund had a pillar upgrade.

Franklin Templeton is a combination of many fund companies that operate fairly independently, so one change doesn’t necessarily color all the other funds. The firm includes equity and bond strategies run by Franklin, foreign-equity strategies run by Templeton, bond strategies run by Western Asset, equity strategies run by ClearBridge, and some more stuff to boot.

To be nice, I’ll start with the upgrade. Western Asset Short Duration High Income’s SHIAX Process Pillar was upgraded to Average from Below Average. The fund’s aggressive posture featuring more than 30% in CCC rated debt had led to some big losses in the past, but management has trimmed the low-quality debt and reined in other risky moves.

The downgrades are spread around Franklin-run equity funds, Templeton-labeled bond funds, and a ClearBridge equity fund, so I wouldn’t say there’s a strong trend here. But it does reflect mediocre oversight and explains why the corporate parent merely has an Average rating.

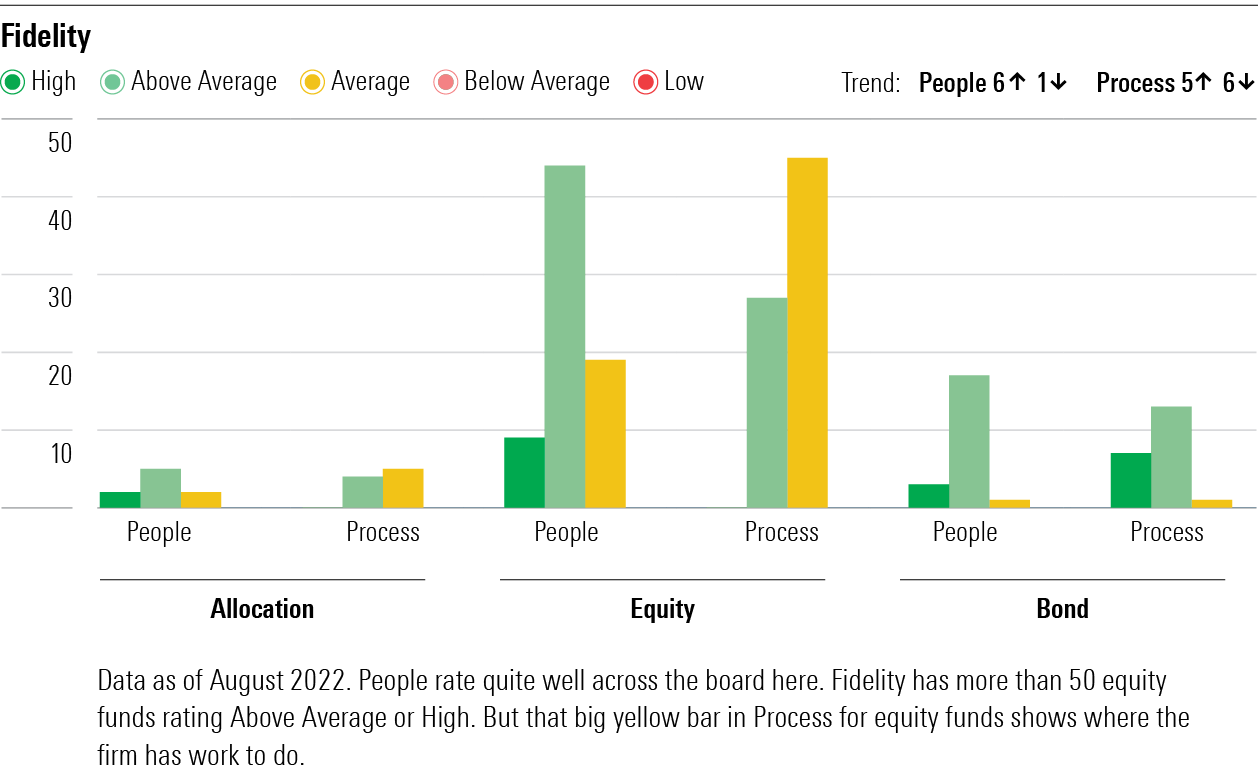

Fidelity

Fidelity notched 11 upgrades and seven downgrades. So, I guess the arrow goes sideways here, unlike the first two fund companies. There were six People rating upgrades and one downgrade. For Process, we saw five upgrades and six downgrades. The downgrades came mainly in equities, where strategies are often less distinct than the more disciplined strategies in bonds and allocation. It’s a legacy of the old Fidelity, where the house approach was largely a wide-ranging growth strategy that was mainly aimed at buying ahead of a pop in earnings. We have nine equity funds rated High for People but none with a High for Process. Size challenges are among the issues bringing a downgrade to Fidelity Contrafund’s FCNTX Process rating, and Joel Tillinghast’s retirement announcement led to a Process rating downgrade for Fidelity Low-Priced Stock FLPSX. On the plus side, growing confidence in the managers led to People upgrades at Fidelity Puritan FPURX and Fidelity Overseas FOSFX.

