U.S. Fund Flows: Investors Pull Back in September

Tumbling equity markets and declining bond prices drove some investors to the exits.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for September 2022. Download the full report here.

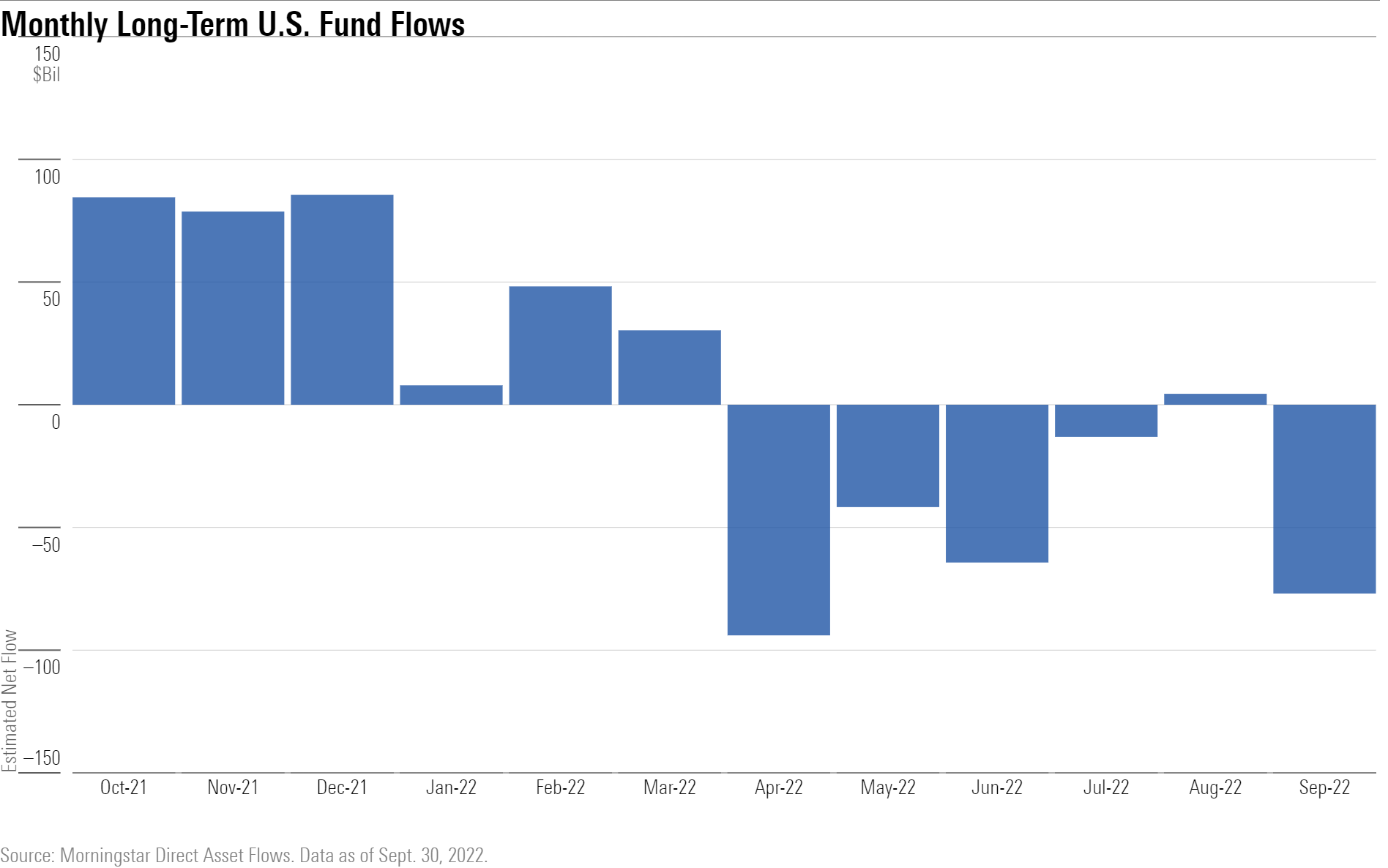

Investors withdrew $77 billion from U.S. funds in September, their largest monthly outflows since April. Few areas of the market were spared as six of the 10 U.S. category groups shed assets.

