Markets Brief: 3 Things to Watch at This Week’s Fed Meeting

After another selloff in stocks and bonds, the Fed meeting could set the tone for the rest of this year.

With both stock and bond markets hitting a big air pocket thanks to a hotter-than-expected inflation report, all eyes are on this week’s Federal Reserve meeting.

In the markets, investors have once again ratcheted up expectations for how aggressive the Fed will need to be in order to tame inflation. The question is how will the central bank itself respond when it announces its latest decision on interest rates Wednesday afternoon, and what will officials signal about their thinking around future rate increases.

The spark for all this was last week's disappointing reading on inflation from the August Consumer Price Index report. Many in the markets had been looking for further signs that inflation was finally starting to cool. But while the CPI rose just 0.1% in August, the so-called core rate of inflation rose by a greater-than-expected 0.6% from July.

That set off a sharp downdraft in both stock and bond markets. The Morningstar US Market Index dropped 4.81% last week, its worst performance since mid-June, when stocks hit their bear-market lows.

Bond yields, meanwhile, continued their climb higher. The yield on the U.S. Treasury 10-year rose to 3.4% from 3.3% a week earlier. The move was more pronounced among short-term bonds more directly affected by Fed policy shifts. Yields on the Treasury 2-year rose to 3.8% from 3.6%.

Against that backdrop, what should investors focus on at the Fed meeting?

1. Expect Another Big Rate Hike

The Fed has already raised rates more aggressively than any time in the past four decades, lifting the federal-funds rate from zero at the start of the year to its current target of 2.25%. That included unprecedented back-to-back increases in the funds rate of 0.75 percentage points.

