What Tesla Stock’s 50% Decline Means for the Market

Tesla’s size, wide price swings, and fervent fanbase give the company an outsize impact on many investors’ portfolios.

Not even Elon Musk’s Tesla (TSLA) can escape this bear market and that has implications for investors far beyond the stock’s die-hard followers.

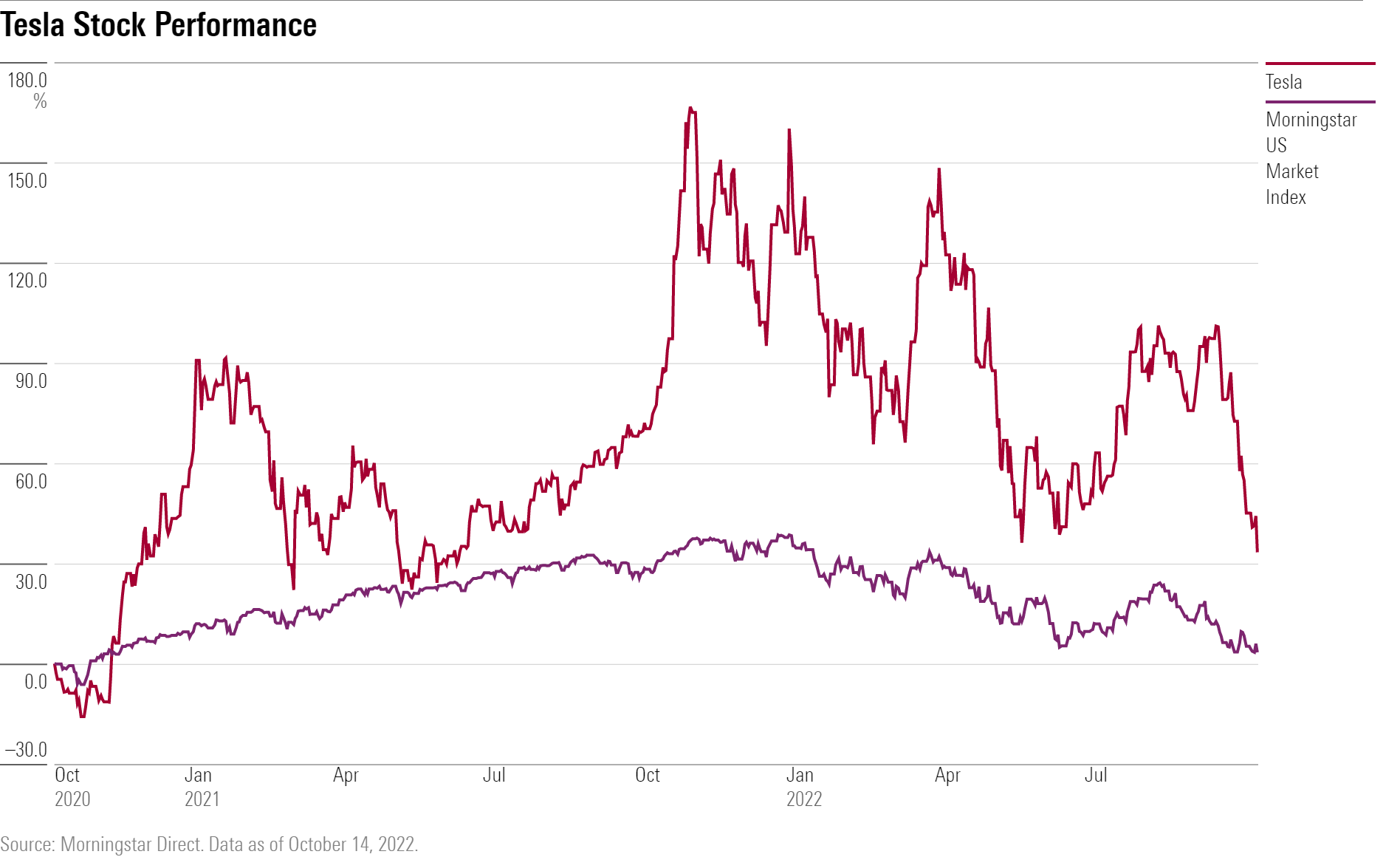

After defying gravity for much of the past two years, Tesla’s stock is down nearly 50% from its November peak and has given back all its 2021 gains. Much of the electric vehicle maker’s decline came in the past two weeks, when it plummeted 30% after chief executive Musk reversed course and said he planned to complete the $44 billion acquisition of social media platform Twitter (TWTR).