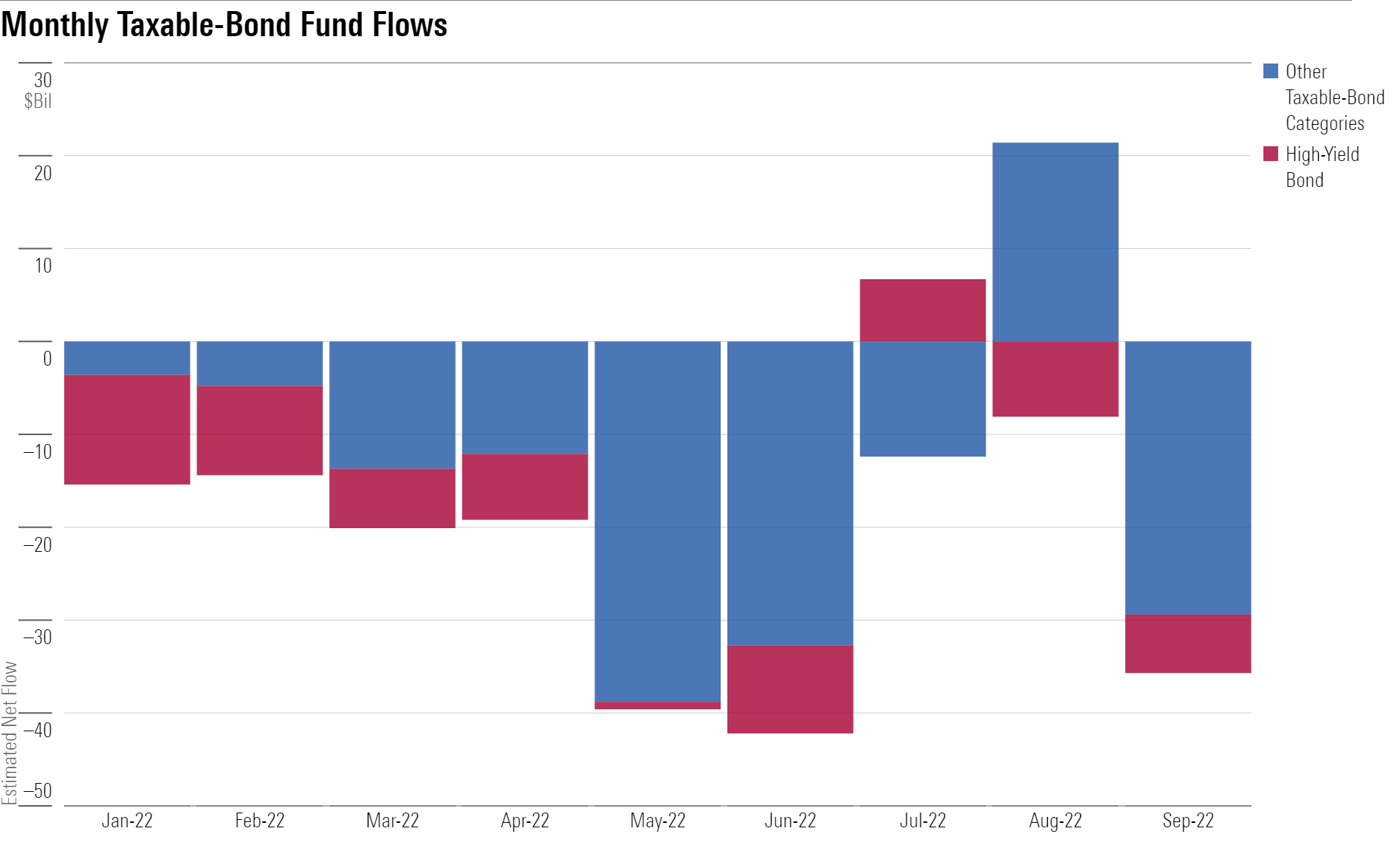

Investors Flee Taxable-Bond Funds

Aversion to risk helped drive about $36 billion out of taxable-bond funds in September. The bank loan, high-yield bond, and intermediate core-plus bond categories punctuated a difficult quarter with more than $5 billion of outflows each. Safer ultrashort bond funds fared much better. They attracted $10.9 billion in September—their best monthly organic growth since June 2020.

