Markets Brief: What to Watch in the October Jobs Report, Fed Meeting

After mixed big technology earnings, focus turns to healthcare and energy Q3 results.

Despite some bad earnings news from the big technology companies, stocks managed to hold their own last week. But coming up this week are two key events—the next Federal Reserve policy-making meeting and the October jobs report—that could have a big influence on investor sentiment.

While markets are expecting yet another big interest-rate increase from the Fed this week, the focus will be on where policy goes from here. And the jobs report could play a key role in shaping that direction. That means a jobs report that shows continued strong hiring could set the stock and bond markets back on their heels.

“For now, the ‘good news is bad news’ regime is still in place,” says Morningstar’s chief economist Preston Caldwell. “If the jobs market is too strong, that’s actually bad news for the markets because it necessitates further interest rate hikes.”

On the other hand, if the market sees signs of cooling in the jobs report—suggesting that the Fed will be able to slow the pace of rate hikes—it could be good for both stocks and bonds.

What to watch for in the October jobs report:

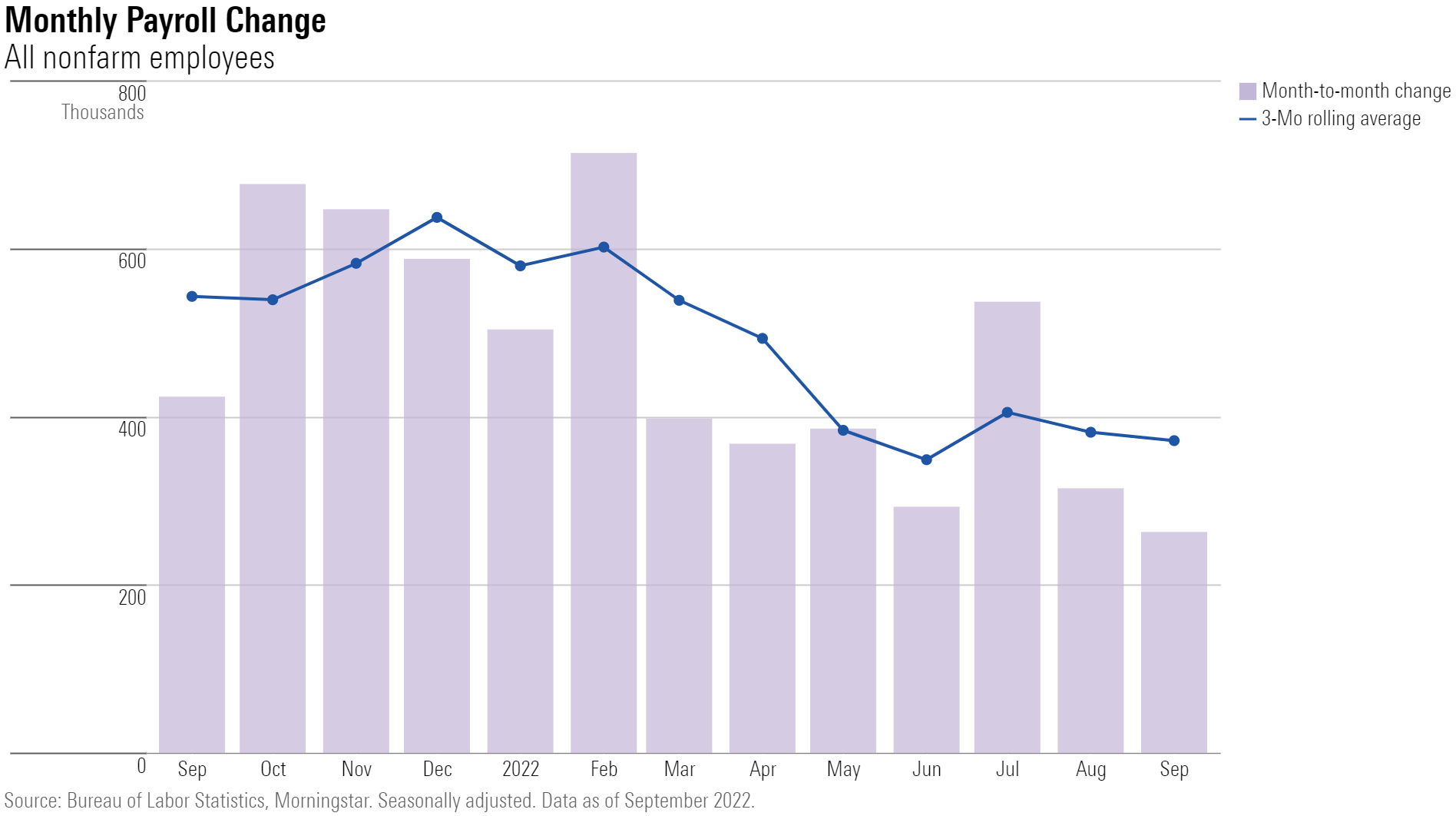

- Pace of hiring: Consensus estimates see an October nonfarm payrolls increase of 200,000, according to FactSet. That would be a slowdown compared with the prior month’s growth of 263,000, but not by much. Caldwell’s expectation is for job growth to trend lower. “With economic activity still decelerating, hiring is going to decelerate sooner or later.” Caldwell says hiring will be minimal over the next 12 months, according to his forecast of 0.3% economic growth for 2023.

- Wage growth: These numbers are also consequential for the Fed’s determination of the situation, according to Caldwell. Investors will look for signs of wage growth continuing to soften or even begin trending lower, which could nudge the Fed to slow its pace on interest rate hikes.

“If wage growth subdues, and labor force participation ticks up, then fast jobs growth wouldn’t be such a big deal for the markets,” Caldwell says. “It depends on the holistic signs of whether the jobs market is truly overheated or not.”

What to watch for at this week’s Fed meeting:

