Investors Show Few Signs of Throwing in the Towel on Stocks

Stock fund managers have raised cash as investors put money to work, but investors are still choosing U.S. equity funds.

It’s been a brutal year in the stock and bond markets, and while individual investors and stock fund managers have gotten more defensive, in general, both continue to hang tough.

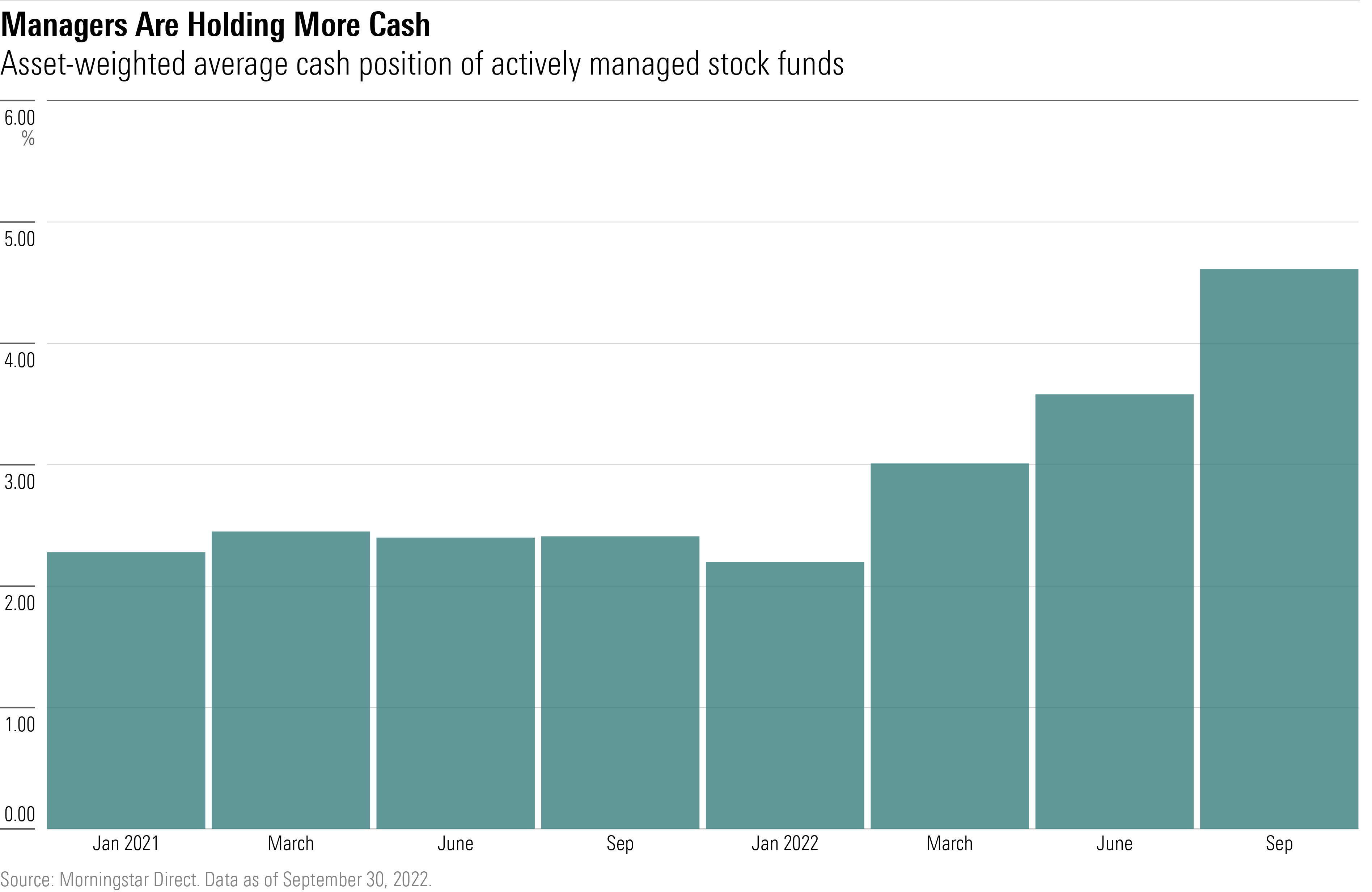

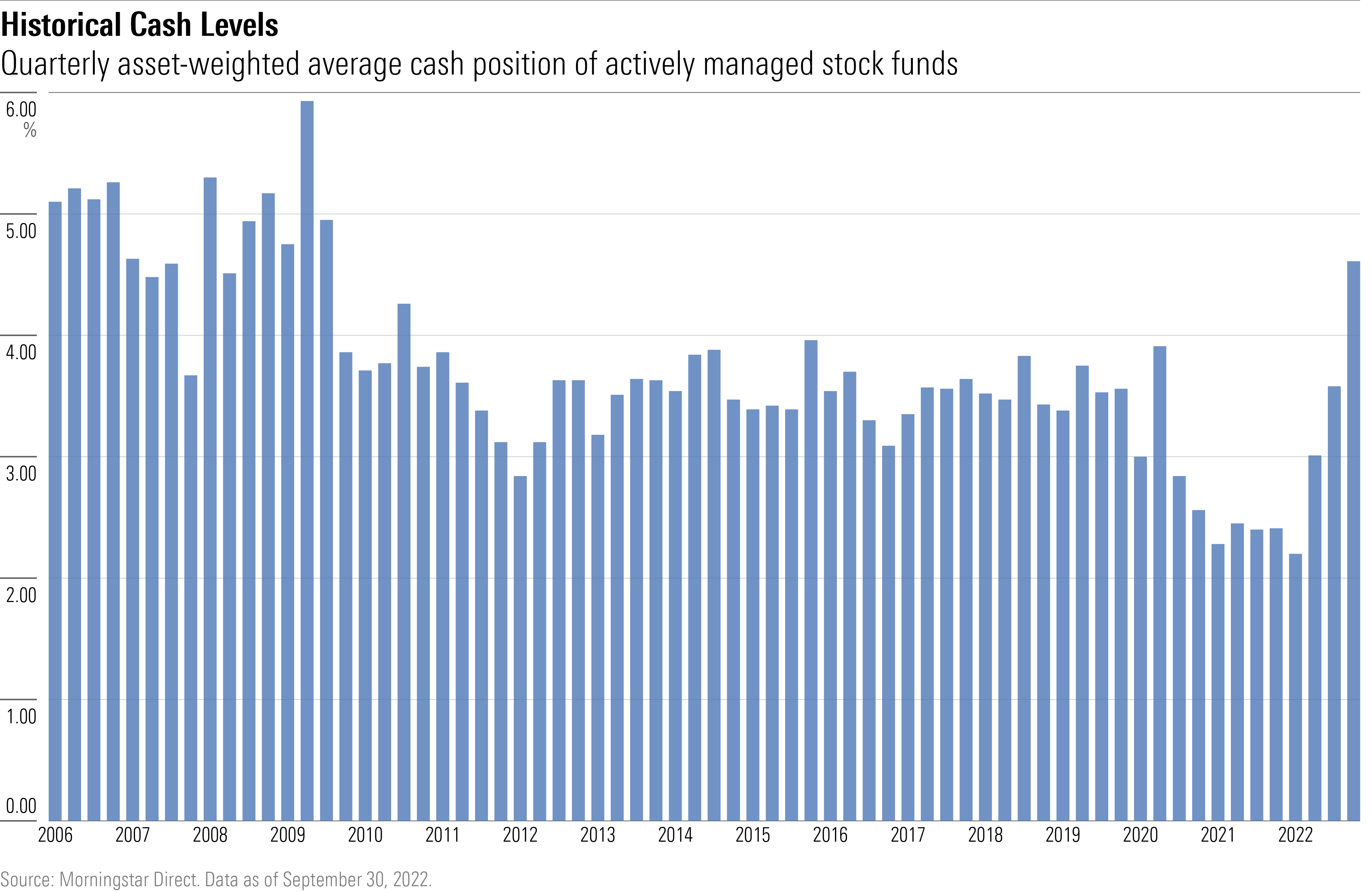

Stock fund managers broadly have been raising cash, but their dry powder is at levels comparable to previous bear markets.

