What You Need to Know About Ethereum’s Software Upgrade

A brief summary of “The Merge,” the biggest enhancement to the ethereum blockchain since its launch in 2016.

Last month, the second-biggest cryptocurrency by market cap enabled a software update years in the making. Called “The Merge,” it represents a massive shift in how the ethereum blockchain validates a block. Although it’s an exciting development, hailed as a watershed achievement of decentralized collaboration for an industry sorely in need of good news, it’s far from a panacea. Below we’ll walk through exactly what is—and what isn’t—changing with this new upgrade.

What It Will Do: Slash Emissions

At its core, The Merge is a carefully choreographed transition from a Proof of Work to a Proof of Stake consensus mechanism. A consensus mechanism is a way for multiple anonymous parties who don’t know each other to reach an agreement on a transaction so that it may be added to a ledger. PoW has been around for longer by virtue of the fact that it is crypto’s first consensus mechanism—it was pioneered by Satoshi Nakamoto and deployed in bitcoin’s original blockchain ledger.

PoW’s problem is its carbon footprint. In order to get multiple parties to agree on a transaction, PoW blockchains give every validator on the network a copy of an algorithm. The first validator to solve that algorithm gets to stitch up a bundle of transactions into a block, receiving cryptocurrency as the reward. The only way to solve the algorithm is through guess-and-check, requiring a lot of computing power. Because every validator on the network wants the cryptocurrency reward, they all race to solve the algorithm at the same time. In the process, they collectively gobble up enough power to rival entire electrical grids of small countries like Chile.

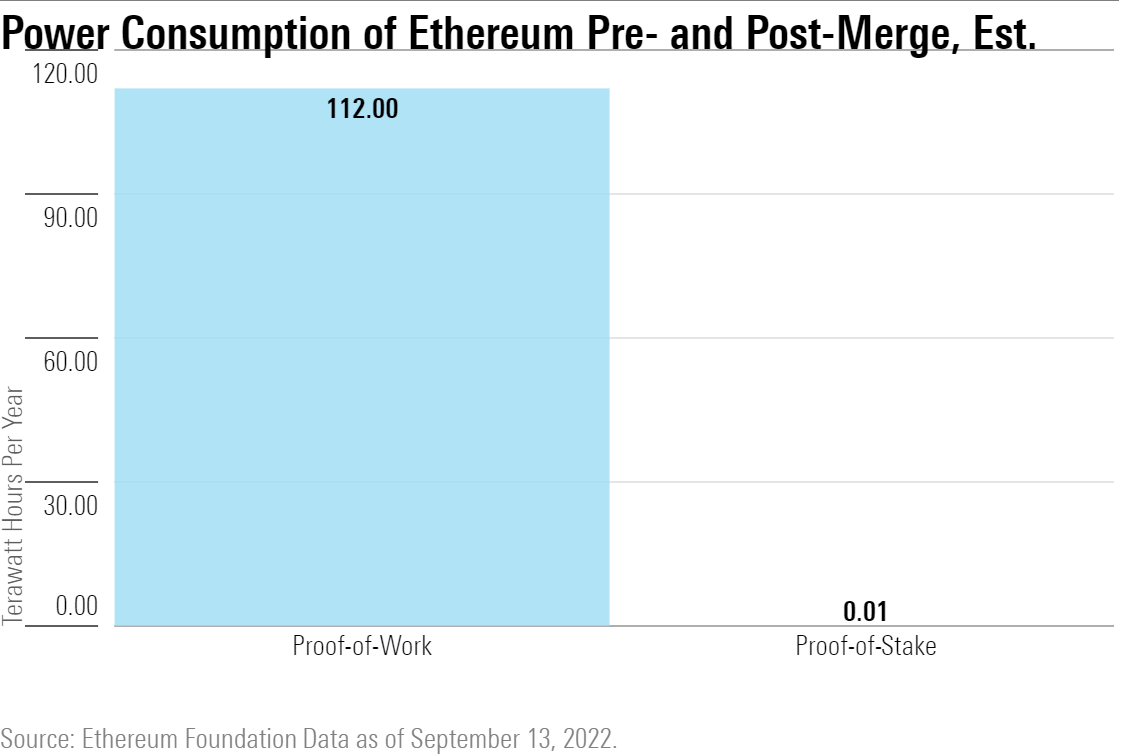

PoS, which was invented in 2017, has different plumbing. Unlike PoW, validators on PoS systems must deposit cryptocurrency in order to get the chance to validate a block. From there, the system semirandomly selects a particular validator to process a block of transactions. Validators have to wait their turn to get an opportunity to approve a block, which eliminates the redundancy of every validator in the PoW system scrambling to reach the solution at the same time. The Ethereum Foundation expects this to reduce energy consumption by more than 99.9%.

