Which Funds Took a Big Hit From Meta’s Stock Collapse?

Fidelity funds, Oakmark Select are among those dented by the woes of Facebook’s parent company.

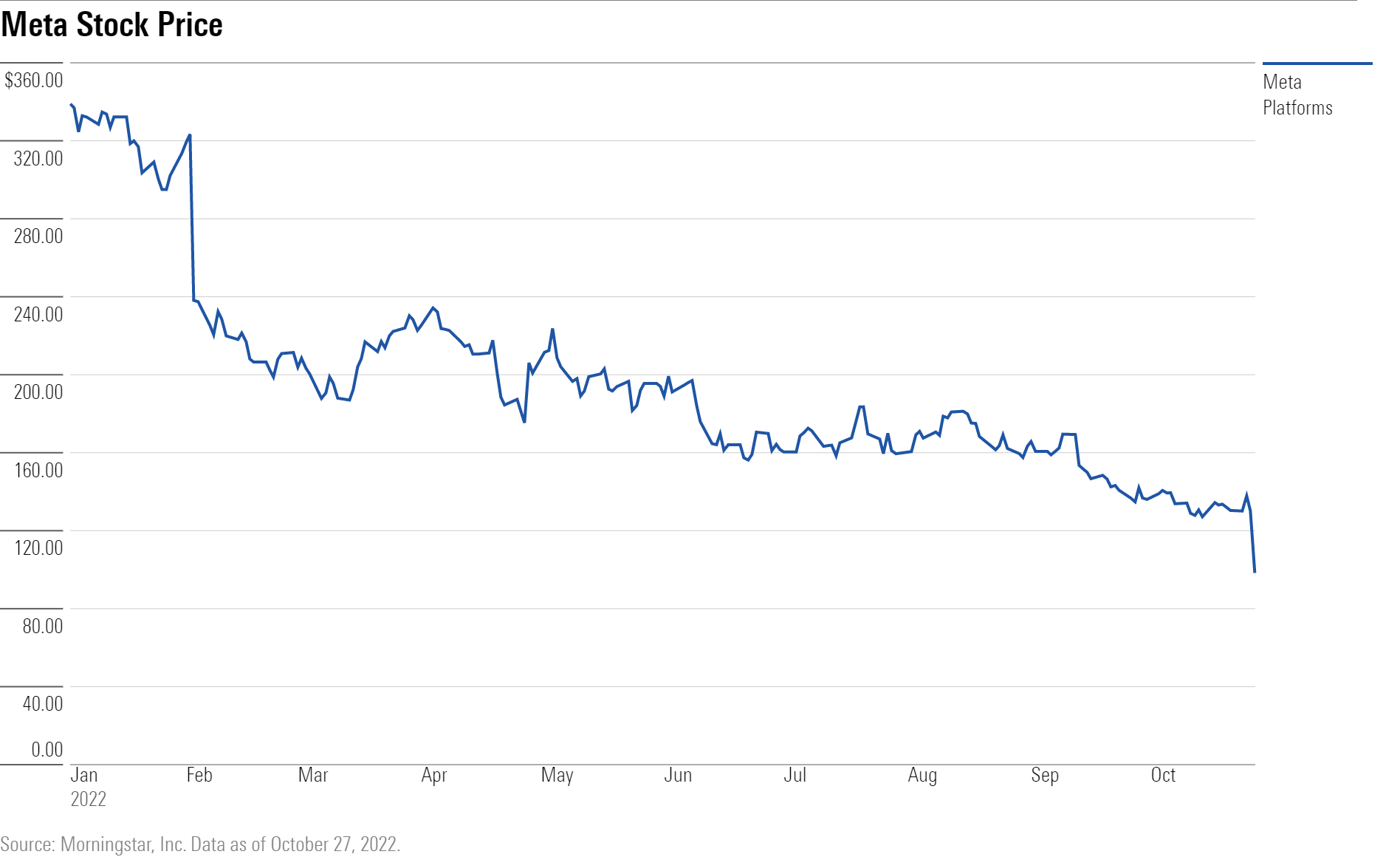

Shares of Meta Platforms (META) plunged 24.56% on Oct. 27, wiping nearly $85 billion from the company’s market value in its biggest one-day drop since Feb. 3, and that has spelled bad news for some big mutual fund holders.

