CPI Report Suggests the Fed May Step Up Rate Hikes, Again

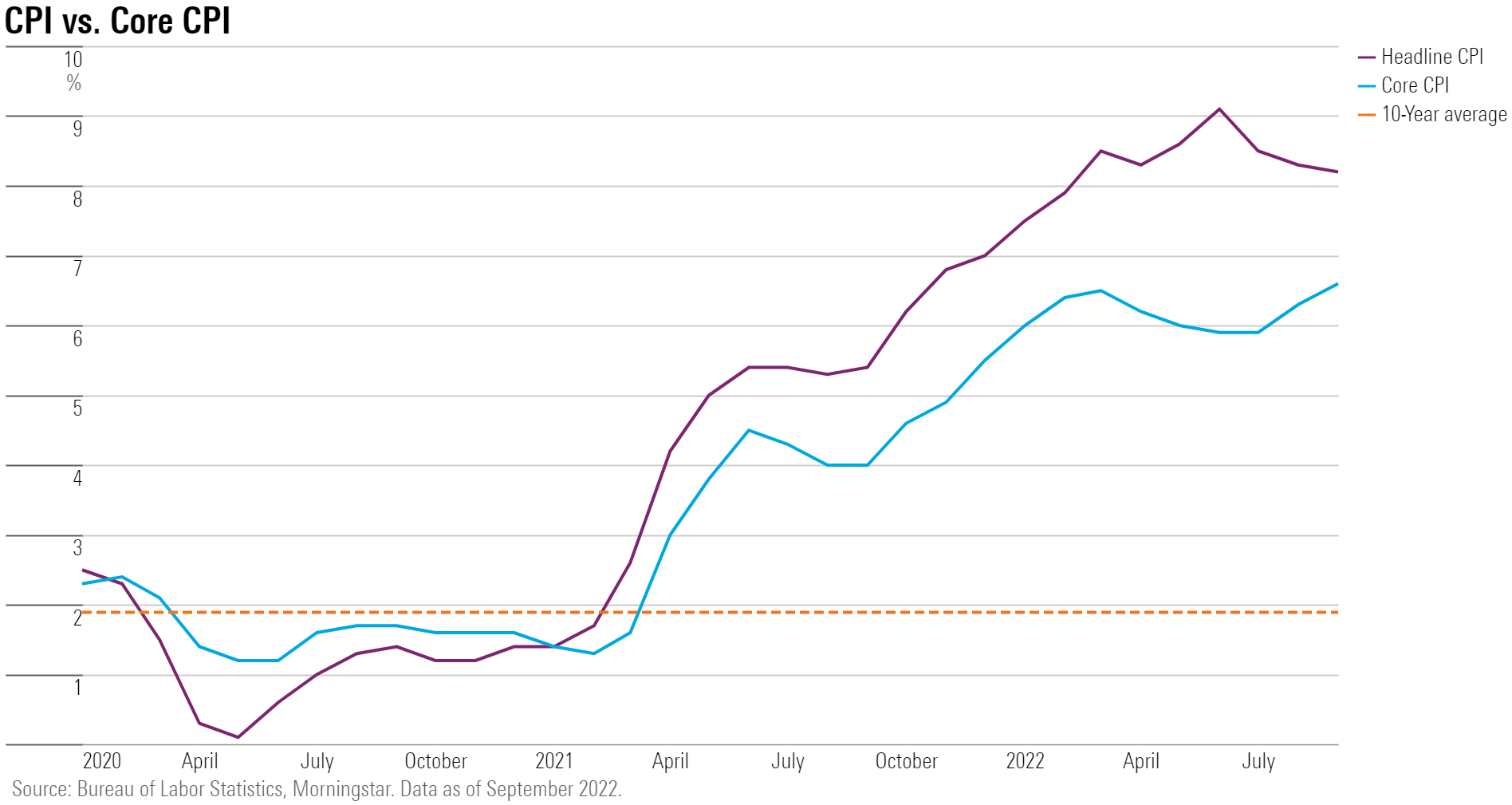

Despite hot inflation for September, the case for cooling in 2023 remains strong.

