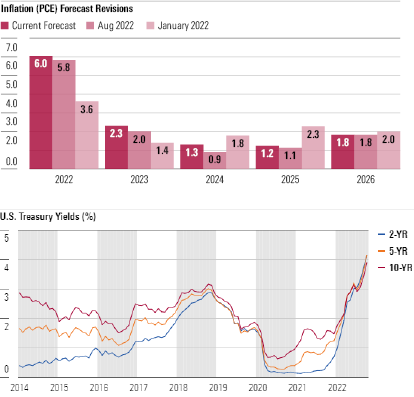

As Pendulum Swings, Stocks Go From Overvalued to Undervalued

The U.S. stock market has overcorrected.

In our 2022 Market Outlook, we noted that the U.S. stock market was overvalued coming into the year. The four headwinds we identified have been joined by additional headwinds, including the appreciation of the U.S. dollar and expectations that Europe is entering a recession. While these headwinds will pressure near-term earnings growth, according to our long-term valuations, the market has overcorrected to the downside and is trading deep into undervalued territory.

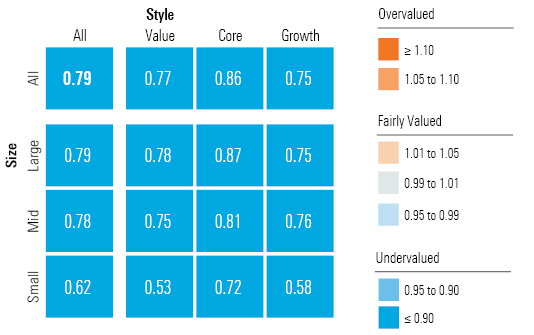

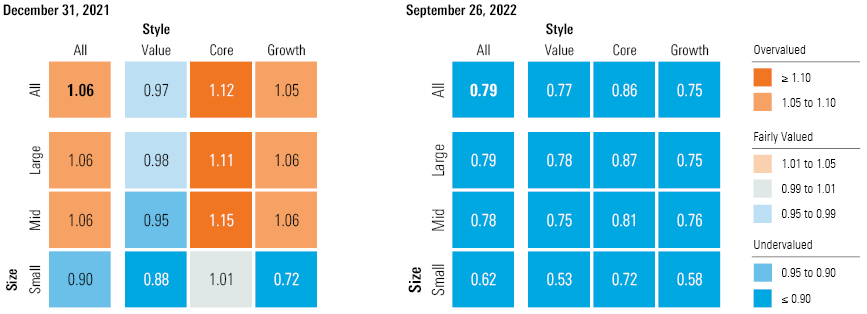

Based on a composite of the intrinsic valuation of the approximately 700 stocks we cover that trade on U.S. exchanges, we calculate that the broad U.S. stock market is trading at a price/fair value of 0.79. Growth stocks are the most undervalued, trading at a price/fair value of 0.75, followed by the value category trading at 0.77. Core stocks are trading closer to fair value estimate at 0.86. Investors appear to be best positioned with a barbell-shaped strategy, overweighting both value and growth categories and underweighting core.

Across capitalization levels, large- and mid-cap stocks are trading near the broad market valuation, whereas small-cap stocks are trading at the greatest discount to fair value at 0.62.

Morningstar Equity Research Coverage Price/Fair Value, U.S. Equity Style Box

Source: Morningstar Analysts

Near-Term Dynamics Appear Ugly, but Valuations Provide Large Margin of Safety

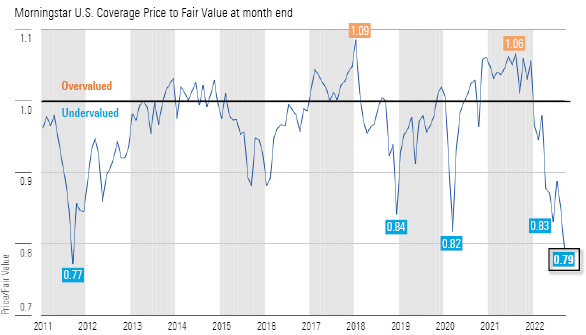

The current level of undervaluation is the greatest discount to our long-term, intrinsic valuations since the start of the pandemic. Intramonth March 2020, the price/fair value bottomed out at 0.77 on March 23, 2020.

On a longer historical time frame, there have only been a few other instances when our price/fair value metric had dropped to similar levels. Stocks dropped precipitously in December 2018 as the Fed had already been tightening monetary policy for a year and markets were pricing in a global growth scare. In fall 2011, concerns that possible contagion from the Greek debt crisis was spreading to other countries (Portugal, Italy, and Spain) and that systemic risk from the European sovereign debt crisis was spreading to the European banking system.

While near-term conditions may pressure earnings in the short term, at current valuations we think the market has fallen more than enough to incorporate those headwinds. In our view, we think the market is overly pessimistic regarding the long-term prospects for equity valuations.

