Markets Brief: What Investors Should Watch for in the September Jobs Report

Stocks kick off Q4 in a slump, waiting for the next batch of economic news for direction.

The Federal Reserve’s determination to fight inflation left stocks slumping into the final days of the third quarter, and for the market going forward, much will hinge on how quickly the economy starts to slow and to what degree.

Against that backdrop, investors will be keeping a close eye on jobs data for September to be released this upcoming Friday. Despite companies setting plans to cut their workforce and slow down hiring, the labor market has remained strong. While that is generally a sign that the economy isn’t currently in a recession, it doesn’t mean one isn’t ahead, nor is it a great sign for inflation.

“What we're looking for and what I think all investors are looking for, are signs that the labor market is starting to weaken,” says Eric Winograd, senior economist at AllianceBernstein. “That’s a critical part of getting inflation back under control.”

Data in the monthly employment report can be very volatile and is often subject to fairly substantial revisions in the months after its initial release. So, investors should be wary of putting too much stock in one month’s set of data. However, there are key trends to keep an eye on.

Will Job Growth Really Start to Slow?

So far, expectations for a meaningful slowdown in job growth haven’t materialized. Nonfarm payroll employment has grown by an average of 380,000 over the last three months. While that’s below the average of the past year—which clocks in at 490,000 a month—it’s still a relatively high level of job growth.

“Anything over about 75,000 to 100,000 counts as the labor market still strengthened in terms of the payroll number,” says Winograd. “I don’t think there’s any reason to see that [normal payroll additions] this month.”

For the September report, economists expect an increase in payrolls of 250,000 according to FactSet, which would be down from the 315,000 new jobs added in the previous month. An increase of 250,000 would be the smallest gain since December 2020, when employment shrank by 115,000.

The continued strength in hiring in part reflects the large number of vacancies.

“I think businesses struggled to find labor earlier in the [economic] cycle … firms are still filling vacancies from earlier in the year,” says Winograd. Furthermore, a labor participation rate, the percentage of the capable working-age population actively looking for work, has yet to recover to prepandemic levels, exacerbating the gap between labor supply and demand.

Morningstar chief economist Preston Caldwell also points to labor force participation as a data point to watch. "We expect labor force participation—adjusted for demographics—to soar past prepandemic rates as widespread job availability pulls in formerly discouraged workers,” he says.