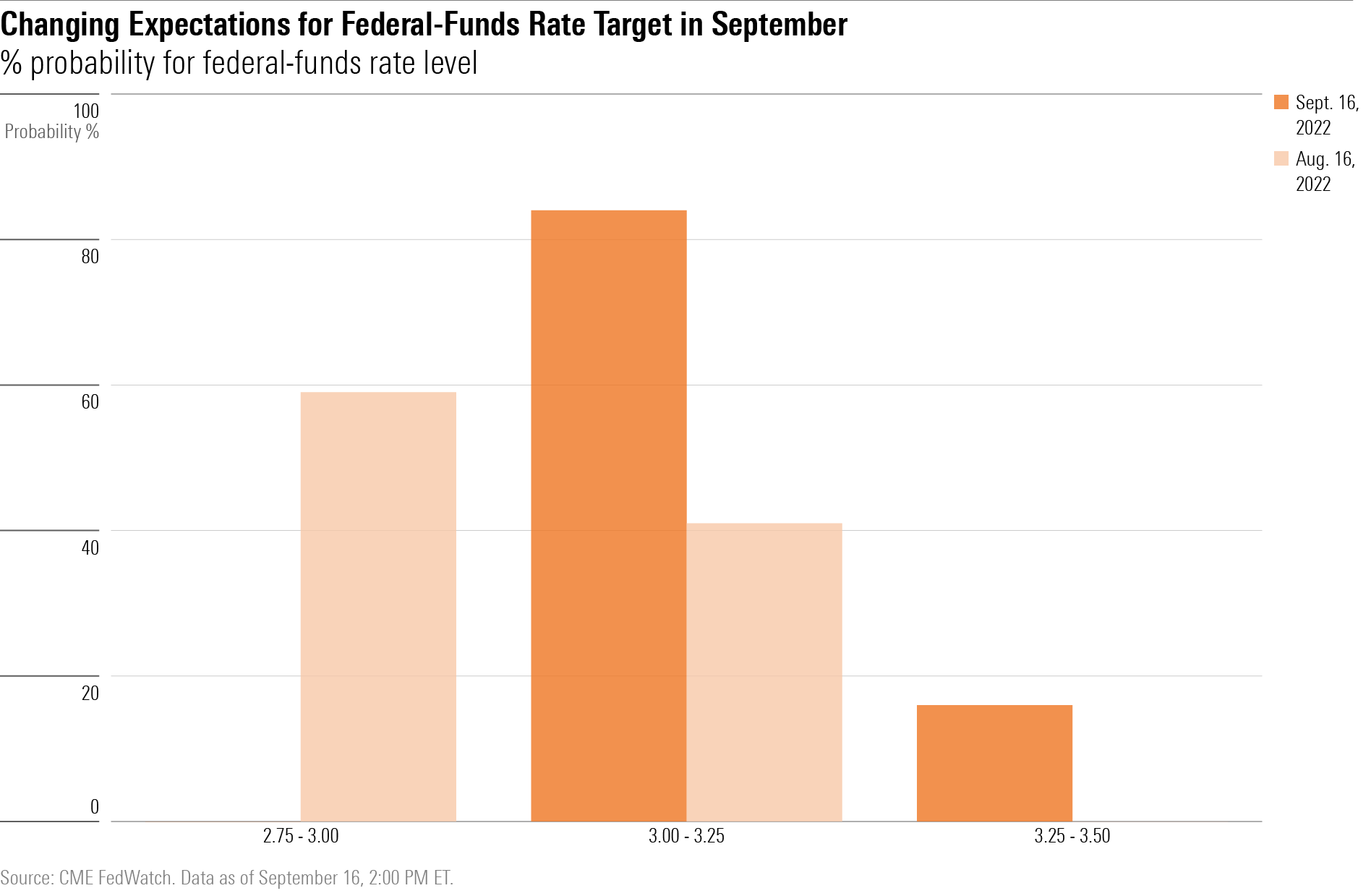

Following the CPI report, markets ratcheted up their expectations around the Fed meeting and now expect another three-quarter-point increase rather than 0.50 percentage points.

“The decision looks very firm, going from 50 basis points to 75 basis points,” says Jan Nevruzi, U.S. rates strategist at NatWest Markets. “Our forecast is that they will go with 75 basis points at this meeting, will probably maintain that pace in November, and maybe step down to 50 basis points in December.”