Investors sold shares following disappointing third-quarter earnings results, which led Morningstar senior equity analyst Ali Mogharabi to cut his fair value estimate for the social-media giant to $260 from $346.

While Meta’s revenue for the third quarter of $27.71 billion beat forecasts of $27.44 billion, earnings per share fell short. The firm reported EPS of $1.64, below consensus estimates of $1.90, according to FactSet.

Like many other tech companies, a tough macroeconomic environment and currency headwinds have weighed on Meta’s bottom line. However, it’s the company’s commitment to its metaverse strategy that has Mogharabi, and the market, concerned.

“The firm plans to invest significantly more than we had projected in 2023, without much clarity about when any return on this investment could be realized,” he says. “Its guidance for significant operating expense growth in 2023 was disappointing.”

The stock is down 70.88% so far this year, and its influence on the broad market has fizzled. As of Sept. 30, the company represents just 0.89% of the Morningstar US Market Index, less than half of the 1.86% it did a year ago.

Who Owns Meta Stock?

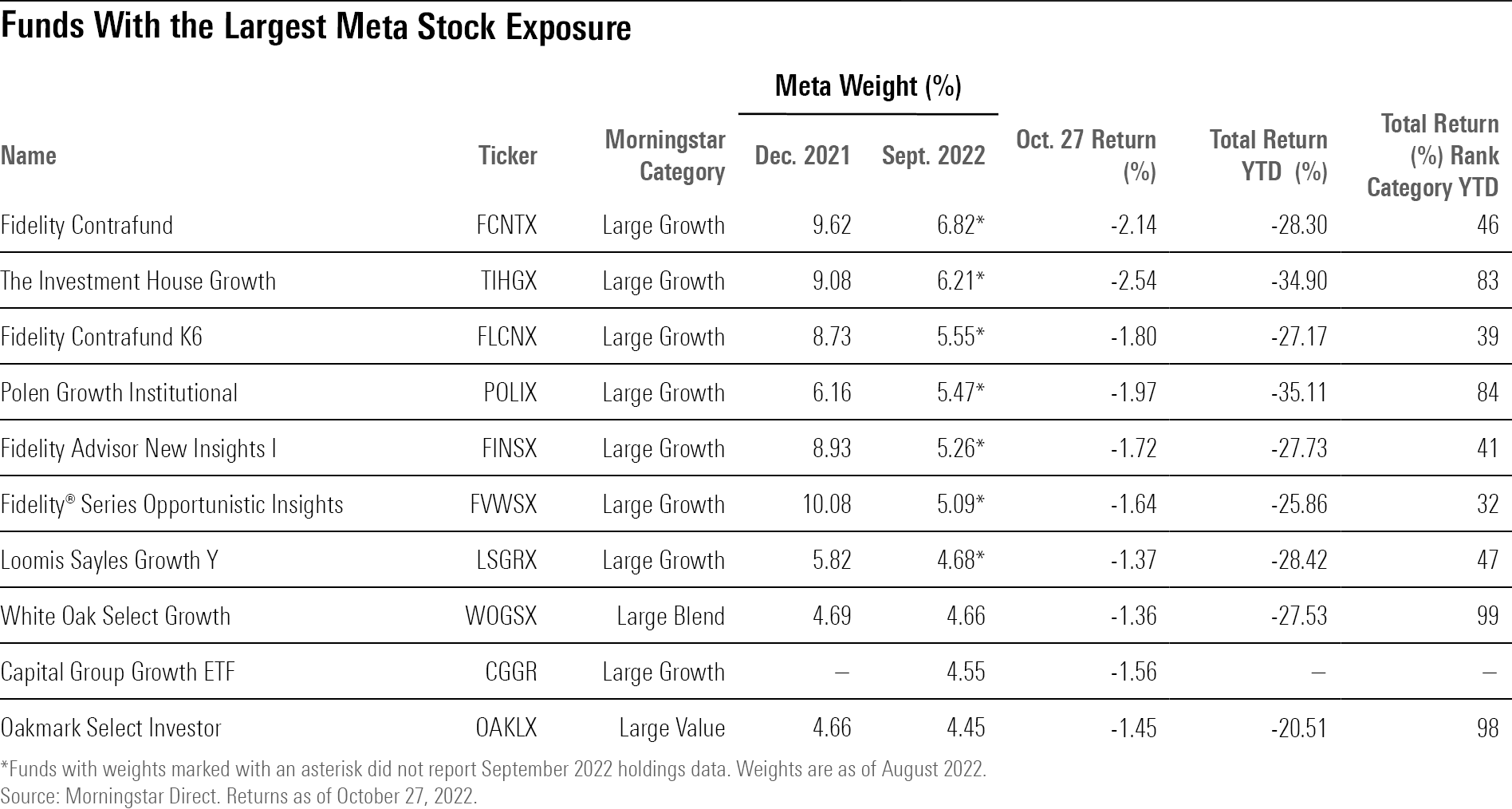

Meta’s impact in some funds has dwindled somewhat since the start of the year, with the current largest actively-managed funds having cut their weighting in the stock over the last nine months. Nonetheless, Meta still has a significant impact on their performance. The stock is mostly favored by large-growth funds.

Take Fidelity Contrafund (FCNTX), a large growth fund with a Morningstar Analyst Rating of Silver. The fund has 6.82% of its assets invested in Meta stock, the largest weighting among the actively managed funds we looked at. Even so, fund manager Will Danoff, who has run the fund since September 1990, trimmed its weight in Meta from 9.82% at the beginning of the year.

Unsurprisingly, Meta stock still has significant sway on Fidelity Contrafund’s returns. The company contributed 7.39 percentage points to the fund’s year-to-date losses of 28.30%. The situation is similar for the fund’s K6 share class (FLCNX), which has the third-largest weighting in Meta stock.

