Why Equity-Fund Investors Have (Mostly) Held Tight in This Year’s Market Rout

Have investors learned that patience often pays off?

Market conditions have been unusually tough in 2022. Broad market indexes were down about 17.5% for the year-to-date period through Aug. 31, 2022, and the tech-oriented growth stocks that previously led the market dropped 30.0% or more.

But at the same time, fund investors have actually been net buyers of U.S. equity funds. This steadfast response may not last forever, but it's an encouraging sign. The merits of patience and investing with a long-term view seem to be winning out, at least for the moment.

Why Fund Investors Haven't Panicked in 2022

Equity-fund investors have had plenty of reasons to worry so far this year. After a robust rebound in 2020 and 2021, markets have spiraled into panic mode. Market headlines have suddenly gone from bad to worse, with negative headlines on the Russian invasion of Ukraine, stubbornly high inflation, and the risk that rising interest rates could touch off a recession in 2023.

As a result, investor sentiment remains relatively negative. About 46.0% of investors participating in the AAII Investor Sentiment Survey were bearish as of the week ended Sept. 14, 2022. That's down from a one-year bearish high of 59.4% in April 2022, but still well above the historical average of 30.5%.

The CBOE VIX Index, which measures market expectations for equity market volatility based on index options for the S&P 500, has generally trended up after a relatively quiet year in 2021. The benchmark spiked into the low 30s earlier this year and has recently been in the mid-20s, compared with a long-term average of about 19.6.

