Markets Brief: What to Watch as Big Tech Stocks Report Q3 Earnings This Week

Microsoft, Alphabet, Meta, Apple, and Amazon earnings could set the market’s tone.

When it comes to third-quarter earnings, so far, not so bad. But the big guns among technology stocks have yet to make themselves heard.

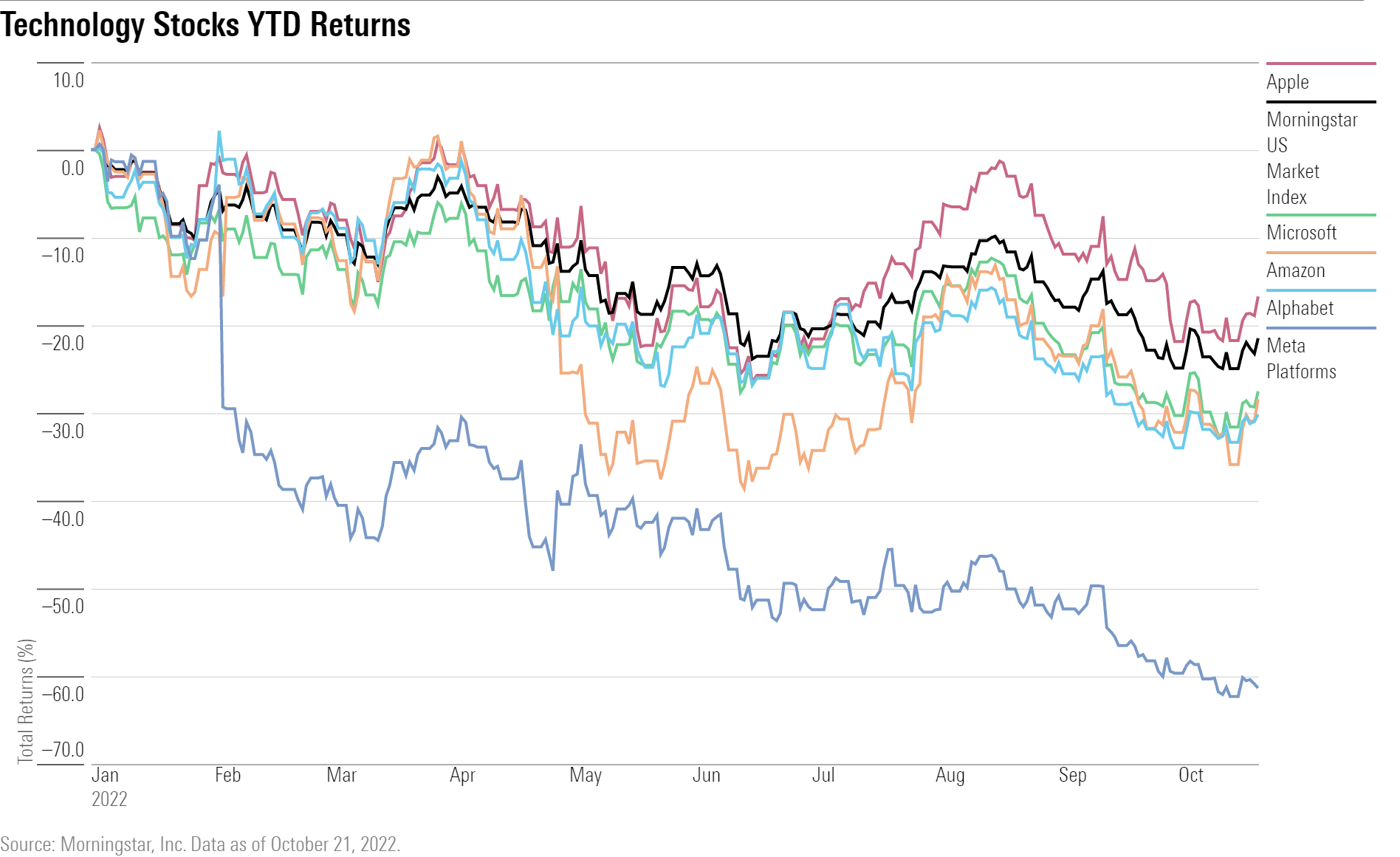

Third-quarter earnings season so far has proved to be a pleasant surprise, with major banks posting results that either met or beat expectations. Even companies like Netflix (NFLX) are showing a turnaround from what has been a depressing year for stock prices. The well-received results kicked off another relief rally, sending the Morningstar US Market Index up 4.61% from the latest bear-market low set on Oct. 14.

Business Outlook From Tech Stock Names in Focus

This week brings another large wave of earnings results, but big tech stocks will take center stage. Market giants such as Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), Apple (AAPL), and Amazon.com (AMZN) are slated to report in the coming days.

