U.S. and International-Equity Funds Continue Their Slide

Growth funds hold up better than their value counterparts, but year-to-date performance is still ugly.

All nine Morningstar Style Box categories finished the third quarter with losses. Amid rising inflation, economic uncertainty, and tightening monetary policy, growth funds broadly outperformed their value counterparts. Mid-cap growth was the best-performing Morningstar Category in the quarter but was still down 1.9%. Meanwhile, the average large-value fund fell 5.9%. Growth’s outperformance was a shift from the previous two quarters; the large-value category was down 16.7% for the year to date thorough the third quarter, while the large-growth category was down 31.4%.

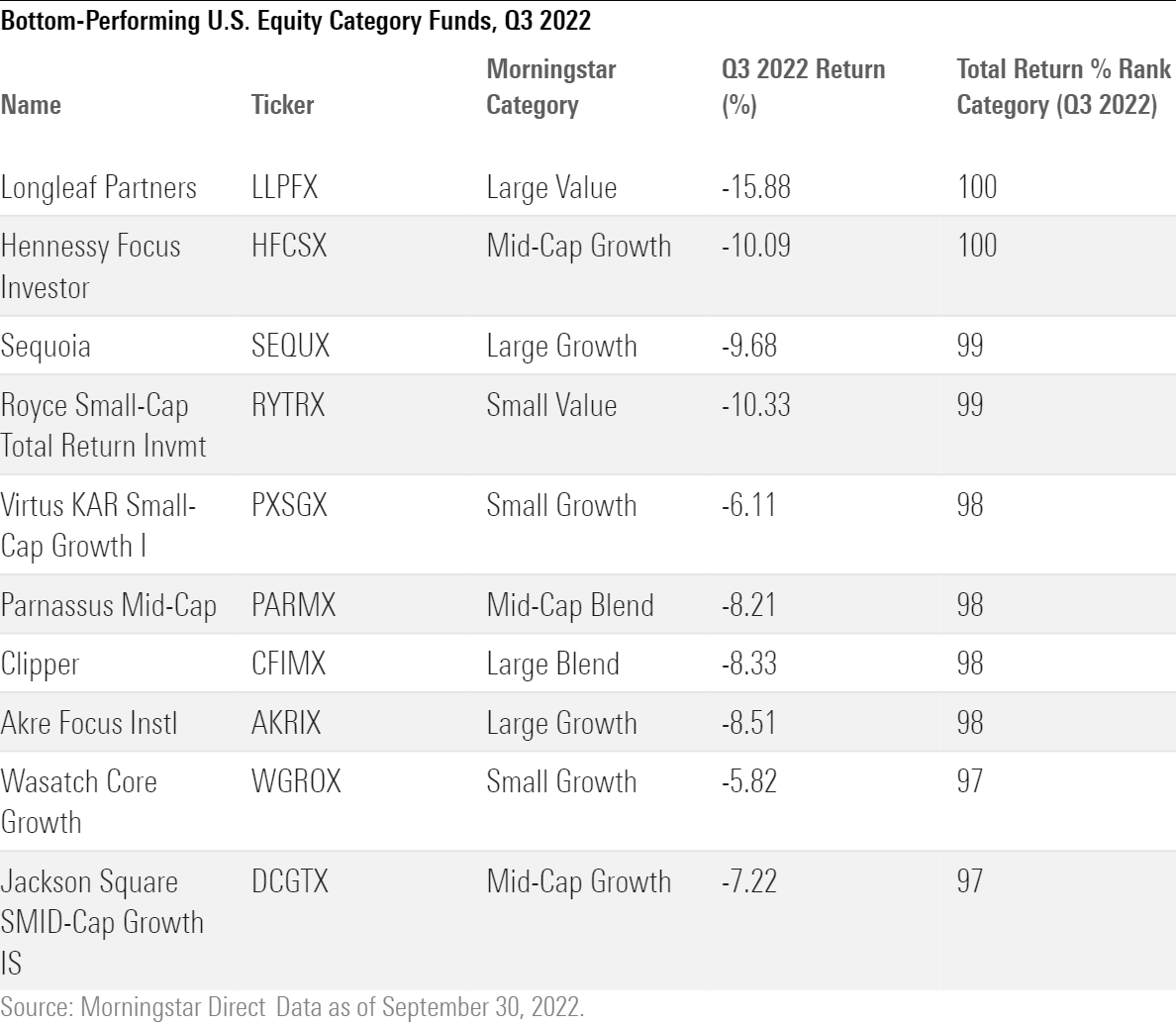

While most U.S. equity funds lost money in the quarter, funds with more exposure to growth stocks tended to hold up much better than their value-oriented peers. Baron Partners BPTRX, Morgan Stanley Institutional Advantage MPAIX, and ClearBridge Aggressive Growth SHRAX, for example, all benefited from strong stock-picking, particularly within the technology sector. Meanwhile, Longleaf Partners LLPFX, Royce Small-Cap Total Return RYTRX, and Sequoia SEQUX were among the worst performers relative to their respective categories in the quarter. Poor stock-picking across the board weighed on performance, and a value-leaning approach relative to peers also held back performance.

