How the Russia-Ukraine Conflict Is Changing Carbon Markets

Two key economic forces should dictate how carbon credit prices move in the short term.

The Morningstar US Energy Index has trounced the broad market in the year to date, returning 48% through August 2022 versus the broader stock market’s 15% decline. The ongoing crisis in Ukraine is largely to blame for the rapid upswing in energy stocks, led by higher crude-oil and natural gas prices.

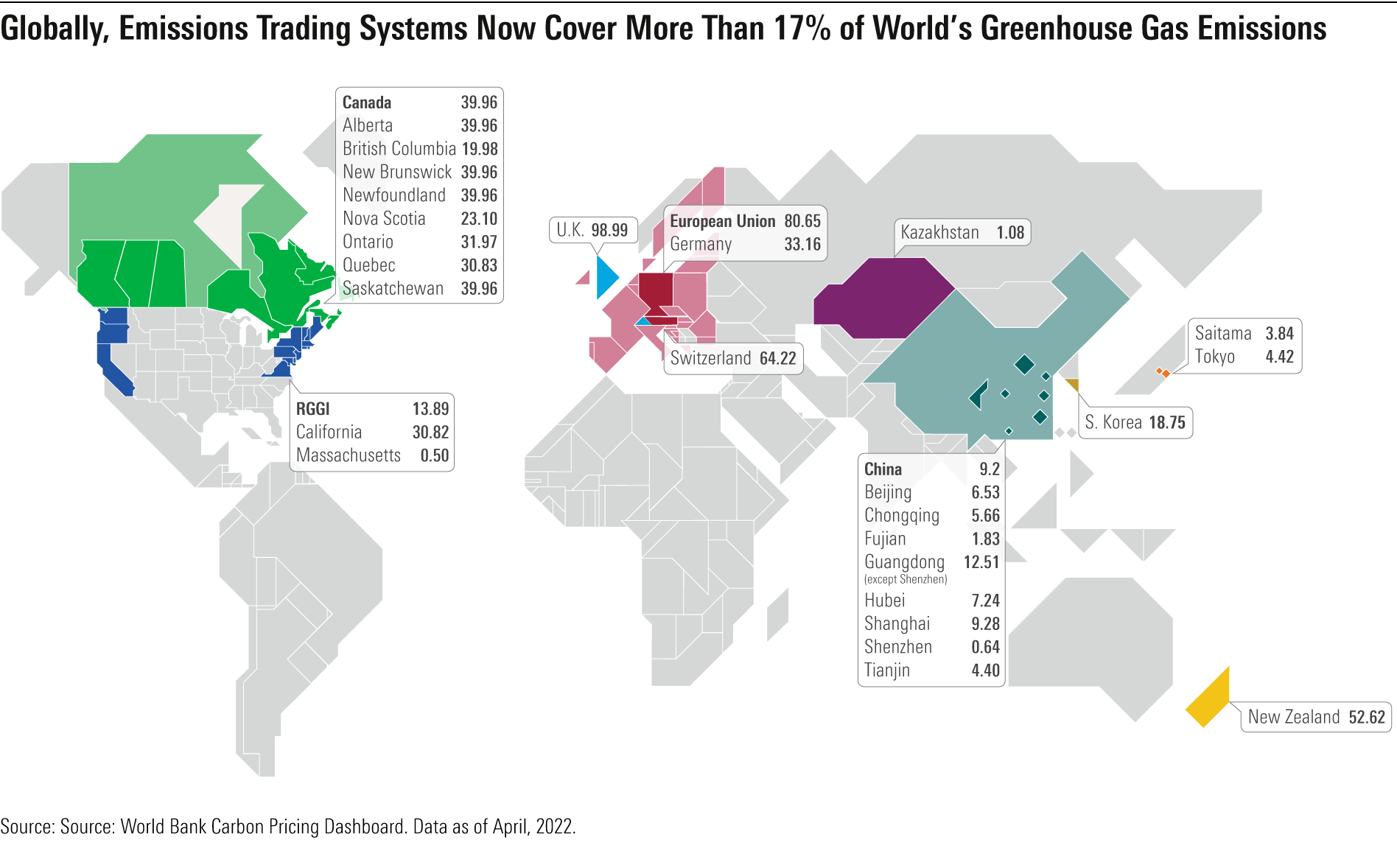

Given the renewed scrutiny of fossil fuels, interest in carbon credits has also kicked up in recent months. Carbon credits represent a holder’s right to emit one ton of carbon dioxide, and they exist as part of cap-and-trade programs like the European Union’s Emissions Trading System. Firms regulated under cap-and-trade programs must purchase a carbon credit before emitting if they want to burn fossil fuels. (If you’re unfamiliar with carbon markets and want to learn more, you can find a summary of the asset class.)

