7 Charts on Value Versus Growth Stocks in the Third Quarter

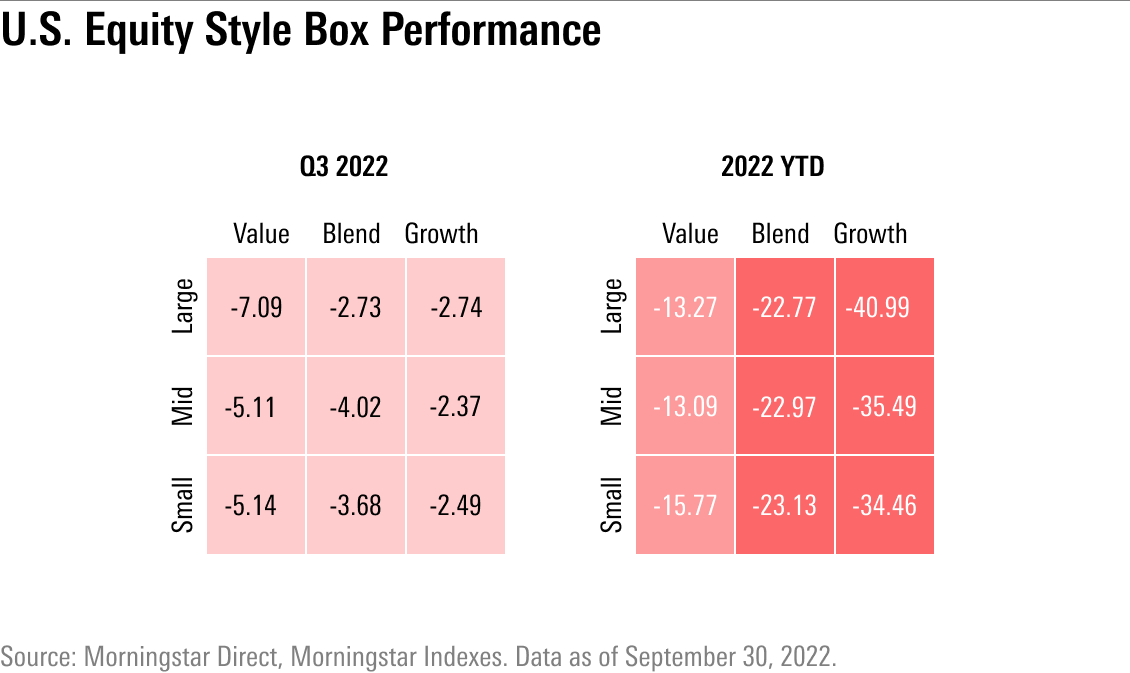

Growth stocks were down in the quarter yet still managed to outperform value stocks.

Growth stocks had another down quarter, but for the first time in a year they held up better than value stocks.

