CPI Report Defies Hopes of Easing Inflation, for Now

While inflation should slow in 2023, the Fed is seen as staying on an aggressive path in the coming months.

Even as consumers finally found relief at the gas pump in August 2022, inflation remained stubbornly higher elsewhere across the economy, with the latest Consumer Price Index report defying expectations for broader relief from the past year's surge in prices.

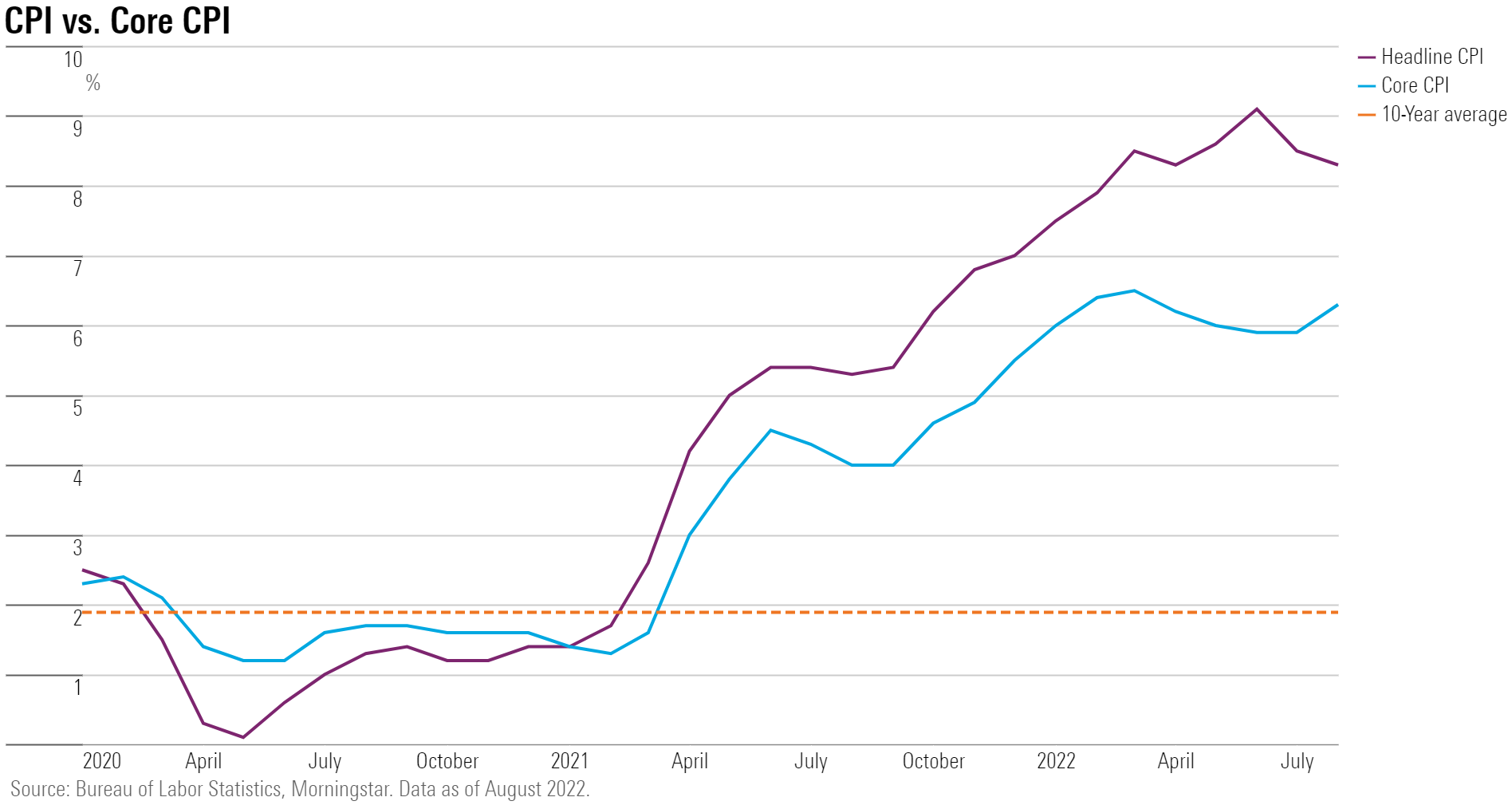

Still, the trend toward lower inflation remains intact, even if the progress won't come in a straight line.