Short (Term) Squeeze

Theoretically, two key economic forces should dictate how carbon credit prices move in the short term: overall demand for energy and how carbon-intensive the energy is.

The first component—demand for energy—is determined by many factors, but prices are an important input. In normal circumstances, people emit more fossil fuels when they are cheap relative to renewables. Increased appetite for energy would require companies to buy carbon credits in order to burn more fossil fuels to meet demand. As competition for carbon credits rises, so too should prices.

The second component—how carbon efficient those energy sources are—is determined by the mix between fossil fuels. Under compliance markets, less carbon-efficient fossil fuels such as coal require more credits to burn to get the same amount of power. If the consumption mix trends toward less carbon-efficient fare, all else equal, that should cause an uptick in demand for carbon credits.

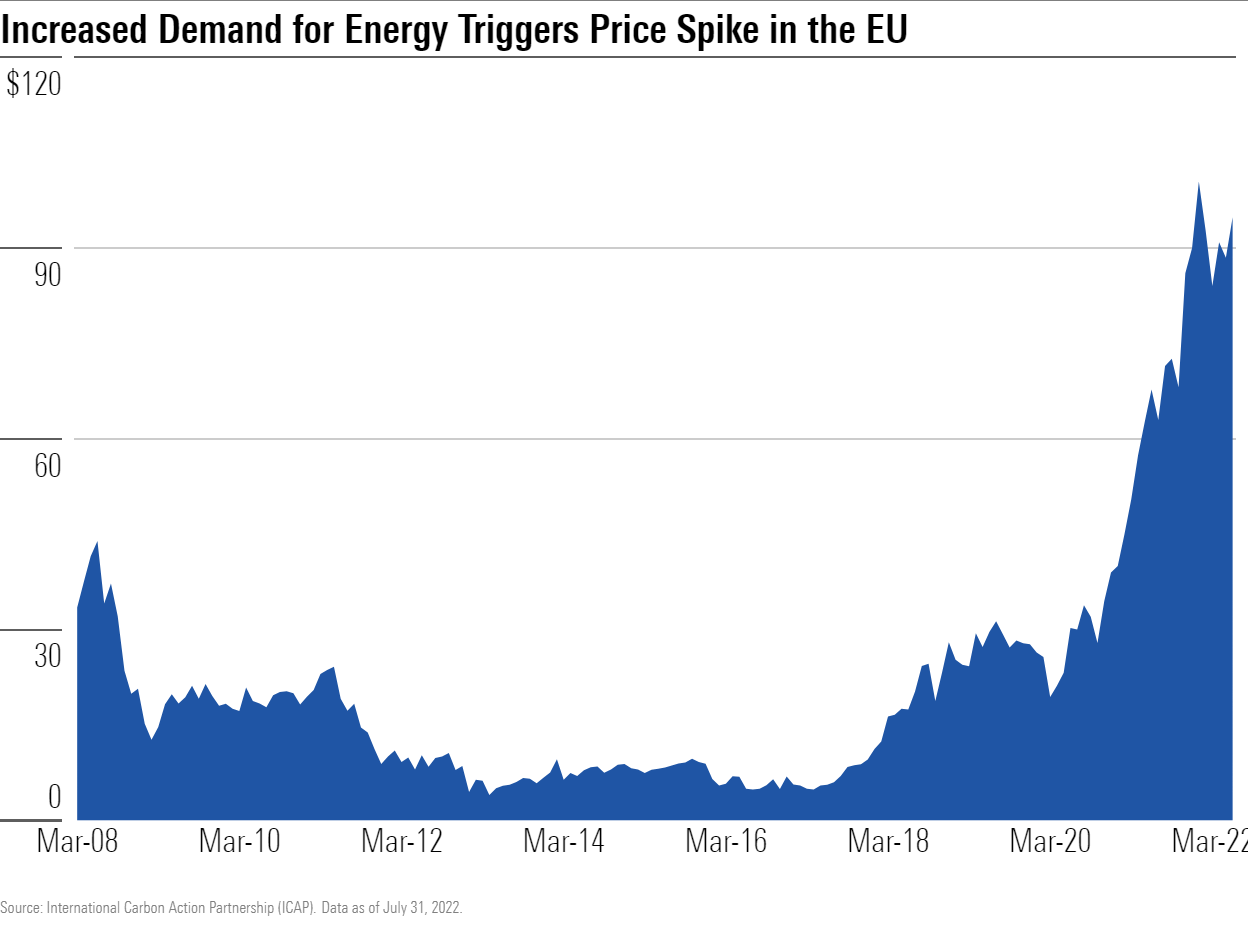

These two inputs can work together to move carbon credit prices in the same direction. Indeed, carbon credit prices surged throughout 2021 and 2022 during the first wave of sanctions against Russia levied by the United States, EU, and United Kingdom.

However, this coming winter, the Russia-Ukraine conflict may pit these two influences against each other. The U.S. has already directly banned crude-oil imports from Russia, and the EU is deliberating whether it should follow suit. Russia has proactively shut off access to its Nord Stream natural gas pipeline, and it is unclear when it will be turned on—if at all. In response to the standoff with Russia over natural gas, countries are bracing for biting power shortages and cautioning consumers to cut back, which should drastically suppress demand.

While overall power demand must fall amid lower supply, the withdrawal of Russian natural gas could tip the scales toward more carbon-intensive fuel sources like coal. (Under normal conditions, natural gas is the cheapest and greenest nonrenewable source of power; coal produces almost 79% more carbon per unit of energy, according to the Energy Information Administration.) Like Rome, wind farms aren’t built in a day. The acute short-term nature of this crisis may make it necessary to keep every megawatt of existing, albeit inefficient, energy production on line despite the ugly economics.

The Bigger Picture

In the longer term, carbon credit prices are at least partially a bet on the system itself and the willingness of the governed to affect climate change.

The cap for any compliance market may fluctuate year to year but is expected to gradually decline over time. Conceptually, carbon emissions have to get more expensive to meet reduction targets. Regulators can achieve this by laying a steady ladder of cap reductions for carbon emissions to march down. Over time, the available supply of credits tapers, and the cost of polluting rises, converging with the long-term theoretical emissions cost to reach climate action goals.

Ideally, the price to pollute should climb over time as caps decline—regardless of energy sector turmoil. The logic follows that over long swaths of time, energy prices shouldn’t have much impact on carbon credit prices at all.