While consumers found relief at the gas pump in September, inflation remained a significant problem elsewhere, leading markets to look for even still more aggressive interest rate increases from the Federal Reserve.

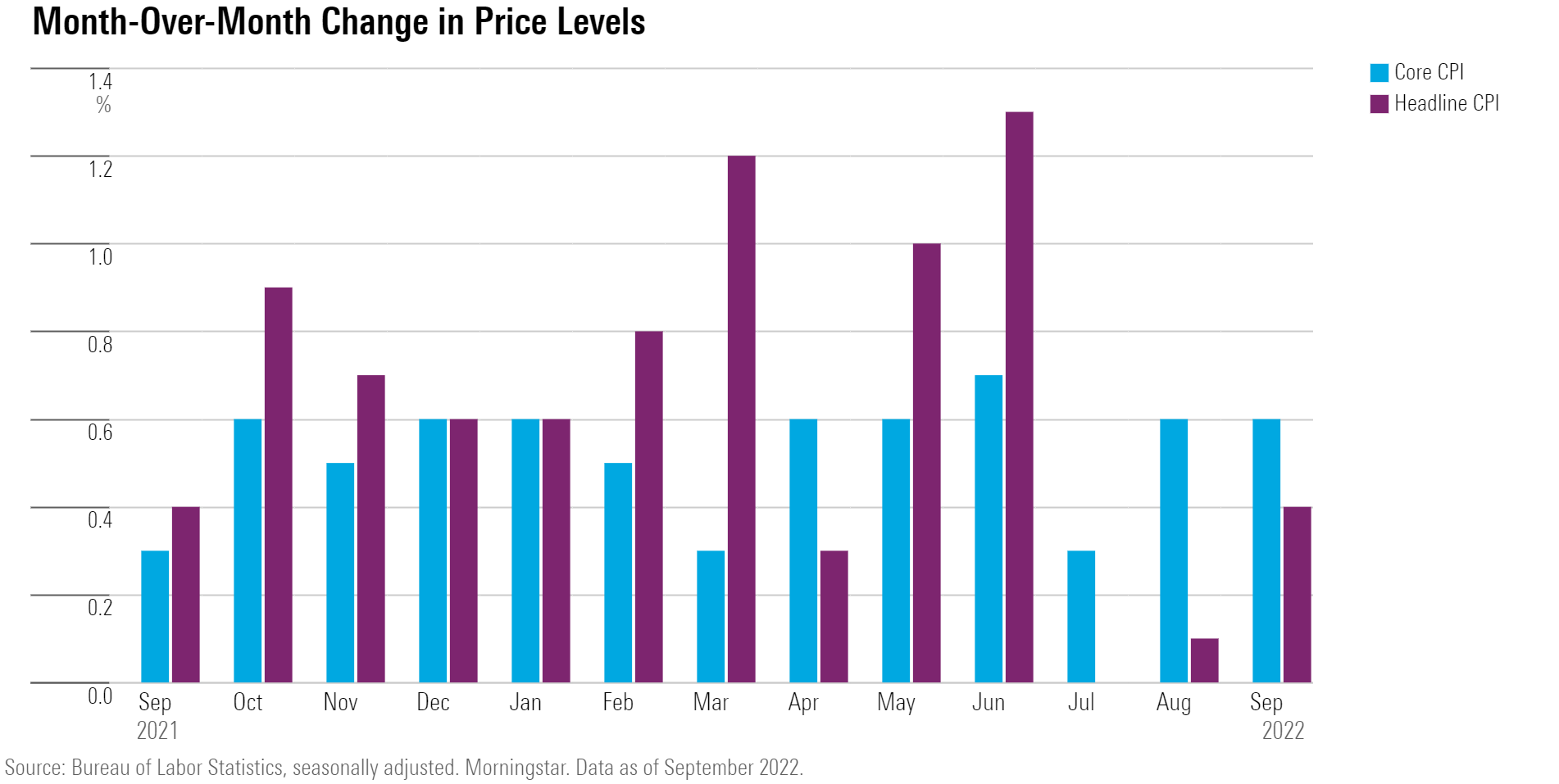

The Bureau of Labor Statistics reported the Consumer Price Index rose 0.4% in September, four times the rate it rose in August. The acceleration in the overall CPI was driven by energy prices, which—although they decreased—fell at a slower rate than they did in August.

