Never Mind Growth vs. Value Stocks, Look to Beta

Why investors should be focusing on stock volatility instead of style.

If there’s been a smart way to position a stock portfolio in 2022, it’s been to avoid the big-name, high-growth stocks that had been top-performers in recent years, and instead tilt toward value names that had been long out of favor. That wouldn’t mean avoiding losses, but the damage would have been a lot less severe.

Now, a summer revival in growth stocks has many investors asking if that is the start of another shift in the market, or if the value rally will continue.

Others say that’s the wrong question to ask.

Instead, they say, investors might be better off looking to a different factor: beta.

Beta is one of those Greek-letter named metrics that Wall Street pros love to talk about when they want to sound smart. But it’s actually a simple concept. Beta reflects how volatile a stock is. High beta means more volatile while low means less volatile, compared to the overall market.

Many investors are more familiar with value or growth stocks, either through their funds or individual stock names: growth stocks such as Google parent Alphabet GOOG, Amazon AMZN, Meta FB and other tech giants; big value names including Berkshire Hathaway BRK.B and Johnson & Johnson JNJ. But strategists say that the challenge right now is that, amid the uncertainty about the economic outlook, it’s even harder than usual to say whether the environment will favor growth or value. At the same time, as Morningstar’s data shows, valuations among growth and value stocks are relatively even.

But the contrast is starker between valuations on high-beta versus low-beta stocks, which could offer opportunities. On balance, high-beta stocks are cheap.

“More than value versus growth, the factor that I prefer right now is beta, which represents risk and volatility,” says Denise Chisholm, director of quantitative market strategy at Fidelity Investments. Investors must decide for themselves how much up-and-down portfolio risk they can stomach in the short term, even as high-beta stocks trade at low valuations. That's especially the case if the Federal Reserve needs to raise rates even more aggressively than is expected in order to contain inflation and the risk of serious recession increases.

