Why Are Utility Stocks Doing So Well?

Margins may be trapped between an inflation rock and a regulation hard place, but investor enthusiasm for utility stocks has been anything but squeezed.

It’s been a strong year for utilities stocks, as investors have flocked to these dividend paying names.

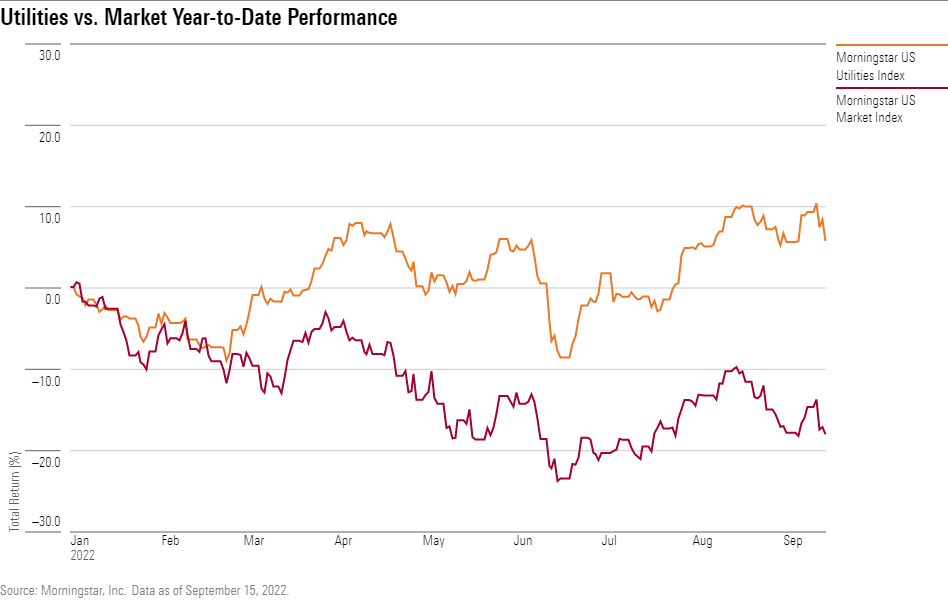

Utilities stocks are up 5.66% year-to-date according to the Morningstar US Utilities Index, greatly outpacing the overall market, which is down 18.10% in the same period. Top performers among utility stocks this year include Sempra Energy SRE, which rose 31.12% for the year, and Consolidated Edison ED, which is up 17.43%.

Normally that might not be a surprise. In times of market turmoil, investors often favor these stable companies as a defensive play.

However, this year is different. Inflation is raging and interest rates have surged—two factors that normally would be a negative for utilities stocks, especially given that state-level regulations limit the ability of utilities to pass on higher energy costs to their consumers. Not only that, utilities stocks were already expensive coming into 2022, and valuations have become even more stretched.

So what’s driving the continued rally in utilities stocks?

Normally Stable Utility Stocks May Enter a New Era of Growth

Investors typically flock to utility stocks during periods of economic uncertainty due to their stable revenue and high dividend yields.

“Utilities are names that will not disappoint. Businesses are very stable and not really subject to the ups and downs of the economy,” says Raheel Siddiqui, senior research analyst and managing director at Neuberger Berman. Utilities also have “great earnings quality,’’ Siddiqui says.

“Earnings quality is insensitive to economic growth, utilities are that,’’ he says. “They have all the right characteristics to be doing well in this environment.’’

The stability of utility companies may not be the only factor in their ability to attract investors as of late. The federal government, thanks to the Inflation Reduction Act, also known as IRA, along with state and local governments, have increased their efforts when it comes clean to energy investment. That will create new opportunities for utility companies to expand over the next decade, Morningstar senior equity analyst Travis Miller says.

“There is better long-term growth in the industry now than ever before,” says Miller.

That is a reversal from conditions at the start of the year, when solar and wind growth in the U.S. faced headwinds from inflation and tariffs on solar panel imports from Asia.

“A lot of that has now gone away,” says Miller. “The IRA and state policy has created incentives to expand renewable energy at any price…2023 looks like it’ll be a pretty robust year of solar and wind growth [now].”