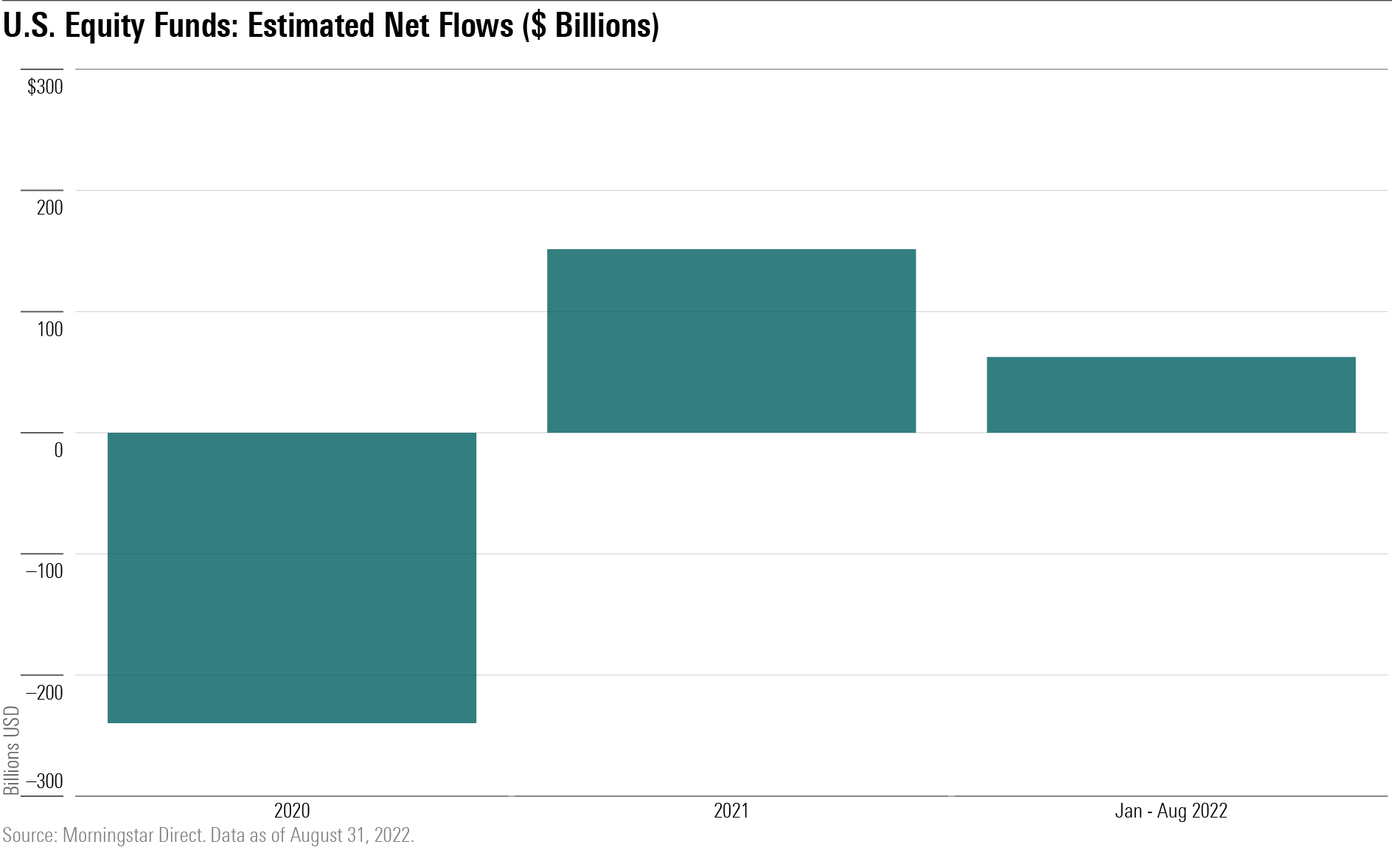

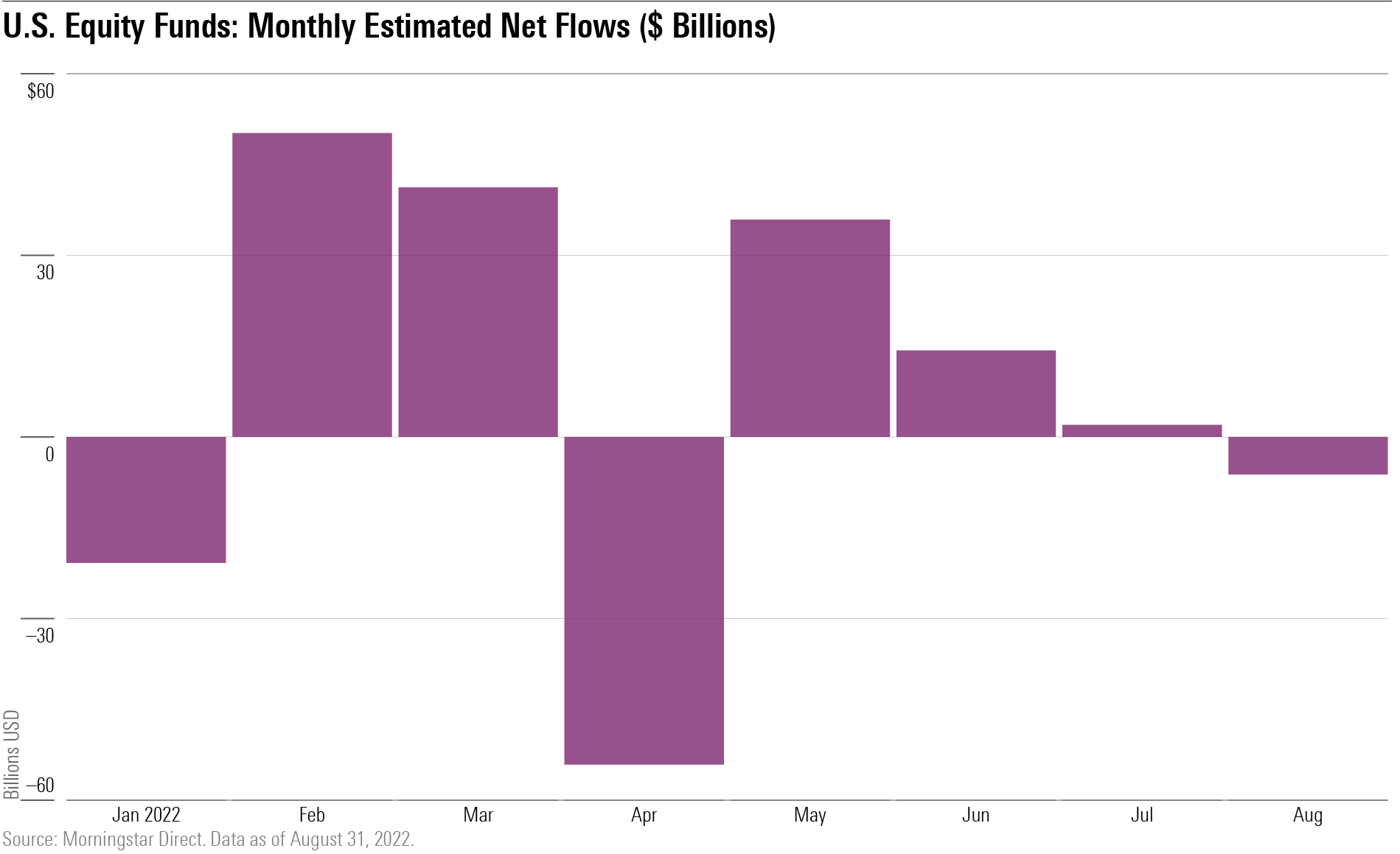

Yet fund investors seem relatively unfazed. Monthly inflows to U.S. equity funds (including mutual funds and exchange-traded funds) have been positive for five out of the past eight months, with estimated inflows totaling about $62.5 billion for the year to date through Aug. 31, 2022.

Why the mismatch between equity-fund flows and market returns? For one thing, fund investors account for a relatively small portion of total assets invested in publicly traded stocks. Based on data from the Investment Company Institute, equity funds (including both mutual funds and ETFs) made up a combined 30% of the total market capitalization in U.S. stocks as of Dec. 31, 2021. Fund investors are a large audience, to be sure, but they're not necessarily representative of the market writ large.

In addition, equity-fund shareholders might be less prone to panic selling because many of them are investing in pursuit of long-term goals, such as retirement. Mutual funds account for more than half of all assets in defined-contribution plans and about 45% of assets in IRAs, based on data from the ICI. Many defined-contribution plan participants automate their investments (either by making an active choice or via default enrollment) by setting up a percentage of salary to contribute, choosing how to allocate assets to funds available in the plan, and then investing in the same options throughout the year. In many cases, this might involve allocating assets to a target-date fund, which in turn would lead to more-stable cash flows for the underlying funds.

Lessons From the Past

Stock-fund investors haven't always been as steadfast. In 2020, for example, estimated outflows from U.S. equity funds totaled nearly $240 billion, or about 2.6% of assets as of the previous year-end. Outflows tapered off toward the end of the year, but many investors who previously sold missed out as equity market returns bounced back starting in late March and early April.

Equity-fund flows also turned negative in the wake of the financial-crisis-driven bear market in 2008. Outflows over the five-year period from 2008 through 2012 totaled about $214.5 billion. Investors who sold off during that period missed out on part of the market's double-digit returns starting in 2009, which continued mostly unabated until 2018.

Overall, though, equity-fund investors haven't been particularly prone to selling at the wrong time. Most inflows and outflows tend to be relatively small as a percentage of assets. That, in turn, has helped investors in U.S. stock funds capture a greater percentage of their funds' returns.