U.S. Growth Funds Made a Moderate Comeback

Baron Partners, which has a Morningstar Analyst Rating of Neutral, rose 7.3% in the quarter, topping the Russell 1000 Growth Index’s 3.6% loss. This fund’s fortunes, for better or worse, are tied to Tesla TSLA, which took up nearly half of its June 2022 portfolio, and the electric vehicle maker gained more than 18% in the quarter. That said, the fund is still down 29.9% this year, which is steep but better than more than 60% of its large-growth peers.

Gold-rated Oakmark OAKMX beat more than 98% of its large-value peers during the quarter with a 1.9% loss that was better than the Russell 1000 Value’s 5.6% loss. Manager Bill Nygren’s willingness to own some growth stocks, such as Netflix NFLX and Pinterest PINS, helped the fund. Such nontraditional value picks remained a liability for year to date, however. Those same two holdings were among the worst detractors for the fund that still ranked behind more than 90% of large-value funds for 2022 through Sept. 30.

Neutral-rated American Century Heritage’s TWHIX 2.5% gain beat the Russell Midcap Growth’s 0.7% loss and 95% of its mid-growth peers. Technology and consumer cyclical stocks propelled its results in the quarter. Digital advertising enabler The Trade Desk TTD gained more than 40% over the period, and top-10 holding electronics testing and measurement company Keysight Technologies KEYS rose more than 14%. The stocks and fund are still down significantly for the year, though.

Not All Growth Funds Benefited From the Stylistic Tailwinds

Neutral-rated large-value fund Longleaf Partners’ 15.9% loss was far worse than the Russell 1000 Value Index’s 5.6% decline and worse than 100% of its large-value peers. Unlike Baron, this portfolio’s concentration worked against it in the quarter. Its largest holding, Lumen Technologies LUMN at 11% of the portfolio, dropped more than 30%, and its second-largest holding FedEx FDX—about 7% of the fund—fell more than 30%. The strategy’s year-to-date numbers don’t look any better; it was down nearly 29% and behind virtually all large-value funds for 2022 through Sept. 30.

Some growth-leaning funds, such as Neutral-rated Sequoia, did not benefit from the stylistic tailwinds. The fund’s 9.7% decline lagged 99% of its large-growth peers. Consumer cyclical and tech stock picks weighed on performance. The portfolio’s second-largest holding, Liberty Formula One at 7% of the June portfolio’s assets, declined nearly 10% in the quarter. Liberty Broadband LBRDA—nearly 3% of the portfolio—fell more than 30%. The fund’s year-to-date numbers remain poor, ranking in the large-growth group’s bottom quartile as holdings like CarMax KMX and Meta Platforms META have plunged.

Gold-rated Primecap Odyssey Stock’s POSKX benchmark-agnostic approach did not pay off in this most recent quarter. Five managers run their own sleeves of the 140-stock portfolio in eclectic styles that mix value and growth stocks. The combination boosted performance versus its large-blend category peers earlier in the year, but the tide reversed in the third quarter. The fund fell nearly 6.4%, worse than the Russell 1000′s 4.6% decline and 87% of other large-blend funds. The fund’s 2.5% in FedEx and 4.5% in AstraZeneca AZN weighed on performance. The fund had lost about a fifth of its value in 2022 through Sept. 30, but that was better than about 84% of large-blend peers.

China Stocks That Helped in Q2, Hurt in Q3

Non-U.S.-stock funds that invested heavily in China were among the strongest performers in the second quarter of 2022, but that reversed in the third quarter, as the Morningstar China TME GR Index dropped 21.4%, far more than the respective 4.6% and 9.4% declines of the Morningstar US Market and Morningstar Global ex US indexes. The four worst-performing funds under Morningstar analyst coverage all resided in the China region category. Matthews China MCHFX was the worst-performing fund; it underperformed the index by nearly 5 percentage points. Its real estate overweight was painful. Top-15 holding CIFI Holdings plummeted more than 80% as reports emerged that the company defaulted on some debt obligations. Since the start of the year through September, the Morningstar China TME index was down nearly 30%, and Matthews China’s 35% decline was among the worst in the category.

