Amid Poor Performance for Tech Stocks, Selloff Is Overdone in Software

Despite macro headwinds, we remain optimistic about long-term trends for cloud computing and rising semiconductor demand.

After several years of market outperformance, the technology sector is now a drag on the U.S. equity market. While mega-cap tech stocks (Apple AAPL , Microsoft MSFT ) are still holding up relatively well, we continue to see punitive selloffs across the rest of the tech investment landscape. We remain optimistic about secular tailwinds in technology, such as cloud computing and rising semiconductor demand.

However, a softer macroeconomic environment and a stronger U.S. dollar is providing some headwinds. We especially see sluggish demand for PCs and lower-end smartphones weighing on both hardware companies and the providers of processors, graphic cards, and memory chips going into such devices. Nonetheless, for long-term patient investors, we would still recommend high quality, wide-moat names in software and semis.

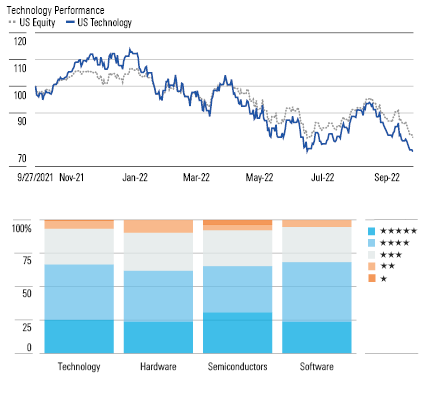

As of Sept. 27, the Morningstar US Technology Index was down 24% on a trailing twelve month basis, a sharp reversal from the +33% trailing one-year performance just nine months ago. The U.S. equity market is down 19% over the past year. Over the past quarter, both tech and the U.S. equity market are down roughly 3% each.

As of Sept. 27, the U.S. technology sector was 22% undervalued, a complete flip-flop from a sector that was 14% overvalued at this time a year ago. Software remains the most attractive sub-sector of tech as the median stock is 28% undervalued. However, the median semiconductor stock is 26% undervalued, and we see more buying opportunities for investors this quarter than in the recent past. The median Hardware stock is 25% undervalued.

Source: Morningstar Equity Research, Data as of Sept. 27, 2022.

Technology’s Selloff Is Overdone in Software

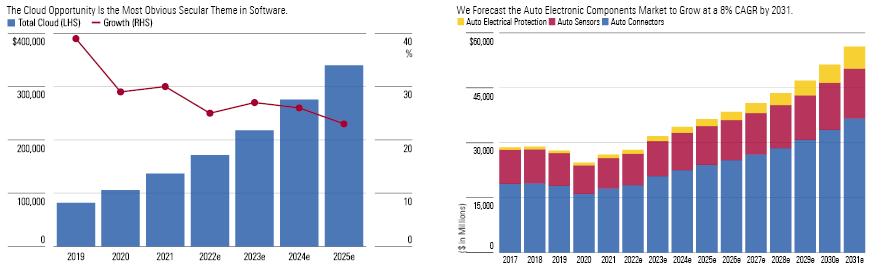

In software, IT departments have been focused on digital transformation, first from the secular shift to cloud computing and software as a service, or SaaS, followed by the coronavirus pandemic and the critical rush to implement remote working tools. We foresee enterprises using software to modernize all types of business processes, in turn leading to software industry growth at a low double digit CAGR. We view the electronic components space, such as sensors, connectors, and electrical protectors, as underappreciated. We think these mission-critical electronic components are the result of decades of robust engineering development by their suppliers. They ensure flawless performance of the planes, trains, and automobiles we rely on daily—eliciting strong switching costs and commanding pricing power by doing so. The electrification of the automotive market is an increasingly important growth theme for these suppliers.

Source: Gartner. Morningstar. Data as of June 27, 2022.

Top Picks

Salesforce CRM Star Rating: ★★★★★ Economic Moat Rating: Wide Fair Value Estimate: $240 Fair Value Uncertainty: Medium

We believe Salesforce.com represents one of the best long-term growth stories in large-cap software due to its ever-expanding portfolio of complimentary solutions that allow users to completely embrace their customers, thereby building relationships, strengthening retention, and driving revenue. In our view, Salesforce will benefit further from natural cross selling among its clouds, upselling more robust features within product lines, pricing actions, international growth, and continued acquisitions such as the recent deals for Slack and Tableau.

ServiceNow NOW Star Rating: ★★★★★ Economic Moat Rating: Wide Fair Value Estimate: $675 Fair Value Uncertainty: Medium

ServiceNow excels at executing the land and expand strategy, and it continues to leverage its strength in workflow automation to penetrate existing customers more deeply in IT and more broadly with HR, customer service specific, and other back-office products. We expect both tiered offerings and vertical specific versions to continue to provide a nice tailwind to revenues. We think ServiceNow has become a key partner in digital transformation as shown in retention statistics, which remains at the elite level. Importantly, we are impressed with ServiceNow's excellent balance between strong and highly visible revenue growth and robust margins.

ASML Holding ASML Star Rating: ★★★★★ Economic Moat Rating: Wide Fair Value Estimate: $696 Fair Value Uncertainty: Medium

ASML is one of our top picks in the semiconductor space, thanks to the increasing adoption of extreme ultraviolet lithography at large chipmakers such as TSMC and Intel to support explosive chip demand. Although the firm's first-quarter outlook is negatively affected by supply chain constraints, we think ASML will outgrow the wafer fab equipment industry in 2022. With TSMC, Intel, and Samsung all vying for process technology leadership, we expect ASML to be a primary beneficiary as it sells tools to all three chipmakers.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)