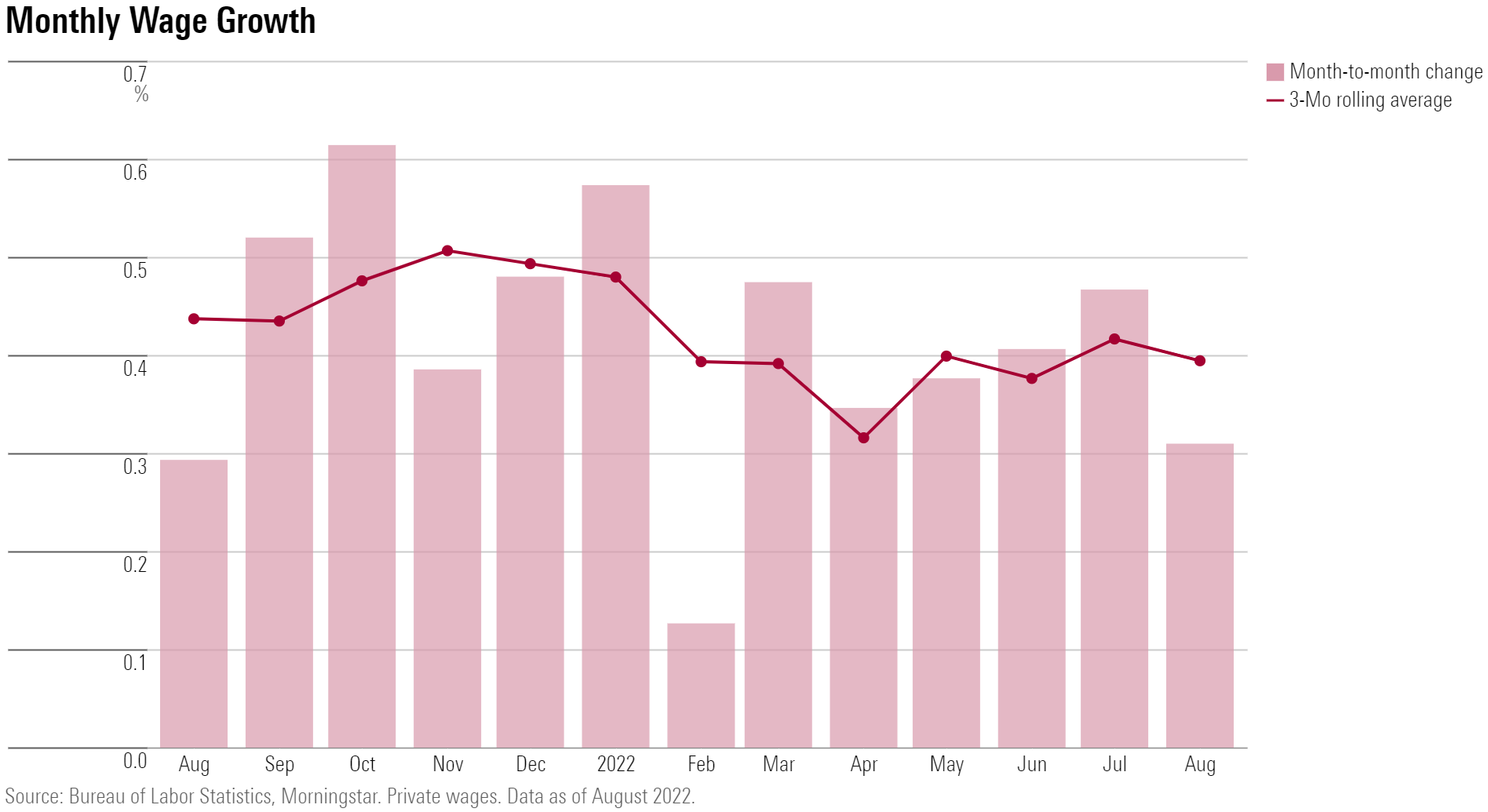

Will Wage Growth Start to Decelerate?

The mismatch between labor supply and demand has placed upward pressure on wage growth, a factor that would keep inflation high and one the Fed is watching carefully.

“In order for inflation to come back under control, we would need to see wage growth actually slow,” Winograd says. According to the August employment report, wage growth has risen 5.2% in the past 12 months. “Right now it’s just that it’s high, but we’re not seeing it increase any further.”

The question is how long will it be until signs of a weaker labor market, and thus wage deceleration, appear. If the Fed sees that the labor market is still too strong, it’s a sign for them to continue raising rates and keep them high for longer, says Winograd.

“The risk then, of course, is that because monetary policy works on a lag, that by the time it is felt on the economy, the Fed may have gone too far.”

Events scheduled for the coming week include:

- Wednesday: Lamb Weston LW reports earnings.

- Thursday: McCormick & Co MKC, Conagra Brands CAG, and Constellation Brands STZ report earnings.

- Friday: September employment report. Tilray Brands TLRY reports earnings.

For the trading week ended Sept. 30:

- The Morningstar US Market Index fell 2.69%.

- The best-performing sector was energy, which rose 2.21%.

- The worst-performing sectors were utilities, down 8.55%, and real estate, which fell 4.41%.

- Yields on the U.S. 10-year Treasury rose to 3.80% from 3.69%.

- West Texas Intermediate crude oil prices rose 0.95% to $79.49 per barrel.

- Of the 851 U.S.-listed companies covered by Morningstar, 230, or 27%, were up, and 621, or 73%, declined.

