How Has Private Equity Investing Fared for Mutual Funds?

Fund companies have embraced ownership of ‘unicorn companies,’ with mixed results.

Private equity investing has continued to gain steam and investor interest.

According to PitchBook, the number of unicorns, or private companies valued over $1 billion, has ballooned from 39 in 2013 to more than 1,200 as of September 2022. And while mutual fund investment in these companies has resulted in its share of success stories, it has also yielded disappointments.

This update of Morningstar's original 2016 "Unicorn Hunting" report assesses the historical trends of U.S.-domiciled open-end diversified U.S. equity mutual fund ownership of private-firm equities between Jan. 1, 2007, and June 30, 2022. It excludes exchange-traded funds and funds of funds.

Historical Context: Firms That Paved the Way in Private Equity Investing

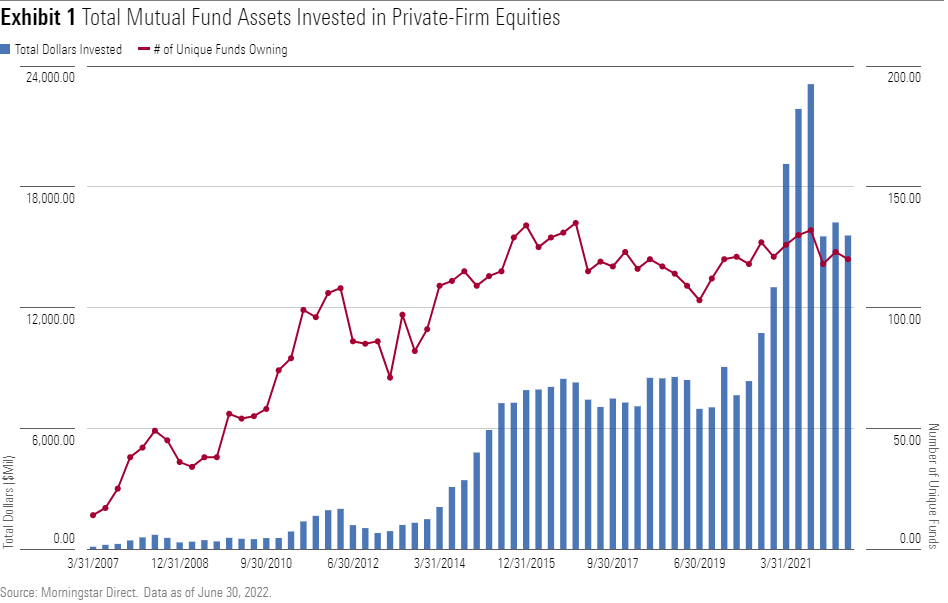

Mutual fund ownership of private-firm equities exploded in the last decade and a half. At the start of 2007, a little more than $110 million of mutual fund assets were invested in private-firm equities across nine fund families and 14 funds. That number grew to $23 billion in late 2021 before falling to roughly $15 billion as of June 2022 as the broad market declined and a number of widely held private-firm equities went public.