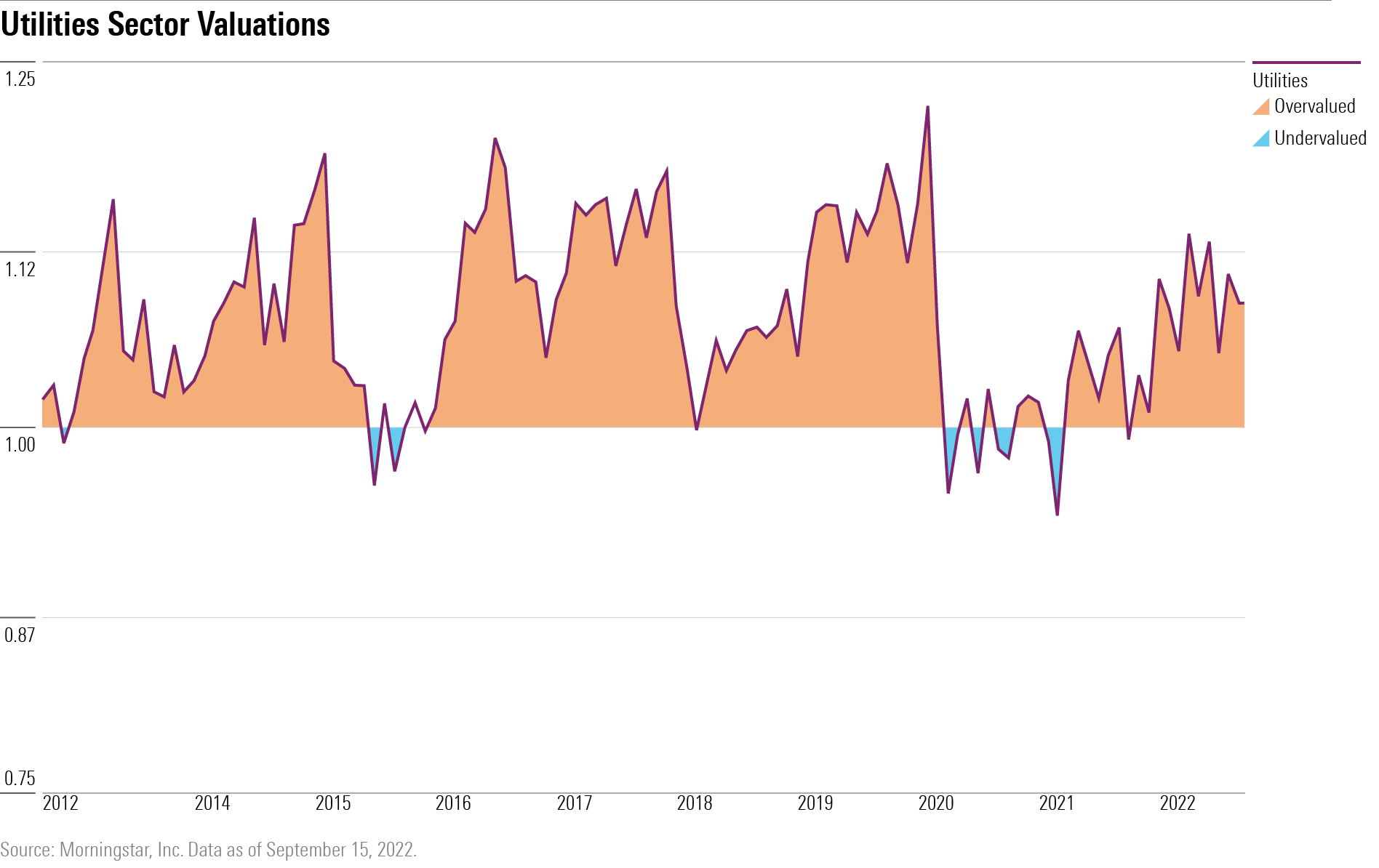

All of that has contributed to investor’s enthusiasm, which has driven up valuations and made utilities the most overvalued stock sector in the market, according to Morningstar analysts. As of Sept. 15, it trades at an 8% premium relative to Morningstar’s Fair Value Estimates.

Of the 37 U.S.-listed stocks covered by Morningstar analysts, 26 are overvalued, with both Xcel Energy XEL and CMS Energy CMS trading at the highest premium to their fair value estimates, about 26%, in the group. Ten stocks are fairly valued, and only one is considered undervalued: NiSource NI, which trades at a discount of 9%.

