Surging U.S. Interest Rates Squashed Bond Fund Returns Again

Most fixed-income funds post third-consecutive period of losses in the third quarter.

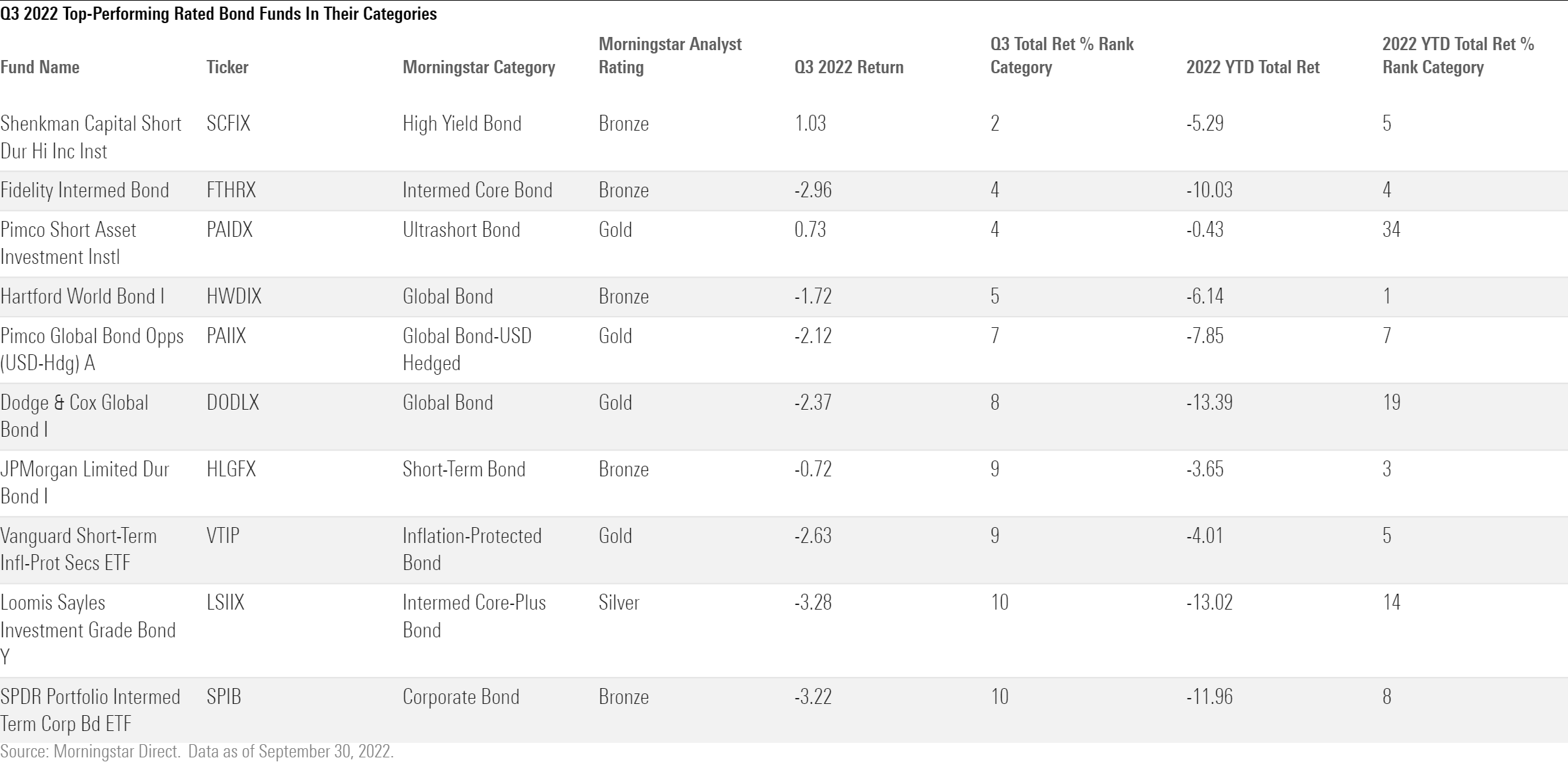

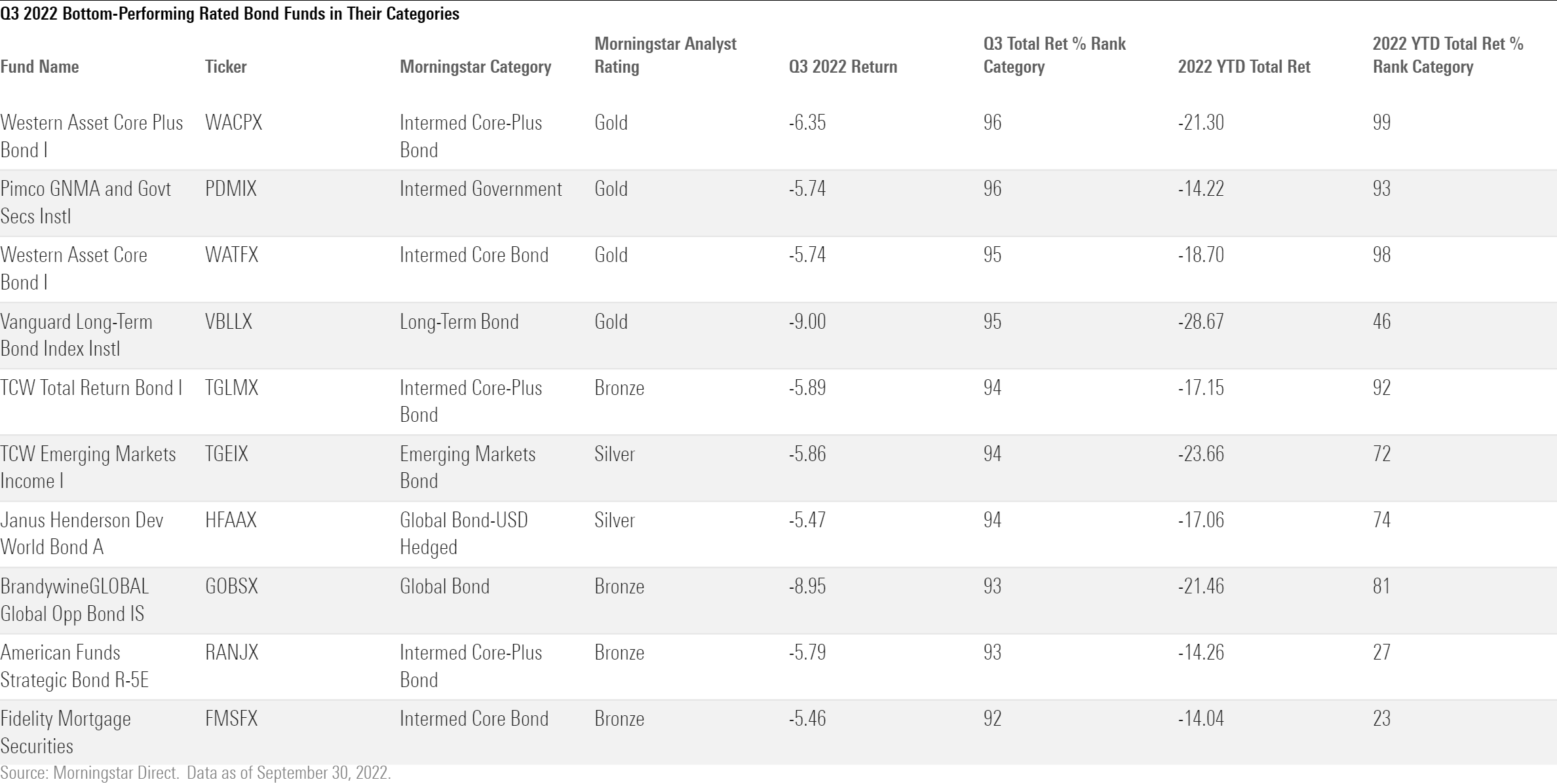

All major Morningstar fixed-income fund categories except the bank-loan group fell for a third consecutive quarter in the three months ended in September and remained on pace for what could be the worst year for bond-fund investors ever.

The march of U.S. interest rates higher trampled bond-fund investors’ returns. The Federal Reserve raised short-term rates by 75 basis points each at its July and September meetings, pushing the overnight interest rate, or the rate at which banks lend to each other, 300 basis points higher than it was in January.

That drove bond yields up and prices down across the fixed-income market. As of Sept. 30, 2022, the yield on Treasury notes maturing in two years had jumped 130 basis points to 4.22%, a level not seen since 2007. The 10-year Treasury yield rose 84 basis points to 3.83%, its highest point since 2010. Broadly diversified fixed-income funds that usually serve as the linchpins of investors’ fixed-income portfolios—represented by the intermediate core bond Morningstar Category and funds like Vanguard Total Bond Market ETF BND—fell about 4.7% in the quarter and were still on pace for their worst year in decades, down 14.6% through Sept. 30.