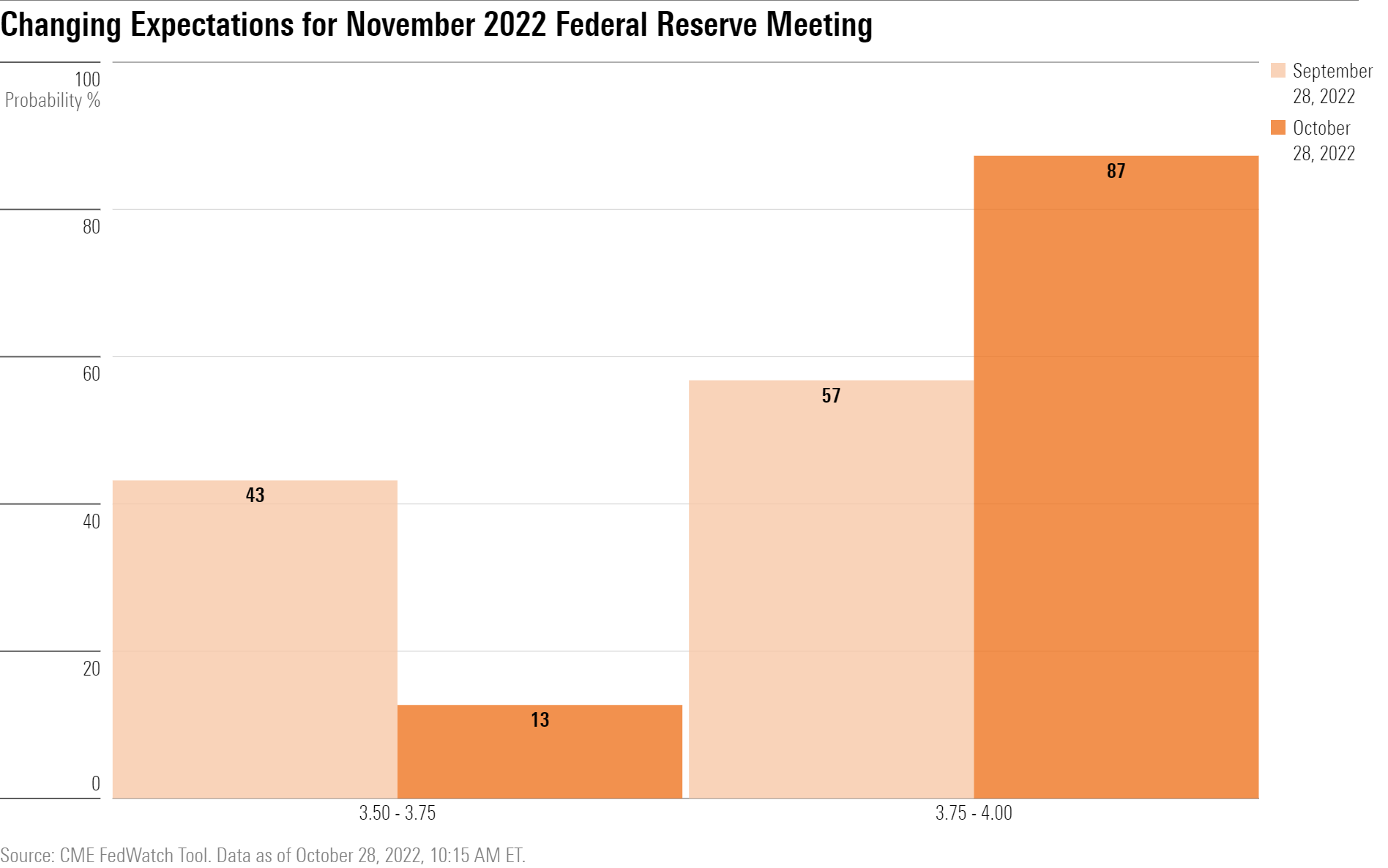

- Another big rate hike: Current expectations show that 84% of the futures market sees another 0.75-percentage-point hike at the FOMC meeting, according to the CME FedWatch Tool. A month ago, expectations were split between 0.50 and 0.75 percentage points. “A 75-basis-point hike at the November meeting is pretty much set in stone at this point,” Caldwell says.

- Future plans: In his usual post-meeting news conference, Fed Chair Jerome Powell is likely to be asked about any longer-term plans for interest-rate hikes. At the December meeting, Caldwell expects a softer 0.50-percentage-point hike, in line with what the majority of the futures market has baked in. Looking ahead to 2023, nearly half of the futures market expects an additional 0.50-percentage-point hike at February’s meeting.

Events scheduled for the coming week include:

- Tuesday: Federal Reserve Open Market Committee meeting starts. Sirius XM Holdings (SIRI), Pfizer (PFE), Uber Technologies (UBER), SoFi Technologies (SOFI), Eli Lilly and Company (LLY), and Energy Transfer (ET) report earnings results.

- Wednesday: Federal Reserve Open Market Committee meeting concludes. Paramount Global (PARA) reports earnings results.

- Thursday: Marathon Oil Corporation (MRO) reports earnings results.

- Friday: October employment data to be released.

For the trading week ended Oct. 28:

- The Morningstar US Market Index fell 4.10%.

- All sectors were up in the last week except communication services, which fell 1.06%. The best-performing sectors were real estate and financial services, which both rose 6.64%.

- Yields on the U.S. 10-year Treasury fell to 4.02% from 4.22%.

- West Texas Intermediate crude oil prices rose 3.35% to $87.90 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 723, or 86%, were up, and 120, or 14%, declined.

What Stocks Are Up?