Tesla’s one-day drop of nearly 8% Friday prompted Jim Bianco, a long-time market observer and president of the Chicago-based macro analytics firm Bianco Research, to tweet a chart of its deteriorating performance. Bianco noted that “this is arguably the most important stock” to watch as a warning that the worst could be yet to come because its wide base of fans continue to provide support, but that could change if disenchantment grows.

On Wednesday, Tesla reported third-quarter earnings with revenue of $21.45 billion that was below a consensus estimate of $21.98 billion, according FactSet. The company’s earnings per share of $1.05 topped the estimate of $1.00.

Tesla blamed the shortfall in revenue on higher costs associated with raw materials, logistics, and the strong dollar. Officials also said the company will miss its goal of boosting vehicle deliveries 50% by year-end 2022, citing production problems at new plants in Texas and Berlin. Analysts remain concerned the delivery delays, coupled with shorter wait times for Tesla vehicles, might reflect weakening demand as recession fears mount.

Musk acknowledged he was overpaying for Twitter but said the long-term potential of the social media platform outweighed justified the price

What happens with Tesla’s stock matters to so many investors because, even if they don’t own the shares directly, the company has become a larger and more important component in many stock market indexes, specialty exchange-traded funds, and growth funds. With a market capitalization of $687 billion, advances in its shares tend to lead to outsize gains in the indexes to which many funds are pegged, and declines can result in heightened losses.

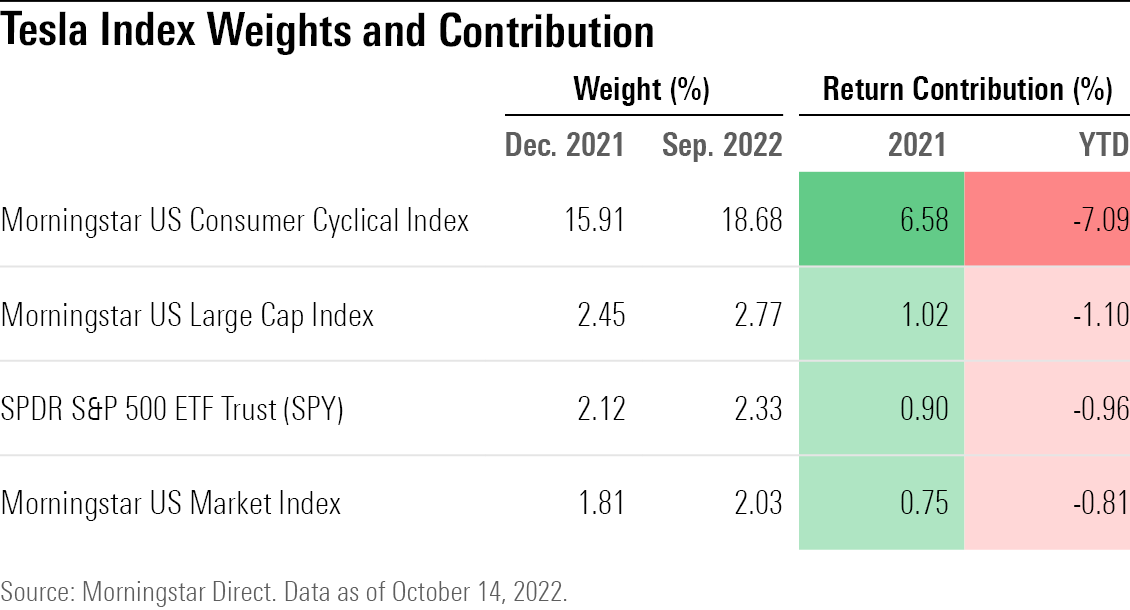

In fact, even with a 50% drop since last November, Tesla stock’s weighting in key indexes has risen this year.

The broad-based Morningstar US Market Index, which is down 24.94% this year, had a 2.03% weighting in Tesla at the end of September, up from 1.81% at the start of the year. For the Morningstar US Large Cap Index, which is down 25.41% for the year, the electric vehicle company has a 2.77% weighting, up from 2.45% in January. The SPDR S&P 500 ETF Trust (SPY), down 23.88% so far this year, has seen its stake in Tesla rise to 2.33% from 2.12% at the beginning of 2022.

Tesla’s losses have left it consistently ranked as the sixth-biggest detractor from the performance of all three this year after Microsoft (MSFT), Apple (AAPL), Meta Platforms (META), Amazon.com (AMZN), and Nvidia (NVDA). It is the fifth-biggest company by market cap after Apple, Microsoft, Alphabet (GOOG), and Amazon.

