Jobs Report Shows the Economy Is Still Chugging Along

A gradual softening of the labor market and slowing wage growth provides room for inflation to cool off.

The latest jobs report showed that payroll growth has slowed, but not enough to deter the Federal Reserve from at least one more aggressive interest rate hike.

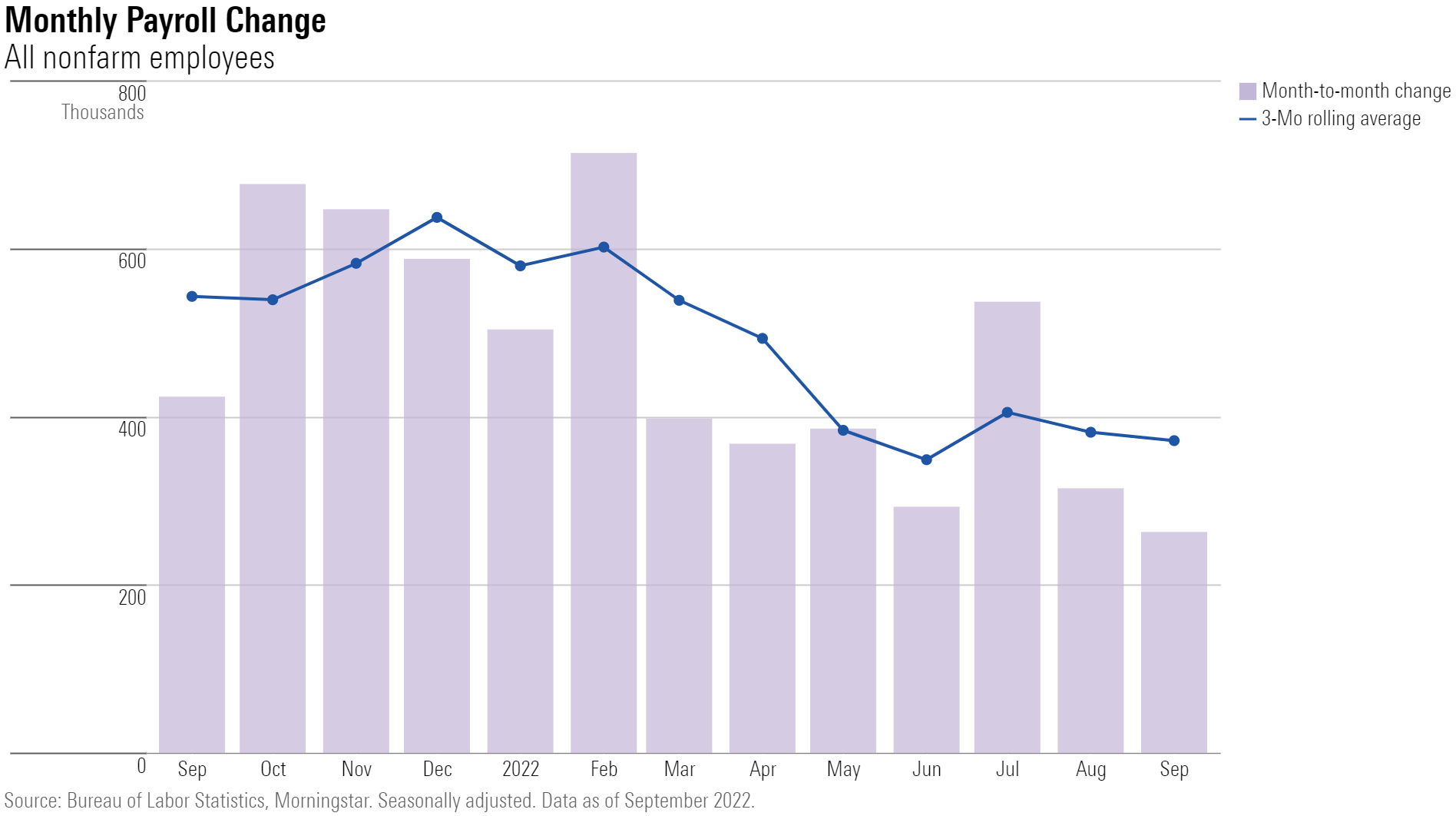

The September jobs report from the Bureau of Labor Statistics showed total nonfarm payroll employment rose by 263,000—a slowdown from the 315,000 rise reported in August—still a healthy number that was roughly in line with economists’ estimates. September’s reading was the weakest since April 2021, but still strong in comparison to the prepandemic average.