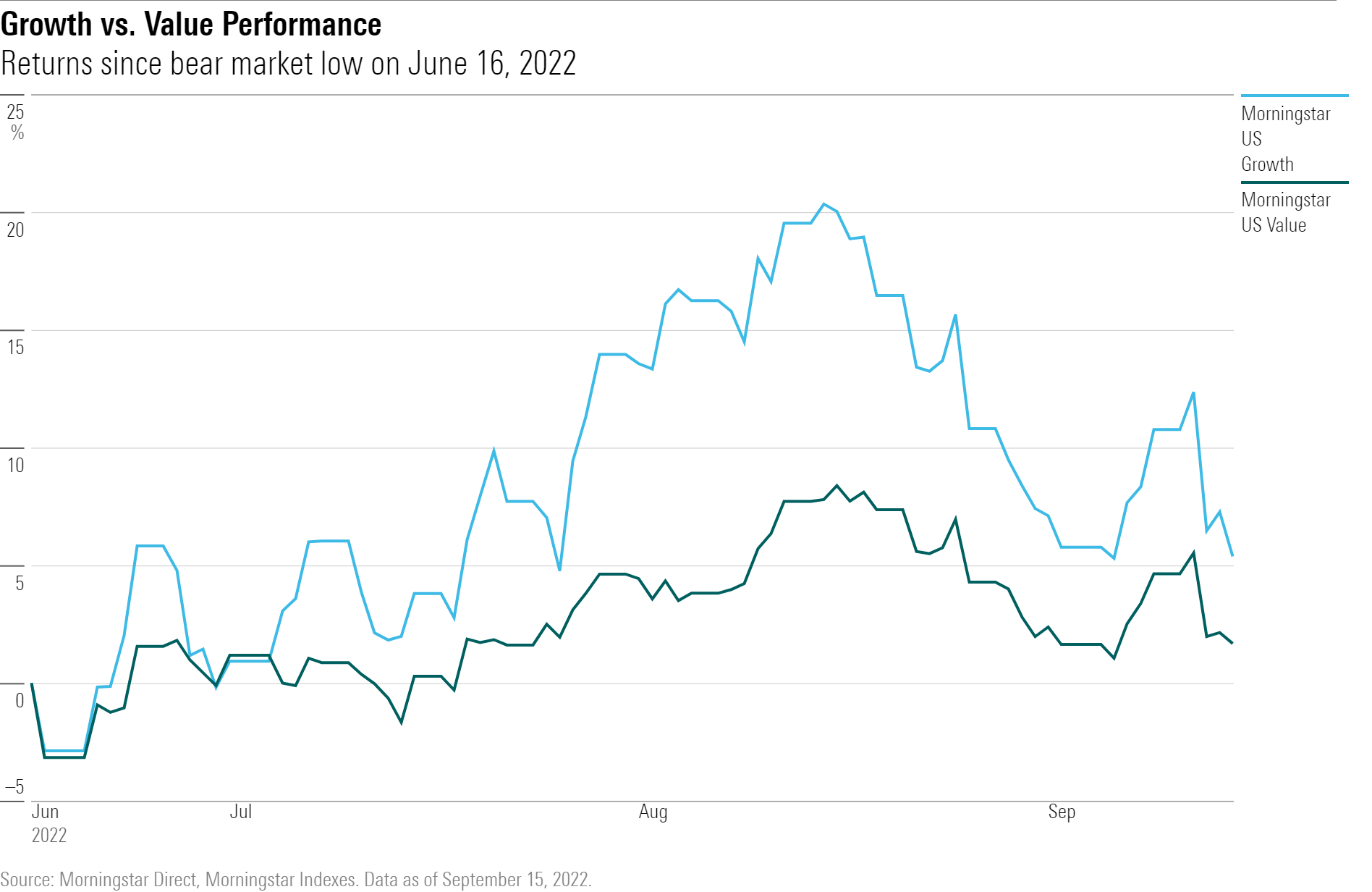

Growth vs. Value Performance

Coming into 2022, many growth stocks—especially technology names—were trading at lofty valuations thanks to their perception as a haven during the pandemic-sparked recession. Those high valuations left them vulnerable to any significant changes in outlook for the economy. For growth stocks, valuations are based heavily on expectations of future earnings, and future earnings for many companies can be affected by the pace of economic growth.

The narratives of rising rates, economic growth, inflation, and a possible recession have been dominant factors that led to growth stocks getting slammed.

But that was followed by signs of a growth revival during the summer as investors hunted for bargains among beaten down names and investors began to think the bulk of the rise in interest rates was behind them.

Since the bear market's low point in mid-June, growth stocks started to advance: the Morningstar US Growth Index gained 20.3% in two months while the Morningstar US Value Index rose just 7.8% through Aug. 15.

This year has been a horse race for growth versus value.

The horse race has continued as sentiment continued swinging back and forth around the outlook for interest rates and whether the economy will sink into recession or avoid one with a soft landing. The gap between value and growth has narrowed since the most recent market peak on Aug. 16, with value stocks ahead of growth by 6.8 percentage points.

“In the current environment, the risks and rewards of value versus growth aren’t favoring one over the other,” says Raheel Siddiqui, senior research analyst and managing director at Neuberger Berman.

What Is Beta in Stocks?