Tesla stock is also a darling of options traders, speculators, and those who view Musk with almost cult-like adoration, says Bianco. A poster child for the frothy and speculative trading frenzy sparked by the easy money policies that characterized the pandemic, Tesla often seemed to trade on hopes and dreams rather than on solid fundamentals.

Morningstar lowered its fair value estimate on Tesla to $250 from $255 earlier this month. Strategist Seth Goldstein wrote that while the company was viewed as fairly valued, “we recommend investors wait for a larger margin of safety before considering an entry point.”

Musk’s Twitter Distraction

Investor skepticism has heightened with Musk’s recent about face on Twitter. Almost immediately after entering the agreement to buy Twitter, the mercurial Musk had spent months trying to wriggle out of the deal he first proposed in April for $54.20 a share. It came as a shock to the market that he would go ahead with the transaction after all.

Funding for the deal remains a concern. Market conditions have radically changed since it was announced. Backers who pledged more than a combined $7 billion early on, including Qatar’s sovereign wealth fund and Oracle co-founder and Tesla board member Larry Ellison, have stayed mum on whether they continue to be interested. The risk is that Musk might have to sell more Tesla shares to come up with the necessary equity funding if investors bail out. Banks, including Morgan Stanley and Bank of America, have also agreed to loan $12.5 billion for the transaction.

There have been other issues, too, surrounding Tesla. Third-quarter vehicle deliveries fell short of Wall Street expectations, COVID-19 lockdowns hampered its Shanghai production facilities, and there have been challenges opening new plants in the U.S. Also, investors fear, that Musk is spreading himself too thin: In addition to Tesla, he also heads the SpaceX aviation company, a few startups and now potentially Twitter.

