The End of the SPAC Experiment

Investors lose interest amid big losses and the drying up of mergers between SPACs and public companies.

As year-end approaches, it’s become increasingly clear that the flood of activity by special-purpose acquisition companies—commonly known as SPACs—in 2020 and 2021 has diminished to a trickle.

At the beginning of it all, the new wave of blank-check vehicles was touted as a creative solution to the dwindling number of publicly traded corporations, and as a way to potentially disrupt the traditional IPO process. But a distinct change in investor sentiment was followed by a swift change in the economic outlook.

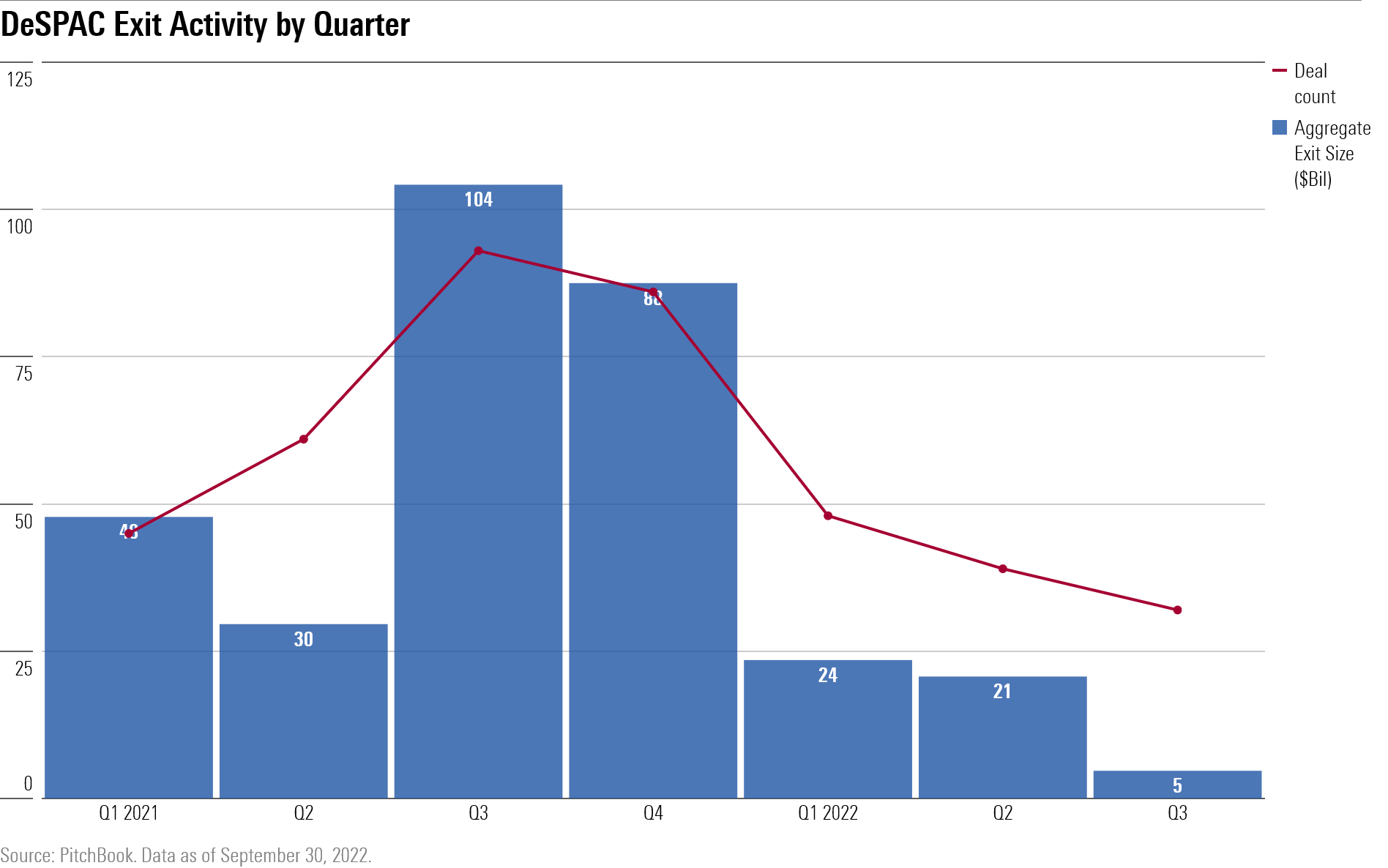

Earlier this year, there were a number of signs that SPACs were falling out of favor with both institutional investors and private companies. Most notably, there was a major slowdown in the first quarter in the number of private companies going public by merging with SPACs, often referred to as “deSPAC activity.” The sharply negative market performance of newly listed companies has only worsened throughout the third quarter and seems to be the final nail in the coffin for this most recent SPAC experiment.

Of course, a significant portion of this can be attributed to the bias of SPACs in 2021 to pursue deals with younger, high-growth businesses, which have been revalued swiftly in the wake of the rising-interest-rate environment in response to persistent inflation.

Approximately 700 SPACs have raised an IPO but are yet to close a reverse merger, meaning we should still see some activity over the next quarter or two. But it’s likely to be relatively subdued given the outlook for any kind of public listings. There has already been an uptick in SPACs winding down and returning money to investors without completing a business combination—even a high-profile name like Social Capital recently announced two of its SPACs would be returning capital as they ran up against the end of their allotted time.

Hindsight always makes many things clearer, but it seems that this recent SPAC boom had a lot more to do with an attractive bull market in growth businesses rather than a fundamental improvement of the public listing process. For more data and analysis, see PitchBook’s Q3 SPAC Market Update.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)