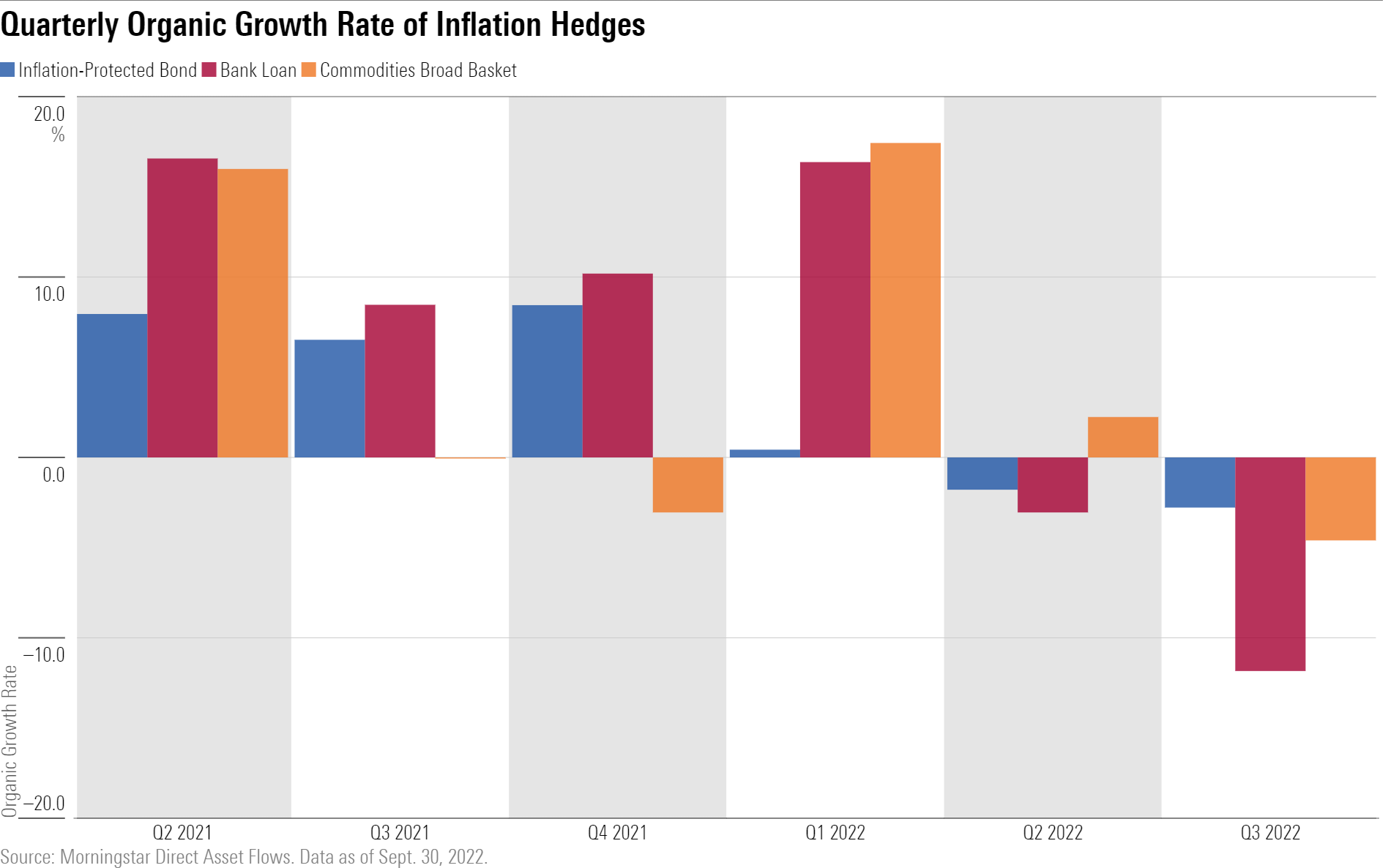

Investors Trim Inflation Hedges

Funds that can be used to combat inflation have fallen out of favor. Demand for inflation-protected bond, bank-loan, and commodities broad basket funds dried up in the third quarter, when all three categories shed more than $3 billion. Time will tell whether the investors looking past inflation are prescient or overly optimistic.