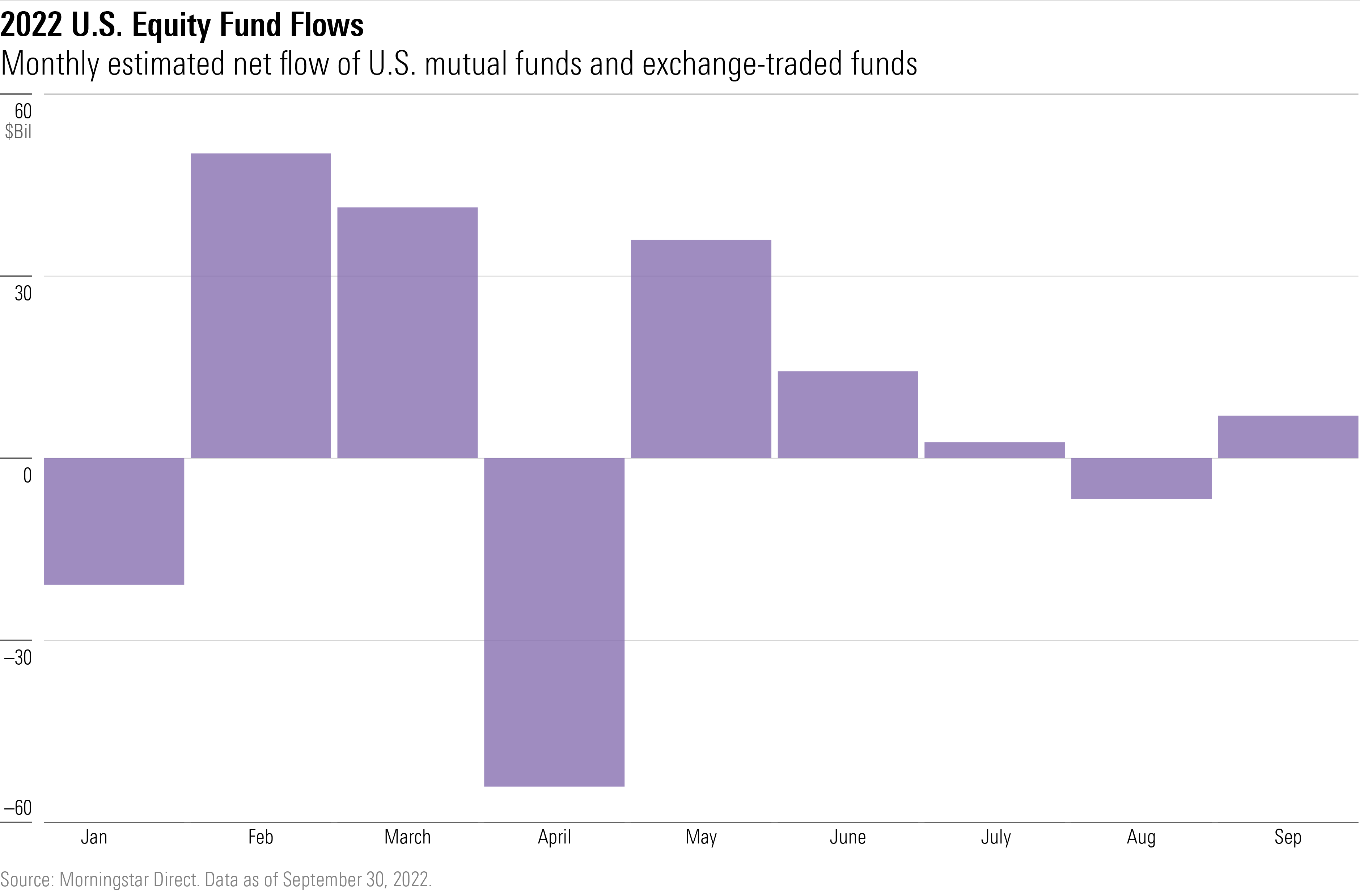

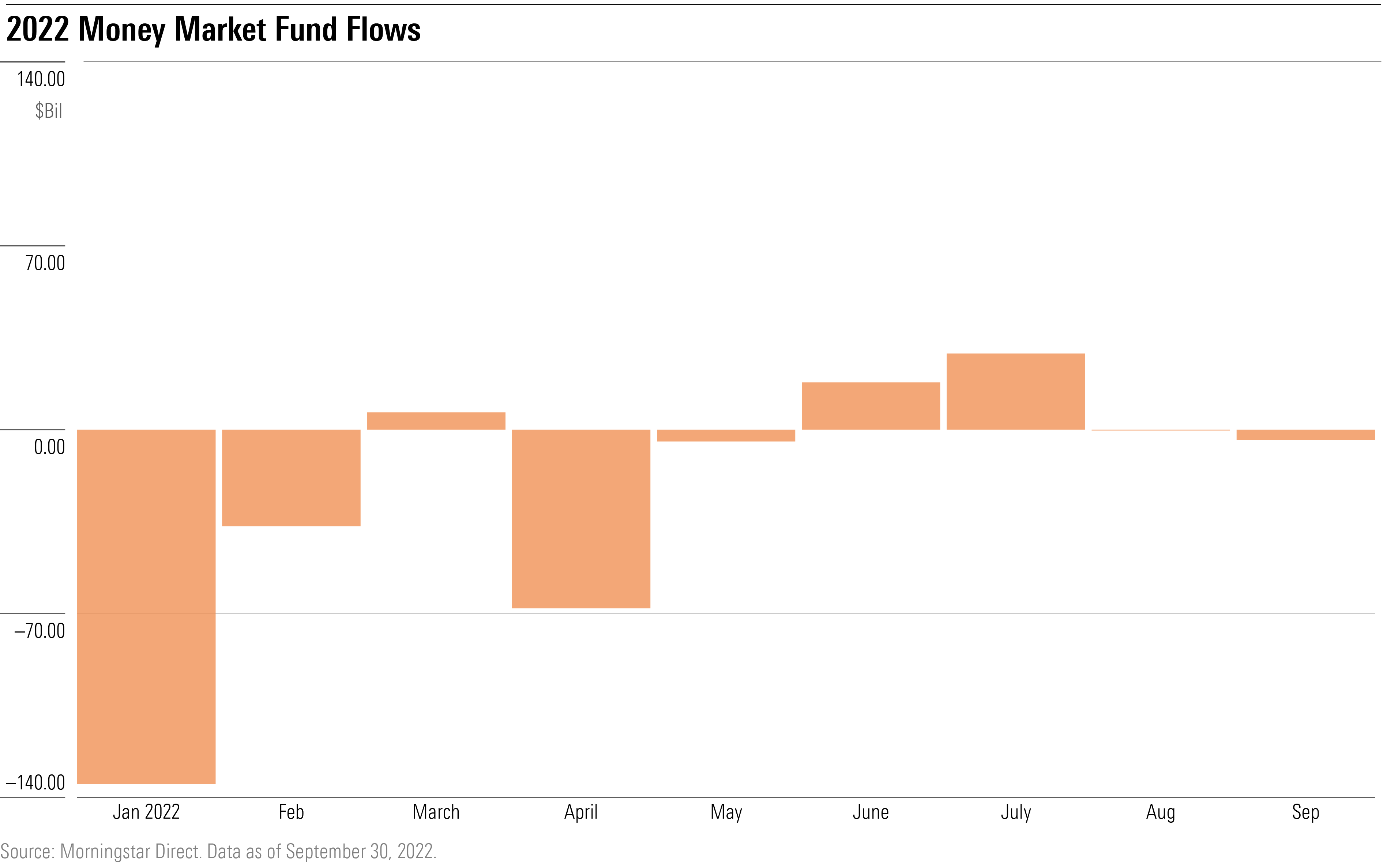

Investors, meanwhile, are showing no signs of bailing out of the markets. Over the course of this year, cash has been moved out of money market funds and investors continue to put money to work in stock funds, while bond funds have seen outflows.

``Flows into U.S. equity funds are on pace to fall well short of 2021. But that doesn’t mean investors have capitulated,’’ Morningstar manager research analyst Ryan Jackson says. ``Rather, it seems they have used routine rebalancing to stick to their plan or picked their spots more carefully.’’

For the most part, investors seem to be staying calm. Cash levels aren’t much higher than their historical levels, investors are still purchasing U.S. equity funds, and money market funds aren’t seeing large inflows like they have in other periods of distress.

The amount of cash that managers are holding isn’t much higher than their long-term averages. Cash levels have hovered around 3.19% for the past five years.

From a longer-term viewpoint the level of cash isn’t extreme, and even one quarter with higher cash levels can be temporary. Managers also raised cash in 2010 and 2016, but quickly returned to normal levels. Morningstar senior manager research analyst Adam Sabban points out that there’s a natural effect of cash weightings going up when equity markets are going down if managers don’t rebalance.

However, an uptick in cash allocations among equity managers could still be meaningful given managers are typically required to be fully invested in U.S. stocks, he says.

Some funds have hung on to more cash. One of the most widely held mutual funds, American Funds Investment Company of America AIVSX, allocated 8.72% of its portfolio to cash as of the end of September, up from 6.95% at the end of June.

Provident Trust Strategy PROVX doubled its cash stake to 20% at end of September from June.

Overall, investors still find U.S. equity funds attractive. They have poured $70 billion into U.S. equity funds this year and bought up $12 billion in international equity funds this year. Investors mostly favored passive, U.S. large-blend funds, but haven’t redeemed active funds at a greater rate than they have in previous years.

“”When it comes to flows, U.S. equity funds have hung tough given the market environment. Investors added about $3.1 billion to U.S. equity funds in the third quarter while they fled most other categories,” says Jackson.

Investors also aren’t parking cash in money market funds like they did in other volatile periods. March 2020 was a time of extreme volatility owing to the onset of the coronavirus pandemic, and investors put $686 billion into money market funds. This year, investors have pulled almost $200 billion from money market funds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)