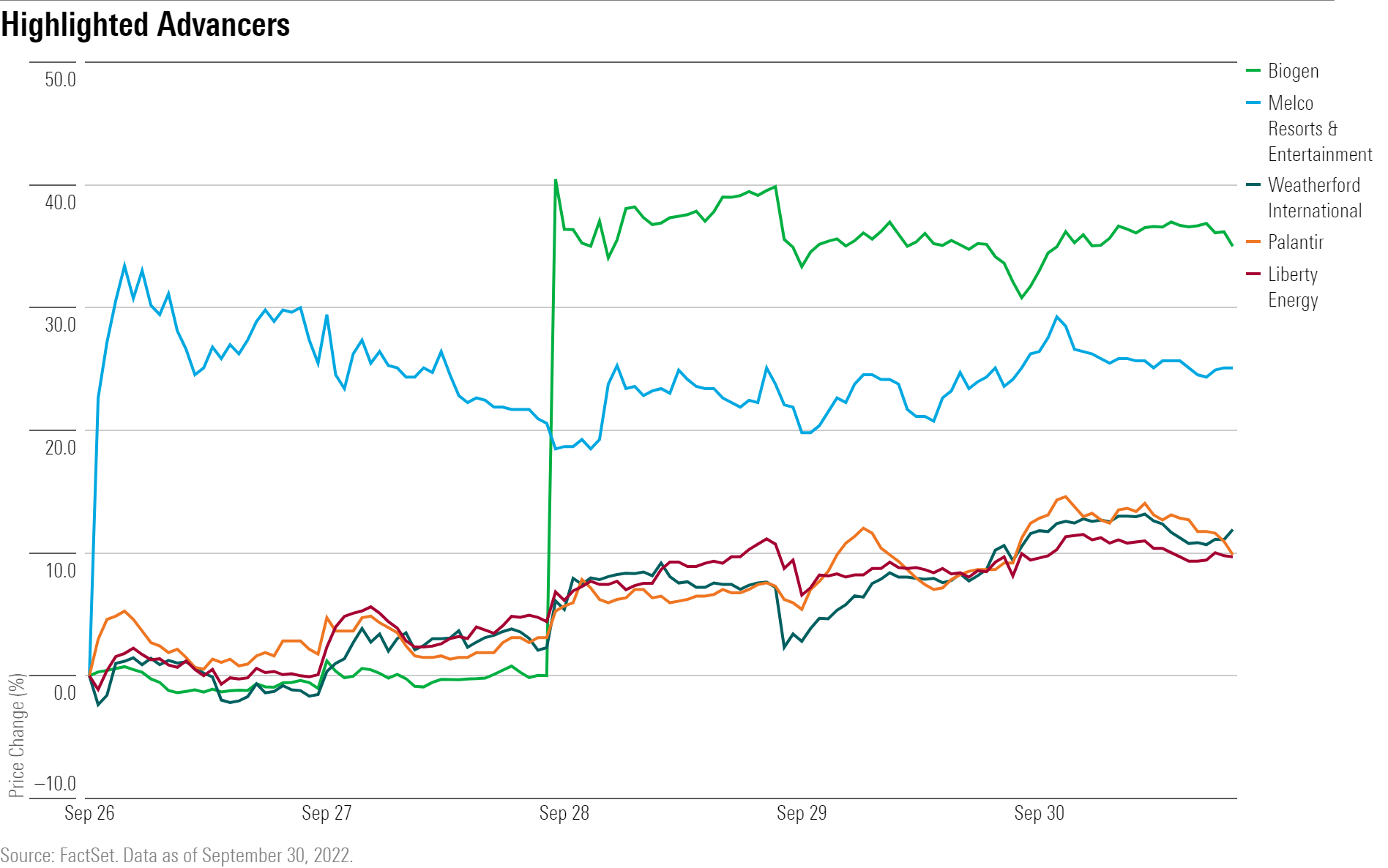

What Stocks Are Up?

Shares of drug manufacturer Biogen BIIB rallied on the release of data from its phase 3 trial for lecanemab, a treatment for Alzheimer’s disease.

“Given the strength of the data, we expect lecanemab could be one of three new Alzheimer’s drugs to potentially reach the market over the next couple of years,” Morningstar healthcare strategist Karen Andersen says. The company’s Fair Value Estimate was raised to $330 from $305 following the news.

Gaming companies including Melco Resorts and Entertainment MLCO, Las Vegas Sands LVS, and Wynn Resorts WYNN were up following news that China would allow tour groups to travel to Macao from the mainland.

Palantir Technologies PLTR shares climbed after the U.S. Department of Defense extended a contract with the firm that is worth up to $229 million.

Oil prices climbed, and that fueled gains for a number of energy stocks, including Weatherford International WFRD, HF Sinclair DINO, and Liberty Energy LBRT.