There were no changes to Fidelity’s bond pillar ratings but look how strong they are: Only one Average People and one Average Process for Fidelity bond funds. The rest are Above Average or High.

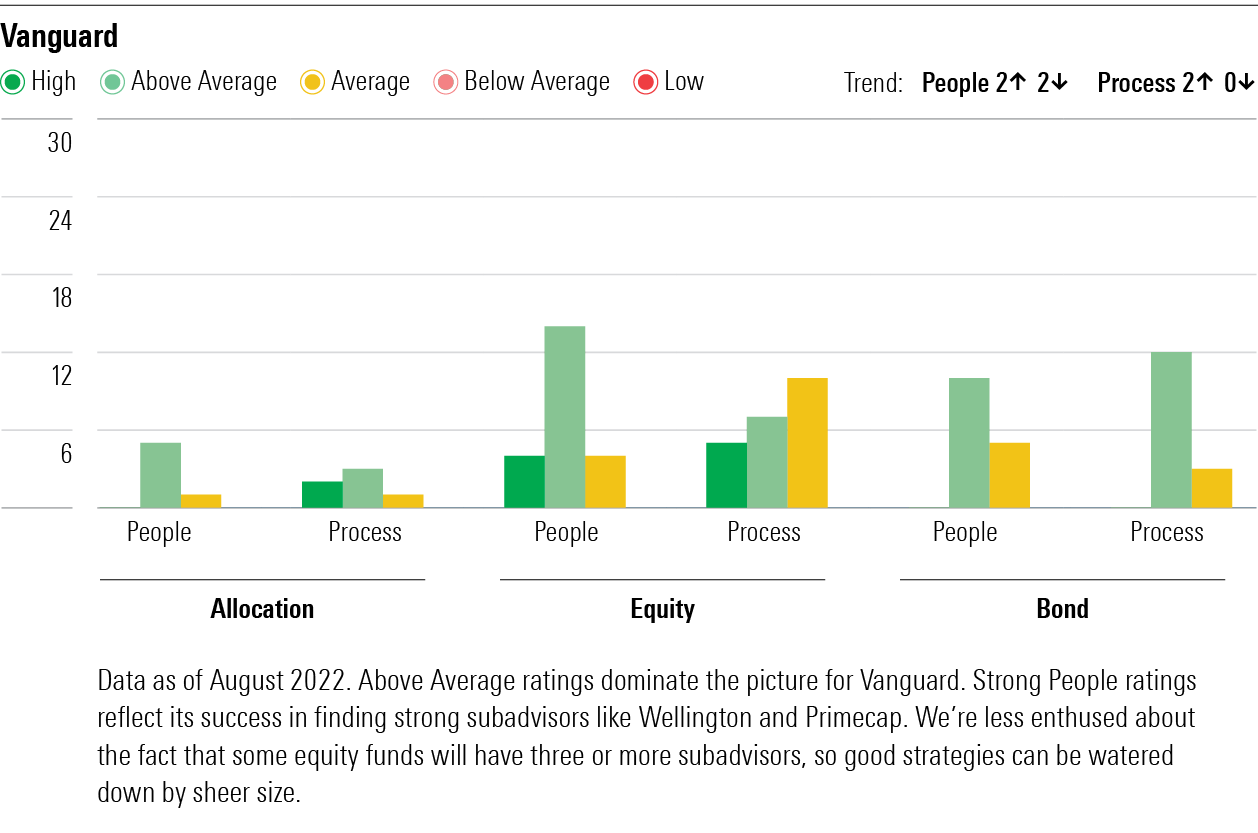

Vanguard

Things were pretty quiet at Vanguard. Two equity funds got People Pillar upgrades, and we raised our Process ratings for one allocation fund and one equity fund. We did downgrade the People ratings for one equity fund and one bond fund.