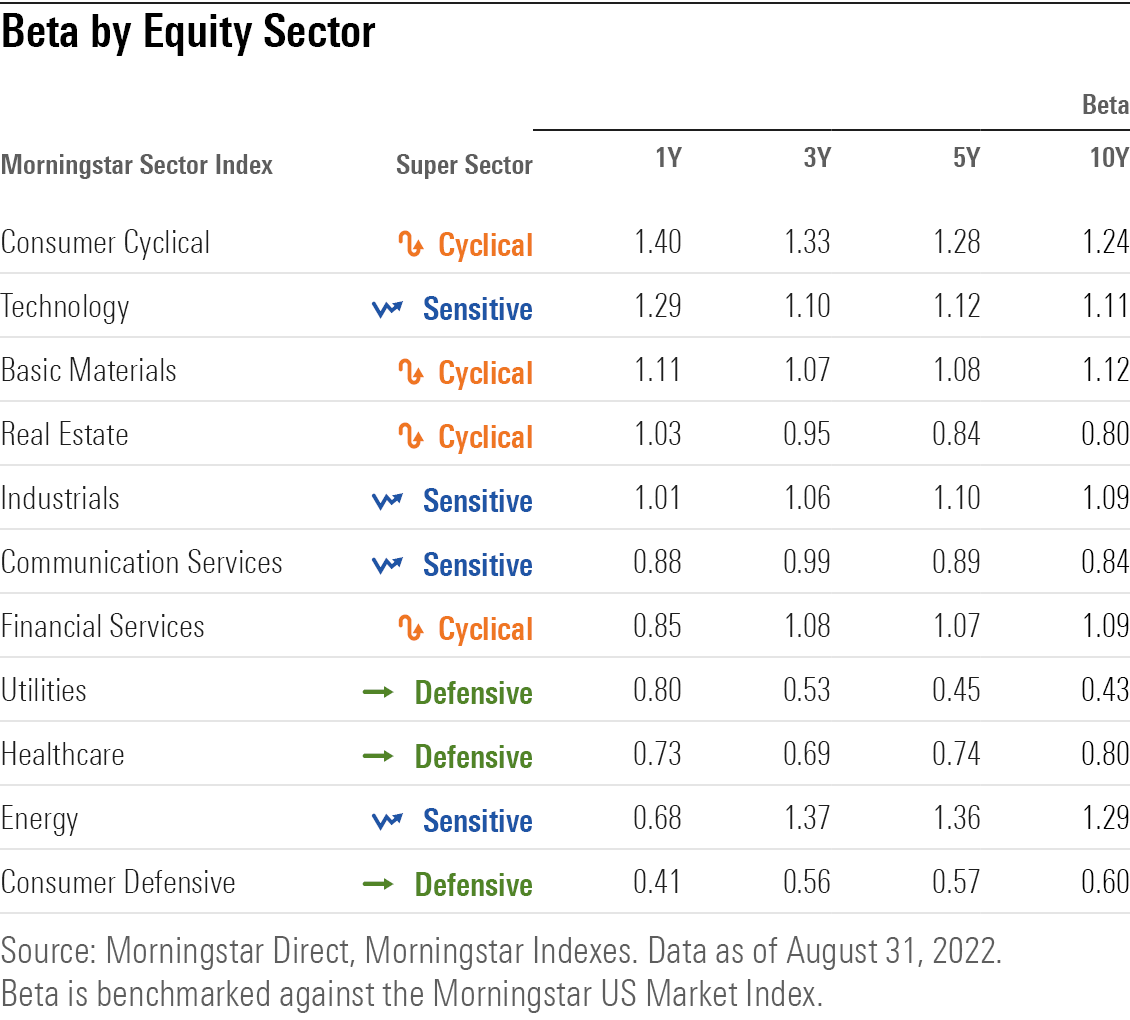

Beta is a commonly cited risk measurement that gives insight into how volatile an investment has been compared to the broader market. Investments with a beta greater than 1.00 tend to be more sensitive to market movements, while investments with a beta lower than 1.00 tend not to move as far up or down as their broader-market benchmark.

The utilities sector in particular tends to be very low beta, as it contains stocks with stable businesses that are less subject to the ups and downs of the economy.

High-beta stocks can often be found within the cyclical super sector, a grouping of stocks from industries that are highly impacted by economic shifts. Investors might assume that technology stocks are the highest beta group, but for the 10-year trailing period, the group actually ranks fourth, behind energy, consumer cyclical, and basic materials. (These rankings can shift when looking over different time frames. For the past year, energy stocks have been very low beta.)