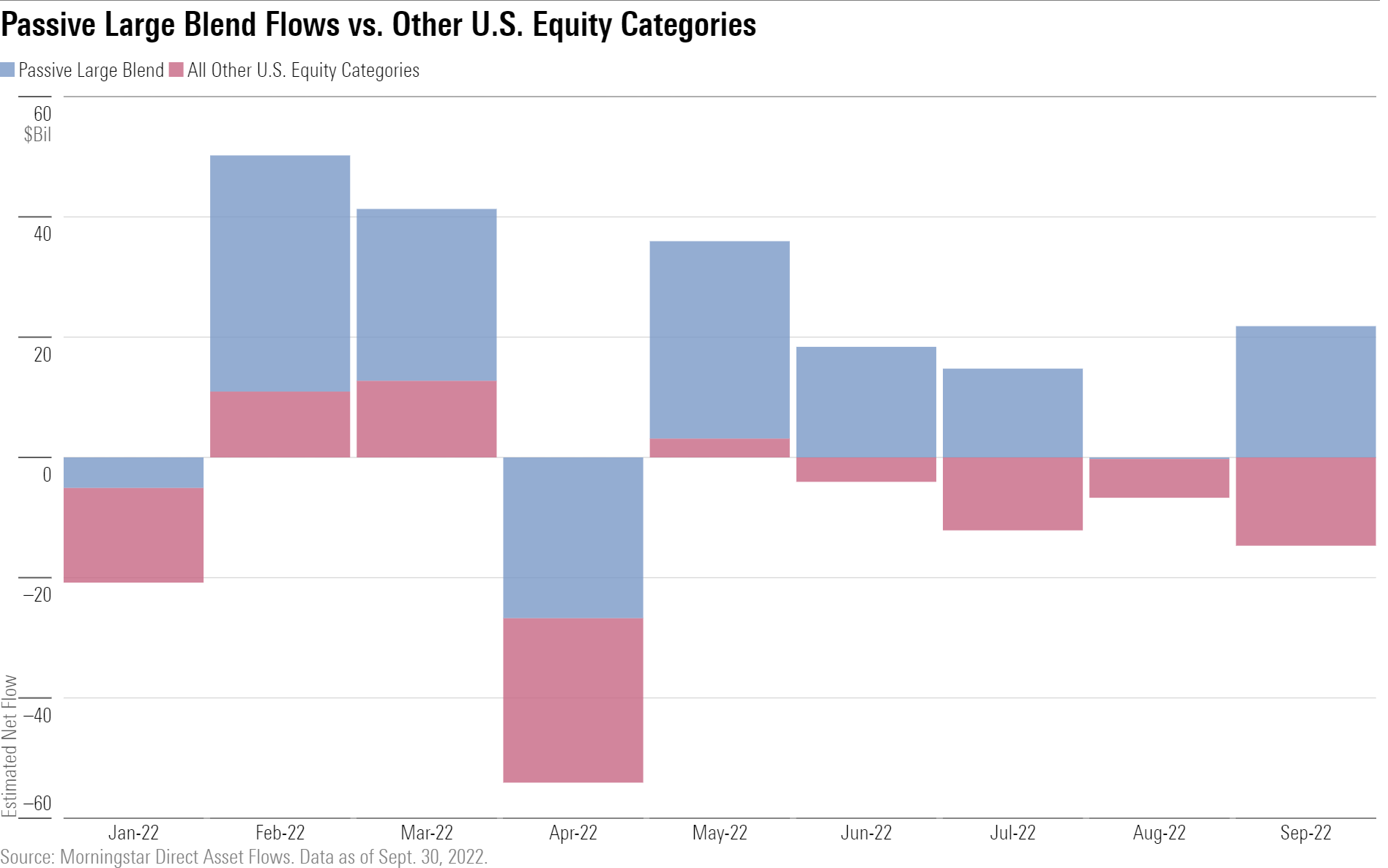

Buyers of Index Funds Keep U.S. Equity Fund Flows Steady

Demand for passive U.S. large-blend funds has kept the U.S. equity Morningstar Category group afloat in 2022. Investors have poured $124 billion into these offerings for the year to date through September, including $36 billion in the third quarter. All other categories in the group (plus active large-blend funds) saw combined outflows of $54 billion and $33 billion over those respective periods.