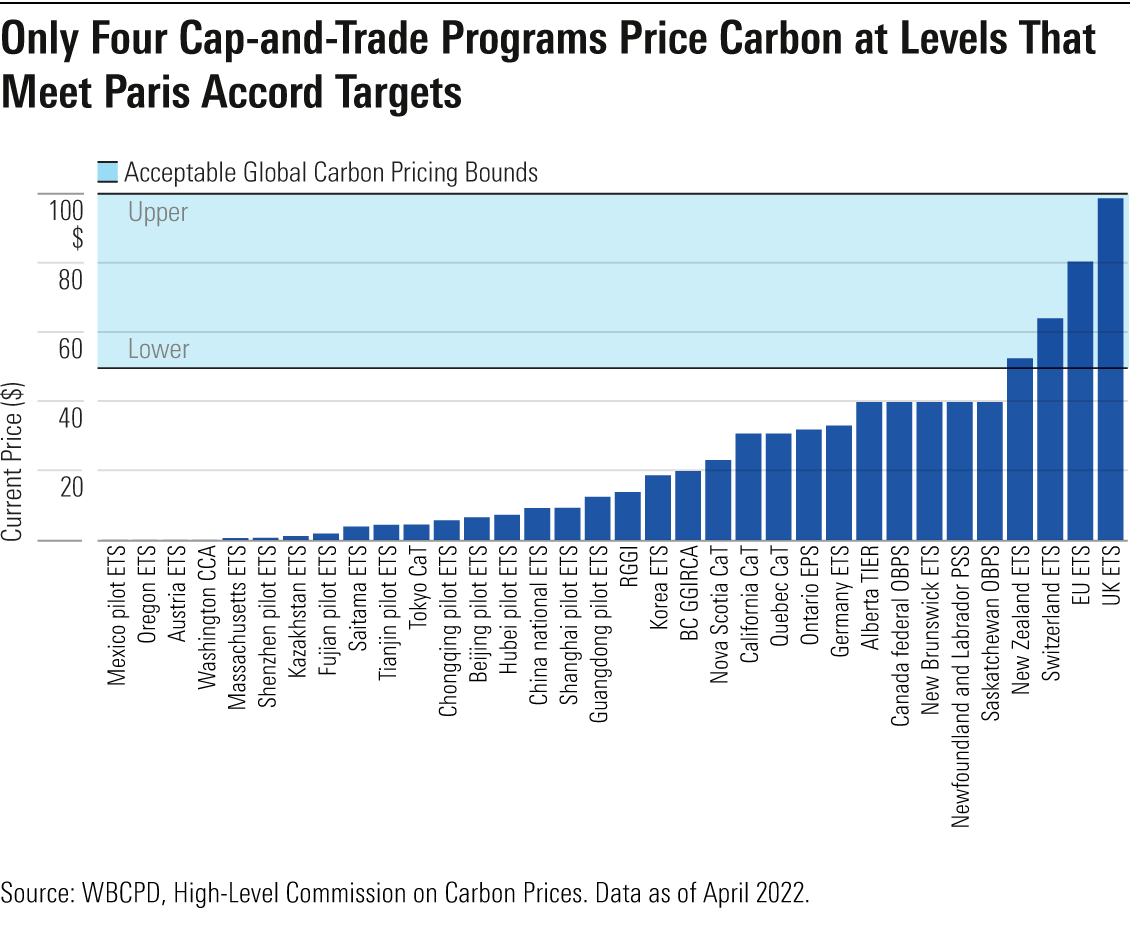

Investors may be lured by this philosophically sound argument. Indeed, declining caps do explain some of the EU’s astonishing performance. But if an investment sounds like it’s too good to be true, it probably is. With carbon credits, what investors get exposure to is a financial proxy of how successful regulators are at executing their ambitions. Investors are “betting” on the outcome of carbon markets rather than the value of a ton of carbon. And in reality, most governments haven’t matched the EU’s commitment to climate. All but four existing cap-and-trade programs fall short of the global carbon price threshold of $50 to $100 necessary to keep global warming under 2 degrees Celsius in line with the Paris climate accord.

Instead, prices for carbon credits vary widely, from $1.08 in Kazakhstan to $98.99 in the U.K.

Different regimes may have different methods for setting allowable emissions standards, limiting comparability. We find that even sophisticated cap-and-trade programs exert little control on how fast emissions fall, especially early on. Companies that reduce emissions faster than expected flood the market with cheap credits, introducing price volatility. When this happens, energy producers and industrial firms can hoard credits, forcing regulators to restructure to preserve existing incentives, as California discovered when it hit its 2020 abatement targets four years ahead of schedule in 2016.

Methodological adjustments alter the supply of available credits and the rate of change year over year, making it more difficult for regulators—especially of immature programs—to exert consistent influence on the price of carbon or the contours of future emissions reductions.

There are solutions to this problem. Exponential forecasts may be more effective for setting cap reductions relative to linear models that undershoot the pace of emissions reductions and need frequent adjustments, especially for newer programs. To address price volatility, governments could impose a convertible credit and tax approach. Under this system, carbon is traded at market price when emissions track above the cap-specified level, but the system would trigger a minimum price if emissions fall below target. California, for example, has implemented a price “floor” for its primary auctions.

But a bigger challenge remains.

Effective emissions abatement blends “carrots,” or incentives, and “sticks,” or penalties. In the past, economists and regulators have rallied behind cap-and-trade programs as a stick because they are cheaper to implement and more popular among constituents than alternatives like direct regulation and carbon taxes. Market incentives motivate the covered group, as a whole, to find the cheapest way to reduce overall emissions. In a perfect world, this obviates the need for specific government plans on energy mix or areas for reduction.