Investors can reference beta to help them minimize risk in their portfolios: low-beta investment strategies may miss out on rewards when the market does well, but they also minimize the risk of big downside losses.

High-Beta Stocks Look Cheap

For now, Fidelity’s Chisholm says, “Risk is still cheap, and it’s less correlated to inflation than many other factors.”

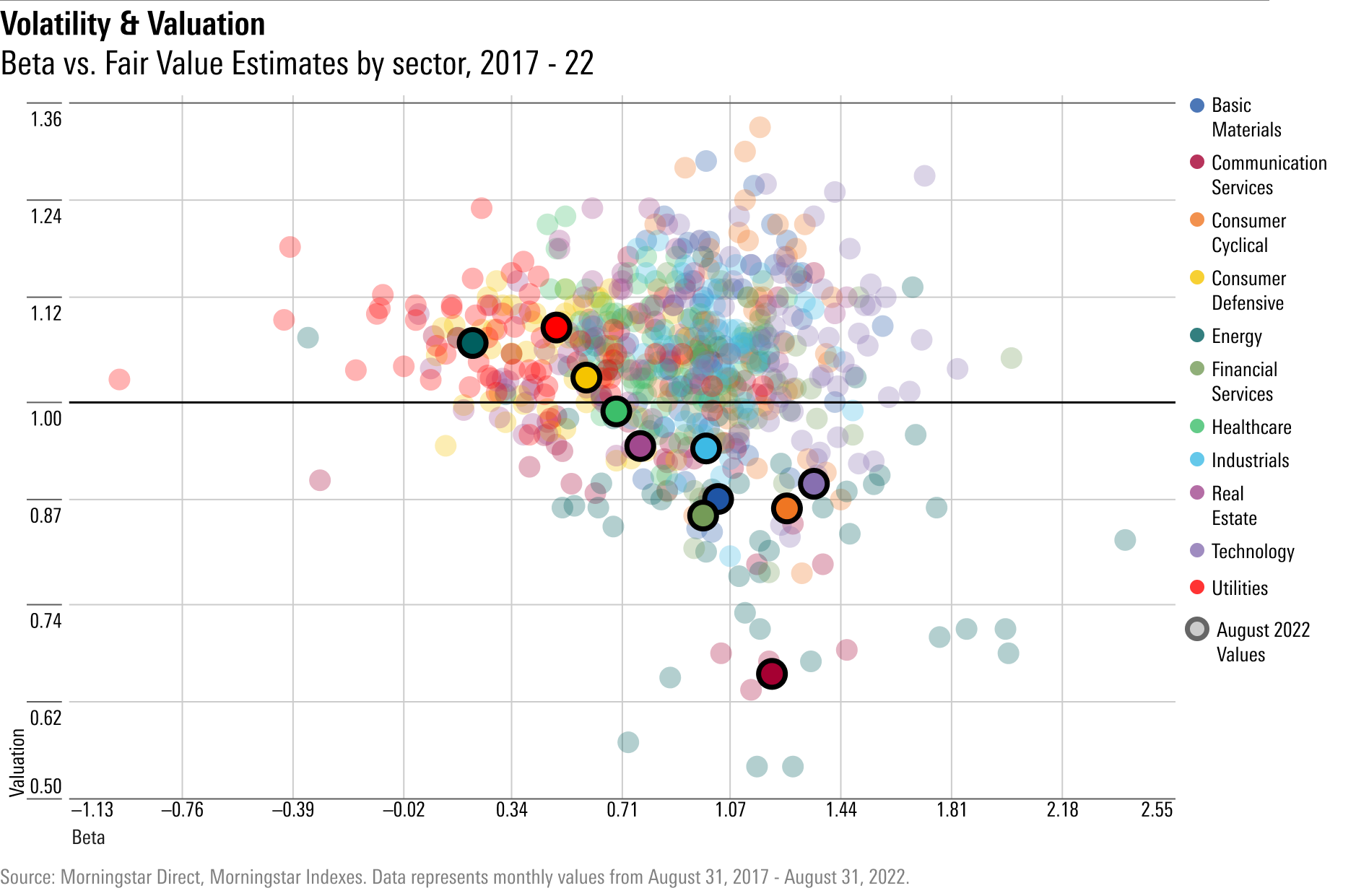

Through the lens of the Morningstar US equity sector indexes, areas of the market with the highest beta are trading at some of the lowest prices. We looked at beta values for the month of August 2022, based on daily returns, as compared to the Morningstar US Market Index, to see which sectors have been most volatile lately. We compared the August values to every month over the past five years to get a closer look at recent trends and longer-term patterns, comparing each sector’s beta values to their fair value estimates over time.

The Morningstar US Consumer Cyclical Sector Index carries an above-market beta of 1.26 as of the end of August, and finished the month at 87% of its aggregated fair value, or a 13% discount. The technology and communication services indexes—each carrying some of the highest sector-level betas as of August—are also among the most undervalued market sectors, currently at 89% and 65% of their Morningstar analyst-assessed fair value estimates, respectively (where analyst estimates are unavailable, Morningstar quantitative fair value estimates are used).

