5 Clean Energy Funds to Consider

Plus, options for investing in lithium and electric vehicle ETFs.

With the passage of the landmark climate bill last summer and the EPA’s proposed emissions standards intended to spur the adoption of electric vehicles, the clean energy transition is now in full swing. While the thesis for investing in the transition is strong over the long term, investors will likely have to weather short-term volatility due to regulations still needing to be finalized, higher interest rates, and the difficulty of picking winners in a competitive environment consisting of startups and giants. Investing in a clean energy fund is one way to hedge one’s bets and reduce volatility while sharing in the promising long-term upside of the energy transition.

When it comes to choosing a fund to provide thematic exposure to clean energy and EVs, investors have an array of choices. A number of funds have launched in the past year or two that reference the energy transition and climate solutions as broad themes. But several more-seasoned ETFs exist that focus more specifically on renewable energy, electric vehicles, and battery technology. Even among these, there is a fair amount of variation in their investment approach.

The five clean energy ETFs discussed below invest in companies producing renewable energy and in “clean tech” companies providing the technology that supports the development of renewable energy, including energy storage and efficiency solutions. Clean energy ETFs differ in a number of important ways. Investors need to consider whether they want mainly U.S. exposure or global exposure, how much small-cap exposure to take on, and concentration risk. Not all devote assets to EVs and related technologies, so I will also take a look at some ETFs that are specifically focused on those areas.