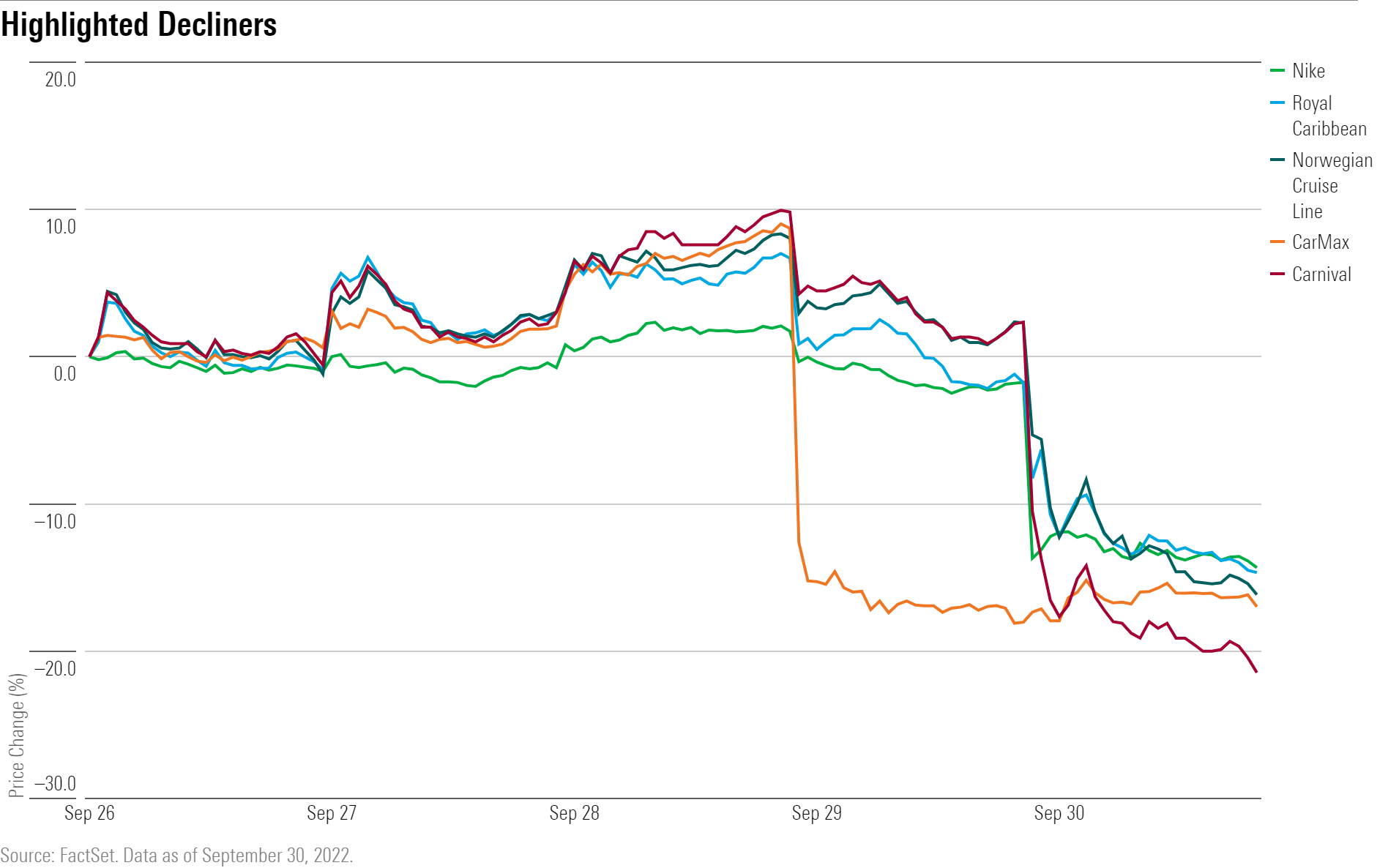

What Stocks Are Down?

Disappointing third-quarter results from Carnival CCL CUK led to a selloff after the firm missed both earnings and revenue estimates. The cruise ship company also forecast a loss for the fourth quarter. Royal Caribbean RCL and Norwegian Cruise Line Holdings NCLH also fell.

CarMax KMX shares plunged over missed second-quarter revenue and earnings expectations as well.

“Macroeconomic pressure from poor consumer confidence and inflation from many areas, as well as poor used-vehicle affordability, hammered results,” says David Whiston, an industrials sector strategist for Morningstar.

Nike’s NKE stock fell after expectations for near-term margins disappointed. Management said they would need to markdown prices to clear a surplus of out-of-season inventory.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)