What Bond-Fund Investors Get Wrong

Consider seizing the opportunity, not fleeing it.

Broadly Successful

My colleague Amy Arnott once asked, “Are Bond Investors Making a Mistake by Bailing Out?” A fine question.

Let us start at the beginning. Historically, mutual fund investors have been regarded as the suckers at the table. Atop the investment hierarchy are the institutional giants, such as California’s fund for public employees, CalPERS. Then come smaller organizations, followed by individual investors who buy their securities directly (with or without the assistance of financial advisors). At the bottom are those who invest in pooled funds, while paying fees for that privilege.

To some extent, that belief makes sense. As detailed by Morningstar’s long-standing study, “Buy the Unloved,” zigging when fund shareholders zag can be profitable. Frequently, fund investors err by chasing category-level returns, such as (for example) buying growth stocks after they have risen, or by selling energy stocks after they have declined. Perhaps their alleged investment superiors make similar mistakes, but if so, we cannot know. The data is lacking.

Viewed more widely, though, fund investors have confounded the skeptics by achieving two major successes. One has been to select good funds. Although shareholders have sometimes pursued the wrong investment categories, their choices within those categories have been sound. The second has been their stock market timing. By and large, equity-fund investors have behaved similarly through both bull and bear markets. Their consistency has served them well.

