The Strong U.S. Dollar: Who Wins and Who Loses?

We looked across stock sectors to see which generate the most and least revenue outside the U.S.

There are very few asset classes having a positive year. Both stocks and bonds have struggled, and even commodities have started to falter with the possibility of a global recession just around the corner.

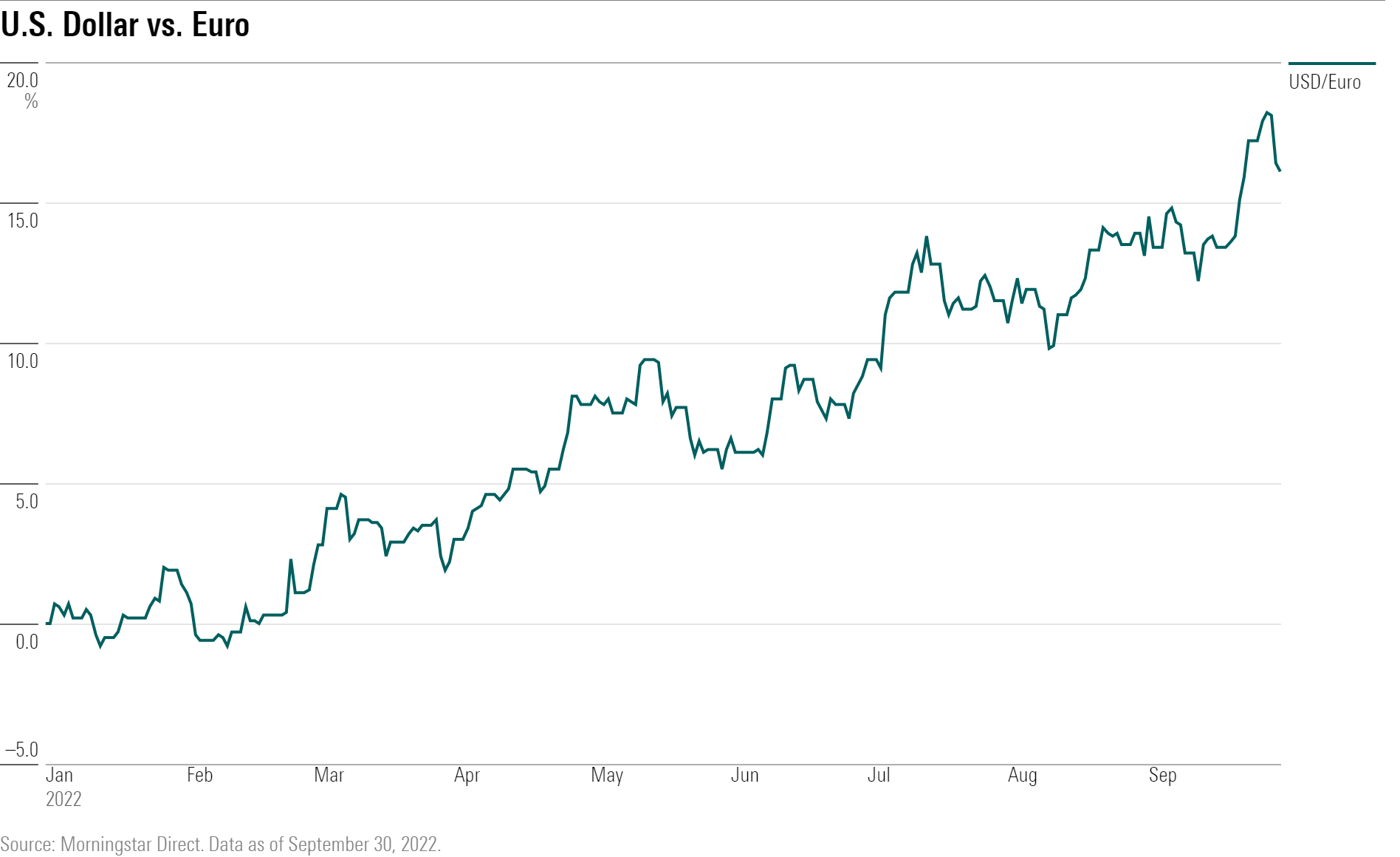

But there is one asset that is the clear-cut king of 2022: the U.S. dollar. The greenback has appreciated by just over 16% against the euro through the first three quarters of this year. It has also appreciated against the pound and the yen.