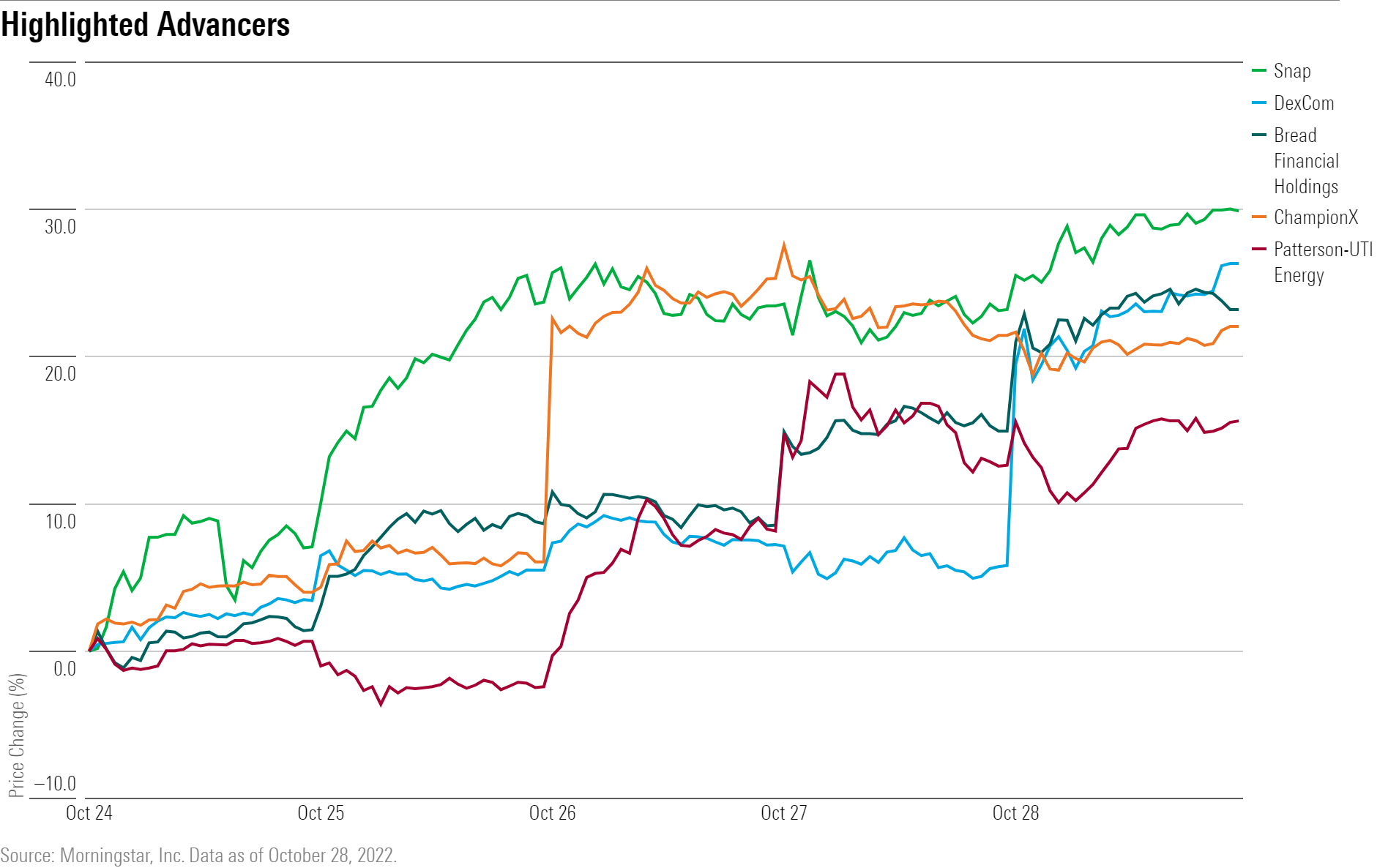

Snapchat’s parent company, Snap (SNAP), rebounded from its earnings selloff. The company also recently reduced payouts to content creators, adding to the company’s efforts to reduce costs.

DexCom (DXCM) rallied after posting third-quarter results showing earnings per share of $0.28, ahead of estimates of $0.24, according to FactSet.

Bread Financial Holdings (BFH), a financial services company, had EPS come in at $2.69, ahead of the $2.52 estimate from FactSet. However, Morningstar equity analyst Michael Miller saw third-quarter results fall within his expectations.

“As we incorporate these results, we are reducing our fair value estimate to $57 per share from $63,” he says. The stock remains undervalued.

Companies that provide equipment for oil and gas producers closed the week higher as earnings results showed that global demand for oil remains strong. ChampionX (CHX) jumped after the firm reported revenue of $1.02 billion, ahead of market expectations of $939 million.

Morningstar equity analyst Katherine Olexa raised her fair value estimate on the stock to $25 from $23 after incorporating the results. Shares of Patterson-UTI Energy (PTEN) also gained after posting earnings.

What Stocks Are Down?