Stock Funds: No Harm, No Foul

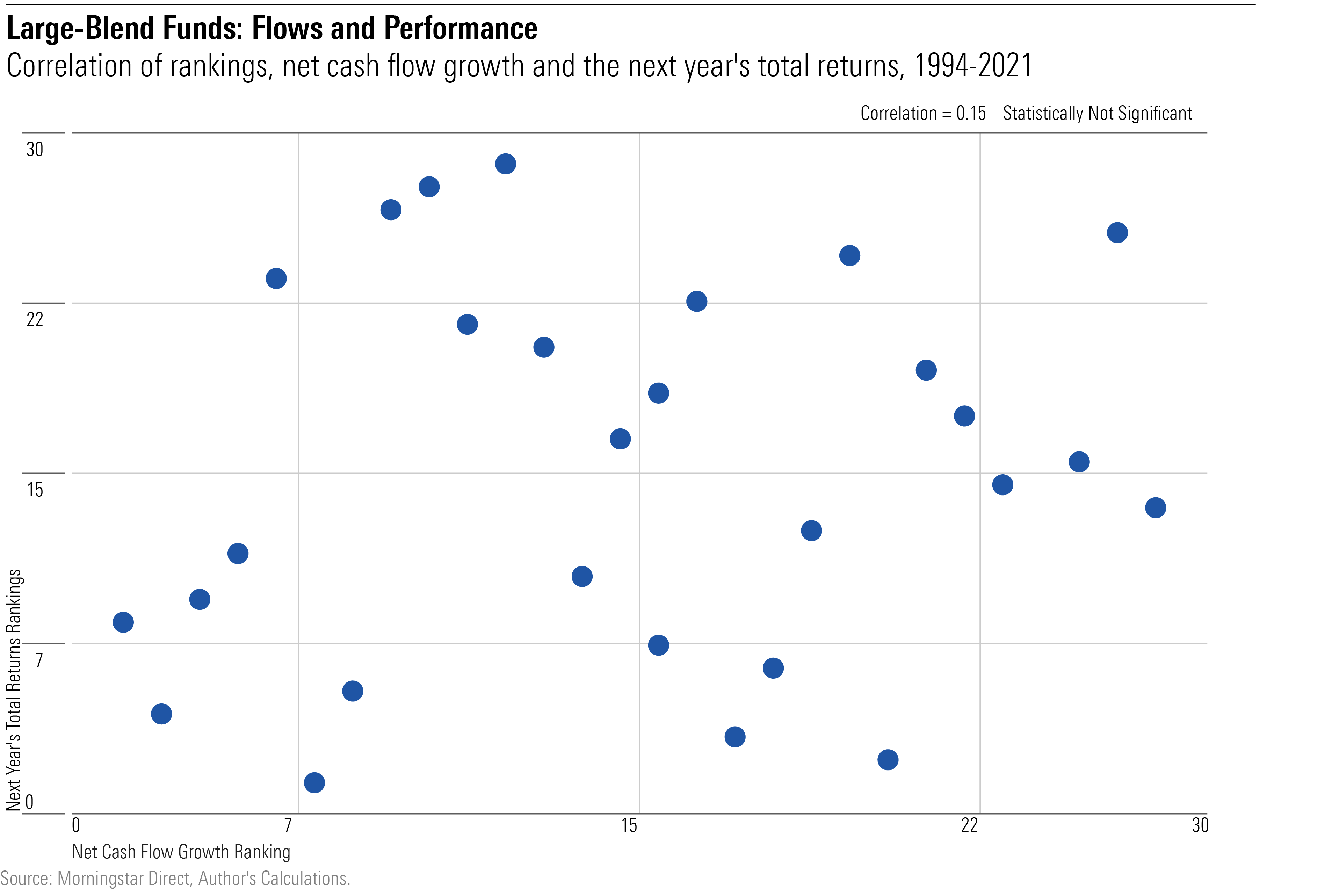

The evidence: For each year from 1994 through 2021, I measured the popularity of large-blend U.S. stock funds (both mutual funds and exchange-traded funds), by dividing the net sales recorded by those funds by their starting-year assets. (In some cases, the sales were negative, indicating that the category suffered net redemptions.) I then ranked each year’s sales percentage, with 1 being the highest and 28 the lowest, and compared those rankings with those of the next year’s total returns.

Had investor foresight about the following year’s performance been perfectly good, the correlation among rankings would have been 1.0. The highest sales percentage would have occurred just prior to the highest investment performance, the second-highest sales before the second-highest returns, and so forth down to the 28th ranking. In contrast, perfectly bad foresight would have led to the rankings being consistently reversed, with a correlation of negative 1.0.

As the actual correlation was 0.11, large-blend fund shareholders benefited slightly from their short-term timing. However, as suggested by that relatively low figure, the finding is not statistically significant. To generalize, equity-fund shareholders were neither wise nor foolish. Sometimes they dumped their stock funds during bear markets, but other times, as through 2001, 2002, and 2008, they persisted through difficulties and were rewarded soon thereafter.

If stock-fund investors were not entirely prescient, neither were their rivals. Aside from hedge funds, which did in fact dodge the New Millennium technology-stock crash, elite investors seem not to have better anticipated the stock market’s gyrations. They may even have fared worse. According to this study, pension funds entered the 2003-07 bull market holding fewer equities than they did prior to the 2008 global financial crisis. If those numbers are correct, pension-fund managers erred where everyday shareholders did not.