For investors, the disappointing August CPI report likely means that the Federal Reserve will remain aggressive in raising interest rates at least through the end of the year and until the U.S. economy begins to show sustained signs of slowing growth.

The high reading on inflation in August "is no reason to panic," says Preston Caldwell, Morningstar's chief U.S. economist. "These numbers can be volatile on a month-to-month basis."

Stock and bond markets sold sharply in the wake of the CPI report, but "we think such a large market movement is overreacting to a single CPI report, and there's still good reason to expect inflation to trend down," Caldwell says.

Easing supply chain pressures, along with slowing economic growth driven by the Fed's rate increases, will act to slow inflation sharply in 2023, Caldwell says.

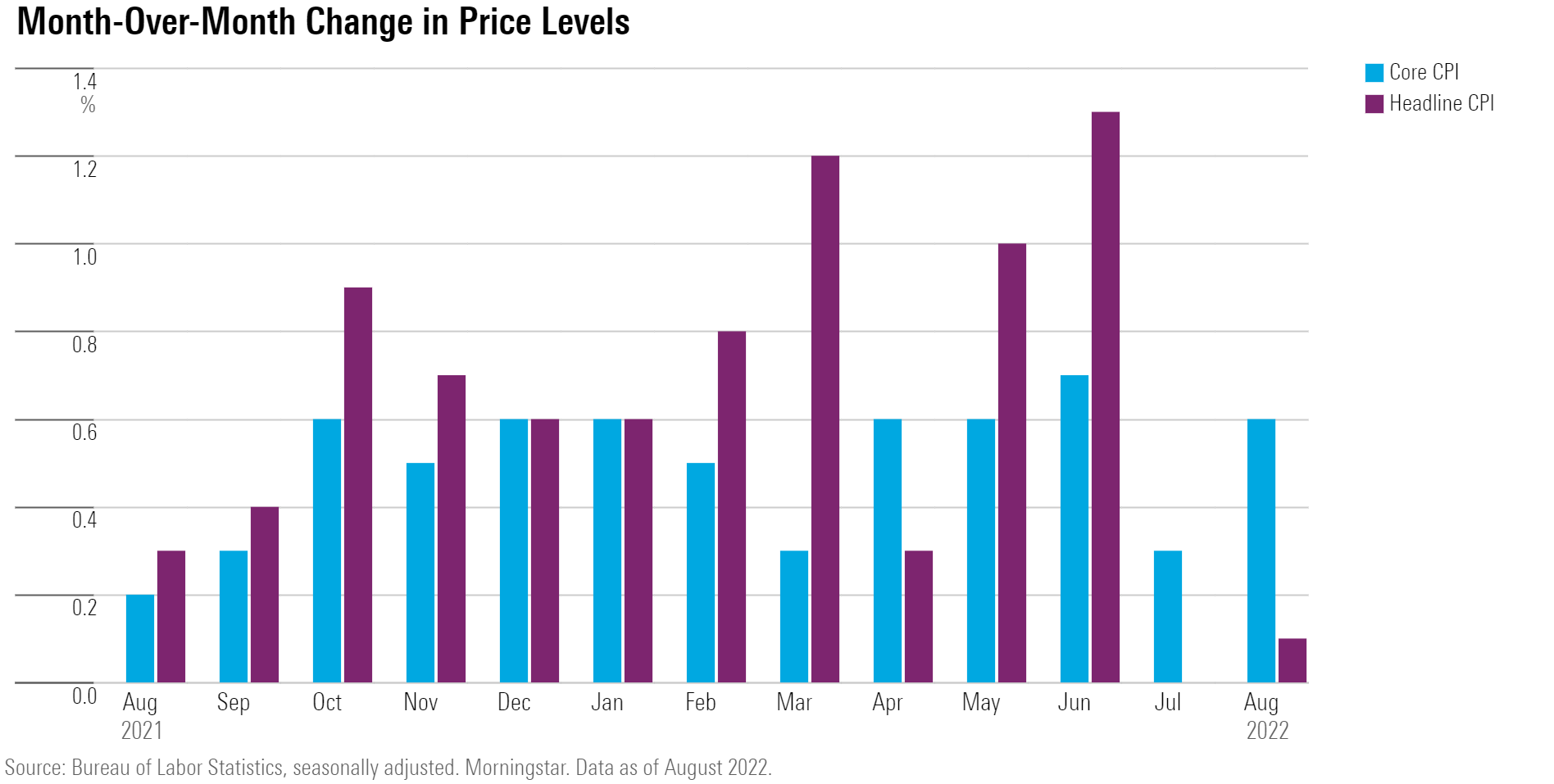

The Bureau of Labor Statistics reported that CPI rose 0.1% in August after being unchanged in July. On an annualized basis, the August increase would represent just a 1.4% rise in inflation.

While that might seem like good news, the CPI excluding food and energy costs—the widely watched "core" reading—rose a stronger-than-expected 0.6% in August from the month before.

"Core inflation at 0.6% is concerning," Caldwell says. "It looks like an across-the-board uptick compared with the prior month, but shelter and healthcare inflation was especially high."

Caldwell notes that core inflation had dipped to 0.3% in July after averaging 0.6% in the prior six months. "But it now seems possible that July's report was an aberration," he says.

On an annual basis, overall inflation rose 8.3% in August, down slightly from the 8.5% increase seen in July. But that was above the 8.1% rise than economists had forecast.