However, the real spotlight was on core inflation, the CPI excluding food and energy, which remained at 0.6% month-over-month, the same pace as in August. Economists had expected core CPI to post a 0.4% increase for September.

The CPI report again disappointed investors looking for signs that inflation would finally show meaningful signs of slowing and enable the Fed to begin slowing its pace of rate increases. Instead, as has been the case for most of this year, the CPI report showed inflation remains stubbornly high.

“For now, inflation has endured despite easing supply chain pressures and moderate wage growth,” says Preston Caldwell, chief economist at Morningstar. “Even while the case for falling inflation next year remains strong, the Fed will not slow its pace of rate hikes until it sees progress in the actual inflation data.”

However, Caldwell says a careful read of the data and the broader economic backdrop shows reasons to continue expecting inflation to soften in the months ahead.

“There are signs that the outlook for inflation isn’t as bad as this report might suggest,” Caldwell says. “Easing supply constraints, falling demand, and restrained wage growth will help bring inflation down in 2023 and thereafter.”

On an annual basis, overall inflation rose 8.2% in September, edging down from the 8.3% rise seen in August. Core inflation, which excludes food and energy prices, rose 6.6% from year-ago levels.

Among core categories, goods-price inflation decelerated while services inflation accelerated, according to Caldwell. Core goods prices were flat after having increased 0.5% the prior month. “Easing supply constraints are beginning to provide relief on goods prices,” Caldwell says.

But there’s a long way to go before supply-chain tangles are fully unraveled. “A slowly-healing supply chain forms a major reason why we expect inflation to fall in 2023 and after.”

Core services prices increased by 0.8%, compared to 0.6% the prior month. The acceleration was driven by transportation services—where there was less pass through of lower fuel prices in September—healthcare, and other categories.

“Smoothing out some of the month-to-month volatility, we have seen some progress on overall core prices,” Caldwell says.

Core prices increased at a 6.0% annualized rate from June to September of this year, compared to a 7.9% rate in March to June. “This progress is hardly sufficient to assuage markets, or to allow the Fed to begin decelerating its pace of rate hikes.”