Morningstar strategist Robby Greengold tweeted that the fund has been “a big owner of Meta over the past decade. From 2015 until early 2022, it was its largest position (most of the time).”

In fact, of the 10 actively-managed funds with the largest weights in Meta, four are Fidelity funds, with the remaining two being Fidelity Advisor New Insights I (FINSX), which has a Morningstar Analyst Rating of Bronze, and Fidelity Series Opportunistic Insights (FVWSX), which Morningstar analysts do not cover. Meta stock has consistently been the lead detractor for these four Fidelity funds’ year-to-date returns, contributing at least 6 percentage points to their declines.

The fund with the second-largest weight in Meta stock is The Investment House Growth (TIHGX). The fund has about $147 million in assets, of which 6.21% is weighted toward Meta. It has lost 34.90% for the year, with Meta contributing 6.47 percentage points to that fall.

Meta’s decline has also started to blur the line between it being considered a value or growth stock. The company’s stock has started to be picked up by large blend funds, such as White Oak Select Growth (WOGSX), and large value funds, such as Oakmark Select Investor (OAKLX). Both funds are among those with the highest weight in Meta, which represents at least 4.45% of their portfolio. The two funds fell 20% or more for the year.

For investors who own the most widely held mutual and exchange-traded funds, their exposure is minimal. Among the five largest funds overall, Meta represented less than 2% of their assets, according to the most recently available portfolio holdings data. The SPDR S&P 500 ETF Trust (SPY), the largest fund overall, only had a 0.91% weight in Meta stock on Oct. 26. As of Oct. 27, that has shrunk to 0.69%. The second-largest fund, the Fidelity 500 Index (FXAIX), had a 1.12% weight in Meta as of Aug. 31.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)