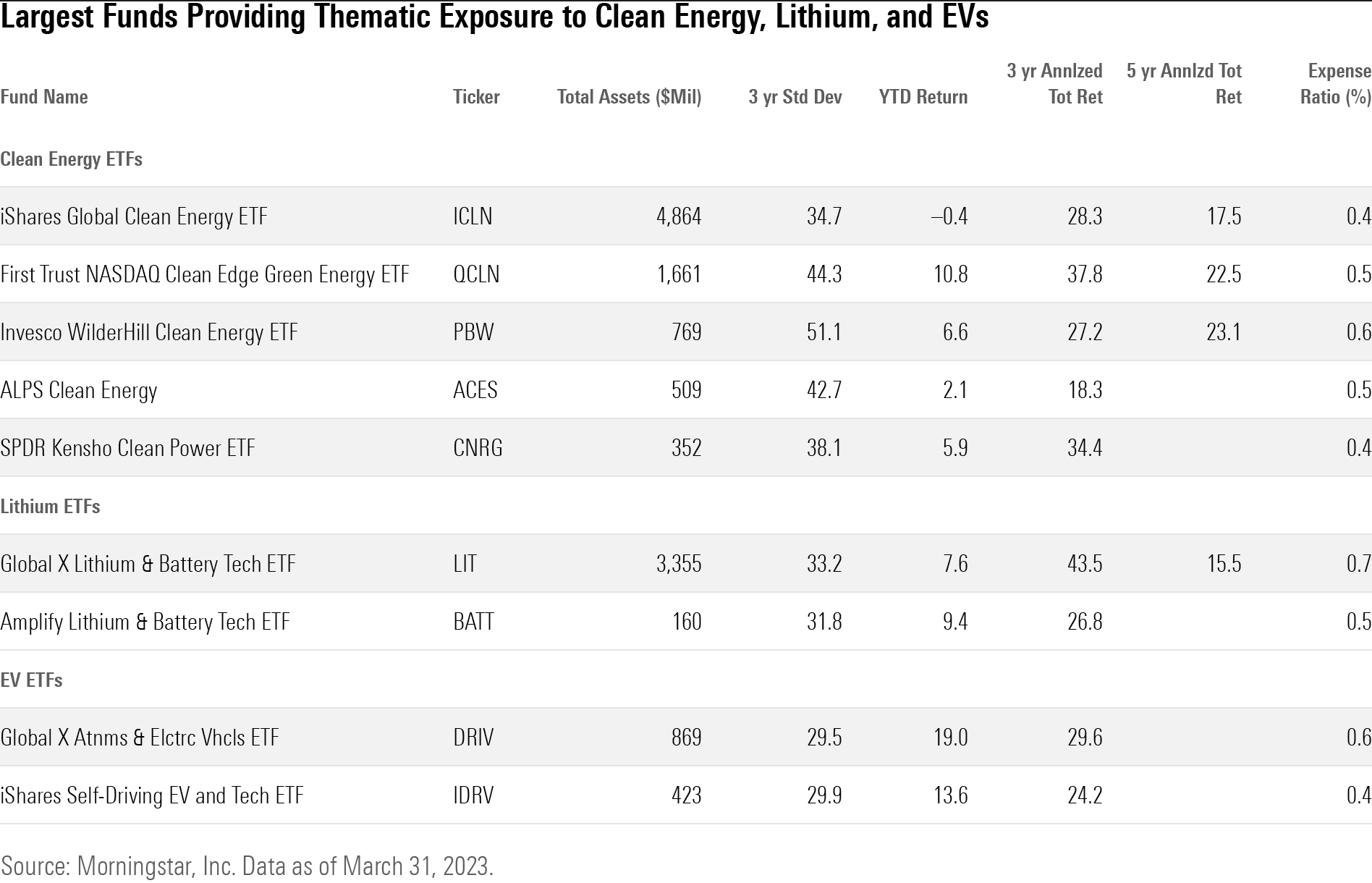

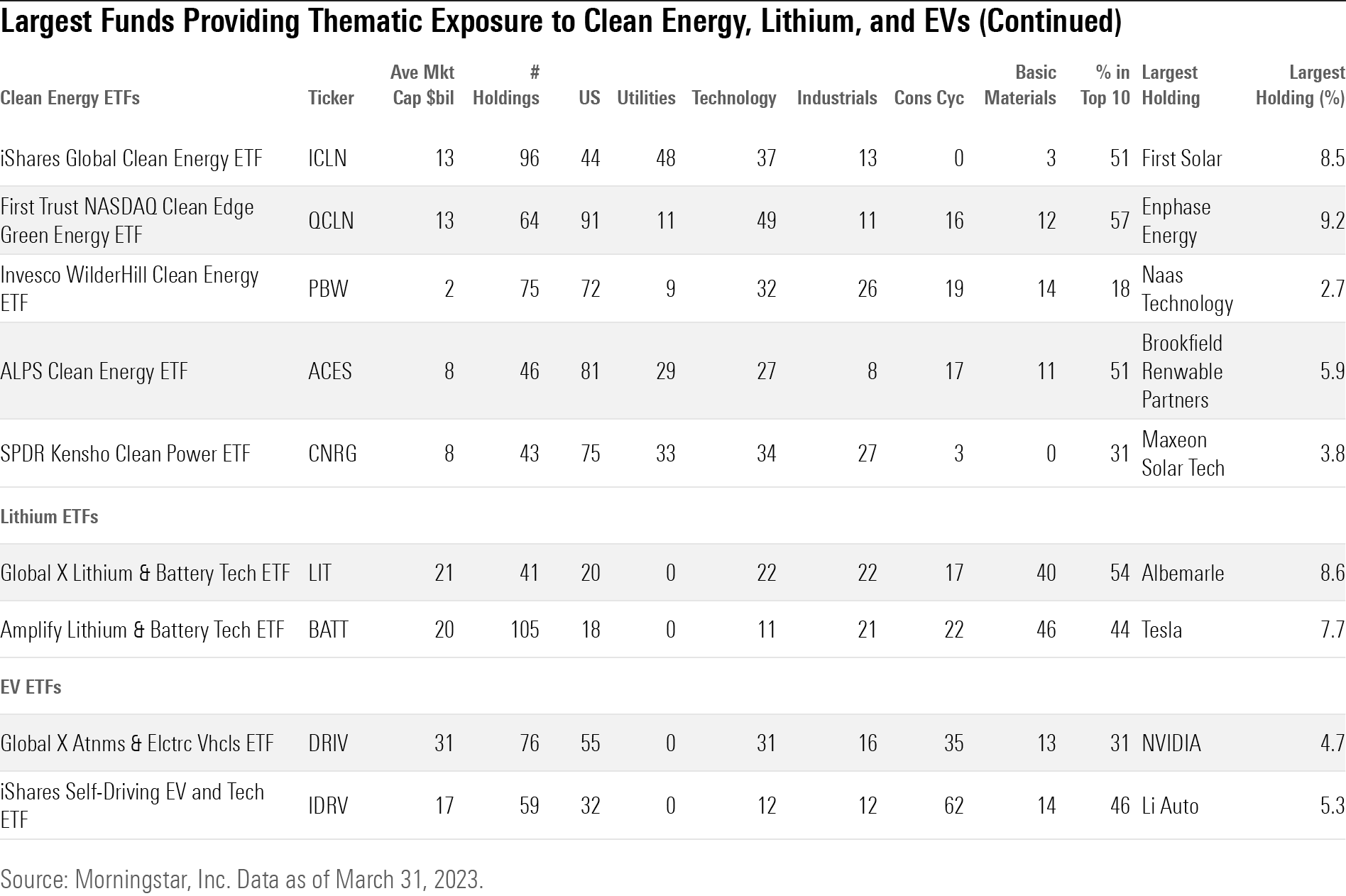

The Largest Clean Energy ETFs

With $4.9 billion in assets, iShares Global Clean Energy ICLN is the largest clean energy ETF. It focuses on companies producing renewable energy or providing the technology for clean energy production and uses. The fund is global in scope, with just under half of its assets in the United States and half outside the U.S. spread among about 100 large- and mid-cap holdings. Its largest position, at a hefty 8.5% of assets, is U.S.-based First Solar FSLR, which makes solar micro-inverters, battery energy storage, and EV charging stations. Third-largest holding SolarEdge Technologies SEDG (6.4% of assets), an Israeli firm, is focused on solar micro-inverters and battery energy storage.

From a traditional sector perspective, the fund has 48% of assets in utilities that produce clean energy, 37% in technology, and 13% in industrials. A three-year standard deviation of returns of 34.7 shows the fund’s volatility, but ICLN is the least volatile of the clean energy funds on this list. Its annualized trailing five-year return through March 2023 is 17.5%. With an expense ratio of 0.40%, ICLN is also the cheapest option of those discussed here.

First Trust Nasdaq Clean Edge Green Energy ETF QCLN is the second-largest clean energy ETF. Although this $1.7 billion fund is U.S.-focused, it has a broader investment scope than ICLN does. In addition to renewable energy producers and enablers, the fund invests in energy efficiency and management, exemplified by second-largest holding ON Semiconductor ON (8.7% of assets), and in EVs, with Tesla TSLA (7.6% of assets) its number-two holding. QCLN’s largest