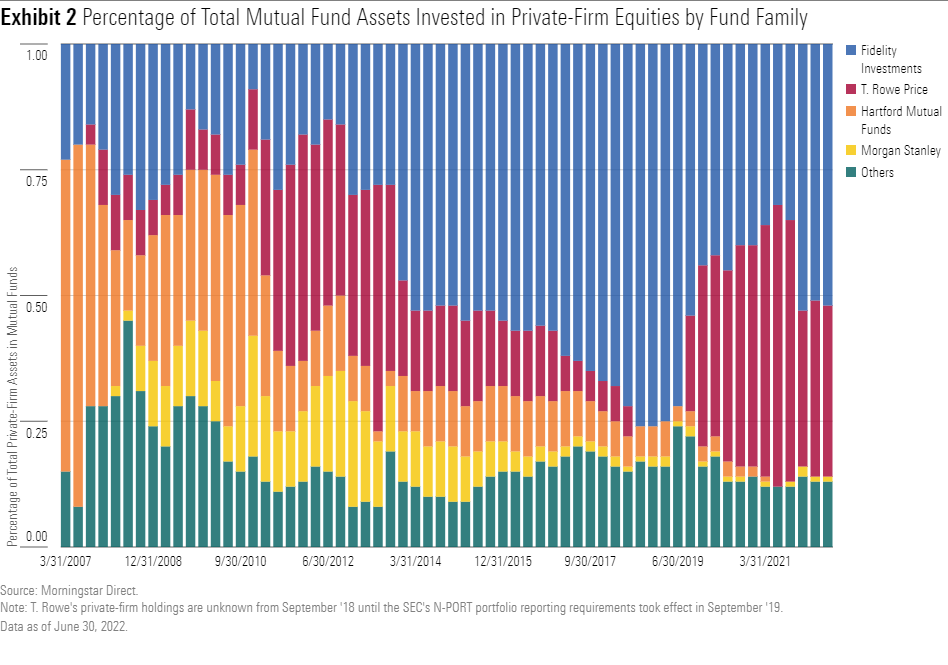

As seen in Exhibit 2, since 2013, Fidelity frequently accounted for more than half of the total mutual fund assets invested in private-firm equities, with its stake growing to nearly $8 billion as of June 2022 from less than $250 million at the end of 2012.

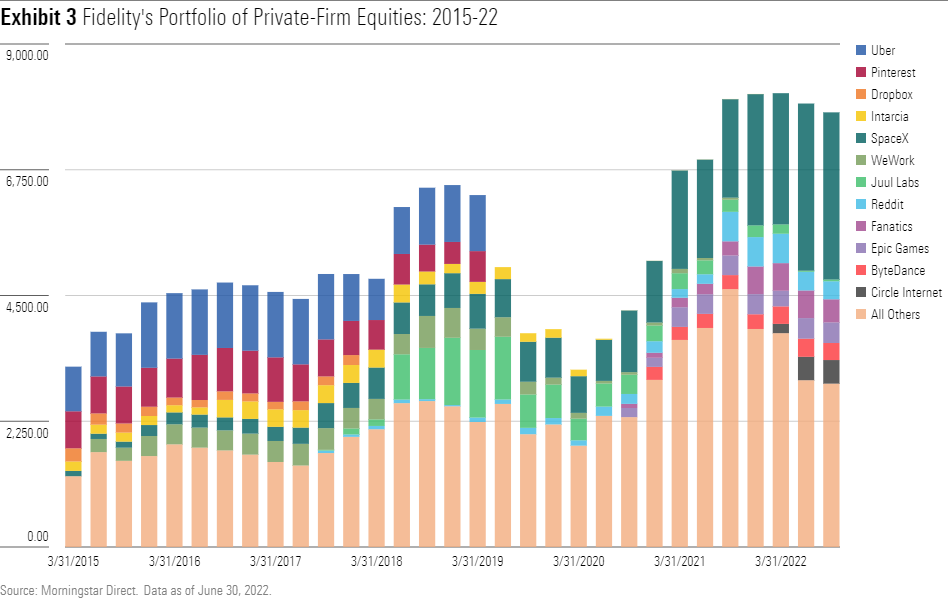

Fidelity's mutual funds, including Fidelity Contrafund FCNTX, made their first big private-firm equity investment with Dropbox DBX in May 2012. Investments in private-firm equities such as Intarcia Therapeutics, Cloudflare NET, Roku, Pinterest PINS, Moderna MRNA, MongoDB MDB, and Uber Technologies UBER followed.

As of June 2022, more than half of Fidelity’s $8 billion in 100 private-firm equities were in just four companies: SpaceX, Fanatics, Circle Internet, and Epic Games. Elon Musk’s SpaceX comprised more than a third of the total stake.

T. Rowe Price’s small- and mid-cap funds, particularly T. Rowe Price New Horizons PRNHX, were among the first to invest in private-firm equities. The firm's overall private-firm equity stake in its mutual funds rose to a peak of nearly $12 billion in late 2021 from $872 million at the end of 2011 before falling to $5.2 billion as of June 2022, mostly because of Rivian Automotive RIVN going public in November 2021.

As Fidelity and T. Rowe Price ramped up their activity in private markets, several firms pulled back. Wellington, which subadvises several Hartford and Vanguard mutual funds, stopped investing in new private-firm equity opportunities in open-end mutual funds by the late 2010s. Meanwhile, Morgan Stanley Investment Management got more selective after some illiquid private-firm equity positions got too big in its small- and mid-cap funds because of outflows.

The Current State of Private Equity Investing

As of June 2022, 113 U.S.-domiciled, diversified U.S. equity mutual funds across 27 fund families owned at least one private-firm equity, accounting for over $15 billion in total investments. Such investments represented 5.8% of the 1,961 distinct U.S. equity funds in Morningstar’s database.