Disappointing earnings from big tech stocks could quickly turn the market south again thanks to their immense influence on market indexes. As of Oct. 20, these tech stocks are among the top 10 detractors to the Morningstar US Market Index’s year-to-date returns, collectively contributing almost six percentage points to a 23.24% loss.

Microsoft and Alphabet are the first of the group to report on Tuesday, Oct. 25, followed by Meta on Wednesday, and Apple and Amazon on Thursday. All are expected to release results after the bell.

Morningstar analysts will be keeping a close eye on their results to get a better understanding of how the companies are navigating their way through tough macroeconomic conditions, and what they see happening in the next few quarters.

5 Big Tech Stocks and What to Watch

Microsoft Earnings

“Microsoft just announced another targeted round of layoffs, so clearly they think the environment is worsening,” says Dan Romanoff, senior equity analyst at Morningstar. “Commentary around that will be interesting.”

He anticipates that sales of personal computers and consumer items are likely to be rough. “Guidance, of course, will be key. [We] need to see that Azure and Office momentum is continuing,” Romanoff says.

Estimates from FactSet show that the market is expecting revenue of $49.66 billion and earnings per share (EPS) of $2.31.

Google Earnings

The focus of the third-quarter earnings report from Alphabet, the parent company of Google, will be on year-over-year YouTube ad revenue, as well the contribution from YouTube Shorts, says Ali Mogharabi, Morningstar senior equity analyst. He is also on the lookout for continuing impressive growth in the company’s cloud business, and no significant increases in traffic acquisition costs as a percentage of advertising revenue.

EPS is expected to be around $1.27, with revenue estimates of $71.08 billion.

Meta Platform Earnings

No significant changes to Meta’s daily/monthly active user counts would be good news, according to Mogharabi. Investors should also be looking to see if user monetization is improving, as well as whether or not Instagram Reels are contributing to ad revenue, or cannibalizing it.

Mogharabi also notes that “how much cash is the firm still burning on the Metaverse” is something to watch. The company’s efforts to invest in virtual reality have led to much skepticism in the last year.

Mean estimates for the firm see EPS at $1.90 and revenue at $27.47 billion.

Apple Earnings

“The biggest thing will be to see how iPhone demand is faring and the firm’s outlook for [the] next quarter that is typically their strongest,” says Morningstar’s Abhinav Davuluri, a technology sector strategist.

The key will be if sales remain strong given expectations that smartphone demand was softening. The tech giant recently had to backtrack on plans to boost production of the iPhone 14s after projected demand failed to appear.

The market expects the company to post EPS of around $1.27 and revenue of $88.79 billion.

Amazon Earnings

“Amazon will be interesting because it’s the first normalized quarter post-COVID, just in time for an arguably recessionary environment,” says Morningstar’s Dan Romanoff. “Consumer spending patterns will be critical.”

“Advertising trends are also important given the growth/margin impact and the slowing trends at other internet companies. AWS should be good, but any slowdown would be a really bad sign,” he says.

Amazon is expected to report EPS of around $0.22 and revenue of about $127.49 billion, according to FactSet.

Events scheduled for the coming week include:

- Tuesday: Microsoft, Alphabet, Coca-Cola (KO), Visa (V), and General Motors (GM) report earnings.

- Wednesday: Meta Platforms and Ford Motor (F) report earnings.

- Thursday: Apple, Amazon, PG&E (PCG), and Mastercard (MA) report earnings.

- Friday: AbbVie (ABBV) and ExxonMobil (XOM) report earnings. The Personal Consumption Expenditures Price Index report for September is expected to be released.

For the trading week ended Oct. 21:

- The Morningstar US Market Index rose 4.61%.

- All sectors were up for the week, with the best-performing sectors being energy, which rose 7.78%, and technology, up 6.94%.

- Yields on the U.S. 10-year Treasury rose to 4.22% from 4.01%.

- West Texas Intermediate crude oil prices fell 0.65% to $85.05 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 694, or 82%, were up, and 149, or 18%, declined.

What Stocks Are Up?