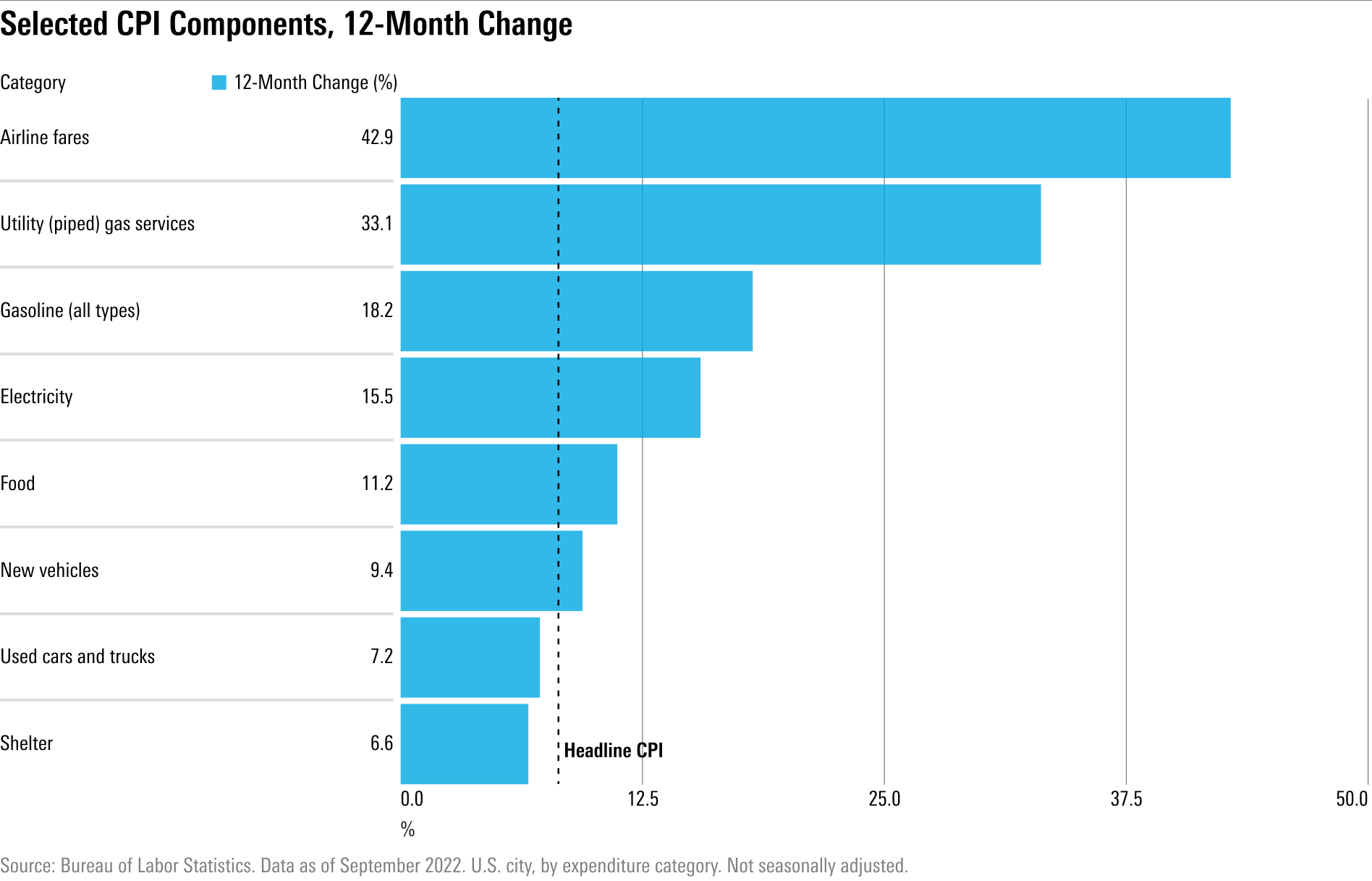

Over the past twelve months, prices for airline fares have risen 42.9%. Utility gas services, gasoline, and electricity have also been major contributors to price growth.