Most funds maintained modest positions in private-firm equities, with the median exposure just 0.5% of portfolio assets. It is rare to see funds place more than 10% of assets in private-firm equities, though it happens. As of June 2022, Baron Focused Growth BFGFX held 11.7% of assets in SpaceX, which it has owned since September 2017.

T. Rowe Price New Horizons, the largest non-Baron holder of private-firm equities, spread its 8.8% stake across more than 50 companies.

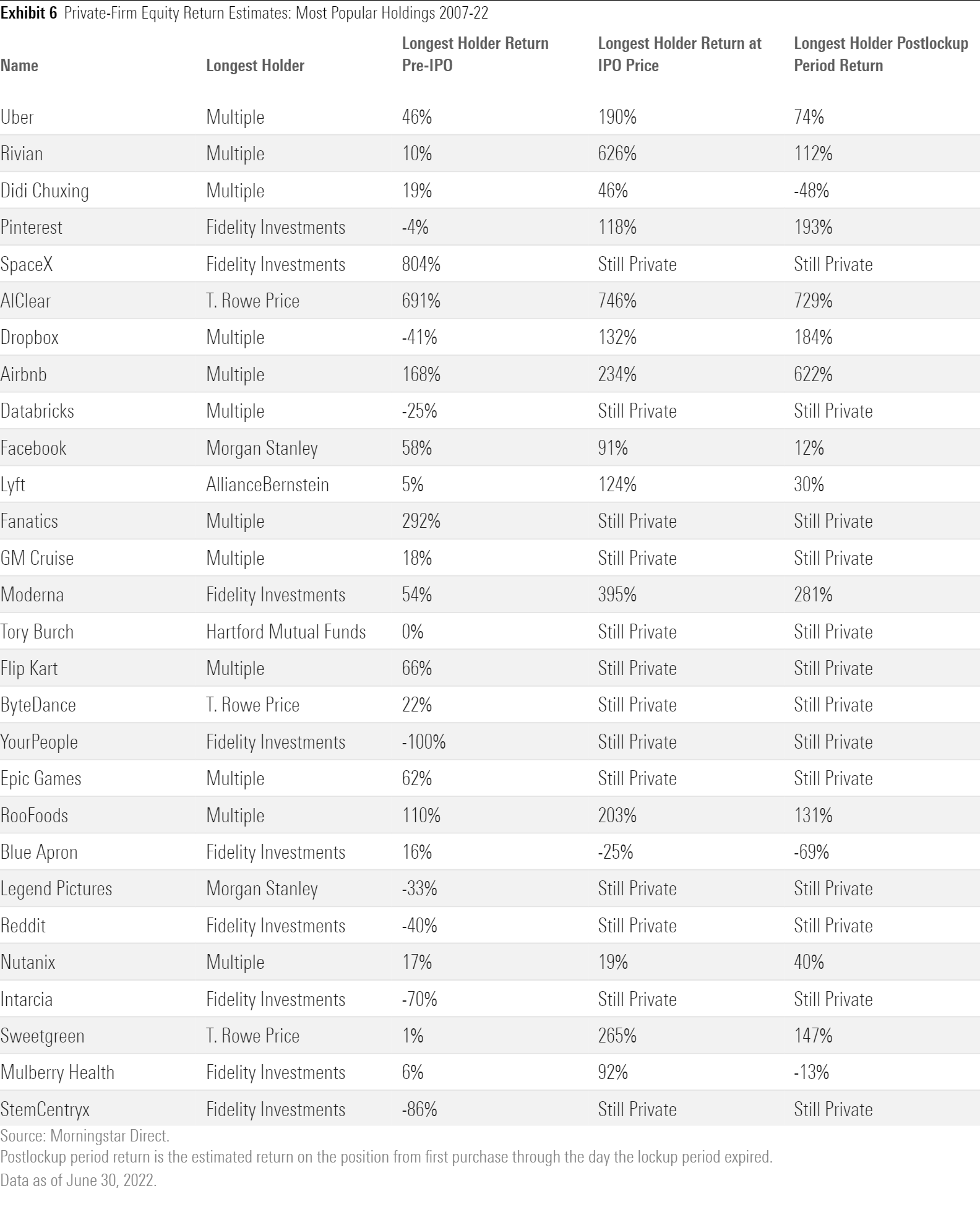

Popular Private-Firm Equity Holdings Over Time

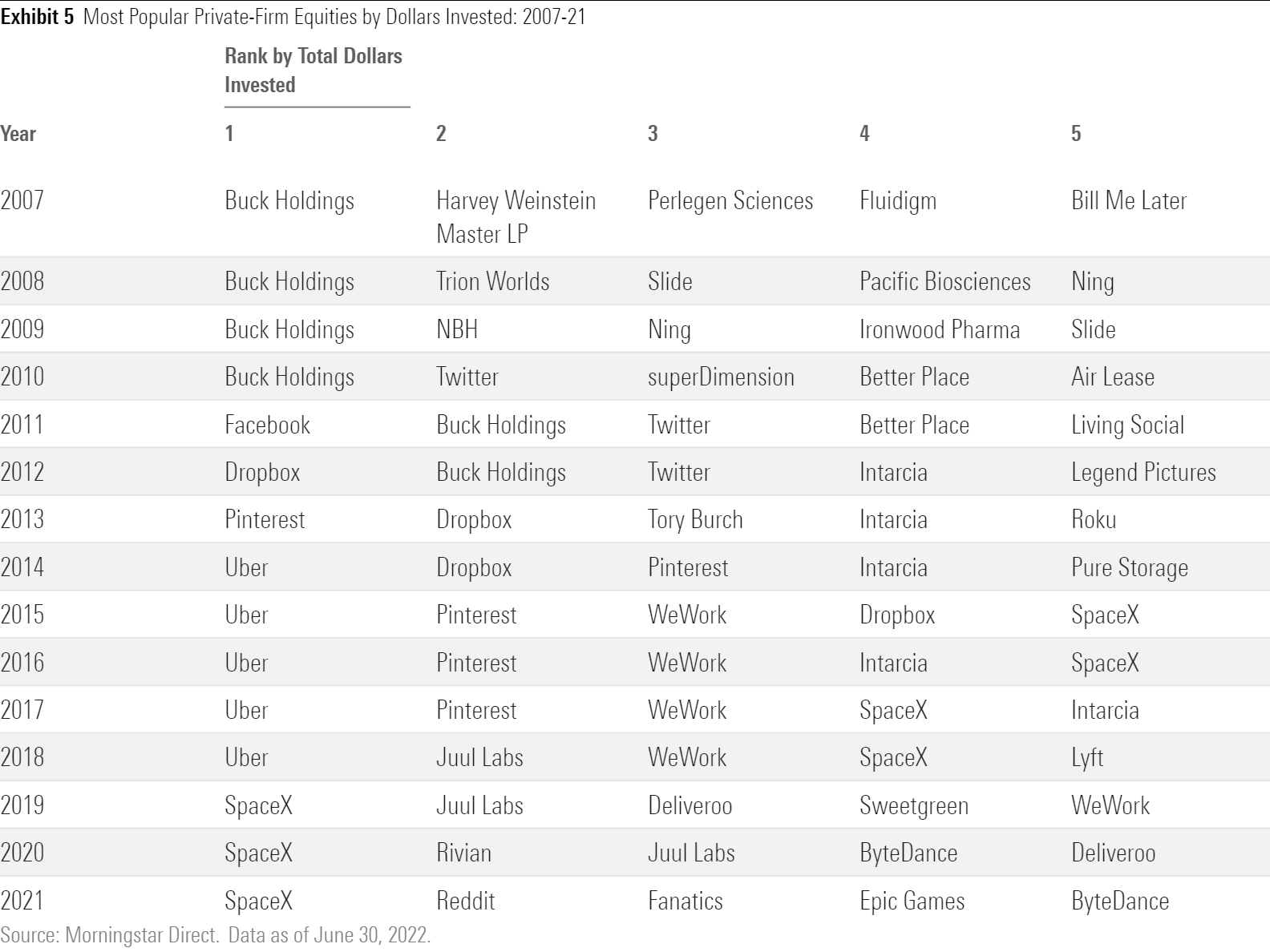

Mutual funds' most popular private-firm equity position in dollar terms from 2007-10 was not a flashy startup. Wellington, Goldman Sachs, KKR, and others backed Buck Holdings to take Dollar General DG private in 2007.

From 2011 on, though, more of the familiar technology and software household names began to dominate.

The rewards of Facebook (now Meta Platforms META) and Twitter's TWTR IPOs to mutual funds inspired more fund companies to try private-firm equity investing in the mid-2010s. Ride-share company Uber, which went public in May 2019, was the most widely held private equity holding from 2014 to 2018.

Cautionary Tales of Private Equity Investing

Amid the excitement around investing in private companies, fund companies should still proceed cautiously; several hot companies have collapsed shortly before or after their IPO.