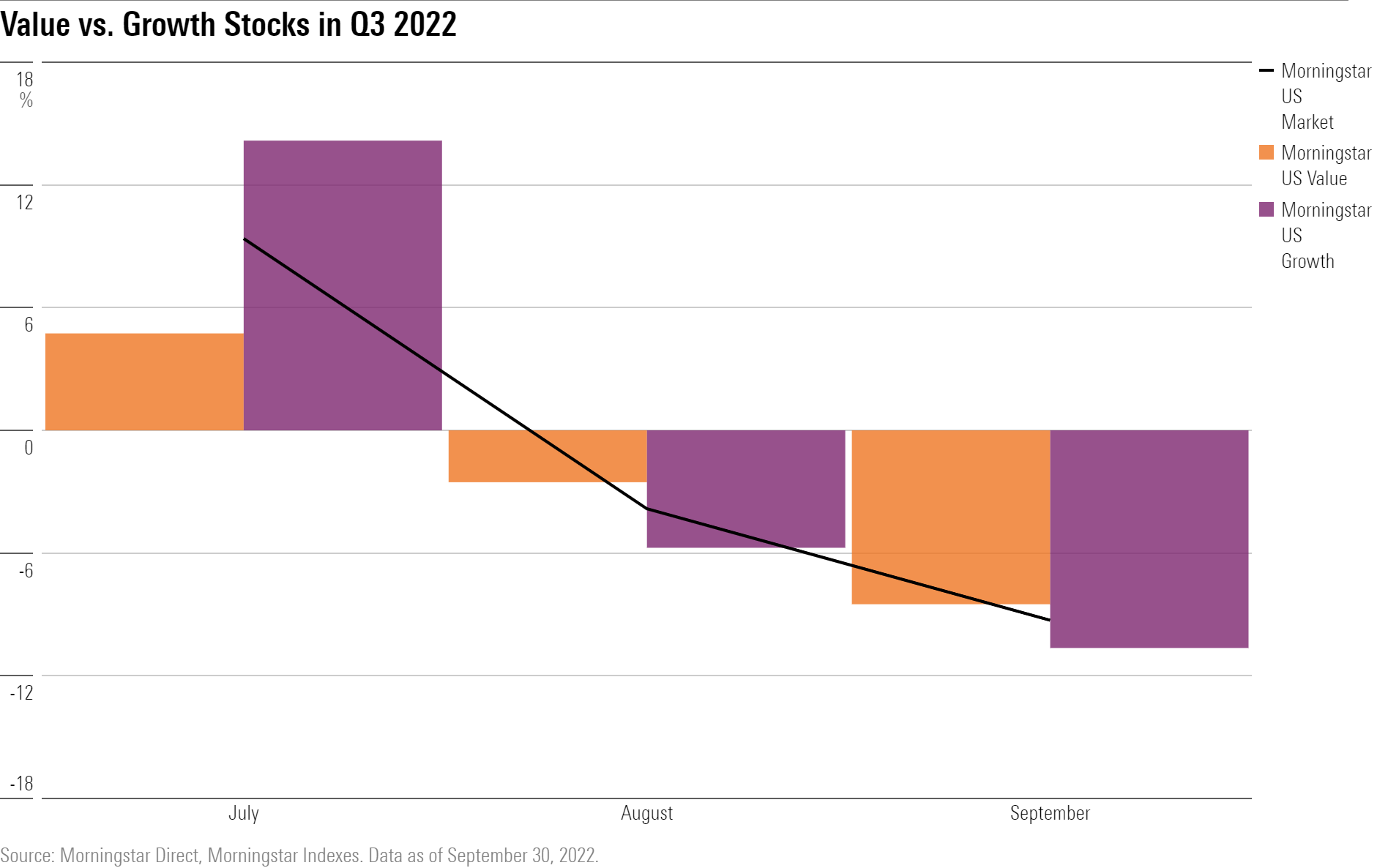

For much of the third quarter, there was no clear winner in the value versus growth stock tug-of-war. Some recommended turning instead to beta—a measure of volatility—to find the next group of market leaders amid the uncertain outlook. But in the quarter’s final days, growth held up better than value as the market fell.

Behemoth growth companies from the technology sector including Microsoft MSFT, Alphabet GOOGL GOOG, and microchip manufacturer Nvidia NVDA were the largest contributors to the overall market’s decline in the third quarter. At the same time, jumps in shares of Tesla TSLA and Amazon.com AMZN helped lessen the decline in growth stocks. Verizon VZ and Pfizer PFE dragged down the market on the value side.

The Morningstar US Growth Index fell 3.8% for the third quarter, while the Morningstar US Value Index dropped 6.6%.

For the year through Sept. 30, growth stocks have lost 36.8%, which puts them on track for their worst year since 2002. Value stocks lost 13.4% in the same period. Even as growth stocks got clobbered, they’ve still given investors an advantage over longer periods.

Growth Stocks Rose Then Sank in the Third Quarter

After reaching a peak on Aug. 16, the market fell fast fueled by a shockingly high inflation reading that spooked investors. That was followed by Federal Reserve Chairman Jerome Powell's comments that the central bank would continue to aggressively raise interest rates, even at the risk of recession. Since that peak, growth stocks fell 20% through September, while value stocks lost 13%.

Understanding the differences in performance between value versus growth stocks starts with their definitions. Morningstar assigns every stock it covers a “style score.” These scores are relative, with companies landing in the value, core, and growth Morningstar Categories.

A company’s style score is based on metrics such as growth rates for earnings, sales, book value, and cash flow. It also factors in dividend yields and relative valuations such as the price/projected earnings ratio, price/book, price/sales, and price/cash flow.