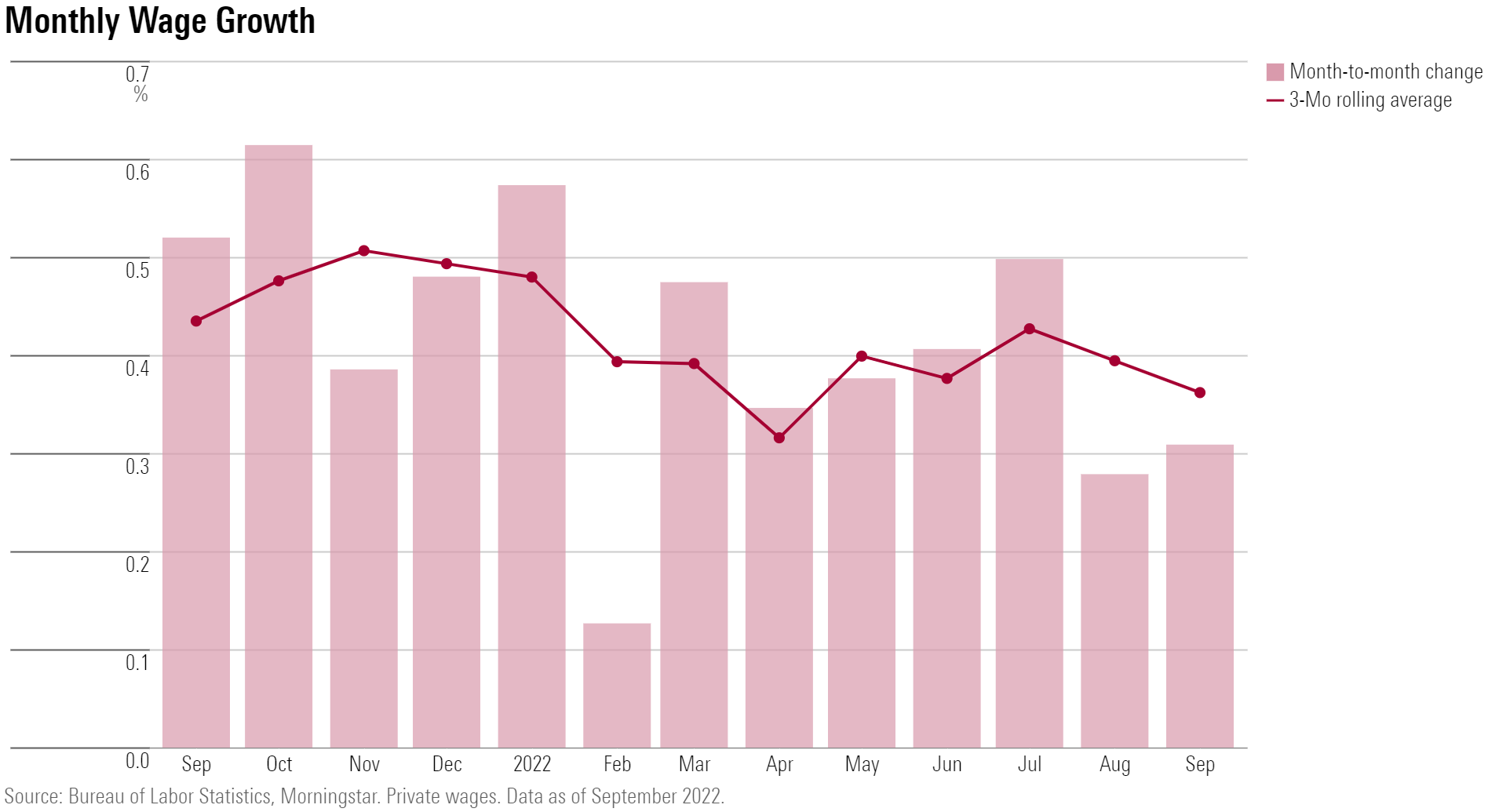

Recent core inflation data has been incongruent with wage data, Caldwell says. Wage growth averaged 4.4% (annualized) over June through September, which is consistent with an inflation rate of roughly 3%.

“Such a discrepancy can’t persist for too long. Either wage growth will reaccelerate in accordance with the current rate of core inflation or—much more likely in our view—core inflation will soon drop substantially to match lower labor cost growth.”

Meanwhile, leading edge data indicates that housing inflation will likely soon be hitting a peak, “which is unsurprising given that housing demand is being crushed by the surge in mortgage rates,” Caldwell says.

“While the case for falling inflation remains strong, the Fed will not reduce the pace of rate hikes until it sees greater progress in the actual data,” Caldwell says.

The September report appears to have cemented the case for additional aggressive rate hikes from the Fed in both November and December. Caldwell expects this will be more than enough to quell high inflation, and the Fed will ultimately bring inflation down well below its 2% target. “But given the dangers around inflation becoming entrenched if allowed to persist,” he says, “the Fed will risk overshooting.”