- WeWork. The WeWork fiasco of 2019 caught many funds off guard. It became a popular holding in 2014 when funds from eight mutual fund families initiated positions at $15-$16 per share in late 2014. Some funds later valued their WeWork stakes to reflect paper gains of 300% to 600%. Concerns about the company's governance and CEO Adam Neumann's conduct surfaced in 2019, and the much-anticipated IPO was eventually canceled. Fund companies began slashing their valuations. By March 2020, for instance, T. Rowe had written down its shares to $3.60, nearly 80% from what it paid and 95% from the shares' late 2018 apex. Eventually, WeWork went public in October 2021, but it was still a failure for the mutual funds that owned it.

- Didi Global. Didi Global is another cautionary tale. One fund family let more ride on it than others. Davis Global Advisors had bought stakes in Didi for several of its funds by June 2016 at $9.56 per share and added to the positions later. Davis Opportunity's RPEAX Didi stake, for instance, stood as high as 4.6% in March 2020, on top of a 5.2% stake in Grab, a Singapore-based ride service in which Didi invested. Its total private-firm equity stake was almost 13%—near the SEC's 15% limit. Shortly after the June 2021 IPO at $14 per share, the Chinese government put the company under cybersecurity review and forced its apps out of service, rocking the stock. By the time the conventional 180-day lockup period ended in December 2021, the stock traded at nearly half what Davis first paid for it. Davis Opportunity still had the currently delisted Didi on the books at $2.50 per share as of June 2022, nearly three fourths less than what it paid for it.

- Intarcia Therapeutics. Biotech company Intarcia Therapeutics raised $210 million in November 2012 for its one prominent product, an implantable Type 2 diabetes treatment. Alger Funds invested in the company in 2014, and it reached a $4.1 billion peak valuation in August 2017. Intarcia, however, went out of business in November 2020 after the United States Food and Drug Administration twice rejected its treatment application. Alger SMid Cap Growth, now known as Alger Weatherbie Specialized Growth ALMCX, put as much as 5.7% of its portfolio in Intarcia in December 2016, and Alger Small Cap Growth's ASCYX stake peaked at 1.3% in June 2017. Alger sold in July 2019 after writing it down more than 70%.

- Blue Apron. Meal-kit provider Blue Apron highlights how private-firm equities stay risky even after their IPOs. Blue Apron raised more than $100 million from 11 Fidelity funds in May 2015. It never exceeded more than 0.15% of any Fidelity portfolio, which proved prudent. Fidelity sat on a 16% cumulative paper gain as Blue Apron's IPO approached in June 2017, but the stock tanked once it began trading. By the time the six-month lockup period expired in December 2017, it had fallen 60%. Fidelity lost roughly 70% from purchase.

Big Winners in Private Equity Investing

While the blowups make the press, there are plenty of success stories, too.

- Airbnb. Airbnb ABNB was a best-case scenario. Fidelity, T. Rowe Price, and Morgan Stanley in April 2014 each paid $20.36 per share after adjusting for subsequent stock splits. By the time Airbnb neared its IPO, most mutual funds had seen 100%-200% gains. The stock hit a high of $165 before closing at $145 on its first trading day. On paper, mutual funds saw gains as high as 700%. Airbnb did not suffer a post-IPO hangover like some other newly public companies. By the time its lockup period expired, the stock traded around $145, and mutual funds were able to realize gains of more than 600%.

- UiPath. Business software firm UiPath PATH raised over $400 million before 2019's second quarter, when it first showed up in Fidelity and T. Rowe funds at $13.12 per share. UiPath went public in April 2021 at $56 per share, more than quadrupling Fidelity and T. Rowe's money in fewer than two years on paper. Even after retreating a little during the 180-day lockup period, the fund companies saw a market-beating, nearly 300% gain.

- SpaceX. Elon Musk's Space Exploration Technologies was the most popular private holding in mutual funds as of June 2022 in absolute dollars. Fidelity owned $2.9 billion, and Baron funds held $800 million. On paper, SpaceX, whose June 2022 fundraising round valued it at $70 per share, has been a huge winner. For Fidelity, that amounted to an 800% paper gain on its initial investment, and for Baron, 364%.

Fund Companies' Role in Responsible Private Equity Investing

As the number of unicorns has increased and mutual fund ownership of private-firm equities has grown, it’s worth remembering that not every unicorn will be a home run. The onus is on fund companies to perform robust due diligence upfront and manage risks appropriately.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)