Growth stocks are more sensitive to the current round of interest-rate increases, and interest rates in general, because their stock prices depend heavily on expectations for future earnings.

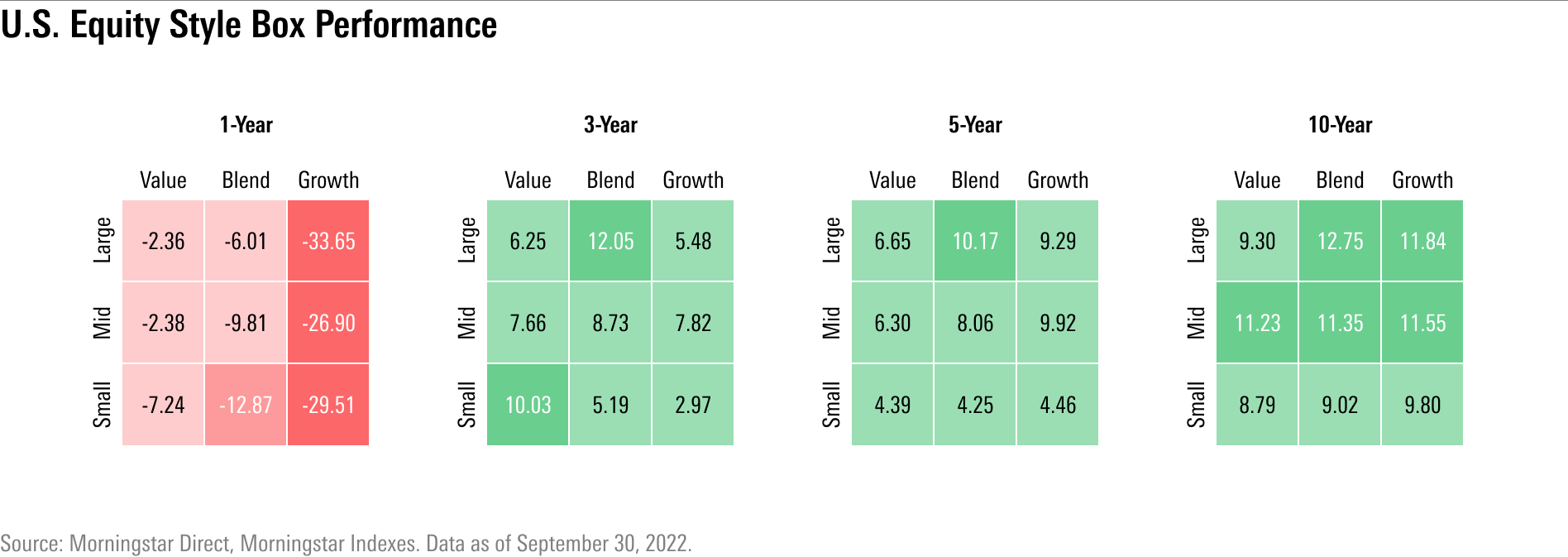

Growth Stocks Have Given Investors a Longer-Term Advantage

Despite this year’s staggering losses, growth remains far ahead of value over the long term. Growth stocks have risen 222.8% over the past 10 years, while value stocks were up 141.3%.

The Morningstar US Growth Index has beaten the Morningstar US Value Index for the past five calendar years, and nine of the past 10 years. The last time value outperformed growth on a calendar-year basis was 2016.

Which Growth Stocks Fell Furthest in the Third Quarter?

Large-cap tech and communication services companies dragged growth stocks down in the quarter. Microsoft lost 9.1%, Alphabet fell 12.2%, and Nvidia dropped 19.9%. All three ended the third quarter in undervalued territory, with Microsoft and Alphabet both trading at five-star price/fair value ratios. (Companies are listed by their contribution to returns.)