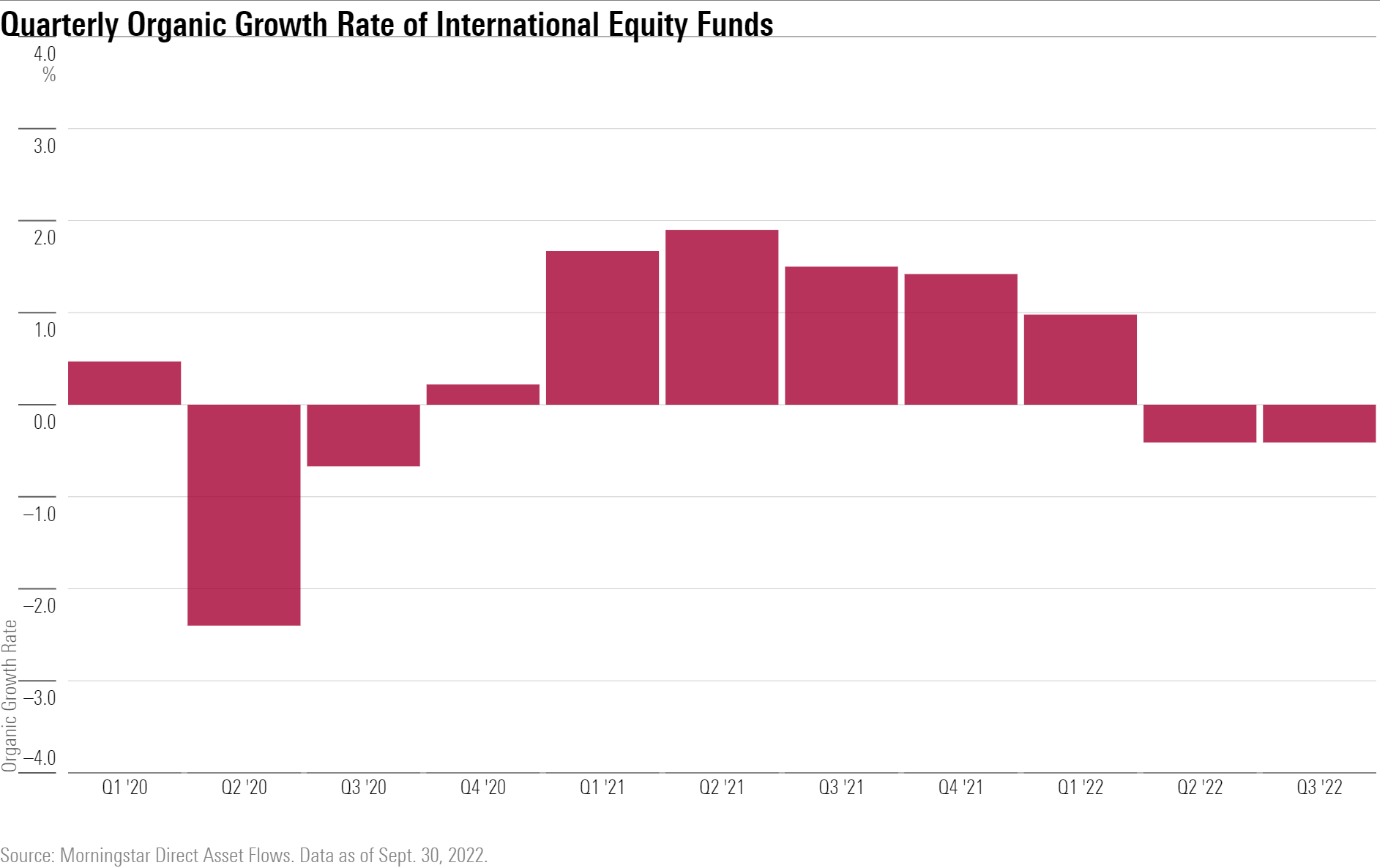

International-Equity Fund Flows Still Stuck in the Mud

International-equity funds shed $9.3 billion in September, extending their middling stretch. Investors haven’t sprinted away from this category group, but they haven’t flocked to it either. Regional categories such as Europe stock, China region, and Latin America experienced the steepest outflows in the third quarter, while foreign large-blend and foreign small/mid-value were relative bright spots.