“The report doesn’t tip the scales for the Fed one way or another,” says Morningstar’s chief economist Preston Caldwell. “The data is consistent with a gradual, but not rapid, cooling-off of the labor market.”

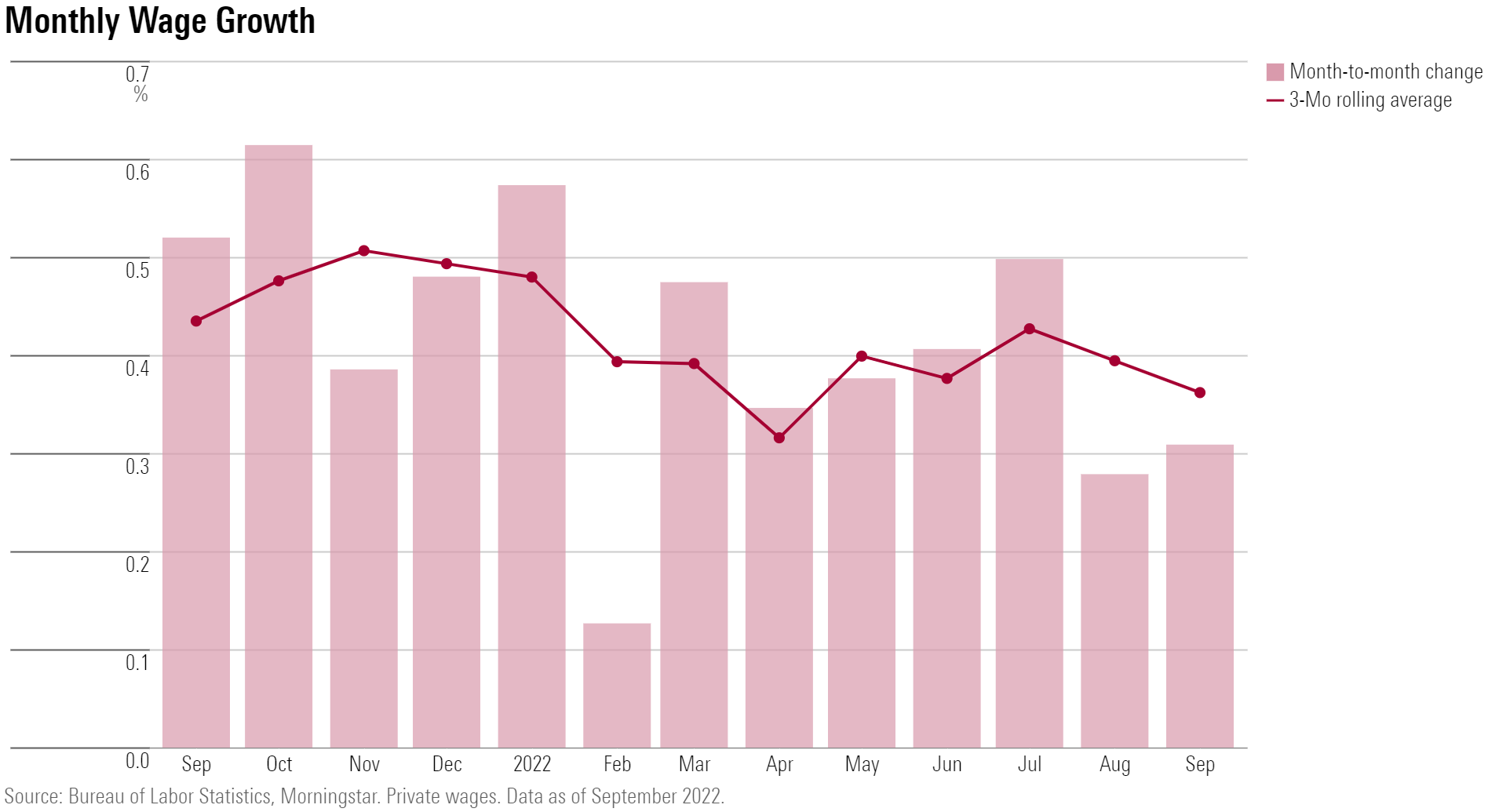

While job growth remains solidly positive, Caldwell says, wage growth is at a pace which is likely to lead to falling core inflation in the near future.

“The Fed’s eyes remain glued on the inflation data,” Caldwell says. September’s Consumer Price Index report will be released in the coming week.

Nonfarm payroll employment has maintained a steady growth rate of roughly 0.25% since May 2022, using a three-month moving average, which smooths out month-to-month volatility. That’s slower than the rate seen in prior months and throughout 2021.

