Commercial Air Stocks Face Numerous ESG Risks, but Current Prices Still Offer Attractive Upside

Commercial air travel faces ESG risks from carbon emissions, human capital, and product governance.

Skyrocketing ticket prices, labor strikes, and stranded passengers massed in airports make it seem as if commercial air travel is always in the headlines. Indeed, both airlines and aerospace manufacturers face numerous environmental, social, and governance risks that can threaten businesses and put them in the news. But after taking a probability—and materiality-centric—approach to ESG risk, we think current share prices offer more than enough upside to compensate.

ESG Risk Matters for Commercial Air Investors

Fuel, labor, and maintenance constitute more than 80% of the direct operating costs of a commercial flight. As such, investors exposed to commercial air travel must pay attention to the related major ESG risks—carbon emissions, human capital, and product governance—as they can directly affect these costs.

Benefits of Flying and Few Avenues for Improvement Limit Valuation Risk From Carbon Emissions

Aircraft burn jet fuel, which predominantly comes from fossil fuels. On a distance-traveled basis, air travel is notably one of the highest greenhouse-gas-emitting ways to get from one place to another. But while air travel is very pollutive, its infrequency at the individual level limits its overall impact. Additionally, many around the world can’t afford regular air travel, limiting overall global environmental contribution to 2.5% of carbon emissions and 3.5% of all emissions that contribute to climate change. But as incomes rise, aviation’s share could rise to 22% by 2050.

Although flying has the highest greenhouse gas emission intensity, it offers significant and largely unmatchable speed (planes travel roughly 10 times faster than cars and 8 times faster than high-speed trains), range before refueling, and flexibility. Cars and trains need roads and rails, respectively, while ships need water. Furthermore, a change in terrain forces a traveler to change forms of transportation if using either of these two.

Electrification and fossil fuel alternatives are much talked about but are limited by technology and economics, respectively. Batteries are far too heavy for how much energy they can carry, while sustainable aviation fuels, or SAF, and hydrogen are far too expensive both today and in the foreseeable future.

In theory, carbon offsets could mitigate the carbon impact of air travel—but very few customers are buying them. Meanwhile, carbon taxes might not do much to change behavior—customers tend to be price-inelastic when it comes to business travel, regional and multinational market price changes, and long-distance flights.

It’s not all doom and gloom when it comes to carbon emissions, though. Airlines and aircraft manufacturers are incentivized to improve efficiency to save on fuel costs, which also reduces the environmental impact. But future improvement probably must come from fleet upgrades, as new engines, materials, and other technologies drive better fuel efficiency.

Airlines’ Exposure to Human Capital Risks

Airlines are particularly exposed to human capital risk, while manufacturers face a much lesser threat. Labor shortages, exacerbated by reductions during the coronavirus pandemic and ongoing positive cases, disrupt operations and have led to reduced capacity. Airlines may need to plan enlarged labor forces to account for disruptions amid future pandemics.

Airlines’ relationships with pilots are particularly important given pilots’ critical role in operations, their part in safety, and the potential labor shortage. Indeed, pilots’ wages rose 31% from 2011 to 2021, roughly in line with the increase for all workers but starting from a base more than 90% higher. Although expensive, significant training requirements make pilots difficult to replace quickly.

Additionally, there’s ongoing debate about whether a pilot shortage is coming. While airlines and industry organizations estimate a potential shortage of 60,000, or nearly 15% of the number needed, to 80,000 pilots, the Air Line Pilots Association argues there is no pilot shortfall. Although the answer is unclear, what is clear is that this is a risk worth monitoring for investors.

Flying Is the Safest It’s Ever Been, but Product Governance Is Still a Key Risk

Flying is safer than ever, with just one fatality per 67 million passengers and one accident per 2.6 million flights in 2017—a more than 95% improvement from 1970. But product governance risk remains paramount for both airlines and aerospace manufacturers.

With about half of crashes attributable to human error, airlines must maximize the skills and training of their pilots. A skilled pilot can mean the difference between life and death, as exemplified by Capt. Chesley “Sully” Sullenberger and the U.S. Airways 1549 crew saving every human life despite losing both engines to birds in 2009.

For manufacturers, wide-moat Boeing’s BA development failures with its 737 MAX led to 346 deaths in two crashes. For its mistakes, Boeing faced a worldwide extended grounding of the plane, $2.7 billion in fines, and nearly 30% of its order log to be canceled. Managing product governance risk can also pay dividends when a competitor stumbles, as competitor Airbus AIR was the biggest beneficiary of Boeing’s 737 MAX issues. Indeed, Airbus was able to narrow the total order gap to the world’s best-selling airplane.

While safety is the biggest aspect of product governance risk for commercial air travel, it’s not the only one. Customers also expect their flights to take off on time. Thus, airlines must minimize cancellations and schedule disruptions if they want to keep customers satisfied. Delays and cancellations can be costly, including potential compensation for affected passengers and lost future sales. The FAA estimated delays cost airlines more than $8 billion and passengers more than $18 billion in 2019.