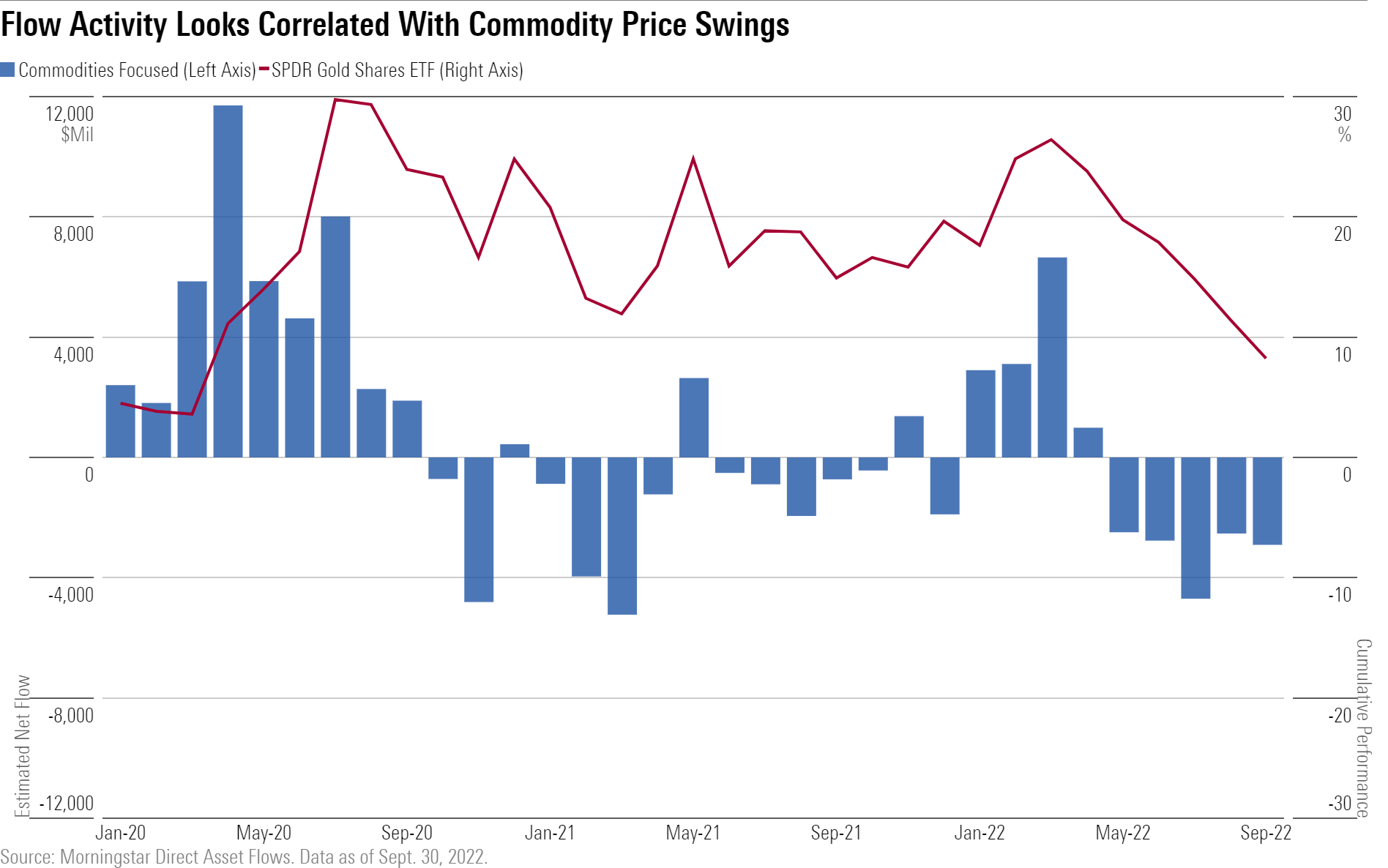

Trend-Following in Metals Persists

While a large portion of U.S. fund-flow patterns reflect rebalancing, some pockets are driven differently. The commodities-focused category comprises nearly two thirds of the commodities category group’s assets and mostly contains funds investing in precious metals. Flow activity there looks to be correlated with price swings in the underlying commodities.

