What’s Next for the Stock Market?

Stocks are well into undervalued territory, against a backdrop of high inflation and weak economic growth.

Equity markets tried to bottom out in June and bounced higher in July and August as inflationary and economic headwinds appeared to abate. However, this reprieve was short-lived as higher-than expected inflation and weaker economic metrics in September sent markets back down to new lows.

Coming into 2022, we noted that the U.S. equity market was overvalued and would have to contend with four main headwinds this year:

• Slowing rate of economic growth,

• Federal Reserve tightening monetary policy,

• Inflation running hot, and

• Our expectation that long-term interest rates were going to rise.

What we have seen most recently is:

• Even weaker-than-expected economic growth,

• Federal Reserve has become even more hawkish,

• Inflation is still running hot, and

• Long-term rates began rising again, 10-year U.S. Treasuries rose 80 basis points in September to almost 4%.

Compounding these headwinds, additional pressures have emerged, including:

• Strong appreciation of the U.S. dollar, which will lower earnings for U.S. companies with significant overseas exposure,

• Europe appears to be heading into recession, with the only question being how long and how deep, and

• Economic outlook for China is especially murky.

Equity Market Trading Deep Into Undervalued Territory

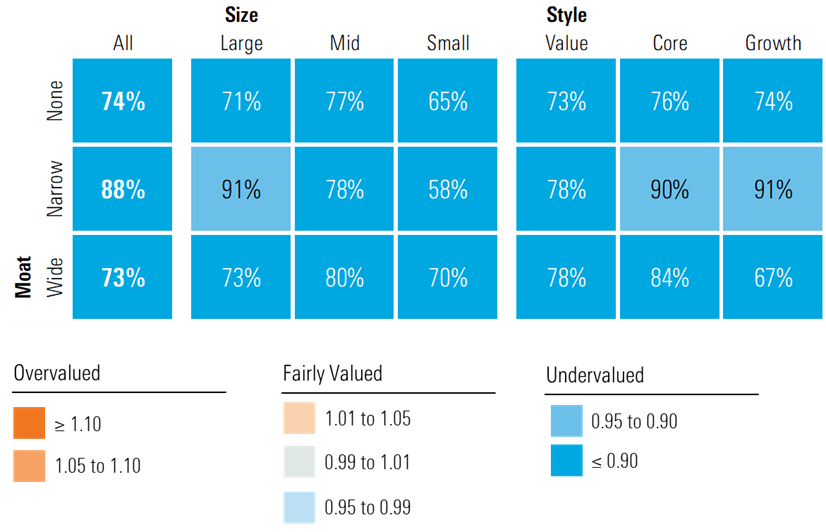

Yet, with equities selling off 24% year to date, it appears to us that the market has overcorrected to the downside. According to a composite of the stocks we cover that trade on U.S. exchanges, the equity market is significantly undervalued and is trading at over a 20% discount to fair value. Growth stocks are the most undervalued, trading at a price/fair value of 0.75, followed by the value category trading at 0.77. Core stocks are trading closer to fair value at 0.86. Investors appear to be best positioned with a barbell-shaped strategy, overweighting both value and growth categories and underweighting core.

Across capitalization levels, large- and mid-cap stocks are trading near the broad market valuation, whereas small-cap stocks are trading at the greatest discount to fair value at 0.62.

Morningstar Equity Research Coverage Price/Fair Value, U.S. Equity Style Box

Source: Morningstar Equity Research. Data as of Sept. 26, 2022.

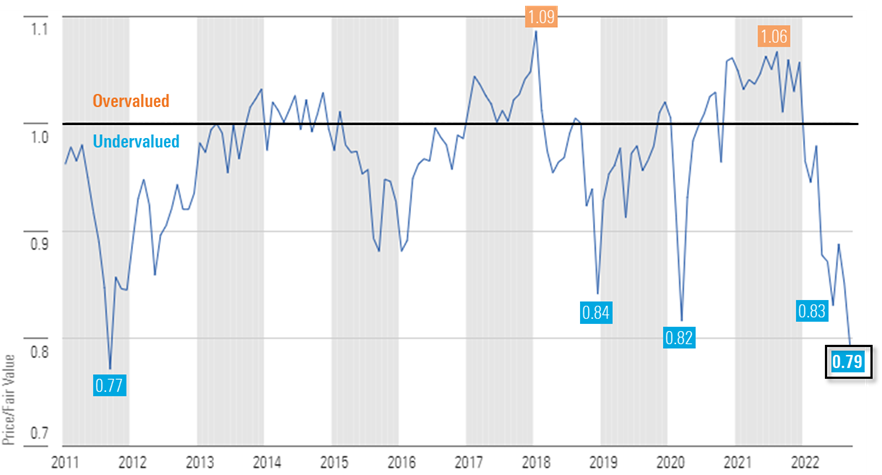

Equities Have Rarely Traded at Such a Deep Discount to Intrinsic Valuation

The current level of undervaluation is the greatest discount to our long-term, intrinsic valuations since the emergence of the pandemic. Intramonth March 2020, the price/fair value bottomed out at 0.77 on March 23, 2020.