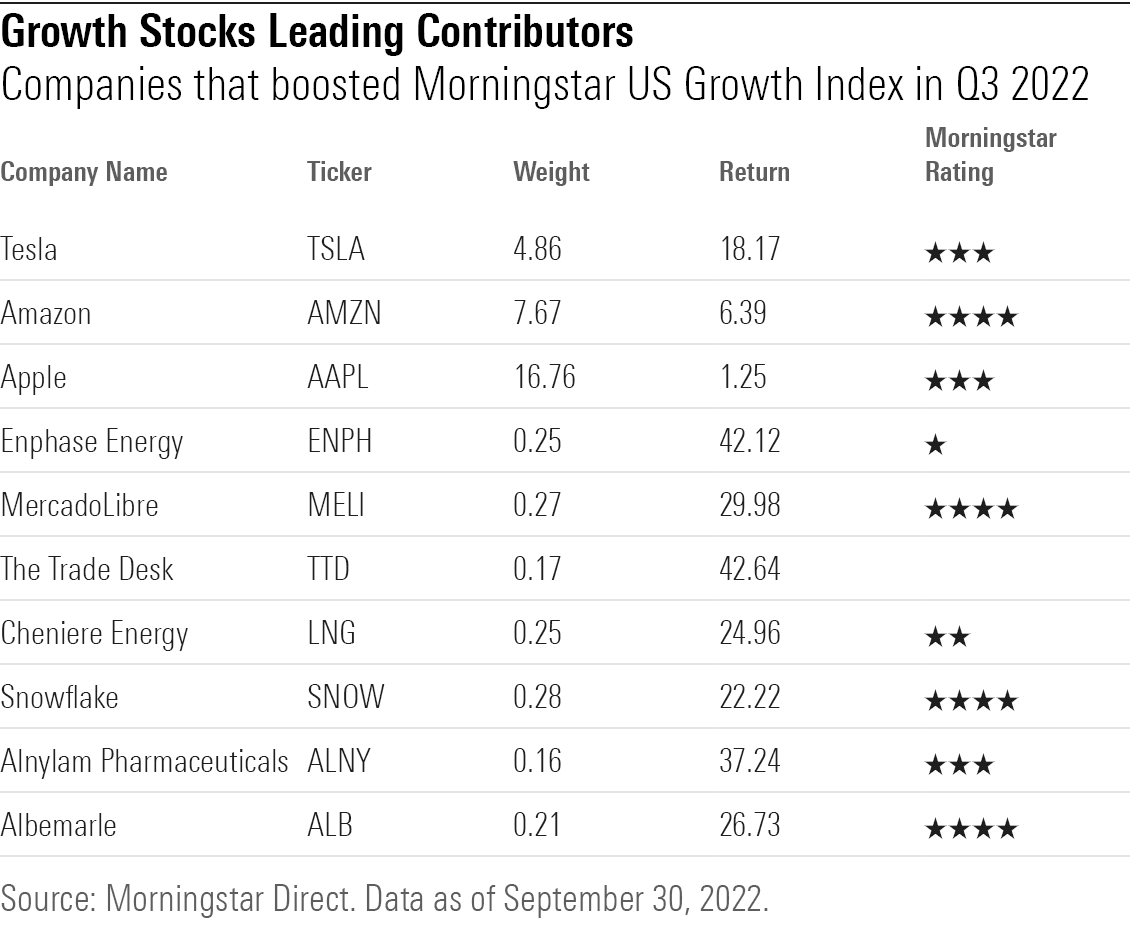

Which Growth Stocks Led the Quarter?

Growth stocks were mainly boosted by consumer cyclical giants Tesla, up 18.2%, and Amazon, which rose 6.4%. Both saw big jumps early in the quarter. Amazon gained 27.1% in July, and 36.3% through the market’s last high on Aug. 16. Tesla rose 14.7% in July and 31.0% through the August peak.

What Stocks Dragged Value Down?

The hit that value stocks took during the quarter came mainly from the healthcare, communication services, and tech sectors.

Verizon dropped 23.9%, and Intel INTC plummeted 30%. Healthcare giant Pfizer, a heavyweight making up 2.1% of the Morningstar US Value Index, fell 15.8%.

Which Value Stocks Performed Best?

The energy sector lifted value stocks over the past three months. Heavyweight oil and gas multinational ExxonMobil XOM and American petroleum company Marathon Petroleum MPC were notable bright spots.

Pharmaceutical company Biogen BIIB soared at the end of the quarter, gaining more than 40% on Sept. 27 following news about trials for its drug to treat Alzheimer’s. The stock finished the quarter up 30.9%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)