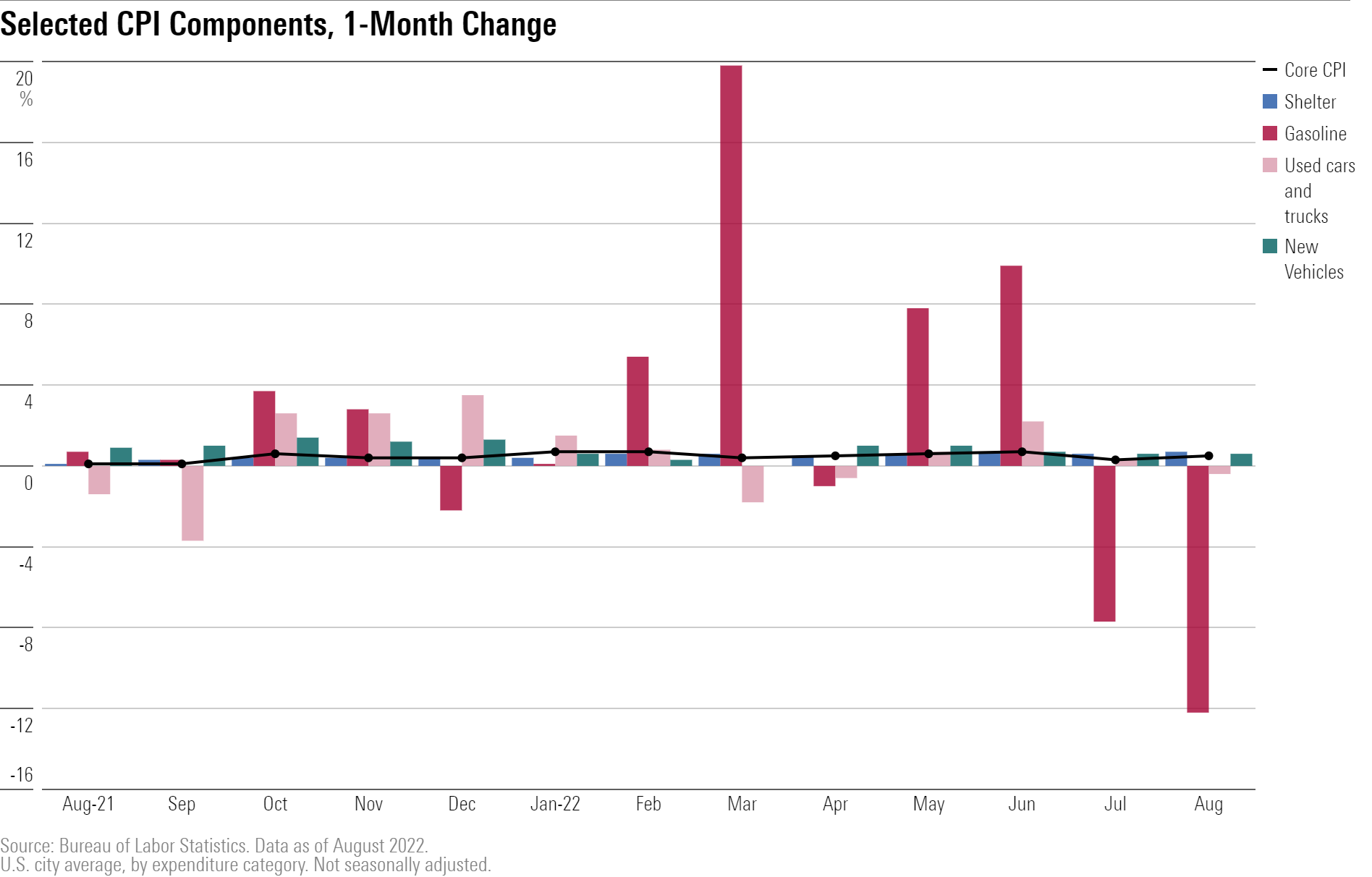

Core goods prices increased 0.5% in August, despite signs of supply chain easing and reports of excess inventory accumulation among some retailers. "We don't expect this situation to last," Caldwell says. "For example, used-car prices fell in August even while new-car prices jumped; used-car prices tend to be a leading indicator for new-car prices."

Meanwhile, core services prices increased 0.6% in August from the month before, driven by healthcare and shelter costs. "The healthcare component of the CPI is very volatile due to its methodology," Caldwell says. "Shelter inflation is more concerning, although plummeting housing demand is set to eventually cool off housing prices and rents and thereby subdue shelter price inflation."