On the flip side, stocks from the current lowest-beta areas, energy and utilities, are the most overvalued in the market at the sector level. Investors typically flock to utility stocks during periods of economic uncertainty due to their stable revenue and high dividend yields.

The Morningstar Utilities Sector Index ended August overpriced: Morningstar analyst and quantitative valuation ratings reveal that the index stood 8.3% above its aggregate fair value.

Where to Invest Now: Cyclical Stocks Have Higher Beta and Lower Valuations

“The overall market is 15% undervalued right now,” says David Sekera, Morningstar’s chief U.S. market strategist. “So it’s a good time to shift further into high-beta stocks, to capture extra upside when the market recovers.”

Fidelity’s Chisholm points to the consumer cyclical sector—also referred to as consumer discretionary—as the ripest for strong performance in the coming months. “Consumer discretionary is the bottom-performing equity sector right now,” she says. “There’s just about a 100% chance that it will improve from prior levels going forward.”

The Morningstar US Consumer Cyclical Index has lost 22.81% this year through Sept. 15, putting it on track for its biggest annual loss since 2008.

Chisholm notes that there are two contrarian indicators acting as tailwinds for the sector: two sequential declines in gross domestic product, and bad news on inflation sparking fears about consumer spending.

“It’s very clear when you look at the historical probabilities: bad news is, more often than not, a good sign for the [consumer cyclical] sector,” she says. “It’s the only sector that more or less clearly benefits consistently from inflation throughout time.”