On a longer historical time frame, there have only been a few other instances when our price/fair value metric had dropped to similar levels. Stocks dropped precipitously in December 2018 as the Fed had already been tightening monetary policy for a year and markets were pricing in a global growth scare. In fall 2011, concerns that possible contagion from the Greek debt crisis was spreading to other countries (Portugal, Italy, and Spain) and that systemic risk from the European sovereign debt crisis was spreading to the European banking system.

While near-term conditions may pressure earnings in the short term, at current valuations we think the market has fallen more than enough to incorporate those headwinds. In our view, we think the market is overly pessimistic regarding the long-term prospects for equity valuations.

Morningstar U.S. Coverage Price/Fair Value at Month's End

Source: Morningstar Equity Research. Data as of Sept. 26, 2022

Looking Forward, Expect More Volatility Until Conditions Improve

Over the next six to 12 months, we expect that the markets will remain under pressure and volatility will remain high. To establish a bottom, the markets will need clarity as to when economic activity will make a meaningful and sustained rebound and evidence that inflation will begin to trend downward and return to the Fed’s 2% target.

Over this period, we expect:

- GDP will remain sluggish and won't start to reaccelerate until the second half of 2023,

- The Federal Reserve will conclude tightening policy by the end of 2022,

- Momentum may push interest rates slightly higher over the near term, but the preponderance of rising long-term rates has already occurred, and

- Inflation will begin to moderate over the next few months and subside in 2023.

We think the combination of these factors will provide the Fed the room it will need to begin easing monetary policy by the end of 2023. Our forecast is that the federal-funds rate will drop to 2.00% at the end of 2023 and the yield on the 10-year U.S. Treasury will average 2.75% in 2023.