Airlines Lack Moats to Mitigate ESG Risks, While Aerospace Manufacturers Are Better Protected

When it comes to moats, airlines and manufacturers stand in stark contrast. No airline under our coverage benefits from a moat that could help mitigate ESG risks. Partially offsetting the exposure to any individual company, we see few ESG risks that wouldn’t affect the entire industry. In comparison, every aerospace manufacturer we cover has a moat. We think this leaves them better protected to cost or expense increases stemming from ESG risk.

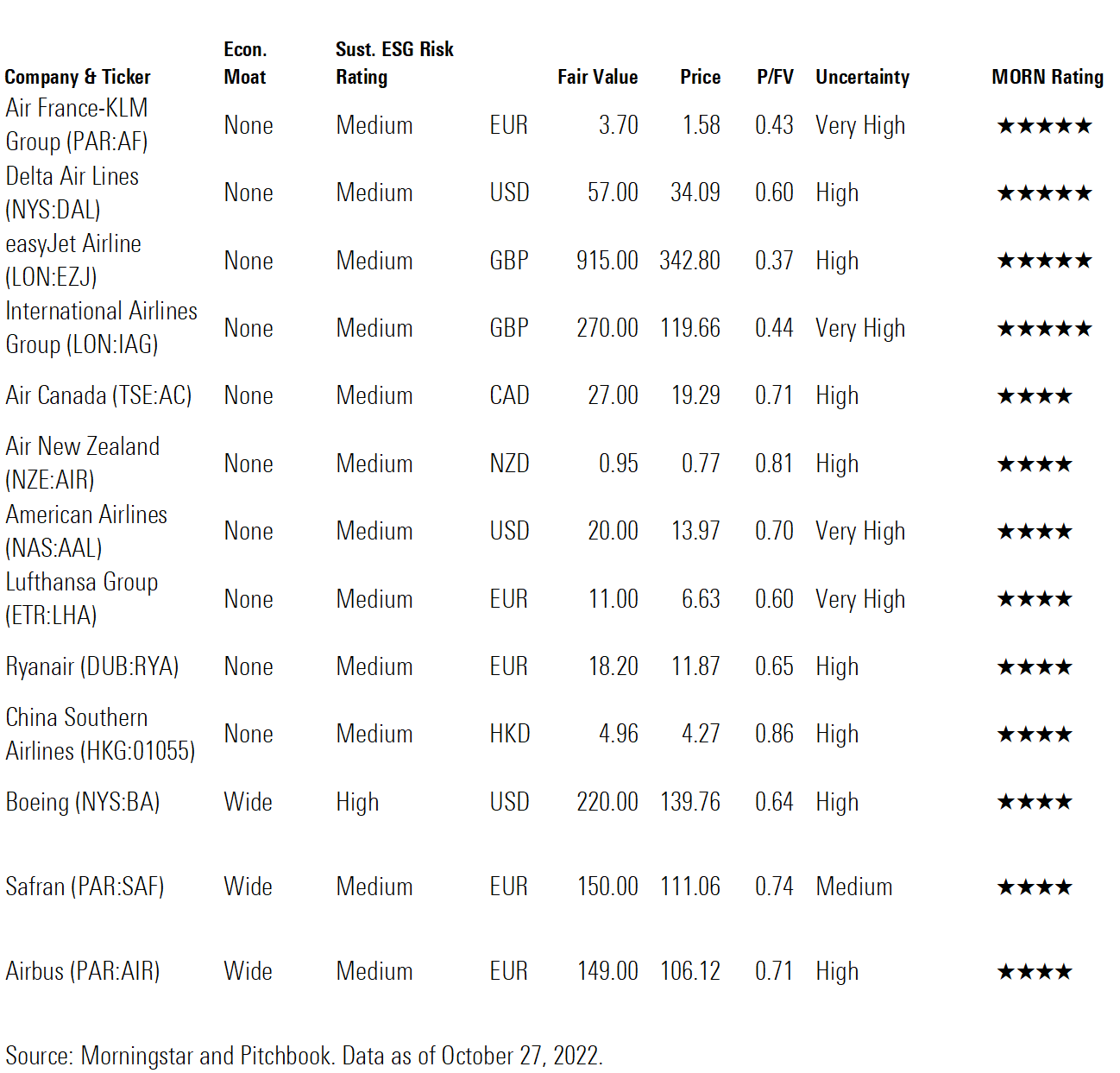

Amid Still-Recovering Travel Demand, We See Open Skies for Many Commercial Air Stocks

We think current share prices offer more than enough risk-adjusted upside for ESG and other business risks. With broader economic fears, there’s concerns for travel outlook, so discounts abound in airlines and aerospace. We see airlines in the territory of Morningstar Ratings of 4 and 5 stars, including the major U.S. and European carriers. For aerospace manufacturers, wide-moat Boeing and Airbus currently trade in 5- and 4-star territory, respectively. Both companies should benefit from airlines looking to upgrade their flights with more fuel-efficient planes. Additionally, we think Safran SAF, one of the manufacturers of the engines pushing improving efficiency, is also meaningfully undervalued.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)