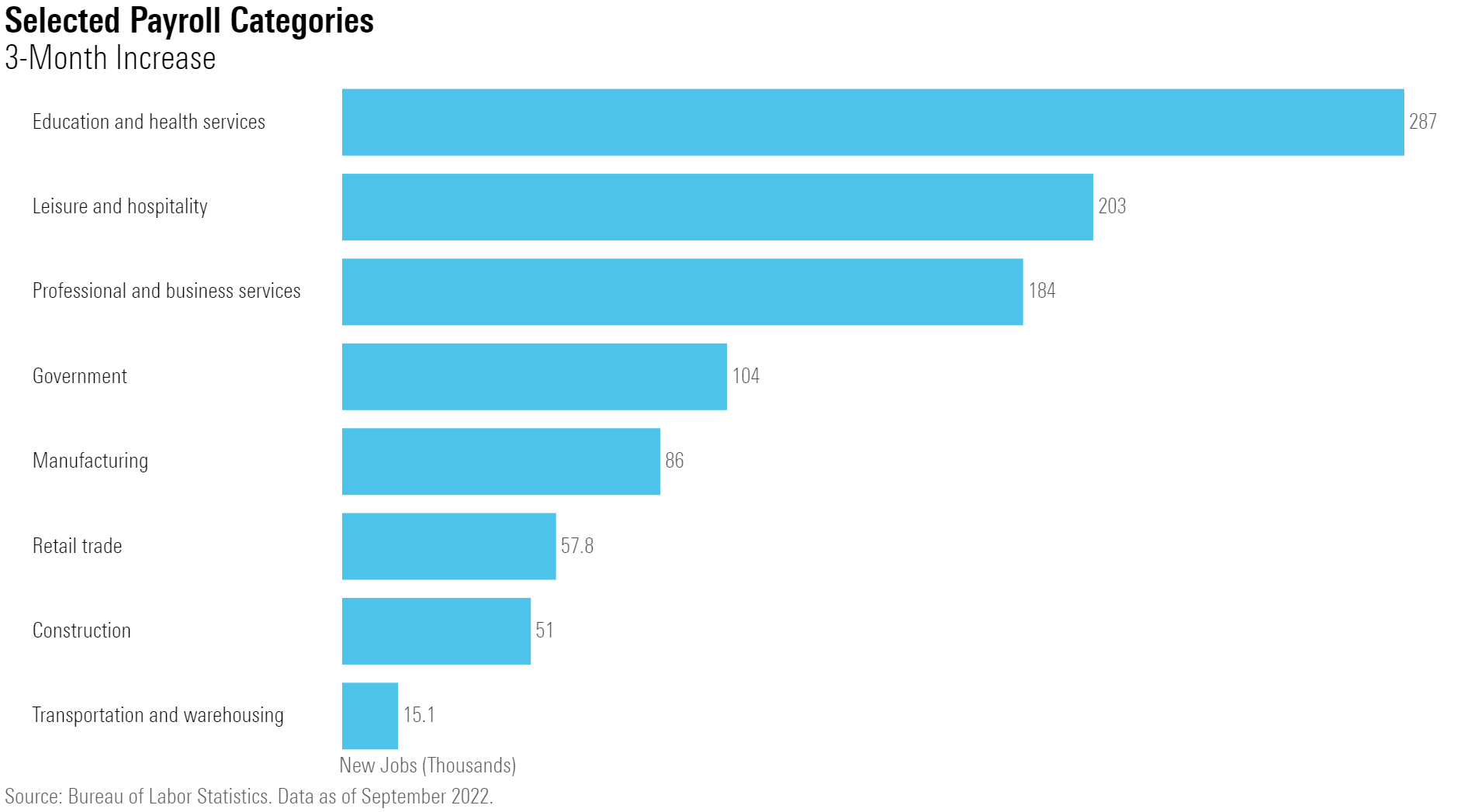

Notable job gains came from leisure and hospitality and healthcare in September, the Labor Department said.