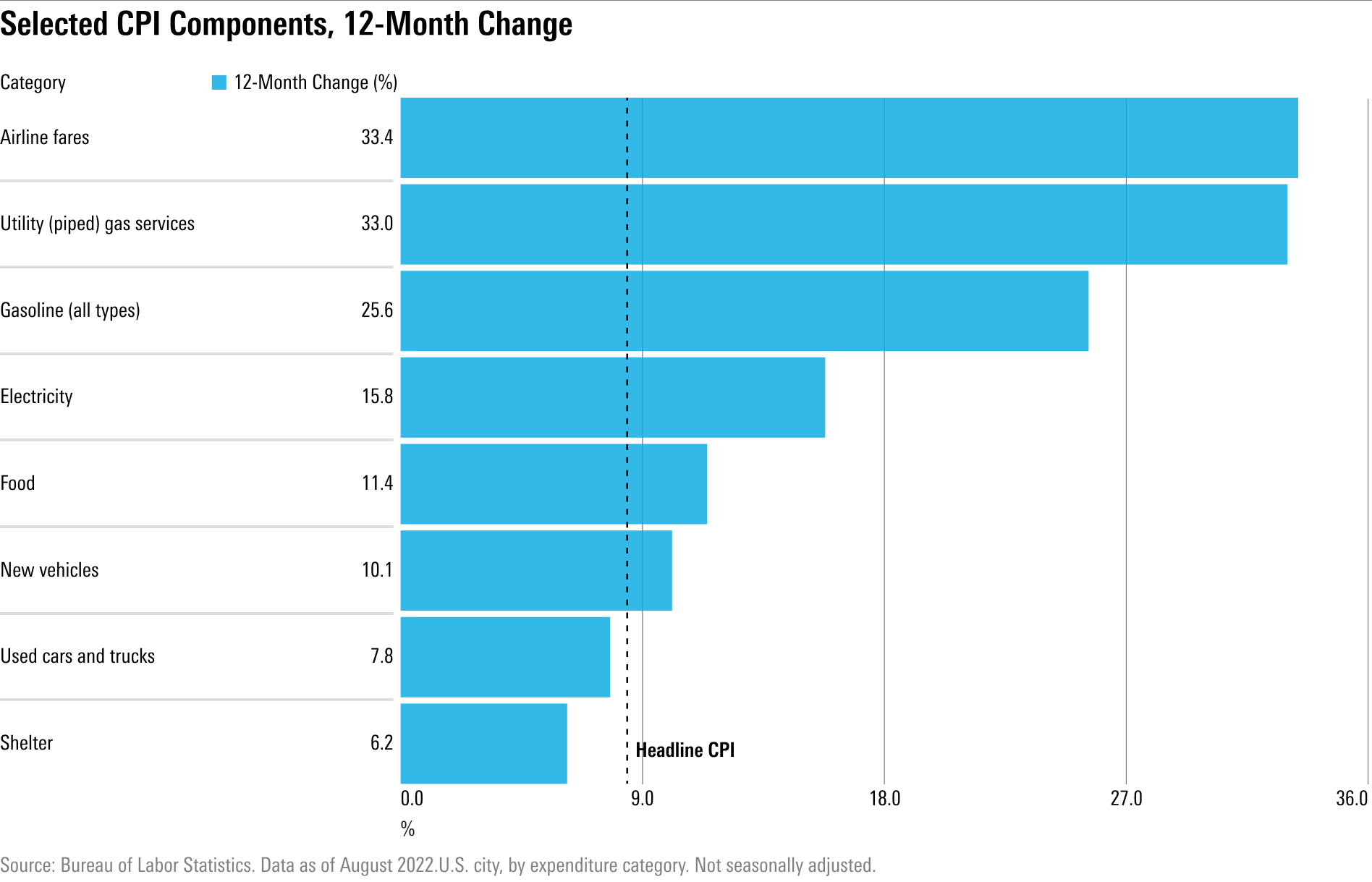

Caldwell says there were signs of some pass-through falling energy prices to core inflation in August. "For example, airline fares fell 4.6% as jet fuel prices dipped," he says. However, diesel prices, which are a key input to goods prices via the cost of transportation, remain much more elevated than normal levels compared with other oil products, he says.

On an annual basis, the 8.3% rise in inflation saw energy prices up 23.8% from 12 months ago even as those costs declined on a monthly basis. Food prices, meanwhile, were up 11.4% from a year ago. Core CPI was up 6.3% over the past 12 months, a larger increase than the 5.9% rise registered in July. Roughly 40% of the annual increase in core CPI was driven by a 6.2% rise in shelter costs.

CPI Points to Continued Aggressive Fed

Following the CPI report, expectations around Fed policy shifted toward the central bank continuing an aggressive pace of interest-rate increases. Some in the markets had begun looking for the Fed to start pivoting to more modest rate increases following a series of historically large 0.75-percentage-point rate hikes.

Market expectations for rate hikes at the central bank's September meeting shifted higher following the report, according to the CME FedWatch tool: The bond futures market now pegs the odds of a 0.75-percentage-point increase in the federal-funds rate at 84%, which would leave the funds rate target at 3.00% to 3.25%. The remainder of the market even expects the Fed to hike rates by a full percentage point during next week's meeting.

"Today's CPI report definitely cements the case for a 75-basis-point hike in the federal-funds rate in next week's Fed meeting," Caldwell says.