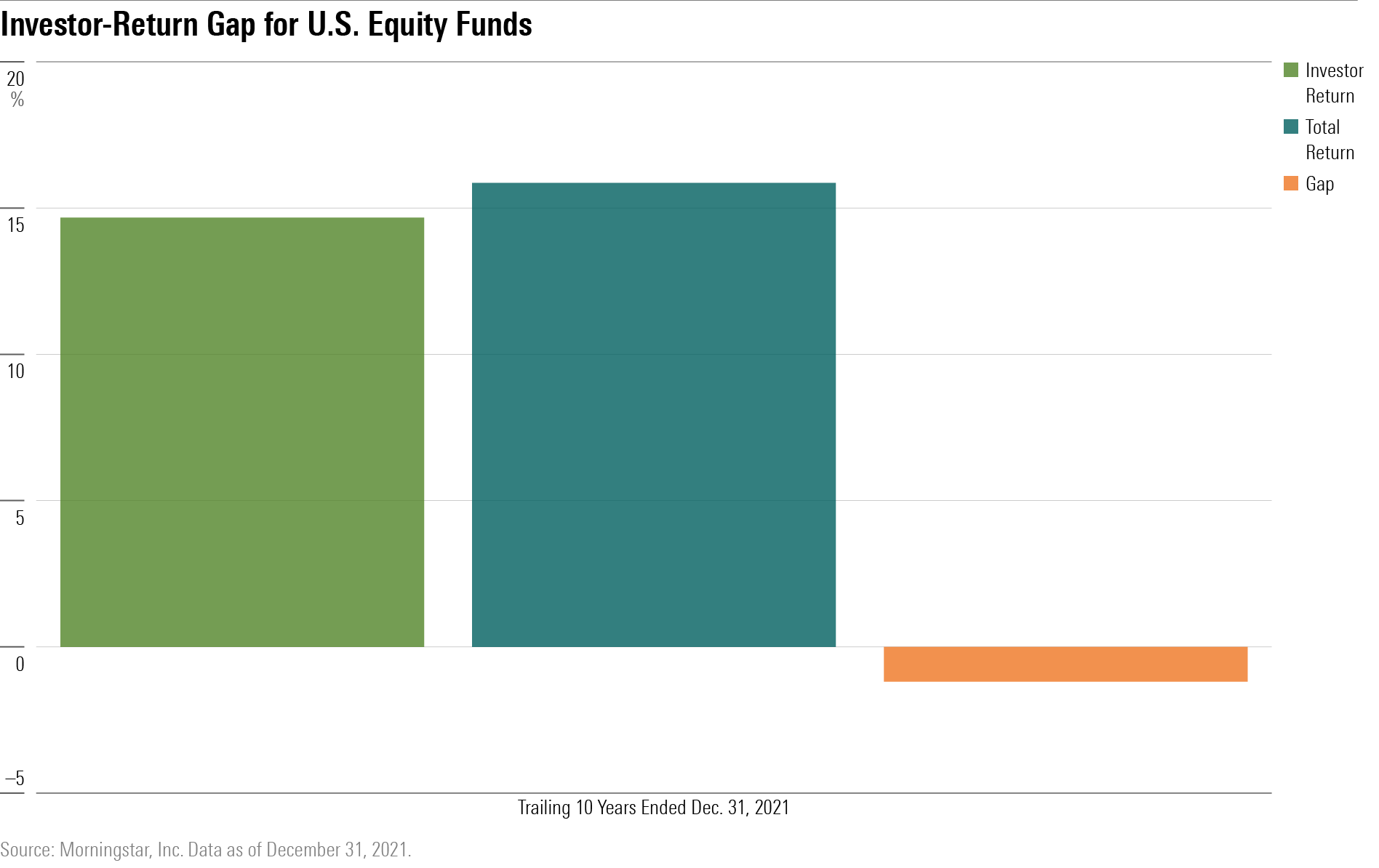

In our annual "Mind the Gap" study of investor returns, we look at the impact of cash flow timing on fund investors' actual results. The difference, or gap, between investor returns and reported total returns represents the amount investors gave up because of poorly timed purchases and sales.

For U.S. equity funds, we found that investor returns lagged total returns by 119 basis points, on average, for the 10 years ended Dec. 31, 2021. That compares favorably with the 173 basis-point gap across all category groups. Over the same 10-year period, total returns for U.S. equity funds averaged 15.9% per year, and investors earned dollar-weighted returns of 14.7%, on average.

Will Patience Pay Off?

There are still plenty of reasons for investors to be skittish. Inflation has failed to moderate as quickly as many investors previously hoped. After making several hikes in the federal-funds rate earlier this year, the Federal Reserve has recently taken a more hawkish tone, suggesting further tightening may be needed to tamp down inflation. At the same time, analysts have been ratcheting down estimates for quarterly earnings growth, and recession fears loom large for 2023.

Investors haven't been completely unflappable, either. As I covered in my previous article, many bond-fund investors have bailed out in response to this year's terrible returns for fixed-income securities, and that could still happen on the equity side. Monthly net flows dipped into negative territory in January, April, and August this year, and that trend could accelerate if market turbulence continues.

So far, though, equity-fund investors’ generally level-headed response to this year’s market turmoil is an encouraging sign. Things may get difficult in the short term, but investors who buy and hold usually reap rewards over time.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)