3 Takeaways From Big Tech Earnings Results

Warning signs from Microsoft and Amazon on consumer spending, advertising, and the outlook for cloud computing.

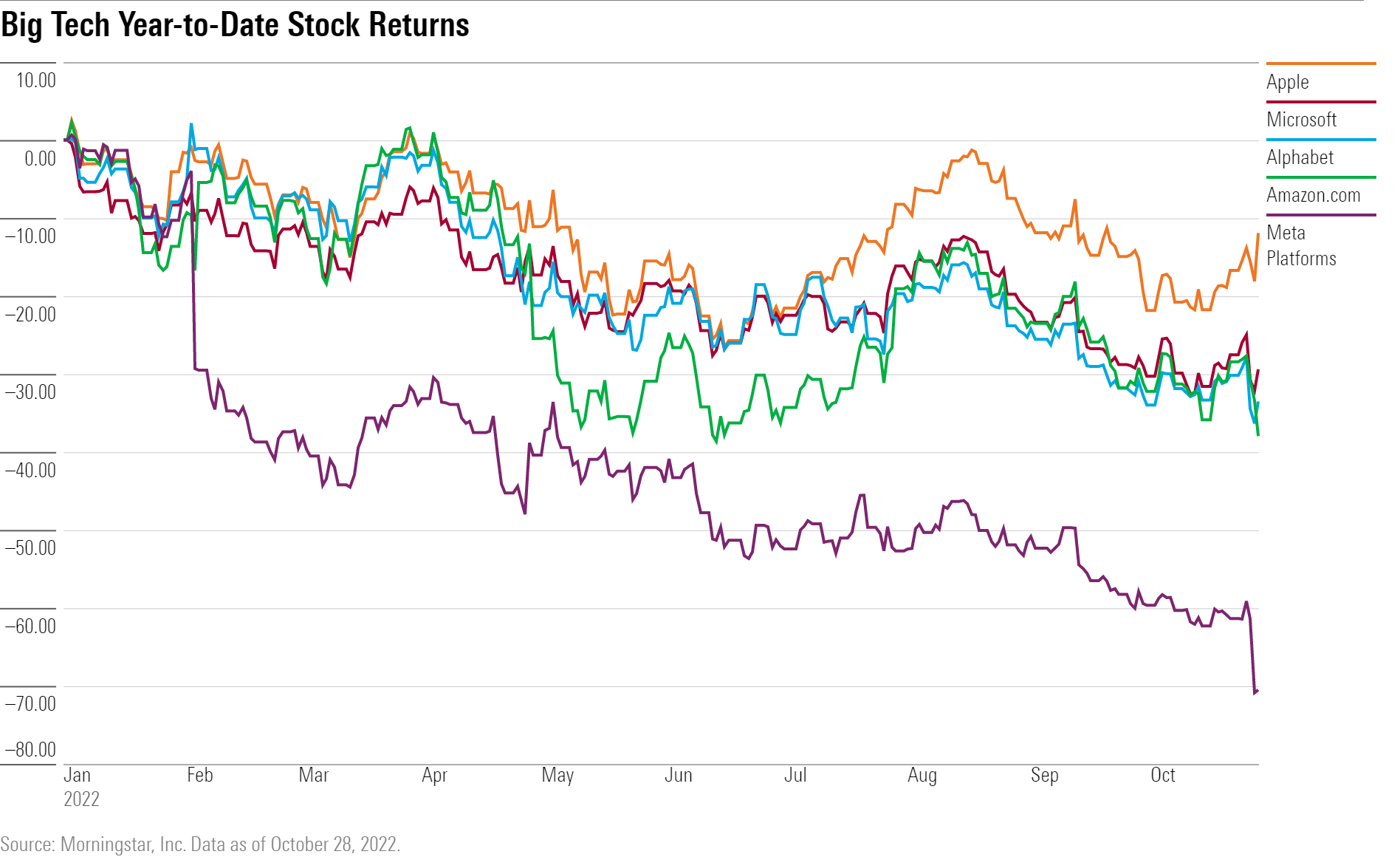

After years where the companies loosely known as Big Tech were the shining stars of the stock market, third-quarter earnings offered a significantly dimmer outlook.

Stocks such as Amazon.com (AMZN), Microsoft (MSFT), and Apple (AAPL) were the market leaders coming into 2022, with huge demand for their products helping inflate their stock prices and playing a key role in driving the overall market higher. But with the latest earnings, the picture was decidedly mixed.

While these companies have flourished during the pandemic, they’re now providing gloomy outlooks as macroeconomic pressures continue to worsen. On top of a stronger dollar, which has continued to serve as a major headwind thanks to their significant international exposure, there are three other major themes that led to a cautious outlook for big tech stocks:

- Slower consumer spending ahead.

- Advertising grows sluggish.

- Cloud computing outlook turns murky.

Here’s a closer look at these three takeaways.