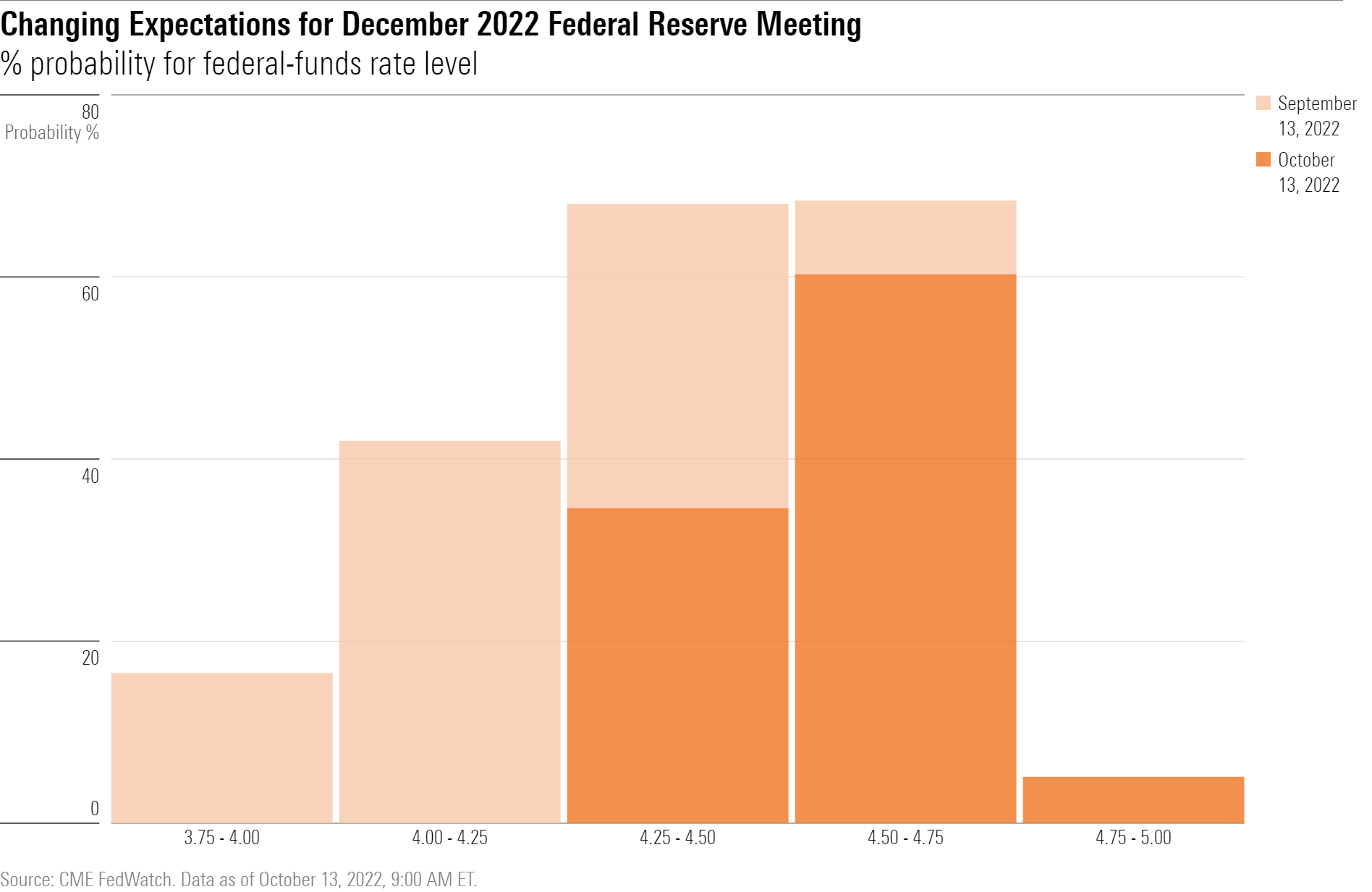

According to the CME FedWatch Tool, market expectations for rate hikes at the central bank’s upcoming November meeting shifted higher following the report. The bond futures market now indicates a 99% chance of 0.75 percentage point increase in the federal-funds rate: Odds were at 85% the day before the CPI report’s release, and just 50% a month prior. A rate hike of this size would bring the federal-funds rate to 3.75%–4.00%.

There are no signs of a letup from Fed rate hikes heading into next year. Market expectations for the Fed’s December and March policy meetings see two additional 0.75 percentage point rate increases. Expectations for December now look more aggressive than was the case after the release of last week’s jobs report, based on CME data.

The Fed has already lifted rates by three quarters of a point three times in 2022, and November and December rises could bring that number up to five. Before this year, the Fed hadn’t raised rates by 0.75 percentage point in any year since 1994.

Commensurate with the increased federal-funds rate hike expectations, short-term bond yields jumped on today’s news, with the 2-year U.S. Treasury yield up about 0.15 percentage point.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)