Of the 10 worst-performing funds of the quarter, only Mondrian International Value Equity MPIEX did not own any Chinese stocks. Lackluster performance across its relatively compact 50-stock portfolio dragged it down. Six of its top 12 holdings, accounting for nearly 20% of the fund’s assets, dropped by 15% or more in the quarter. CK Hutchison, Sanofi, and GSK, three of the fund’s top four holdings, each declined by 17% or more. Gold-rated Natixis Oakmark International NOIAX had less than 5% of its portfolio in Chinese companies, but it did own Alibaba BABA, which dropped 30%, and a slew of its healthcare picks also did worse than the market. Since the start of the year through September, Mondrian International Value Equity’s 24% loss was slightly more than the average foreign large-value category peer’s 23% decline, but Oakmark International’s 31% drop was in the bottom decile of the category.

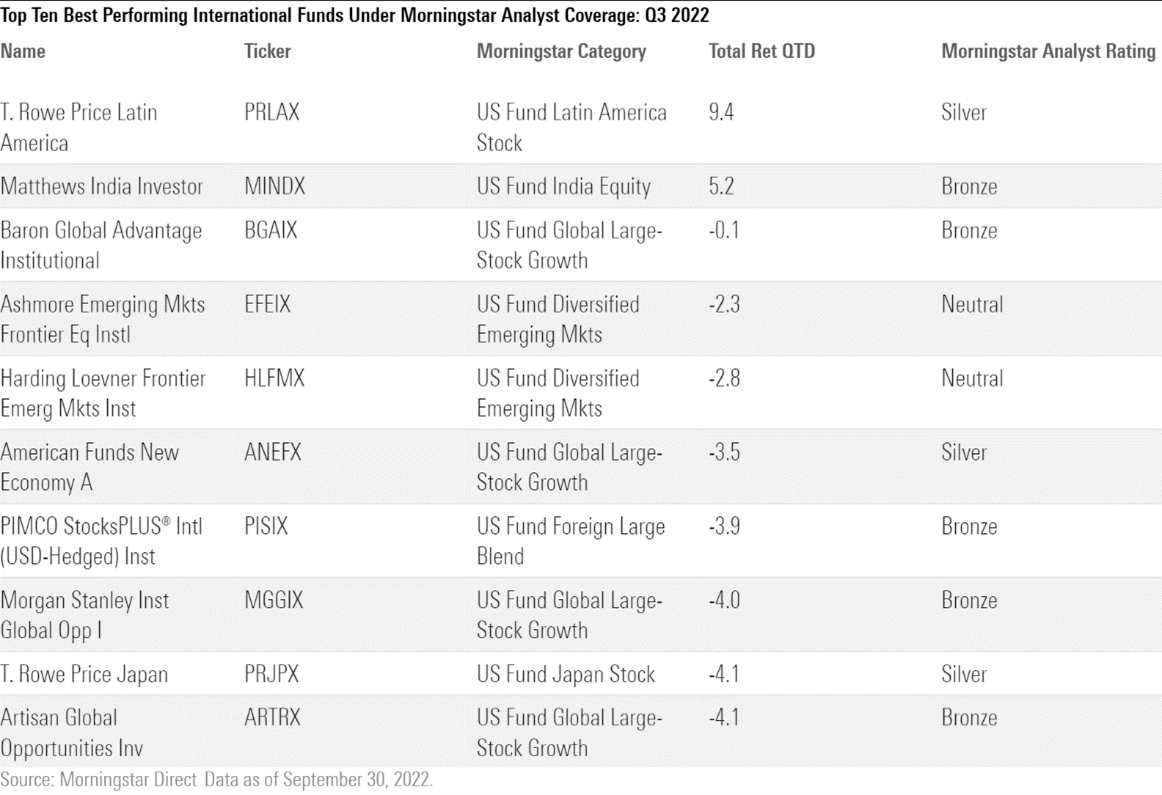

Few International Funds Posted Gains

Few countries or sectors provided refuge from the non-U.S. market carnage. Energy and financials-heavy regions tended to benefit, so funds with heavy Latin American and Indian exposure performed well, including T. Rowe Price Latin America PRLAX and Matthews India MINDX. They were the only two international-stock funds under Morningstar analyst coverage that rose in the quarter. Some of the ultra-high-growth funds that performed terribly in the first half of the year bounced back a little. Baron Global Advantage BGAIX only lost 0.1% in the quarter, which placed it among the best performers in its global large-stock growth category. Beaten-down technology holdings like Snowflake SNOW, ZoomInfo ZI, and Coupang CPNG rebounded from second-quarter lows. Morgan Stanley Institutional Global Opportunities MGGIX declined 4%, which placed it among the best performers in the global large-stock growth category, as Uber UBER, a 6% portfolio position, Coupang, a 4% holding, and MercadoLibre MELI, an almost 4% position, each gained around 30% in the quarter. All three stocks still trade more than 35% lower than where they started the year, and the fund is still down more than 44% since the start of the year, which places it in the bottom decile of the category.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)