The Tesla Stock Effect on Funds

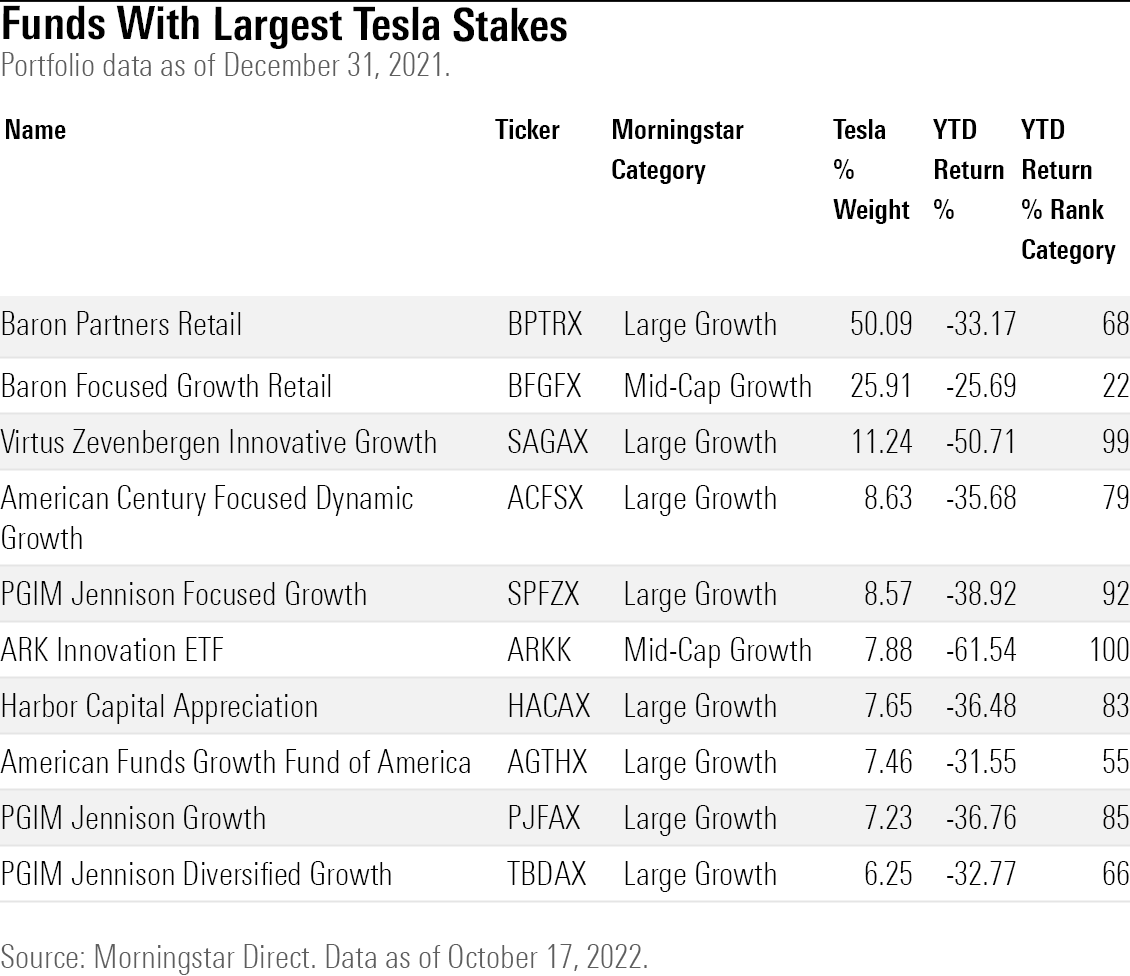

Tesla’s stock performance has helped sink most funds that invested a large percentage of their portfolios in the company at the beginning of the year. Of the ten funds that held the most in Tesla as of Dec. 31, only one ranks in the top half of its Morningstar category in terms of year-to-date returns.

Bianco points out that one of Tesla’s biggest fans is Cathie Wood and her ARK Innovation ETF (ARKK).

“ARKK is in a world of hurt, too, and the only thing that had been holding it up was Tesla.” Wood has been buying Tesla on selloffs in the stock.

The ARK Innovation ETF is down 61.54%, and is the second-worst performing U.S. equity fund this year. Virtus Zevenbergen Innovative Growth (SAGAX) is down 50.71% and allocated 11.24% to Tesla at the beginning of the year.

Fund manager Ron Baron has been one of the most prominent owners of Tesla. His firm, Baron Capital, has two funds with large stakes in the company, including the Baron Partners Retail BPTRX, which dedicates half of its portfolio to Tesla. Morningstar senior analyst Adam Sabban wrote in his recent report that, “no fund is defined by a single stock more than this one.”

American Funds Growth Fund of America (AGTHX), one of the most widely-held growth funds, allocated 7.46% to Tesla, and has fallen 31.55% this year.

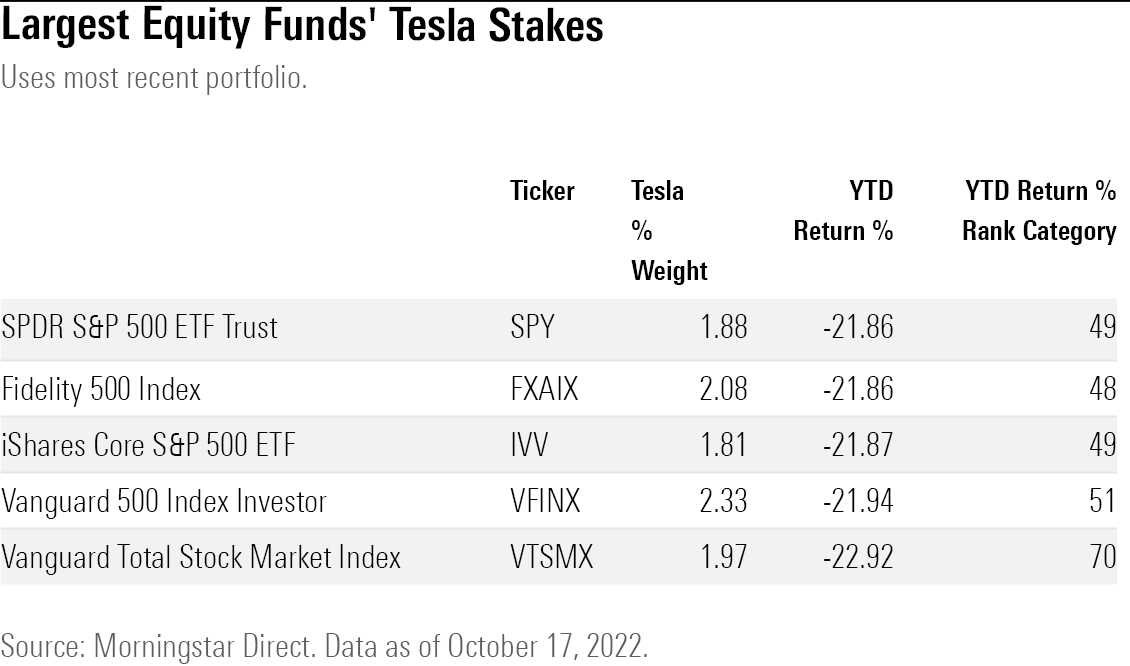

For investors in the most widely-held U.S. equity funds, exposure to the electric vehicle producer is minimal. Though Tesla is a top 10 weighting in each, it represents no more than 3% of each of the diversified funds’ holdings.

Editor’s note: Katherine Lynch also contributed to this story.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)