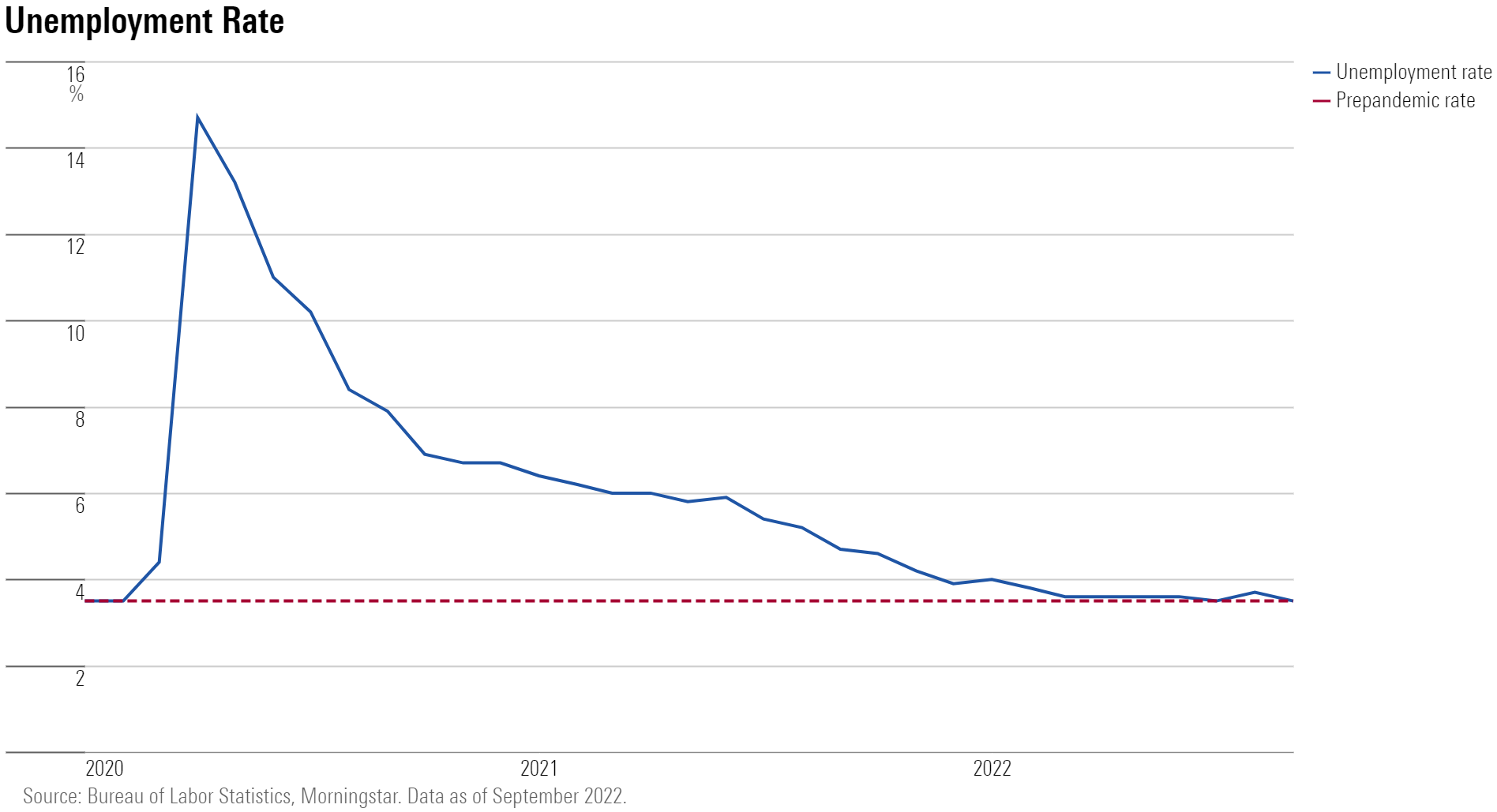

The unemployment rate edged down to its prepandemic level of 3.5% in September, after jumping to 3.7% in August. For most of the year, the unemployment rate has hovered just above its prepandemic level.

The number of unemployed persons edged down to 5.8 million in September, the Labor Department reported.

Though they employment rate ticked back up to its prepandemic level in September, “we still expect job growth to slow markedly over the coming year,” Caldwell says.

So far, he says, “We’ve seen few layoffs in construction despite sharply slowing homebuilding activity.” Over the past three months, jobs in construction rose by 51,000, even as housing starts are down about 12% from their April peak, and are expected to fall further in the coming months.

Leisure and hospitality added 83,000 jobs in September, bringing employment in the sector below its prepandemic February 2020 level by 1.1 million, or 6.7%. Caldwell notes that the brisk hiring rate in restaurants and other leisure services will likely start to slow, given that the “return to normal” for consumers has now mostly played out.

Over the last three months, education and health services have been the biggest drivers of job gains. Within the September jobs report, the Labor Department said that healthcare employment rose by 60,000, and has returned to its February 2020 level.

Alongside the month’s rise in hiring, wage growth ticked upward in September: Average hourly earnings for all employees on private nonfarm payrolls rose by 0.3% to $32.46, up 5.0% from year-ago levels. In three-month-average (annualized) terms, wage growth was 4.4% through September, down from a peak of 5.3% in July.

“It’s too early to say if this is a downtrend,” Caldwell says. Wage growth is now running at a pace consistent with annual inflation of around 3%, much closer to normal than the inflation rate prevailing over the past year (the Consumer Price Index rose 8.2% year-over-year in August).

“With other supply disruptions receding, only tight labor markets and ensuing high wage growth remain as a driver powerful enough to keep inflation high.”

Data from the related Job Openings and Labor Turnover report this week showed a sharp drop in the August job openings rate. “This is positive news for the fight against inflation,” Caldwell says.

Job openings—which have reached record highs over the past year—are a signal of demand for labor. “Excessive labor demand can lead to excessive wage growth, and thereby inflation,” Caldwell says. “If the Fed can bring job openings down without also spurring mass layoffs and a large rise in unemployment, it raises the probability of a soft landing for the economy.”