Morningstar U.S. Coverage Price/Fair Value at Month End

- source: Morningstar Analysts

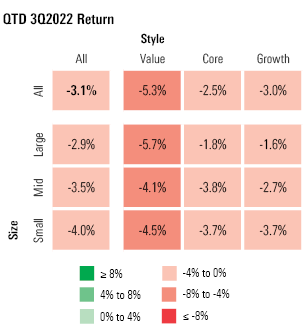

In July and August, markets rebounded from June lows as headwinds appeared to begin to abate. However, in September, markets turned for the worse and gave up those gains and more as the headwinds returned and new pressures began to build. The appreciation of the U.S. dollar will hamper foreign earnings, Europe is on the precipice of a recession, and the outlook for economic growth in China appears especially murky. Quarter to date through Sept. 26, the Morningstar US Market Index dropped 3.08%. The worst losses were concentrated in the value category, which fell 5.29%. Core stocks dropped 2.46%, less than the market average. Growth stocks fell 3.00%, in line with the broader market.

Morningstar US Market Index Returns

- source: Morningstar Analysts

- source: Morningstar Analysts

Equity Markets Enter Bear Market. How Did We Get Here and How Long Will It Last?

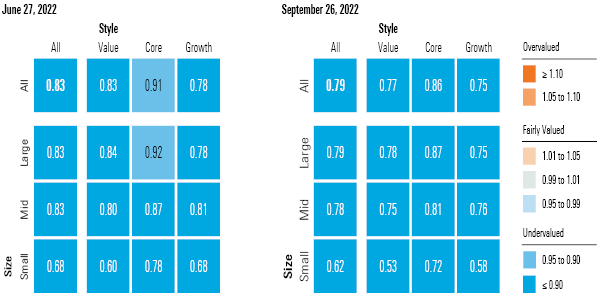

Coming into 2022, we noted that the U.S. equity market was overvalued and would have to contend with four main headwinds this year:

- Slowing rate of economic growth.

- Federal Reserve tightening monetary policy.

- Inflation running hot.

- Our expectation that long-term interest rates were going to rise.

Over the first half of the year, equities fell and bottomed out in June as these headwinds converged. However, in July and August, U.S. equity markets rebounded as it appeared that these headwinds were beginning to abate, and valuations were low.

Yet this reprieve was short-lived as, over September, these headwinds began to resume. What we have seen most recently is:

- Even weaker-than-expected economic growth.

- Federal Reserve has become even more hawkish.

- Inflation is still running hot.

- Long-term rates began rising again, 10-year UST rose 80 basis points in September to almost 4%.

Compounding these headwinds, additional pressures have emerged, including:

- Strong appreciation of the U.S. dollar, which will lower earnings for US companies with significant overseas exposure.

- Europe appears to be heading into recession, with the only questions right now being how long and how deep.

- Economic outlook for China is especially murky.

GDP Forecast Revisions

Source: Morningstar Analysts

The Dot Plot

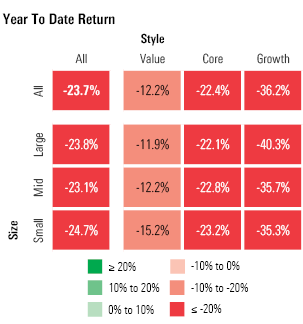

Yet, with equities selling off 24% year to date, it appears to us that the market has overcorrected to the downside. According to a composite of the stocks we cover that trade on U.S. exchanges, the equity market is significantly undervalued and is trading at about a 20% discount to fair value.

Over the next six to 12 months, we expect that the markets will remain under pressure and volatility will remain high for the foreseeable future. To establish a bottom, the markets will need clarity as to when economic activity will make a meaningful and sustained rebound, and evidence that inflation will begin to trend downward and return to the Fed’s 2% target.

Over this period, we expect:

- GDP will remain sluggish and won't start to reaccelerate until the second half of 2023.

- Federal Reserve will conclude tightening policy by the end of 2022.

- Momentum may push interest rates slightly higher over the near term, but the preponderance of rising long-term rates has already occurred.

- Inflation will begin to moderate over the next few months and subside in 2023.

We think the combination of these factors will provide the Fed the room it will need to begin easing monetary policy by the end of 2023. Our forecast is that the federal-funds rate will drop to 2.00% at the end of 2023 and the yield on the 10-year U.S. Treasury will average 2.75%

- source: Morningstar Analysts

Across our coverage, the number of fair value estimate increases and decreases were relatively balanced last quarter. We lowered our fair value estimate by more than 3% on 19% of our coverage and lowered our valuation by more than 10% on 7%. We increased our fair value estimate over 3% on 17% of our coverage and increased our valuation over 10% on 4%. Considering core category is closest to fair value, we see the best relative positioning for investors in a barbell-shaped portfolio consisting of growth and value.

Morningstar Equity Research Coverage Price/Fair Value Estimate

- source: Morningstar Analysts

The markets often act like a pendulum and will swing too far in one direction or the other. This year has been a prime example. According to our valuations, the markets ended 2021 trading at a 6% premium over a composite of our fair value estimates. At this point, we think the markets have overreacted to short-term pressures and that the broad equity markets are now trading at a significant discount to our long-term intrinsic valuations.

Morningstar Equity Research Coverage Price/Fair Value

- source: Morningstar Analysts

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)