Healthcare’s Defensive Nature Helps Against Macro Challenges

And the new U.S. drug policy looks manageable.

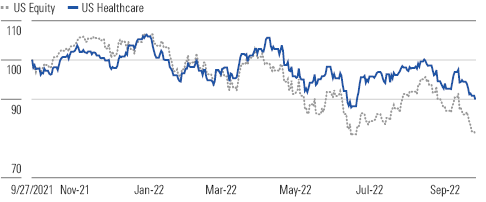

As the markets continue to pull back on several macro headwinds and potentially high valuations, the trailing 12-month performance has fallen with the Morningstar US Healthcare Index down 10%, but still ahead of the broader equity market’s 19% decline. We believe the defensive nature and relative safety of healthcare stocks is supporting the minor outperformance. For the most part, we expect our healthcare coverage (especially firms with moats) will be able to pass along price increases due to any inflationary pressures given the strong pricing power enjoyed by the sector due to patents and high switching costs. However, the labor shortages are affecting some healthcare services companies, which may limit capacity and pressure margins in the near term for the industry. Additionally, recessionary concerns are increasing as interest rates climb to combat inflation, but healthcare demand is fairly inelastic and holds up well during recessions. Further, the war in Ukraine shouldn’t have much of an impact on healthcare as the sector generates less than 2% of sales in Ukraine and Russia.

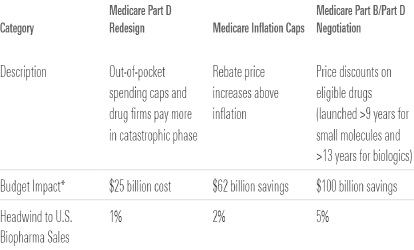

Finally, in a surprising move, the U.S. Congress passed new drug policies as part of the Inflation Reduction Act that will have global implications, as the U.S. drug market represents close to half of the global market. However, we view the new price controls and reimbursement changes in Medicare as a manageable negative headwind for the biopharma group.

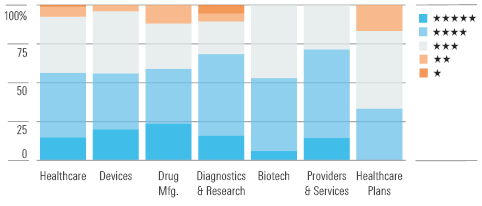

We view the healthcare sector as modestly undervalued. Our sector coverage trades below our overall estimate of intrinsic value at a price to fair value at 0.94. We see just over 50 “buys” in the sector, with over half of our coverage rated 4 or 5 stars.

What We See

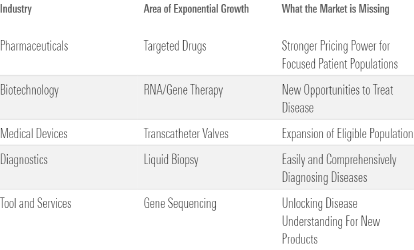

Overall, healthcare looks undervalued, and we believe the market is missing important areas of exponential growth. Biopharma stocks represent one of the most undervalued industries within the healthcare sector, and we believe the biopharma group is well positioned within areas of potential exponential growth. While the new U.S. drug policies embedded within the Inflation Reduction Act may create headwinds, we view the changes as manageable. We expect Big Biopharma to adapt to the new policy through a combination of cost-cutting, agreements with generic firms for limited authorized generic launches (to avoid the list for negotiated drugs), and higher launch prices (to counter pressure on price increases and earlier declines due to negotiation).

The healthcare services industry also looks undervalued. Labor constraints are adding pressure to margins in this industry, but we expect these headwinds to eventually pass, through a stabilization of the labor market and the likely eventual passage of these costs to insurers. These trends will take time, and the market doesn’t look willing to appreciate the current stock price valuations.

Top Picks

Name/Ticker: Illumina ILMN

Rating: 4-stars

Price (USD): 186.84

Fair Value (USD): 307.00

Uncertainty: Very High

Market Cap (USD B): 28.96

Economic Moat: Narrow

Capital Allocation: Exemplary

Illumina represents a growth-at-a-reasonable-price opportunity for investors with a long-term horizon, in our opinion. As the leading provider of genomic sequencing tools, the company should be able to capitalize on the continued expansion of these applications in research and clinical settings. Also, Illumina owns the Grail liquid biopsy assets, which are targeting a nascent exponential technology opportunity for the earlier detection of cancer. While regulators may eventually force Illumina to unwind the Grail transaction, we suspect the company will be able to hold on to those assets for several more years through any appeals processes, which could be enough for the market to recognize the significant growth potential in those assets. While Illumina may face more competition in its legacy genomic sequencing technology in the future, we think the factors that determine its economic moat in genomic sequencing—intangible assets and switching costs for end users—may help Illumina generate economic profits for the long run.

Name/Ticker: Moderna Therapeutics MRNA

Rating: 4-stars

Price (USD): 122.23

Fair Value (USD): 232.00

Uncertainty: Very High

Market Cap (USD B): 46.82

Economic Moat: None

Capital Allocation: Standard

The shares were on a roller-coaster in 2021; we think investors first became overly enthusiastic about the potential of the company’s technology but subsequently too bearish on its post-coronavirus growth. While we have modest expectations for sales of the firm’s COVID-19 vaccine following massive pandemic demand in 2021 and 2022, we think Moderna’s technology is particularly well validated in the field of respiratory virus vaccines; the firm’s RSV vaccine, seasonal flu vaccine and COVID-19 vaccine could eventually form the basis for a single vaccine, as mRNA technology is well suited for combinations.

Name/Ticker: Zimmer Biomet ZBH

Rating: 5-stars

Price (USD): 104.82

Fair Value (USD): 175.00

Uncertainty: Medium

Market Cap (USD B): 22.06

Economic Moat: Wide

Capital Allocation: Exemplary

With the addition of smaller competitor Biomet, Zimmer is the undisputed king of large joint reconstruction, by far. We expect favorable demographics, which include aging baby boomers and rising obesity, to fuel solid demand for large-joint replacement that should offset price declines. However, Zimmer stumbled into a series of pitfalls in 2016-2017, including integration issues, supply and inventory challenges, and quality concerns that have caught the attention of the U.S. Food and Drug Administration. But new management has tackled these issues, and the firm is poised to ramp up its growth.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)