2. Watch the Dot Plot

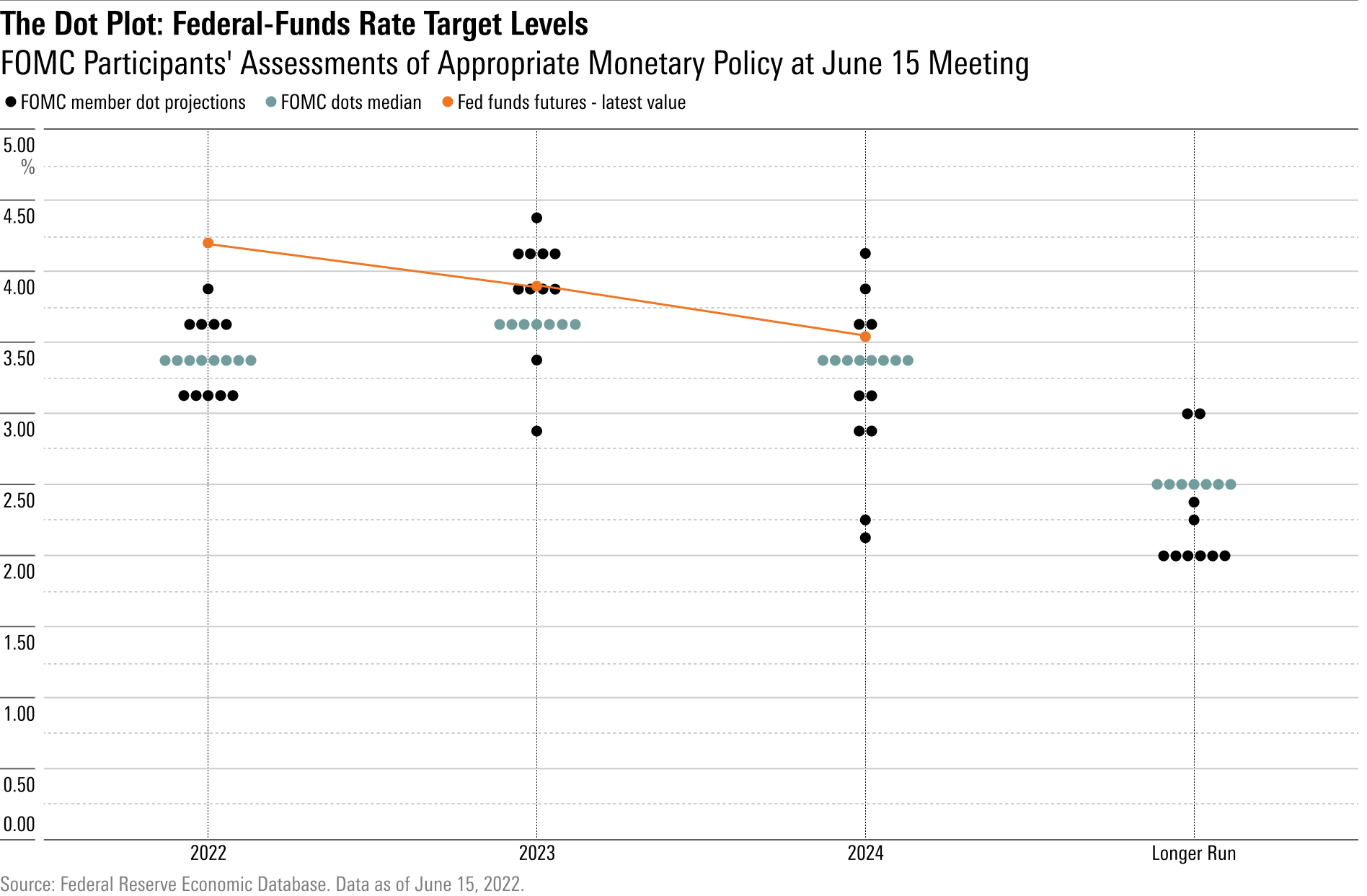

With expectations centered on another big rate increase in September, the question facing the markets is how high the Fed will take interest rates before they pause, or even start to lower them. For clues, look to what Wall Street refers to as the “dot plots.”

The dot plots reflect the individual projections of Fed officials when it comes to the economy and interest rates. While these simply reflect expectations, and don't set where policy will go, investors will be able to get a sense of the direction. Key projections to watch will be the ones on inflation and unemployment. Of particular interest will be the projections for the fed-funds rate.

“I’d be watching the dot plots…and what they are expecting for the end of this year and next year,” says Nevruzi. “The dot plot could show a number like 4.125% (for year-end) and 4.50% next year, and once that happens, the markets tend to track that pricing.”

3. Inflation Outlook

Underlying it all will be the Fed’s discussion of the outlook for inflation in the announcement, projections and press conference by Fed Chair Jerome Powell Wednesday afternoon. One critical question is how the Fed will characterize the latest inflation report. Analysts note that the problem areas of the CPI were in costs that tend to change slowly, such as rents or healthcare. The question then becomes how confident the Fed is that inflation will be trending down toward its 2% target rate.

In addition, the Fed’s views on wage pressures will be important, says Kathy Jones, chief fixed income strategist at Charles Schwab. “The Fed is very, very focused on wage gains, and those are still running high,” she says. “If the whole point of this is demand destruction, we’re going to have to see wage growth slow down.”

Events scheduled for the coming week include:

- Monday: AutoZone AZO reports earnings.

- Tuesday: Federal Reserve Open Market Committee meeting starts.

- Wednesday: FOMC meeting concludes. General Mills GIS reports earnings.

- Thursday: FedEx FDX, Costco COST, and Lennar LEN report earnings.

For the trading week ended Sept. 16:

- The Morningstar US Market Index fell 4.81%.

- All sectors were down for the week, with basic materials, which fell 7.00%, and technology, off 6.29%, declining the most.

- Yields on the U.S. 10-year Treasury rose to 3.45% from 3.32%.

- West Texas Intermediate crude oil prices fell 1.94% to $85.11.

- Of the 851 U.S.-listed companies covered by Morningstar, 63, or 7%, were up, and 788, or 93%, declined.

What Stocks Are Up?