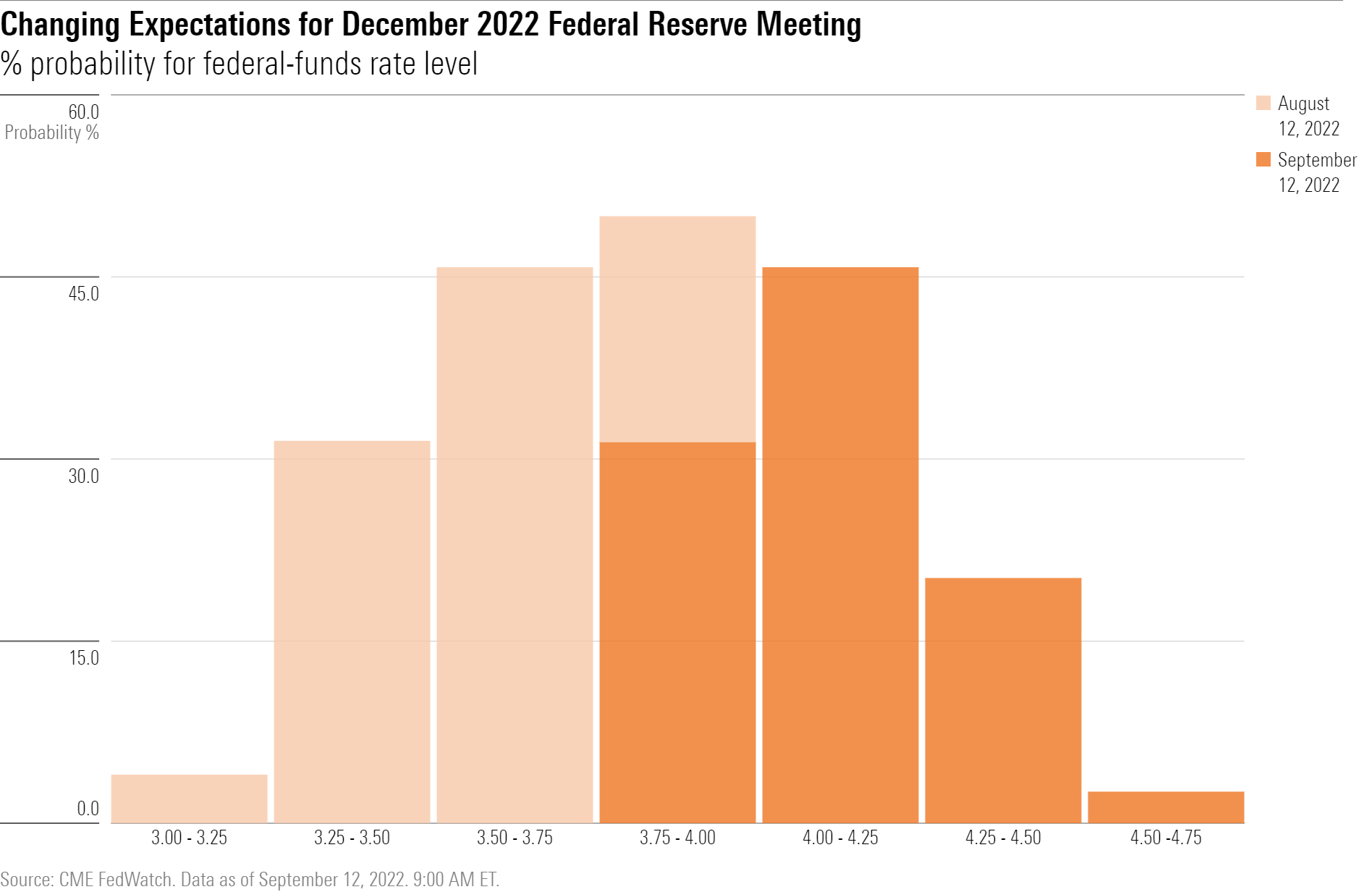

Looking further ahead, market expectations see the Fed most likely to have a 4.00% to 4.25% target for interest rates at its December meeting, up from a month ago, when majority expectations rested at 3.50% to 3.75%. That would imply another percentage point increase by year-end.

But the March 2023 meeting, the market sees the pace of rate hikes beginning to slow: the largest group in the futures market now expects rates to reach no higher than 4.25% to 4.50%.

"Today's report didn't give clearance to the Fed to begin slowing its pace of interest-rate hikes, but we shouldn't overreact to a single CPI report," Caldwell says.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)