Bank Loans Buoyant

Rate trends punished all bond-fund categories, but the average bank-loan fund eked out a 0.8% gain, slightly better than the Morningstar/LSTA Leveraged Loan Index, which was flat for the quarter, and down 3.2% for the year to date through Sept. 30. Fidelity Floating-Rate High Income Fund FFRHX, which earns a Morningstar Analyst Rating of Silver, gained 1.7% in the quarter and matched the benchmark's year-to-date loss, finishing in its category's top decile in both periods.

These funds attract investors when the Fed hikes rates because bank loans are backed by a company’s assets and their interest payments reset every one to three months.

High-Yield Highlights

High-yield funds also held up relatively well. The category average slipped 0.8% in the third quarter and was down 13.5% for year through Sept. 30. The ICE Bank of America U.S. High Yield Index fell 0.7% for the quarter and 14.6% for the year to date. Gold-rated BlackRock High Yield Bond BHYIX slid 0.4% for the quarter and 14% for the year to date because of an overweight in below-investment-grade, CCC rated issuers. The fund finished the quarter in the top third of its peer group but in the middle of the pack for 2022’s first nine months.

The market did not spare investment-grade corporate bonds. The average corporate bond Morningstar Category fund dropped 4.7% for the quarter and was down 17.9% for the year. The category’s longer duration (a measure of interest-rate sensitivity) than the high-yield group hampered results. Diversification and a conservative portfolio took some of the edge off for Bronze-rated Vanguard Intermediate-Term Investment Grade VFIDX, which beat nearly two thirds of its corporate bond peers in the quarter and more than four fifths of them for the year, while still shedding 4.2% and 15.7%, respectively.

Inflation Protection Offers Little

Inflation-indexed bonds could do only so much as inflation hit 40-year highs and the Fed ratcheted up rates to combat it. The inflation-protected bond Morningstar Category fell as much as the broad bond market in the quarter and finished the nine months down 11% because these bonds are extremely sensitive to changing rates. Once again, keeping duration short helped a little. Gold-rated Vanguard Short-Term Inflation-Protected Securities Index VTAPX limited losses to 2.6% for the quarter and 4% for the year to date and beat more than 90% of its inflation-protected bond peers.

Sore Core

Silver-rated Loomis Sayles Investment Grade Bond LIGRX lost 3.4% in the quarter and 13.3% for the year to date but beat its Bloomberg U.S. Aggregate benchmark and most of the intermediate core-plus Morningstar Category. The fund’s large overweight to securitized bonds, a relatively short duration, and 9.8% cash stake helped. The broad intermediate core and core-plus Morningstar Categories fell 4.7% and 4.4%, respectively, for the quarter and were both down around 14.7% for the year to date.

The Bloomberg U.S. Aggregate Bond Index, a common proxy for core and core-plus funds that comprises U.S. Treasuries, agency-backed mortgage-backed securities, and investment-grade corporates, fell about 4.7% during the quarter. The benchmark is now down 14.6% for the year to date. Widening yield spreads played a bigger role in the index’s losses than surging interest rates.

Dollar Damage

Emerging-markets bond funds also lost money for a third consecutive quarter in 2022. The U.S. dollar’s strong rally relative to emerging-markets currencies sank bond prices for issuers of U.S. dollar-denominated bonds. For the year to date, the JPMorgan EMBI Global Index fell 22.2%. Silver-rated TCW Emerging Markets Income TGEIX has taken it on the chin, falling nearly 6% in the quarter and more than 23% for the year through September and ranking in the emerging-markets bond group’s bottom third.

- source: Morningstar Analysts

Municipal Exodus

Municipal-bond rates also continued to rise. The yields on two-year and 10-year AAA rated bonds rose to 3.07% and 3.26%, respectively, dragging the Bloomberg Municipal Bond Index’s loss down to 12.1% for the year to date as of Sept. 30. Silver-rated T. Rowe Price Tax-Free Income PRTAX lost 13.2% in the year to date, more than the benchmark, yet still ranking in the muni national long Morningstar Category’s top quartile.

Similar losses in many muni strategies have had investors rushing for the doors this year. Morningstar’s municipal-bond U.S. category group has seen $77.6 billion in 2022 outflows through August, more than other big outflow years, such as 2013. Nuveen High Yield Municipal Bond NHMRX fell 4.9% during the quarter and has now lost 18.9% for the year to date, landing at the bottom of the U.S municipal high-yield Morningstar Category. The fund’s longer duration, especially an overweight to bonds maturing in 22 or more years, hurt the most.

/s3.amazonaws.com/arc-authors/morningstar/9013a0d5-fa3f-4647-b61d-dd40a8994f6d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9013a0d5-fa3f-4647-b61d-dd40a8994f6d.jpg)