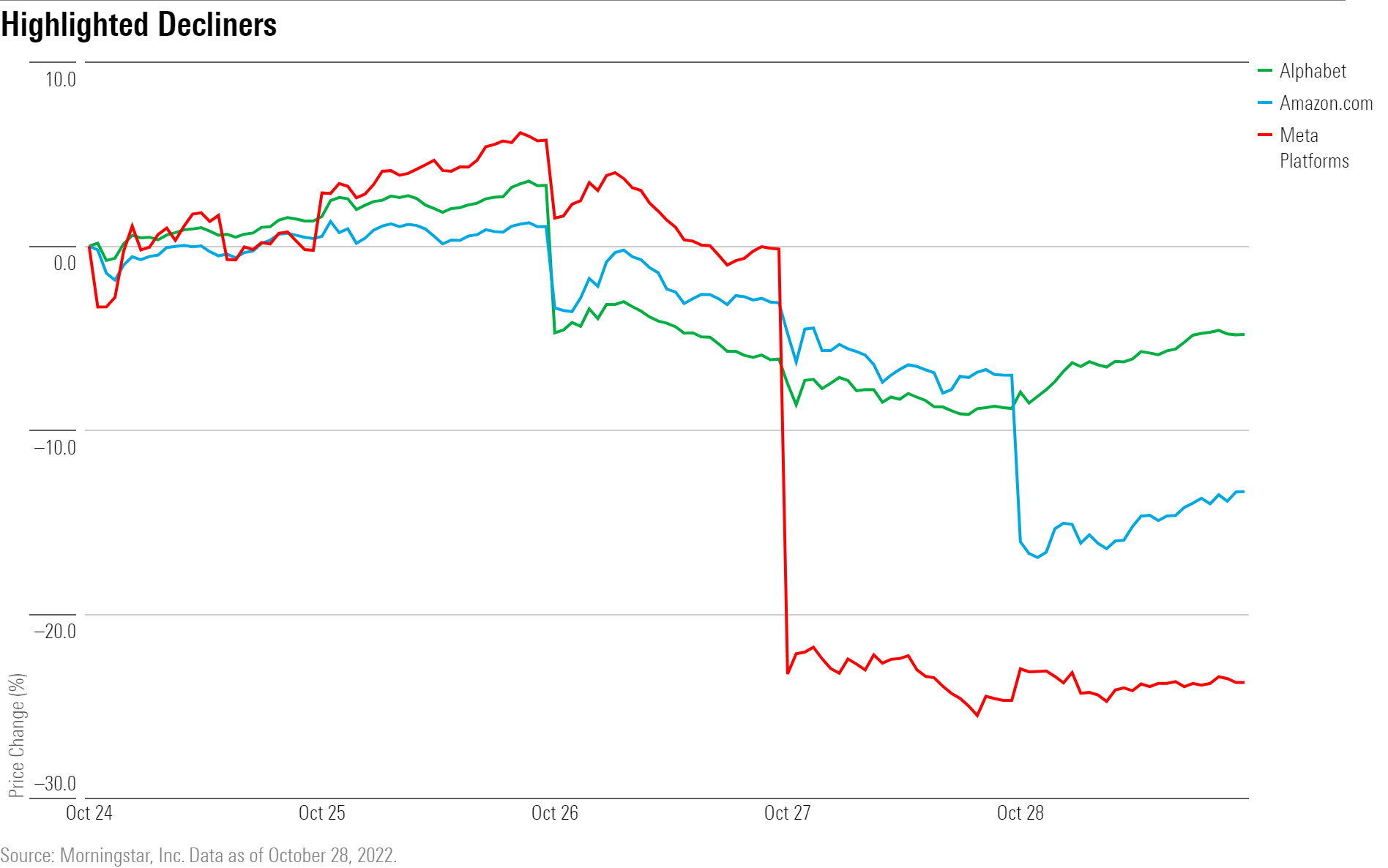

Disappointing earnings results led to some of the biggest one-day losses seen in years for some of the biggest names in the technology sector. Meta’s (META) stock tumbled 24.56% after it reported results as investors grew alarmed at the firm’s investment plan for the metaverse.

Concerns about a slowdown in advertising spending contributed to the decline in shares. That was a headwind that Alphabet (GOOGL), Google’s parent company, also could not avoid.

“We think expectations of an economic downturn among advertisers is the main culprit,” Morningstar senior equity analyst Ali Mogharabi says. He cut Meta’s fair value estimate to $260 from $340, and lowered Alphabet to $160 from $169.

Amazon.com (AMZN) reported earnings results that showed an acceleration in operating costs, and a deceleration in the growth of its Amazon Web Services business. Morningstar senior equity analyst Dan Romanoff sees that as “our greatest near-term concern.” Romanoff cut his fair value estimate to $150 per share from $192 after reducing his growth and profitability assumptions.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)