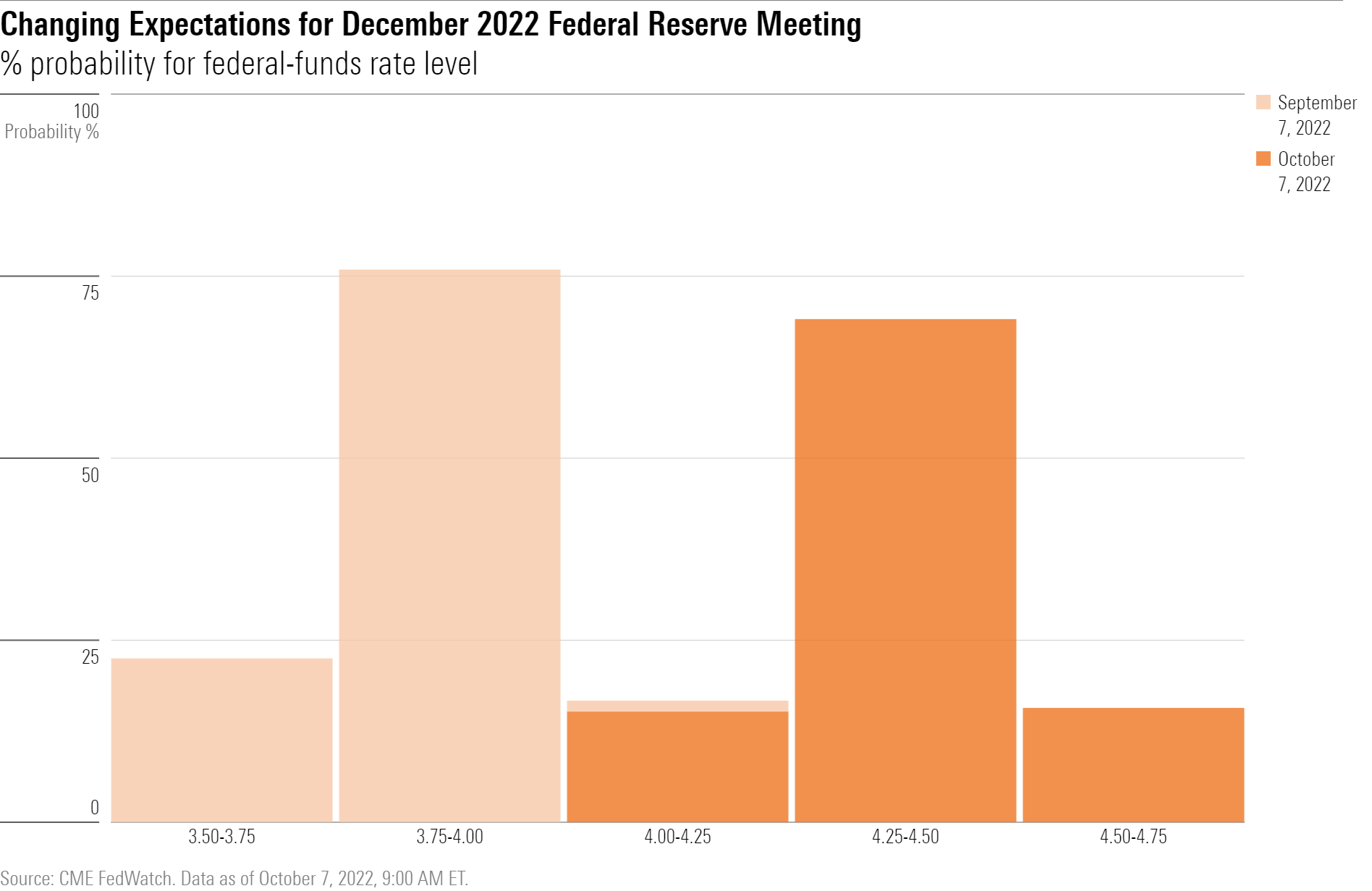

The September jobs report had little impact on expectations for the Fed’s next moves.

In the bond market, futures prices show investors still expect the Fed to raise the federal-funds rate target rate by 0.75 percentage point at its November policymaking meeting. That would take the funds rate target to 3.75% to 4.00%, which is up dramatically from the start of the year, when the funds rate was essentially at zero.

For the December meeting, the market sees a 70% chance of an additional 0.50 percentage point increase. However, the odds for another 0.75 percentage point increase that month are up—that percentage more than doubled to 16% from 7% before the release of the jobs report.

Last month, the Fed communicated the continuation of its aggressive fight against inflation by raising the federal-funds effective rate by 0.75 percentage points and signaling more to come through the rest of the year.

“In the face of ongoing high inflation, only steep job losses would impel the Fed to slam the breaks on rate hikes,” Caldwell says. On the other hand, he adds, moderate wage growth means that labor market data alone doesn’t support aggressive tightening.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)