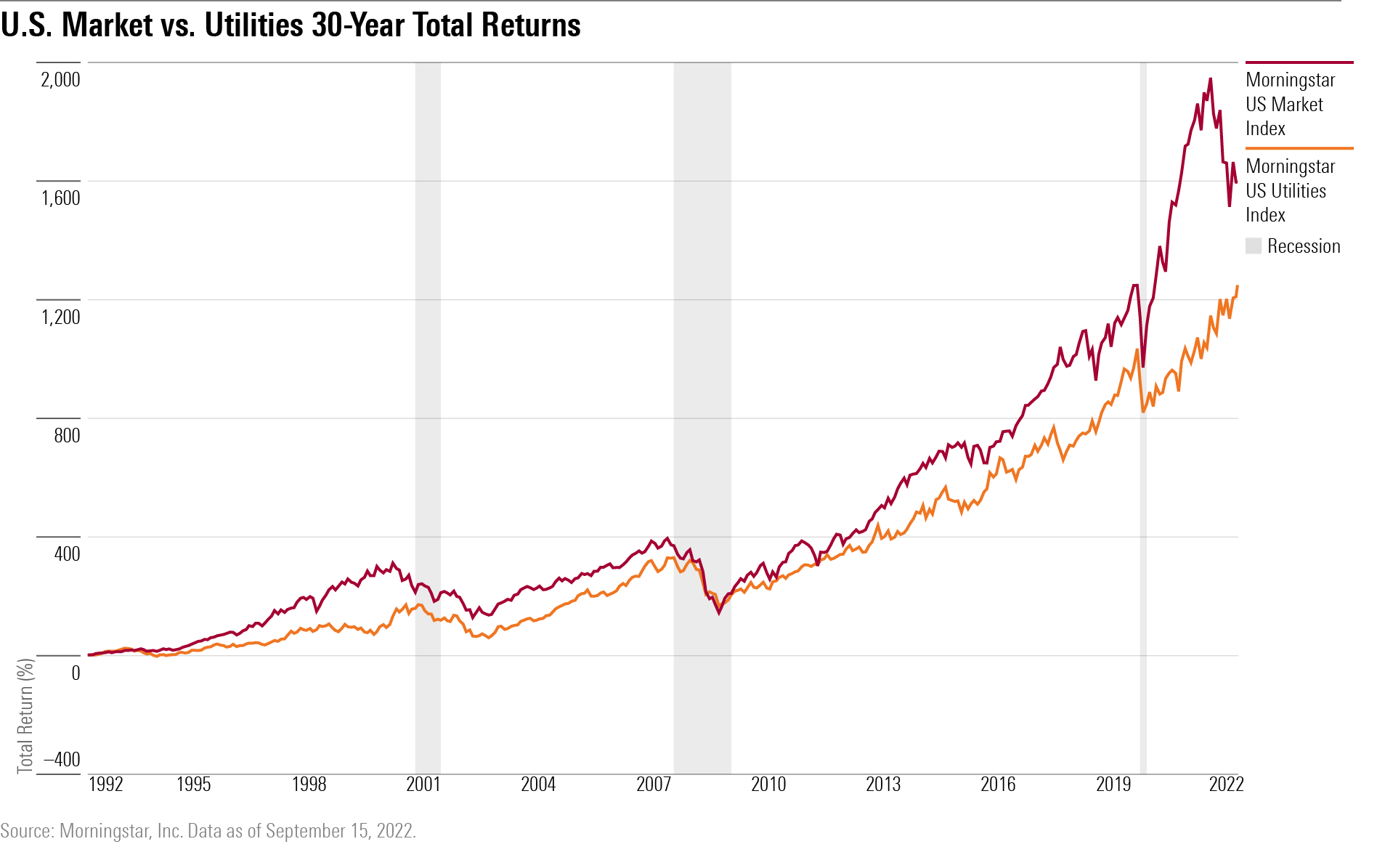

“I’m not surprised if they’ve gotten expensive, but I would not be surprised if they get even more expensive,” says Siddiqui. In periods of economic downturns, it is common for utility stocks to become even more expensive as investors covet their stability. In the past 30 years the sector has seen an annualized total return of 8.97%, almost keeping in pace with the broader market’s 9.80%.

Miller points out that there are two major differences between utilities’ performance over the last 30 years, even during economic downturns, and what’s happening now: inflation was never this high and rates were not rising this rapidly.

Inflation, Interest Rates Could Hurt Utilities More Than Other Sectors

“Interest rates and inflation hit utilities on a more fundamental basis than they do other companies,” Morningstar’s Miller says. “It’s unusual relative to past history that utilities would be the second best-performing sector when you have sky-high inflation and interest rates rising higher.”

On the inflation front, rising prices increase input costs for utility providers. While some businesses in other sectors can raise their prices to help offset inflation, utility providers can’t echo that strategy to the same degree since regulators place limits on how much they can charge consumers.

“Their business models do not keep up with inflation,’’ Miller says “They have a fixed amount of potential revenue, but their costs can keep going up.”

On top of that, utility providers are one of the most leveraged businesses in the country, aside from banks, leaving them especially sensitive to rising interest rates. Higher rates means higher borrowing costs, another way in which utility companies’ costs could increase.

“We see these [interest rates and inflation] as long-term risks for the sector,” Miller says. While he anticipates more growth opportunities for utility companies, that growth may be offset depending on how high inflation remains, and how long the Federal Reserve keeps interest rates elevated.

“To me that suggests we’re going to see lower returns in the sector than we have seen in the past,” Miller says.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)