Bond Funds: Bad Timing, Bad Results

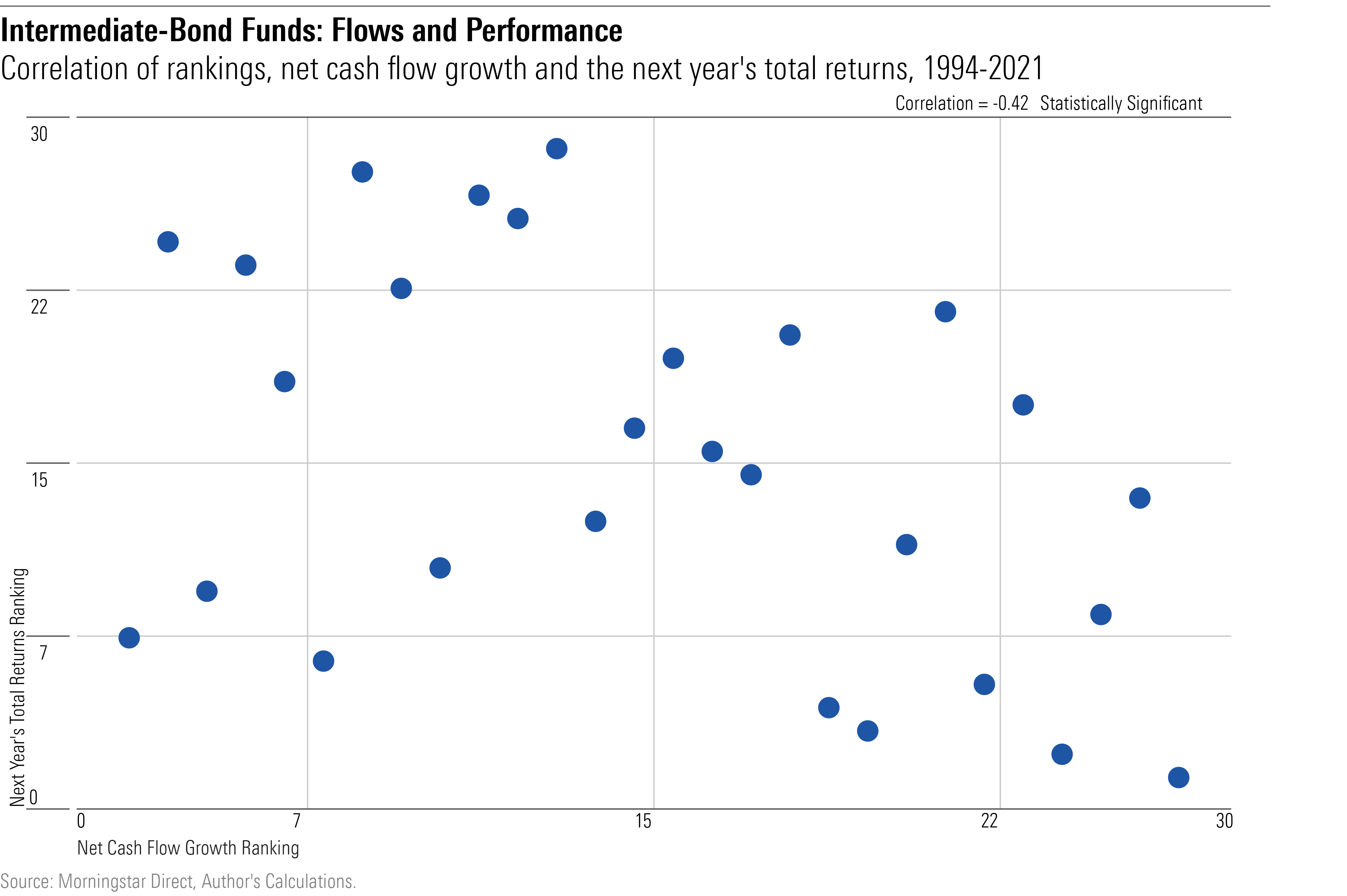

Regrettably, when conducted for largest fixed-income category, intermediate-bond funds, the same exercise yields a different conclusion.

The dots drift downward and to the right. In other words, the lower a year’s cash flows into intermediate-term bond funds, the likelier that those funds will post strong returns in the subsequent 12 months. The correlation is statistically significant. According to the numbers, the likelihood that these results happened accidentally is less than 3%.

The reason for this unsatisfactory outcome is as Amy stated: Whenever intermediate-bond funds lose money, their shareholders reliably head for the exits, or at the least, slow their fund purchases. They did so in 1994, and again in 1999, and again in 2008, and again in 2013, and again in 2015, and again in 2018. After making an exception last year, when inflows were robust despite market losses, they have resumed their customary ways this year.

The tradition has not been helpful. While bond yields have declined for almost four decades, from their 1981 peak to their 2020 trough, their shorter-term movements have often featured reversals. One year’s spike has presaged the next year’s recovery. Thus, the three best performances for intermediate-bond funds occurred in 1995, 2000, and 2009—years that directly followed bond-fund losses.

By now, intermediate-bond funds have accumulated enough assets—$1.2 trillion—that their investors’ returns are not hugely affected by any single year’s activities. Nevertheless, the effect of the cash flows has been greater than I had expected. During both 2019 and 2020, net sales of intermediate-bond funds totaled more than 12% of the category’s assets. That is a meaningful amount.

Wrapping Up

Amy concludes her article by arguing that if bonds appealed to investors before this year began, because of the benefits that they bring to a diversified portfolio, then they should continue to do so. I wholeheartedly agree, albeit with the caveat that when yields on bonds are abnormally low, one may wish to swap them for cash and/or very short notes. To which I would add: When bond-fund prices fall, their shareholders would be well served not to think of the monies lost, but instead the prospect gained. Lower prices lead to higher yields, and thereby a higher expected future return. Consider seizing the opportunity, not fleeing it.

This article was originally published on Dec. 14, 2022. The views expressed here are the author’s.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)