The dollar’s strength also has a direct impact on companies in both the U.S. and Europe. For U.S. businesses, those that generate more revenue outside the country will see their results hurt. For European companies, it will be those that generate more revenue in the U.S. that will benefit.

What Stocks Are Most Affected by a Strong Dollar?

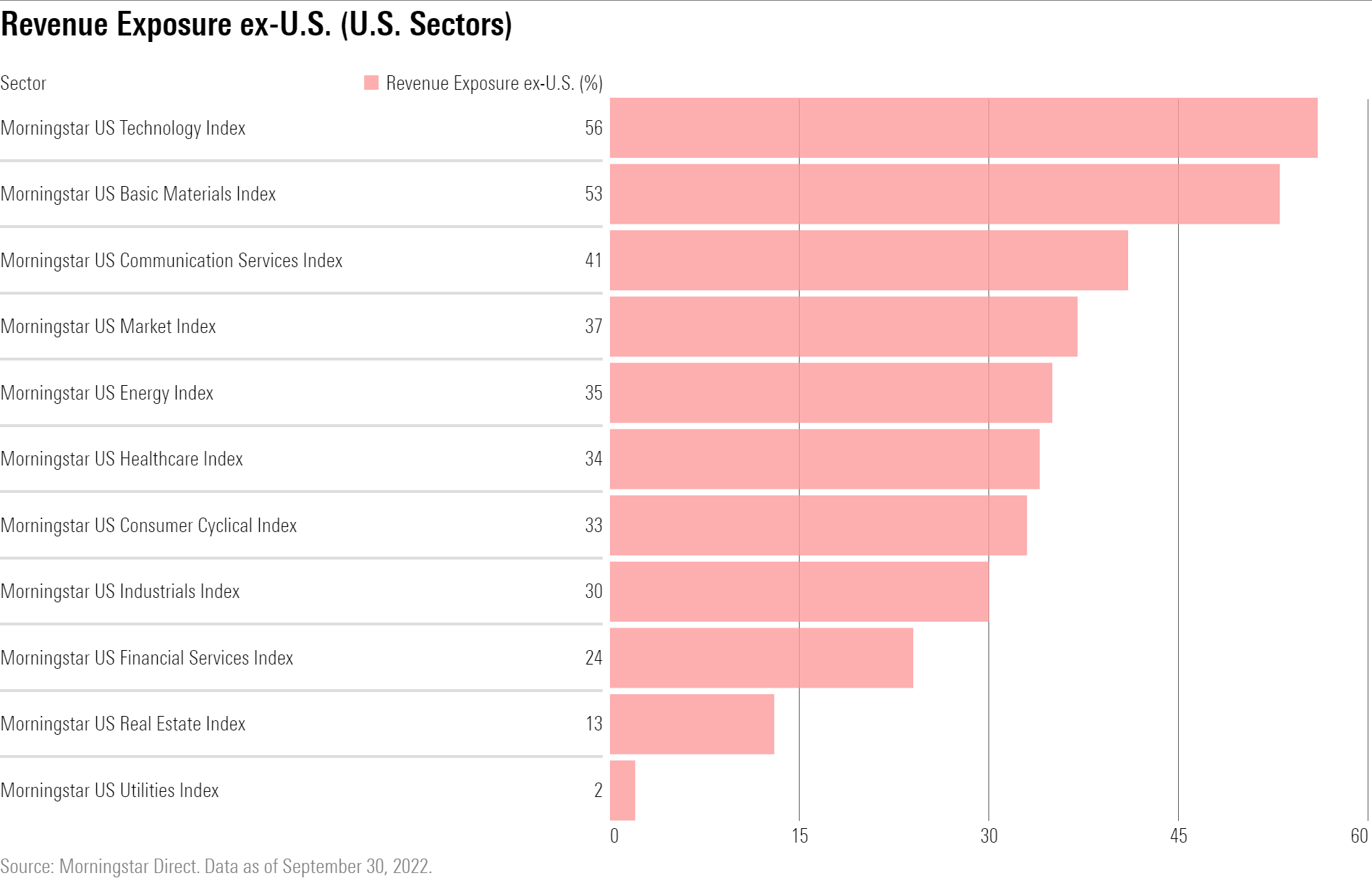

The key question for investors around the strength of the dollar is understanding where companies earn their revenue, rather than on where they are domiciled. We put to work the Morningstar Revenue Exposure by Country tool to see which U.S. sectors generate the most revenue outside the country. These are the sectors that will be the most affected by the dollar’s strength (see Exhibit 1).