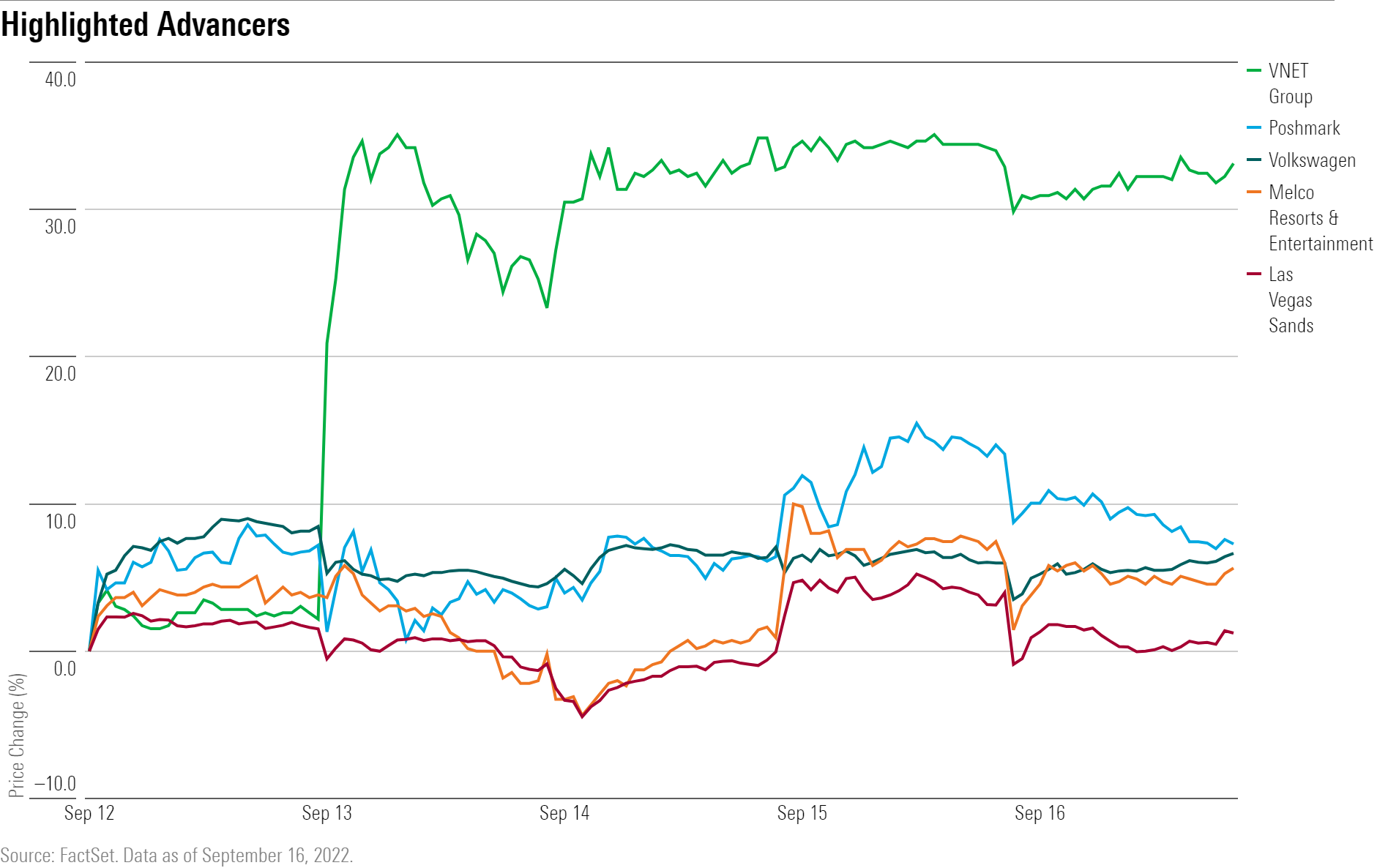

Chinese data center operator VNET Group VNET rallied on news that founder Josh Sheng Chen made an offer to take the company private at $8.20 per ADR share. The shares closed the week at about $6.

A handful of stocks in the consumer cyclical sector also finished higher, led by Poshmark POSH, Nio NIO, and Volkswagen VWAGY, which recently announced plans to launch an IPO of its Porsche subsidiary.

Travel and leisure stocks rose, with Royal Caribbean RCL and Norwegian Cruise Line NCLH up for the week. Shares of gaming companies Melco Resorts and Entertainment MLCO and Las Vegas Sands LVS also gained.

What Stocks Are Down?