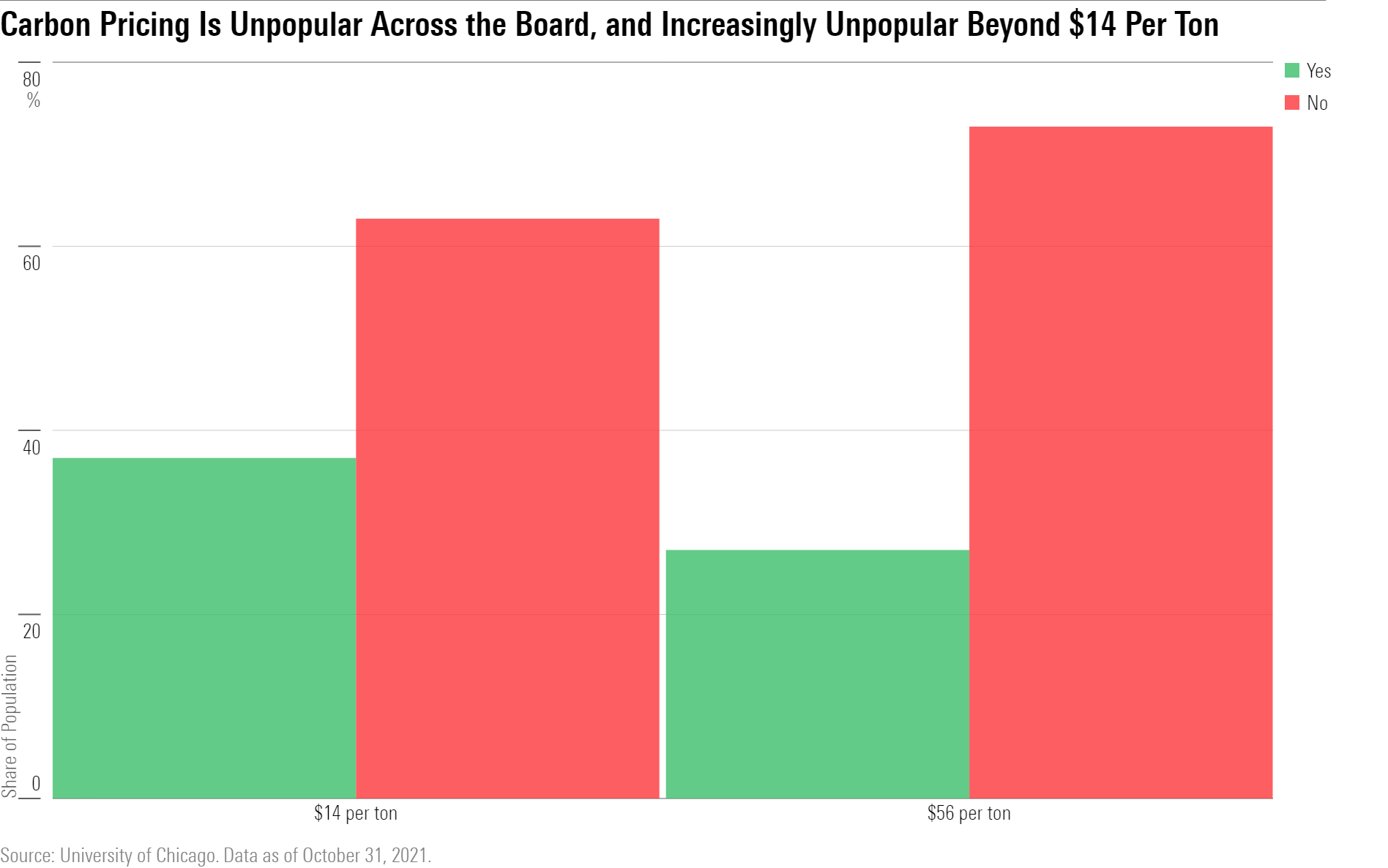

While several previously slated programs are going live in the next few years, some governments—like the U.S.—have begun to vocally disavow the idea of “sticks” altogether because they gum up the legislative process.

Survey statistics breathe life into that relationship. Carbon credits poll abysmally. While more than half of Americans would contribute at least $1 a month to combat the effects of climate change (comparable with a carbon tax of $0.75 per ton per year), support takes a nosedive at price levels beyond that. Just 37% of Americans would support paying $14 extra per ton for their own personal carbon footprint, while fewer than 25% would support a price of $56 in accordance with the Paris climate accord objectives.

Thus far, these political hurdles have proved mostly insurmountable. Carbon prices are too low to combat climate change, and compliance markets have mixed success at reducing emissions. Taking these factors together, for a typical investor, we believe that an investment in a carbon credit represents an implicit bet on the robustness of its parent carbon market far more than it represents an expression of the future cost to society of present emissions, and therefore has limited merit as a strategic allocation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)