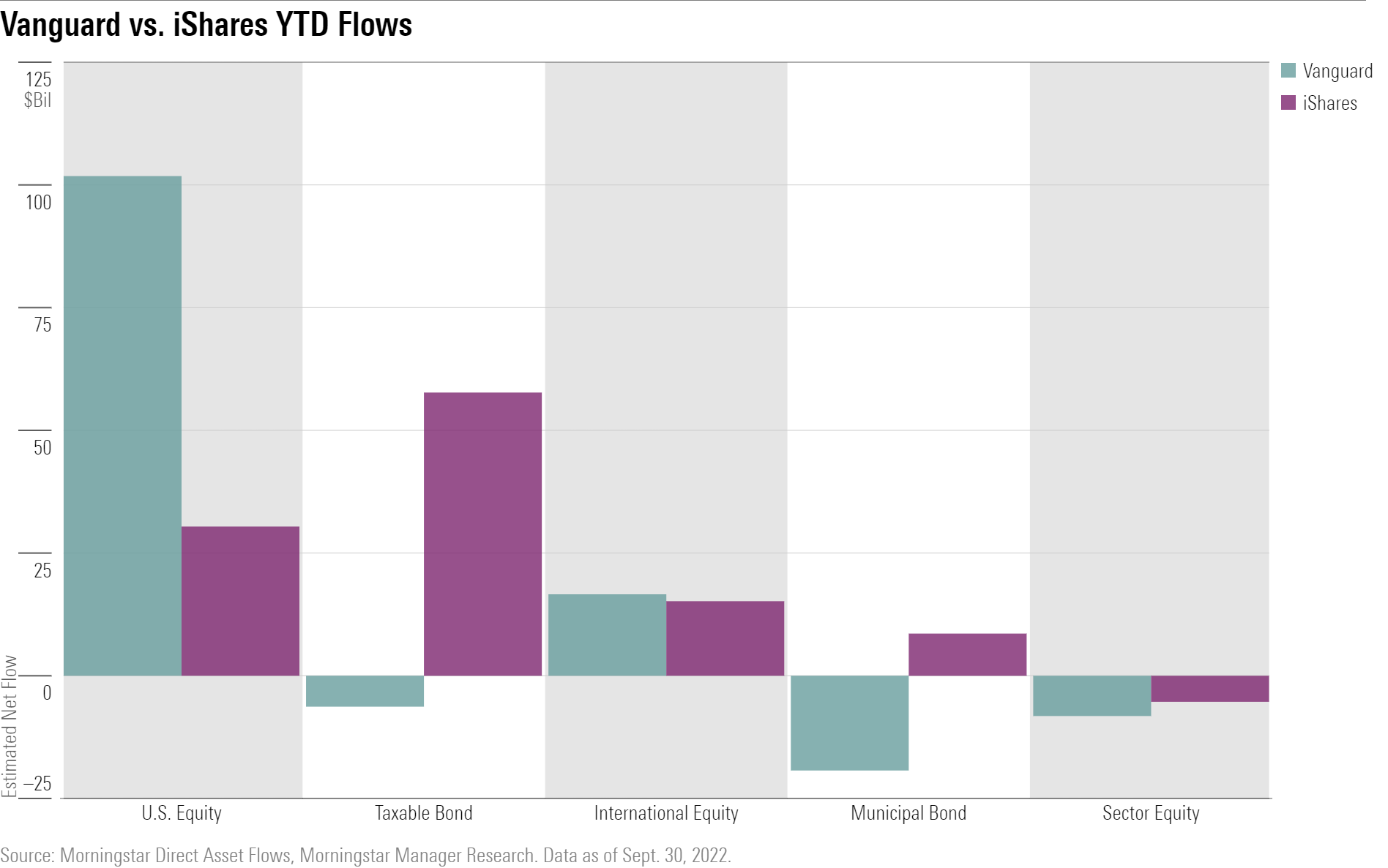

Bond Rout Pierces Vanguard’s Armor

Outflows from Vanguard’s bond funds led to just the firm’s fourth month of outflows in the past decade, to the tune of $3.2 billion in September. IShares has won in the fixed-income arena by a wide margin this year, bolstered by inflows into its Treasury funds. That gave iShares the year-to-date flows lead over Vanguard through three quarters: $105.1 billion to $75.9 billion.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)