holding is Enphase Energy ENPH (9.2% of assets). This is a compact 64-position portfolio split between large- and mid-cap stocks. It has only a 11% position in utilities, reflecting less focus on clean power producers, 49% in technology, and 16% in consumer cyclicals, reflecting its EV exposure. With less exposure to utilities and more to technology, QCLN is a bit more volatile than ICLN, with a three-year standard deviation of 44.3. Investors have been rewarded for that volatility with a 22.5% annualized trailing five-year return. Its expense ratio is 0.58%.

The distinguishing feature of the third-largest clean energy ETF, Invesco WilderHill Clean Energy PBW, is its focus on U.S. small caps. Three fourths of assets in this $769 million ETF are in small-cap stocks, and only 7% are in large caps. The portfolio is mostly U.S.-based (72% of assets) and spread in roughly equal fashion across its 75 holdings, so it avoids the risk of taking large positions. The fund’s emphasis is on clean energy and energy storage. Its largest holding, Naas Technology NAAS, an EV charging station provider in China, takes up only 2.7% of assets. The second-largest holding, FTC Solar FTCI, is a global provider of advanced solar tracking systems. ReNew Energy Global RNW, the third-largest holding, is an independent renewable energy power producer based in India. The fund has 32% of assets in technology, 26% in industrials, 19% in consumer cyclicals, and only 9% in utilities. Its three-year standard deviation is 51.1, a reflection of the volatility that comes with its small-cap and thematic focus. To wit: The fund gained 206% in 2020 and lost 29.8% in 2021. Its five-year trailing return is 23.1% with an expense ratio of 0.62%.