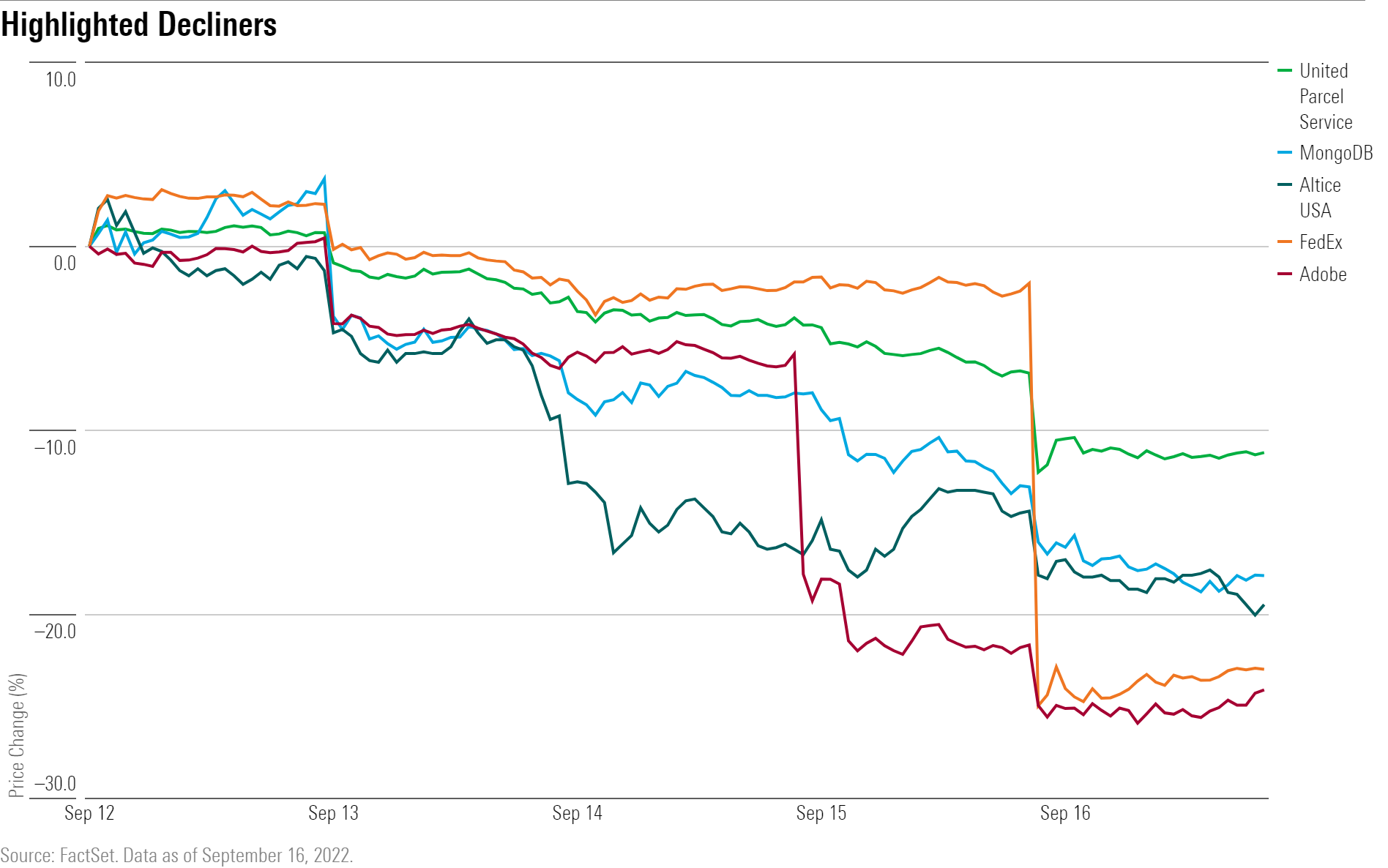

Adobe ADBE plunged following news that the content creation software company would purchase privately held competitor Figma for $20 billion. The deal prices Figma at 50 times its annualized recurring revenue.

FedEx FDX disclosed preliminary earnings that led to a selloff by investors. The logistics company said package volume slid faster-than-expected during its fiscal first quarter, while earnings per share came in at $3.44, below estimates of $5.14.

"Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S.,'' FedEx's chief executive Raj Subramaniam said in a statement. "We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first-quarter results are below our expectations."

The company is expected to release its fiscal first-quarter results on Sept. 22. Shares of United Parcel Service UPS also fell.

Also among the worst performers in the past week were technology and communication services firms such as Altice ATUS, MongoDB MDB, Western Digital WDC, and Meta Platforms META.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)