What It Won’t Do: Speed Up Transaction Processing

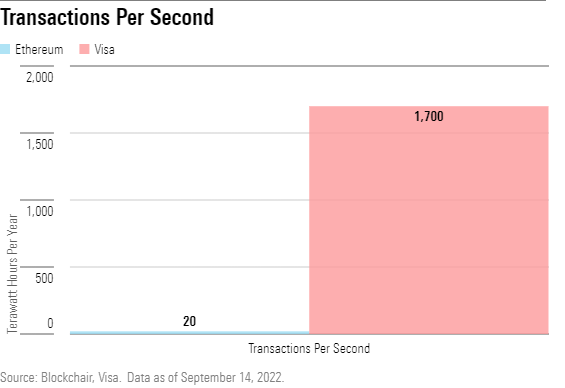

At least meaningfully. Transaction processing times are determined by two things: how many transactions a block can hold and how often those blocks are processed.

In the spirit of decentralization, the Ethereum Foundation has a self-stated goal of allowing ordinary users to validate a block. That means that regardless of the consensus mechanism, the network is limited by the performance of your average computer. Most broadband internet connections allow for a block size of just one to five megabytes, and most computers can only spare up to 10% of their CPU to verify a block while operating normally. Until the performance of a typical computer improves meaningfully, block sizes are unlikely to change.

Block processing times are likewise hamstrung. Under a PoW system, block processing times vary based on the difficulty of the algorithm. The difficulty of the algorithm also determines the security of the network, and ensuring a high degree of network security takes priority over improving transaction processing speed. (Ethereum’s has historically trended within a range of 12-14 seconds.) Unlike PoW systems, PoS consensus mechanisms have fixed block processing times, but asking a validator to process a transaction too quickly could crash their computer. The average computer can comfortably intake and approve a block in 12 seconds, so that’s where Ethereum has pegged its block time.

True, the move to PoS reduces the variability of block times, but this is not a material enough change to make a dent in overall processing speeds or compete with a centralized payment provider.

What It Will Do: Generate Yield

As mentioned, validators in a PoS system have to deposit crypto in order to participate. In crypto jargon, this deposit is referred to as a “stake” (the “stake” in “Proof of Stake”), and that crypto goes into what’s called a “staking pool.”

It takes a big investment in order to stake—naturally, networks want to ensure their validators have skin in the game. Right now, Ethereum’s minimum deposit is 32 ETH, worth about $51,000 as of Sept. 14.

That’s far out of reach for many individual investors, who typically own fractions of a coin. The compelling aspect of a staking system, though, is that small investors can band together to reach the minimum deposit. They do this by delegating their ether to a third-party service that manages the staking process on their behalf. In return, investors receive a proportion of the rewards (currently around 4%) that Ethereum pays out to the third-party validator. Although the underlying mechanics are very different, to investors this exchange looks an awful lot like a yield payout.

Delegation is not without its risks. As crypto enthusiasts have learned many times over, counterparties are never a sure thing. But it means that, for the first time, crypto users can earn a return on ether investments like the way they earn coupon payments and dividends on other investments today. The presence of cash flows allows investors to discount them and arrive at an estimate of a present value for an investment. This may usher in a greater level of price discovery and damp the volatility that has plagued ether since its earliest days. Given that ether is the second-largest cryptocurrency by market cap, this could alter the contours of the overall market, too.

What It Won’t Do: Make It Cheaper to Trade

While The Merge might make ether a better investment to hold, it likely won’t make it more compelling to buy or exchange. Ethereum charges transaction fees, called “gas fees,” to each person who wants their transaction included in a block. This gas fee functions as a bid, with the space on the block going to the highest bidder. Fees climb as competition for block space heats up, and as we learned, The Merge won’t free up any additional block space. That means that the original relationship still holds: the more competition there is for block space, the more the network charges people who want to use it.

Ethereum’s developers hope that the completion of The Merge will free up their time to focus on other technological upgrades. The current road map—whimsically called “surge, verge, purge, and splurge”—aims to reduce gas fees and increase the ethereum blockchain’s scalability. But given the many delays experienced in the runup to The Merge, it’s possible that it could take a long time for these ambitions to bear fruit.

So What?

Whether every road map item ultimately gets implemented or not, the existence of a to-do list is evidence of a broader truth. It signals to the wider world that ethereum is a work in progress, a piece of technology that needs regular maintenance in order to remain relevant. It would be easy to use The Merge to draw a conclusion about the contrast between ether and bitcoin, or cryptocurrencies and fiat money, but a more universal principle is at work.

The proof-of-stake consensus mechanism has a lot in common with contactless credit cards or fresh watermarks on a dollar bill. Society is always looking for ways to graft new technologies onto old payment systems, whether the purpose is to boost convenience or deter fraud. Even though ether still has a long way to go before it is compelling as a form of payment, a software upgrade doesn’t disqualify it. Far from it, actually: If ethereum is able to outgrow a defining feature—its consensus mechanism—and retain its relevancy, The Merge may end up reinforcing its promise.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)