Basic Materials Sector Underperforms; We See Long-Term Opportunities Amid Broader Market Decline

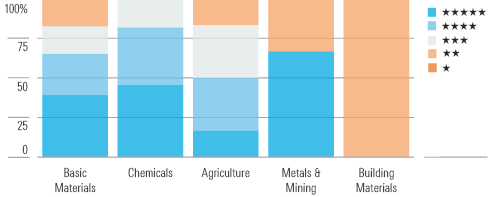

More than 54% of the stocks are trading in either 5- or 4-star territory.

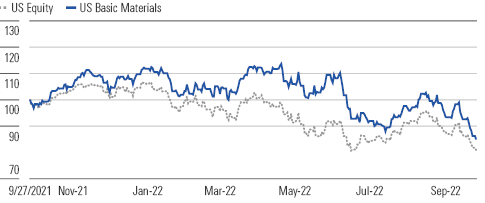

The Morningstar U.S. Basic Materials Index underperformed the broader market during the third quarter of 2022, by roughly 400 basis points. The materials index declined 7.1% during the quarter, while the U.S. market index was down 3.1%. On a trailing 12-month basis, the materials sector outperformed the market by 400 basis points. As a result of the market decline, we see opportunities across the sector with nearly 65% of the stocks trading in ether 5-star or 4-star territory.

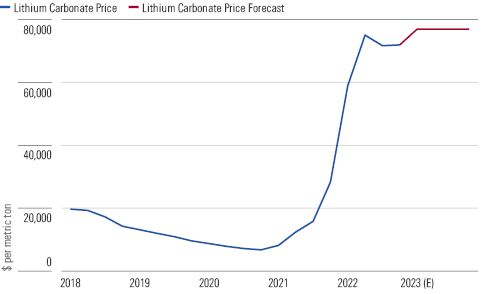

Lithium demand will grow nearly five times by 2030 from 2021 largely due to increased electric vehicle adoption. The lithium market is currently undersupplied, leading to prices at all-time high levels above $70,000 per metric ton, up over 10 times from below $7,000 per metric ton in early 2021. We forecast demand growth will outpace new supply in 2023. Based on our cross-price elasticity model, we forecast prices will rise to $77,000 per metric ton in 2023. This should allow low-cost producers to generate excess returns.

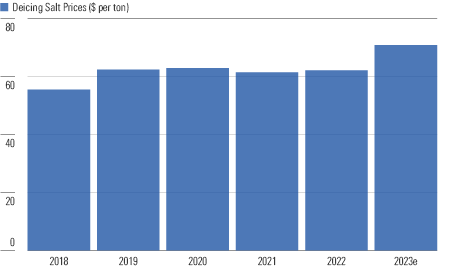

We forecast deicing salt prices will rise 14% in the 2022-23 winter. The rise follows stagnating prices over the last few years as milder winters left producers with excess supply. The 2021-22 winter saw average snow, which led to average deicing salt demand. This dynamic would typically lead to flat price in the upcoming winter. However, producers experienced cost inflation in the previous year, which weighed on profits and led to higher bid prices for this winter. Based on contracted terms, price increases will generally take effect in the fourth quarter of 2022. The increase should help to restore producer profits in the upcoming year.

We see commodity chemical prices remaining elevated over the next couple of years. A major driver of commodity chemical prices is Brent oil prices as oil-based naphtha feedstock is typically the marginal cost of production. We forecast Brent oil prices will remain above our midcycle price forecast as the market remains tight. For low-cost chemicals producers, profits should remain elevated.

Lithium Prices Will Rise in 2023 as Demand Outpaces Supply

Top Picks

Name/Ticker: Lithium Americas LAC

Rating: 5-stars

Price (USD): 26.34

Fair Value (USD): 65.00

Uncertainty: Very High

Market Cap (USD B): 3.54

Economic Moat: None

Capital Allocation: Standard

Lithium Americas is our top pick to play higher sustained lithium prices. The stock trades at less than half of our $65 (CAD 84) per share fair value estimate. Lithium Americas does not currently produce any lithium but is developing three lithium resources that should enter production by the end of the decade, with the first resource entering production later this year. Once all projects are fully ramped up, we forecast the company will become a top five producer by capacity globally. We reiterate our very high uncertainty rating on the name due to elevated company-specific risk as a result of no projects currently operating. However, for long-term investors that can tolerate the volatility, we see massive upside in the stock and view it as one of the best ways to invest in higher lithium prices and growing EV adoption.

Name/Ticker: Compass Minerals CMP

Rating: 5-stars

Price (USD): 37.43

Fair Value (USD): 80.00

Uncertainty: High

Market Cap (USD B): 1.25

Economic Moat: Wide

Capital Allocation: Standard

Our top pick to invest in rising deicing salt prices is Compass Minerals. The stock trades at roughly half of our $80 per share fair value estimate and in 5-star territory. The majority of Compass Minerals’ profits come from its salt business, where Compass enjoys a cost advantage stemming from its unique geological assets. As Compass realizes higher salt prices, we forecast the company’s profits will rise in fiscal 2023, which should be a catalyst for materially undervalued the stock.

Name/Ticker: Celanese CE

Rating: 5-stars

Price (USD): 88.28

Fair Value (USD): 165.00

Uncertainty: Medium

Market Cap (USD B): 9.52

Economic Moat: Narrow

Capital Allocation: Exemplary

Our top pick to play elevated commodity chemical prices is narrow-moat Celanese. The stock trades at roughly a 40% discount to our $165 per share fair value estimate. Celanese is a low-cost producer of commodity chemicals as the majority of the company’s production is made from U.S. natural gas feedstock. Additionally, the company is well positioned to benefit from a long-term recovery in the global auto market as Celanese plans to acquire the majority of DuPont’s mobility and materials portfolio in a deal that should close by the end of the year. We view the current share price as an attractive entry point for the cost-advantaged chemicals producer.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)