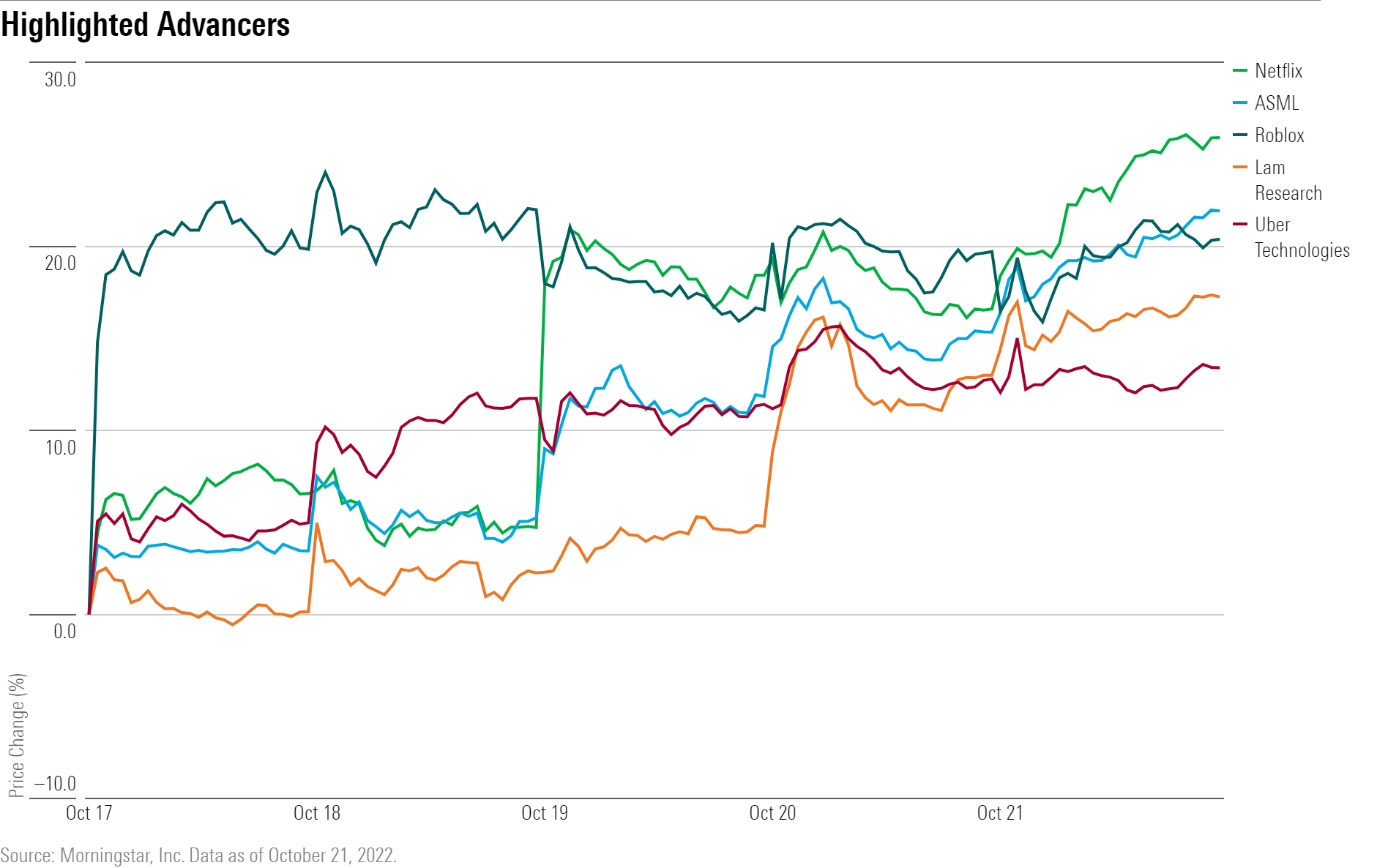

Roblox’s (RBLX) stock rose after the company released September metrics that showed daily active users increasing to 57.8 million, up 23% year-over-year. Hours engaged also rose 16% from a year ago to 4 billion.

Netflix shares rallied after earnings results showed the streaming giant saw a net gain of 2.4 million subscribers in the third quarter, the first time it has seen a gain in users this year.

“Management expects subscriber growth to continue in the fourth quarter, projecting 4.5 million net additions, ahead of our previous projection but well behind the 8.3 million added in the final quarter of 2021,” says Neil Macker, Morningstar senior equity analyst. The company should also benefit from its rollout of a subscription tier with advertising, he says.

Semiconductor equipment manufacturers ASML (ASML) and Lam Research (LRCX) rallied after reporting results. Both companies beat revenue and EPS estimates, according to FactSet. Supply chain conditions have slightly improved for both companies, says Morningstar’s Davuluri.

Software stocks also rallied during the week, including Uber Technologies (UBER), which revealed plans to start running ads on the ride-hailing app called “journey ads,” The Wall Street Journal reported.

What Stocks Are Down?