To Reduce Risk, Lower Beta

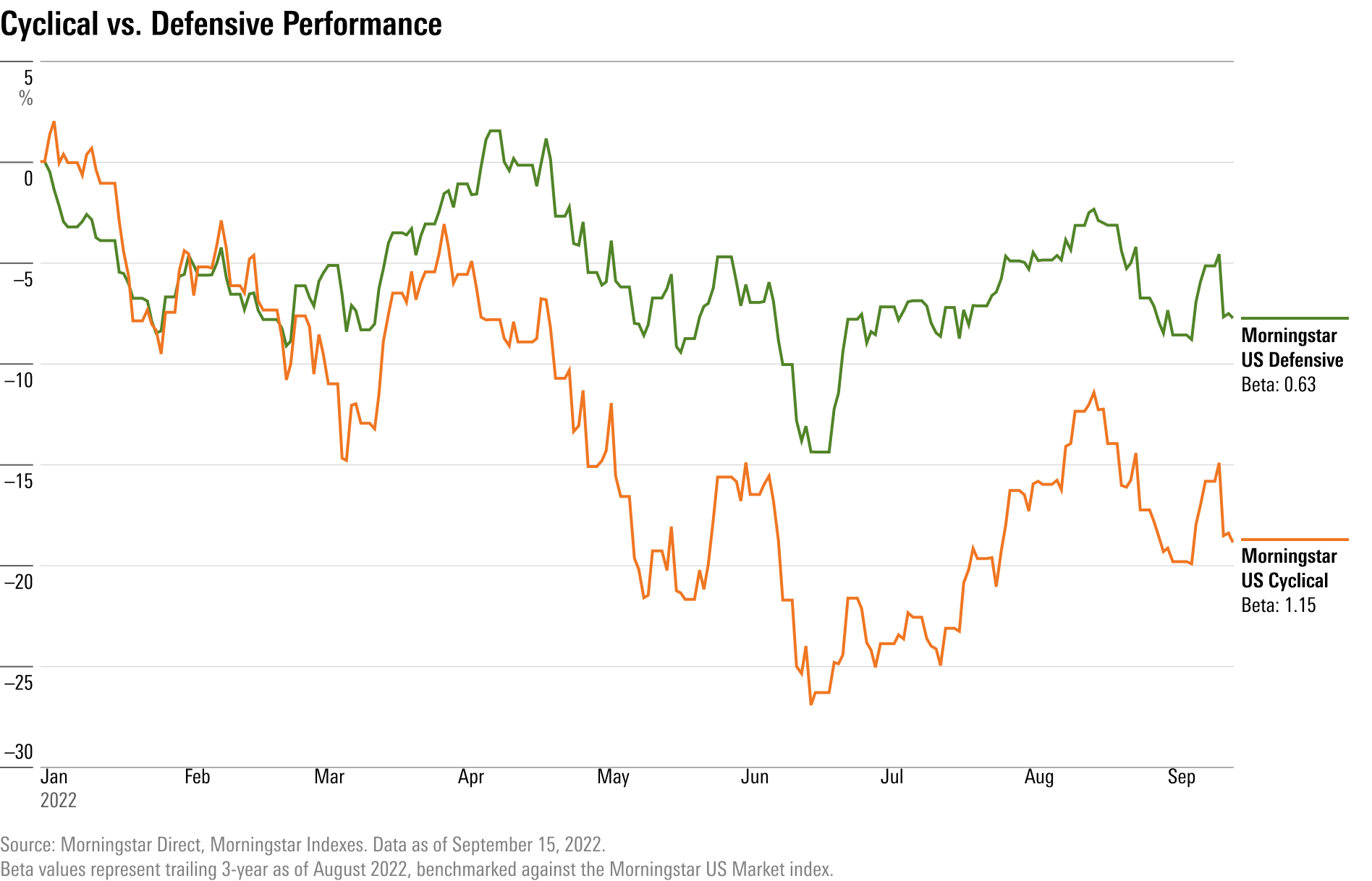

High-beta stocks look cheap, but, by definition, they also come with higher risk. As uncertainty around inflation and the Fed’s response continues to plague the markets, volatility will put high-beta stocks at risk for steeper downturns. For risk-averse investors, low-beta stocks can offer a haven.

“Low-beta investments have had an extraordinary run this year,” Neuberger’s Siddiqui says. He estimates that low-beta stocks should continue to outperform through the middle of next year.

“In this recessionary environment, beta is the factor that matters most,” says Siddiqui. “If you get beta right, you can get a lot else wrong.”

Siddiqui says that defensive stocks with sustainable dividends and high earnings quality are likely to do well in the current environment.

The Morningstar US Defensive Super Sector Index, with beta of only 63% of the Morningstar US Market Index, lost 7.8% through Sept. 15, putting it 10.3 percentage points ahead of the broader market and 11.1 percentage points ahead of the cyclical Super Sector index. Defensive stocks have outperformed their cyclical counterparts this year by a gap not seen since 2014, as measured by the Morningstar Super Sector indexes.

“Right now, it’s all about how much risk you are carrying in your portfolio,” Siddiqui says. “Everything will drop—look for investments that won’t fall as steeply as others.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)