The $845 million ALPS Clean Energy ACES focuses on small- and mid-cap U.S. and Canadian companies that are sources of renewable energy or involved in EVs, energy storage, lithium, smart grid, and energy efficiency. In a compact portfolio of 46 names, its top holding is Brookfield Renewable Partners BEP (5.9% of assets), which holds an array of clean energy technology assets. Enphase Energy (5.8%) is its second-largest holding followed by First Solar (5.8% of assets). The fund has 29% of assets in utilities, 27% in technology, and 17% in consumer cyclicals. Its three-year standard deviation is 42.7. This is a younger fund that has yet to reach the five-year mark, but it has posted an 18.3% annualized trailing three-year return. Its expense ratio is 0.55%.

SPDR Kensho Clean Power ETF CNRG invests its $352 million portfolio in clean energy generation and transmission and clean energy technology, including storage devices. Top holding Maxeon Solar Technologies MAXN (3.8% of assets) manufactures high efficiency solar panels. First Solar (3.7% of assets) is the second-largest holding, followed by solar-power provider Canadian Solar CSIQ (3.2% of assets). The fund is primarily focused on small and mid-caps in the U.S. It has 34% of assets in technology, 33% in utilities, and 27% in industrials. Its three-year standard deviation is 38.6, second lowest in this group, and its three-year annualized trailing return is 38.1%. Its expense ratio is 0.45.

While those five funds have some exposure to battery technology and electric vehicles, investors may also consider ETFs focused on these areas.

Lithium ETFs, Anyone?

With $3.4 billion in assets, Global X Lithium and Battery Tech LIT invests in companies involved in lithium mining and lithium battery production. It is a compact large-cap portfolio of 41 names, with 80% of assets in non-U.S. companies. At 8.6% of assets, its largest holding is Albemarle ALB, the largest producer of lithium batteries for EVs. The second-largest holding is Panasonic Holdings PCRFF (6.7% of assets), a conglomerate that makes rechargeable batteries among many other product lines. Number-three holding Samsung SDI (6.7% of assets) also focuses on rechargeable batteries. The fund’s three-year standard deviation is 33.2, and its trailing five-year annualized return is 15.5%. LIT’s expense ratio is 0.75%.

The much smaller $160 million Amplify Lithium & Battery Tech ETF BATT is similar to LIT in its focus and its mostly non-U.S. portfolio. But it has more than 100 holdings and delves a bit more into small caps and mid-caps than does LIT. Its largest holding is BHP Group BHP (6.9% of assets), the Australia-based mining company. Tesla (6.9%) is the second-largest holding. The third-largest holding, Contemporary Amperex Technology (6.8%), is a China-based lithium battery maker. The fund’s 33.7 three-year standard deviation is nearly identical to that of LIT, but BATT has not performed as well over time. Its trailing five-year annualized return is 15.2%. With an expense ratio of 0.59%, BATT is cheaper than LIT.

Investing in Electric Vehicle ETFs

Global X Autonomous & Electric Vehicles ETF DRIV focuses more directly on electric vehicles, including hybrids and autonomous driving technology. The $870 million fund has 76 positions that are half large-cap and split between U.S. and non-U.S. companies. The top holding is Nvidia NVDA (4.7% of assets), which designs graphics processing units for a variety of uses, including self-driving vehicles. Tesla (4.4%) is the second-largest holding, with Apple AAPL (3.6%) the third largest. Apple is said to be working on a semi-autonomous self-driving vehicle. The large-cap portion of the fund is filled with big technology companies and automakers. Reflecting that, the fund’s three-year standard deviation is just under 30. Its three-year annualized trailing return is 29.6%. DRIV’s expense ratio is 0.68%.

The $486 million iShares Self-Driving EV and Tech ETF IDRV, another electric vehicle ETF, takes a similar approach as DRIV, with half of assets in the U.S. and half outside the U.S., but has a mostly large-cap focus. Top holding Li Auto LI (5.3% of assets) is a leading EV manufacturer in China, as is second-largest holding BYD BYDDY (5.1% of assets). Number-three holding electrical giant ABB ABB (4.8% of assets) makes charging stations. Despite having more in large caps and more names in the portfolio, this fund’s standard deviation is about the same as that of DRIV. With a 24.3% three-year trailing return, however, the fund hasn’t performed quite as well as DRIV. Its expense ratio is lower, at 0.47%.

Most investors already have exposure in their diversified equity funds to the automakers and big technology companies that take up significant portions of these two funds’ portfolios. Thus, an investment in either of these ETFs should be less about getting basic exposure to the EV revolution and more of a deliberate bet on it.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)