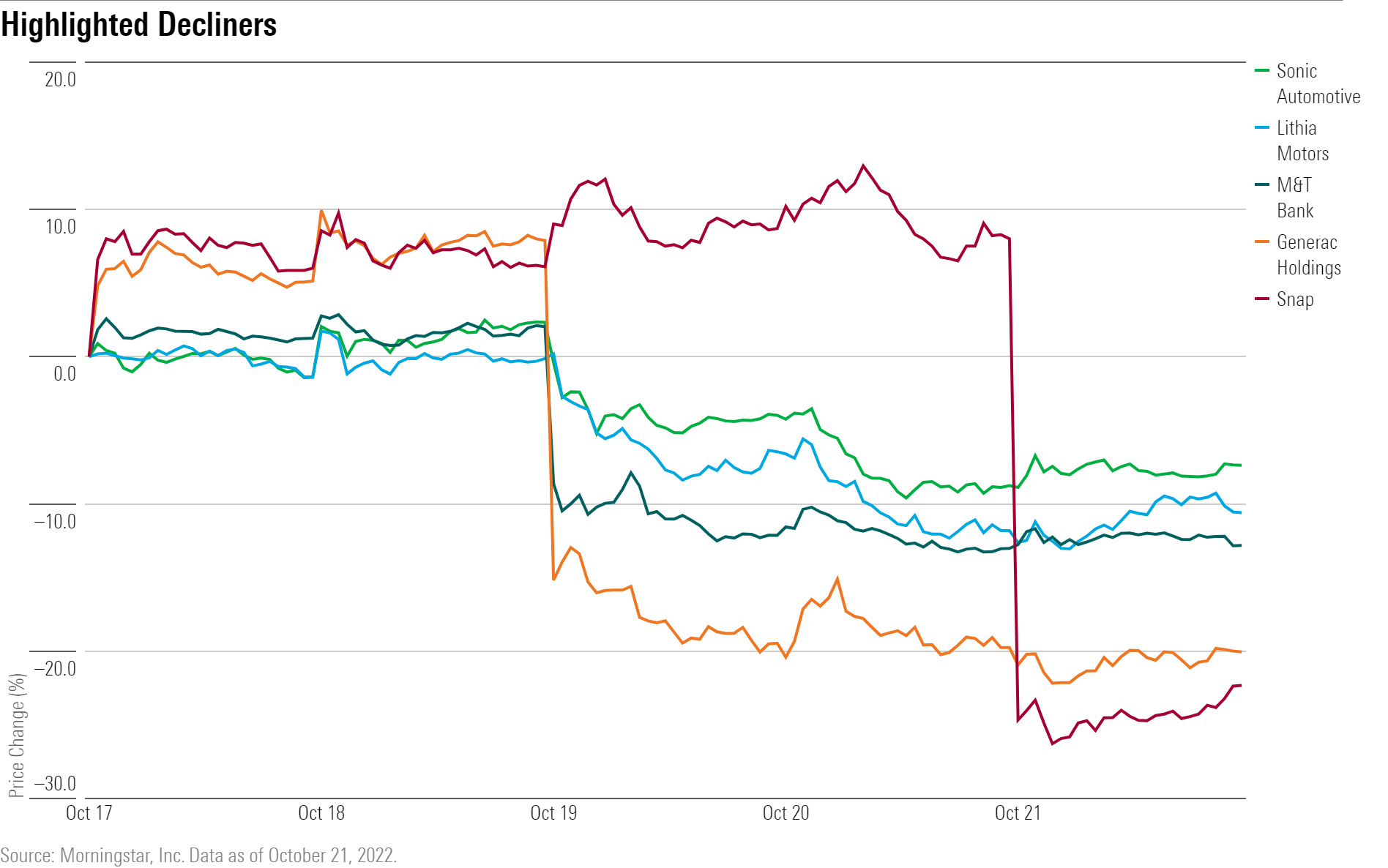

Shares of Snap (SNAP), the creator of Snapchat, tumbled after the company posted disappointing third-quarter earnings results. “While daily average users expanded impressively, monetization remained difficult. In addition to factors such as macroeconomic uncertainty and Apple’s privacy policies, changes in Snapchat user behavior are also increasing hesitancy by advertisers,” says Morningstar’s Mogharabi.

Investors sold shares of Generac Holdings (GNRC) after the generator manufacturer cut its 2022 sales guidance to 22%-24% from 36%-40%.

“Management cited weakness in home standby generator orders as the key culprit, coupled with lower-than-expected clean energy sales following the bankruptcy of a key customer, Pink Energy,” says Brett Castelli, a Morningstar equity analyst. The company’s fair value estimate was slashed to $135.00 from $256.00.

M&T Bank’s (MTB) stock price tumbled after they reported third-quarter earnings per share of $3.53, which missed the estimate of $4.01. Fees came in lower-than-expected while expenses were up, Morningstar financial services sector strategist Eric Compton says.

Lithia Motors (LAD) saw its stock fall after missing earnings expectations. EPS came in at $11.10 versus an estimate of $11.80. Revenue was also lower than expected at $7.30 billion compared with an estimate of $7.34 billion. “The results to us still look mostly solid,” says David Whiston, Morningstar industrials sector strategist. Whiston says, ``we remain confident management can achieve its 2025 targets of $50 billion in revenue and $55-$60 in EPS.”

Stocks in the auto retailing industry also fell ahead of their earnings releases later this week, including Sonic Automotive (SAH) and Asbury Automotive Group (ABG).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.