The pillar breakdown for bond funds is noteworthy. No High ratings for People or Process but a bunch of Above Averages. This is partly due to Vanguard’s plain-vanilla approach to running funds with rock-bottom fees for active management. The basic idea is that with fees that low, the funds can strive to add value incrementally without straying too far from their benchmarks. These funds may lack the tremendous resources of Pimco and Fidelity, but the approach is effective and steady.

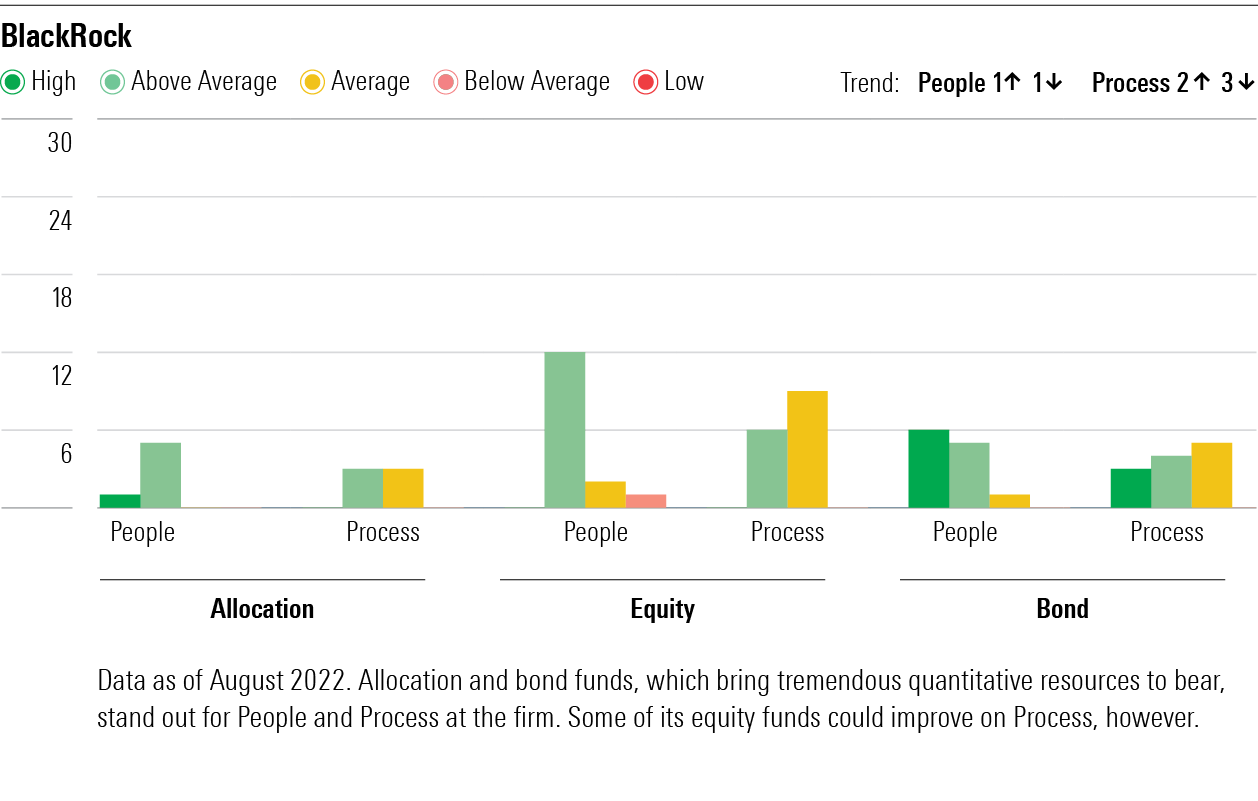

BlackRock

It always seems like the wheels are turning at BlackRock as it embraces technology and innovation. Yet, the rating changes are pretty tame. There were three pillar upgrades and four downgrades.

BlackRock has embraced deep quantitative research, but those insights haven’t yet moved the needle. The firm did net one upgrade at vantage Large Cap Core BIRAX. We raised its Process rating to Above Average, as the marriage of deep quant and rigorous environmental, social, and governance research has made this an appealing fund.

This article originally appeared in the September issue of FundInvestor.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)