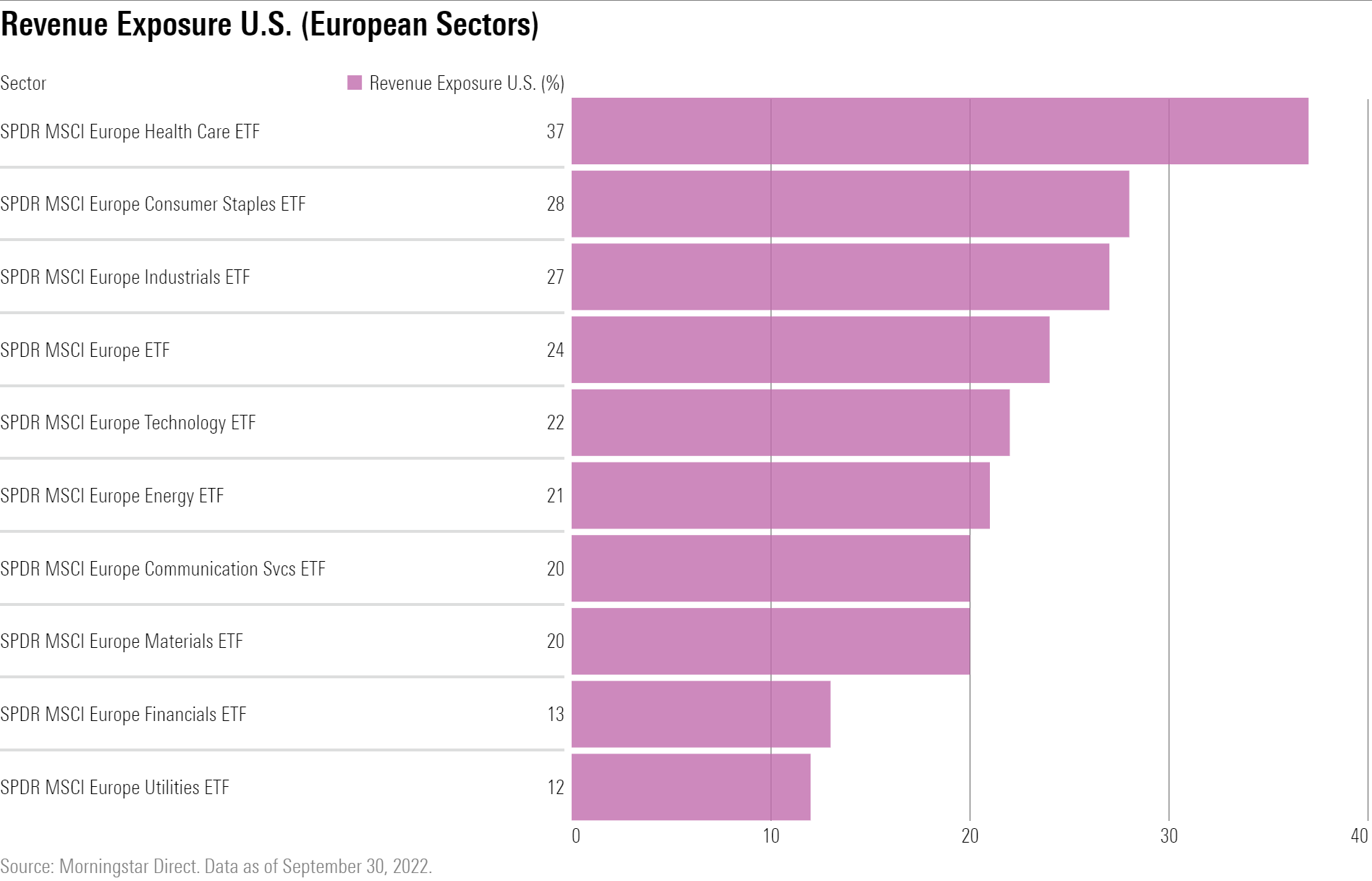

We also looked at which European sectors generate the most revenue in the U.S. These would be the sectors that will benefit most from the strength in the greenback (see Exhibit 2).

The graphic below also shows a comparison with the representative index for the relevant market, with the Morningstar US Market for U.S. sectors and MSCI Europe for European sectors.

In the U.S., technology companies would be those hurt the most by a stronger dollar, while in Europe it would be companies in the healthcare sector that could benefit the most from the dollar’s rise against the euro.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)