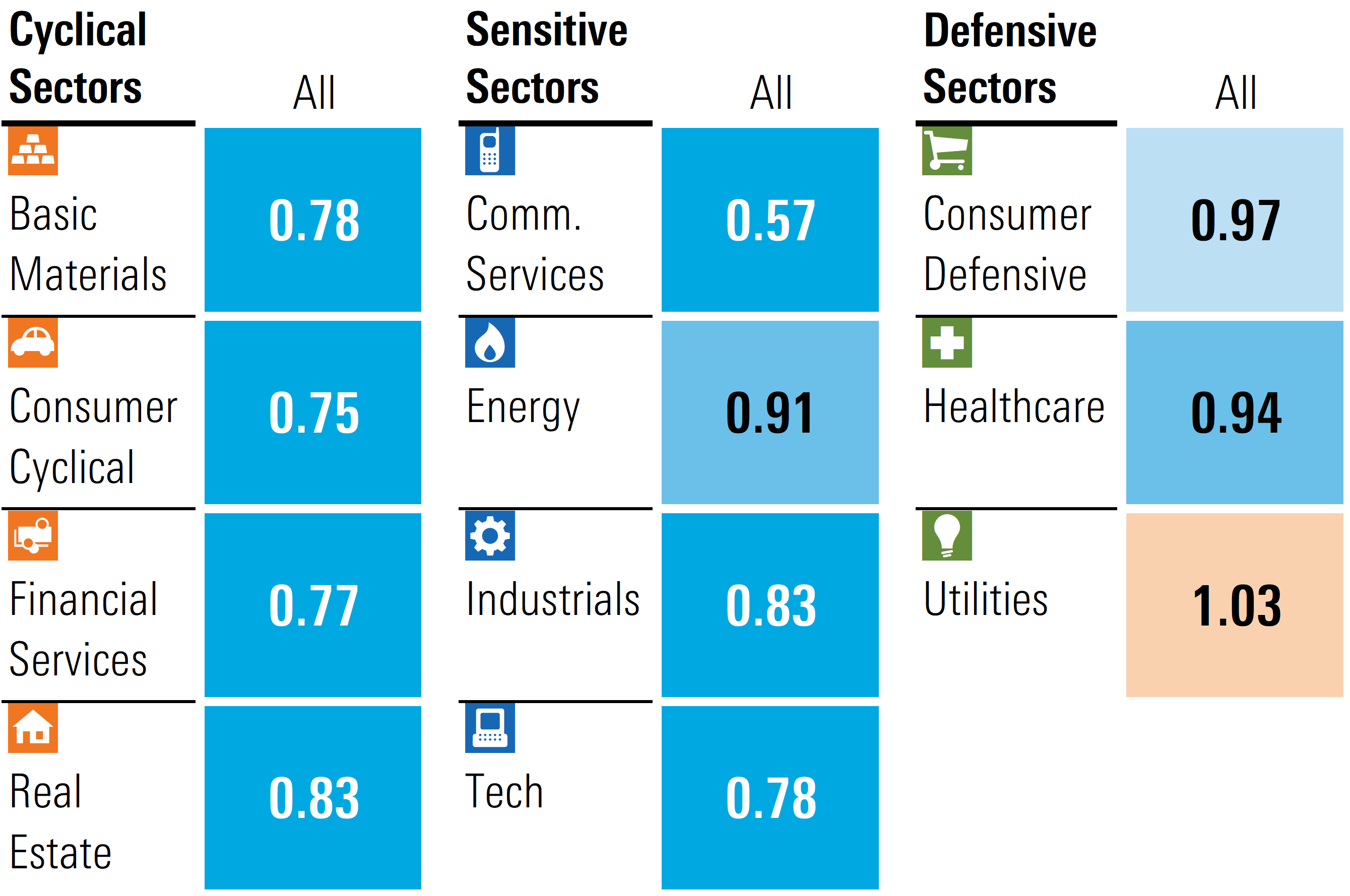

Communications and Cyclical Sectors Have Taken Worst of Selloff and Are Now Most Undervalued

Meta Platforms and Alphabet both underperformed the market this past quarter and helped push the communications sector even deeper into undervalued territory. Yet, even excluding these two stocks, we see significant amount of value among the traditional media and communications companies. Many of these companies are in the midst of building out their own streaming services, and the market has been especially pessimistic regarding their long-term prospects.

The price/fair value of the consumer cyclical sector held steady at 0.75. We think the market is overreacting to concerns of a possible near-term recession. In the event of a recession, we think it would be short and shallow and that the sector already factors in enough of a margin of safety at its current valuation. Many of the services-oriented companies in this sector should benefit as the pandemic continues to recede and consumer spending behavior normalizes and shifts back to services and away from goods.

The greatest decline in price/fair value this quarter occurred in the real estate sector, as the impact of rising interest rates took their toll on net asset values. The next largest decline in price/fair value was in the energy sector. Oil prices peaked in early June and have generally been on a downward trend. Energy stocks followed suit and fell precipitously in September. Following this pullback, the price/fair value has dropped to 0.91 from 0.99 last quarter.

Generally, the defensive sectors have held up relatively well this year and are trading closer to fair value, with utilities skewing a little to the overvalued side. We expect inflation will begin to moderate, but if inflation remains more persistent, utilities would be the most negatively affected sector.

Morningstar Equity Research Coverage Price/Fair Value by Sector

Source: Morningstar Equity Research. Data as of Sept. 26, 2022.

Undervalued Wide-Moat Stocks Especially Compelling

Year to date through Sept. 26, companies with a wide Morningstar Economic Moat Rating have fallen slightly more than the broad market. The Morningstar Wide Moat Composite Index has dropped 26.79% compared with the 23.70% decline of the Morningstar US Market Index. However, when you apply a valuation overlay to wide-moat stocks, such as the Morningstar Wide Moat Focus Index, this index has significantly outperformed the broader market, only having dropped 21.00%. Overall, the market is undervaluing wide-moat companies, which are trading at a 27% discount to fair value.

We also believe that in addition to being able to generate excess returns on invested capital over the long term, wide-moat companies generally have greater pricing power. As such, they should be able to pass through any cost increases to clients and be able to better maintain their margins and thus maintain their valuations in an inflationary environment. We also expect that these companies are best positioned to weather a potential recession based on their long-term durable competitive advantages.

Morningstar Price/Fair Value by Economic Moat

Source: Morningstar Equity Research. Data as of Sept. 26, 2022.

What to Do Now?

In these types of market environments, it is especially important for investors to have a plan that balances their long-term investment goals with their risk tolerances. This plan should also allow for periodic rebalancing to increase equity allocations when valuations decline but also reduce exposure when valuations become overextended. Based on our view that the U.S. equity market is undervalued, we think that now is not the time to be reducing equity exposures but to be adding judiciously—especially in companies with wide economic moats—based on your investment plan and goals.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)