Consumer Spending Shows Signs of Slowdown

Investors weren’t pleased when Amazon released a much softer-than-expected guidance range for fourth-quarter total sales. The news sparked a one-day decline of 6.8% in Amazon stock on Oct. 28. The company set revenue guidance for the fourth quarter to be between $140 billion to $148 billion, under market expectations that were $155 billion, according to FactSet.

“The near term is clouded by a variety of macroeconomic issues, including currency headwinds, high inflation, [and] soaring energy costs,” says Dan Romanoff, Morningstar senior equity strategist. Amazon’s chief financial officer Brian Olsavsky also noted that pressures from inflation were weighing on consumer health, leading to more careful spending. Romanoff cut his fair value estimate for Amazon’s stock to $150 from $192 after lowering his near-term outlook for growth and profitability.

Amazon isn’t the only one contending with falling consumer spending, however. Apple also has recently shown signs of slowing demand for consumer electronics. The iPhone manufacturer even held back from giving concrete guidance levels for its December quarter due to macroeconomic uncertainty, according to Abhinav Davuluri, Morningstar’s technology sector strategist.

“We think broader hardware sales for the firm are likely to slow and/or decline in the quarters ahead as consumers deal with currency headwinds, high inflation, and more challenging year-over-year comparisons,” he says. Davuluri maintained his fair value estimate of $130 for Apple’s stock. Still, investors reacted more positively toward Apple compared with the rest of Big Tech, leading to an earnings rally of 7.56% on Oct. 28.

Advertisers More Hesitant to Spend

As consumer behavior starts becoming more conservative, that’s translating into caution on advertising spending. Alphabet (GOOGL), the parent company of Google, reported advertising revenue growth of just 2.5% on a year-over-year basis in the third quarter, down sharply from 11.6% year-over-year growth in the second quarter and 22.3% year over year in the first quarter. Driving the 2.5% growth for this most recent quarter was mostly Google search’s advertising revenue, as YouTube and network advertising were down 1.9% and 1.6%, respectively.

“Management mentioned that some advertisers are slowing down their spending on Google’s properties, mainly YouTube. Alphabet also saw some pullback in search ad spending, mainly by financial services companies,” says Ali Mogharabi, Morningstar senior equity analyst. “We are assuming that lower ad spending is more widespread, implied by the third-quarter weakness in Google’s network ad revenue, which we view as a demand indicator for ad spending on non-Google properties,” he says. Mogharabi cut the company’s fair value estimate to $160 from $169.

Similarly, Meta Platforms (META) showed softening in advertising revenue. While the number of advertising sales, or impressions, grew by 17% overall, it brought in fewer dollars due to a higher mix of those sales coming from cheaper Instagram Reels advertisements. Total revenue fell by 4.5% on a year-over-year basis.

However, investors were most concerned about how the company doubled down in its efforts to build the metaverse, which contributed to operating expenses growing about 27% in the last year—and with plans to invest even more. That led to a 24.56% decline in Meta’s stock on Oct. 27 and wiped nearly $85 billion in market value for the company. Mogharabi cut his fair value estimate for Meta stock to $260 from $346 following the news.

Slowing advertising demand is also expected to hurt Microsoft’s sales, according to Romanoff, who expects to see revenue deterioration from Bing and LinkedIn ahead. Davuluri sees the same occurring for Apple’s services unit, which includes digital advertising.

Cloud Growth Robust, but Starts to Face Pressure

While Amazon’s slower consumer spending forecast alarmed the market, Romanoff pointed to the performance of Amazon Web Services, as “our greatest near-term concern.” Amazon reported AWS revenue growth of 27% year over year, down from 33% in the period prior. Romanoff cited slowing growth at AWS as one of the main contributors to Amazon’s third-quarter revenue miss.

Microsoft also pointed to signs that demand for its cloud services was being affected by concerns about a recession. While Microsoft broadly posted solid fiscal first-quarter results that beat both revenue and earnings per share estimates, according to Romanoff, he noted that growth in Azure, the company’s AWS competitor, slightly missed its guidance of 43% year-over-year revenue growth, hitting 42% instead. “The company has been engaging in success campaigns to help customers optimize their workloads, which ironically may have contributed to this slight shortfall,” he says.

Even so, the slight shortfall in Azure sales for a single quarter is “not cause for concern,” according to Romanoff. But like Amazon, Microsoft set a much lower guidance range for revenue for the December quarter than expected. “We view guidance as indicative of mounting macro pressures,” says Romanoff.

Microsoft expects revenue of $52.35 billion-$53.85 billion, below the former FactSet consensus of about $56.22 billion. In response to the lower guidance, Romanoff lowered revenue growth and operating margin forecasts for fiscal 2023 and fiscal 2024, leading to a fair value estimate cut to $320 from $352 for Microsoft’s stock.

On top of slower growth for cloud services, the costs to run the infrastructure to provide them are rising, such as through higher energy costs. Amazon reported an operating expense increase of 35% in the last 12 months in its AWS segment. Microsoft expects an additional $800 million in expenses for the rest of its fiscal year just to continue powering its data centers, says Romanoff.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)