Why We Downgraded One of Matthews Asia's Biggest Funds

Plus a look at an upgrade, a downgrade, and a fund that is new to coverage.

Morningstar recently downgraded the Morningstar Analyst Rating of a fund from a firm known for its Asian stock expertise because the type of Asian stocks it was picking—and who was picking them—had changed.

A summary of the rest Morningstar Manager Research's ratings activity follows at the end of this article. First, we'll take a closer look at Matthews Asia Dividend's MAPIX Analyst Rating downgrade to Bronze. It shows the importance of looking at how managers invest, rather than just listening to how they say they invest.

Matthews Asia Dividend, whose two share classes previously earned Gold and Silver ratings, depending on fees, seems to have relaxed its adherence to its own objectives. On paper, it sets out to provide its investors with current income (an overall dividend yield) that exceeds what they could otherwise get by buying an Asia-Pacific-focused index fund. The strategy aims to limit the downside of its total returns and temper their volatility.

It consistently achieved these goals in its early years, including when current lead manager Yu Zhang had served as a comanager (early 2011 through mid-2013) and as co-lead manager alongside Robert Horrocks (July 2013 through April 2018). But its profile shifted substantially during Horrocks’ final months as co-lead manager, and now bears little resemblance to its pre-2017 iterations.

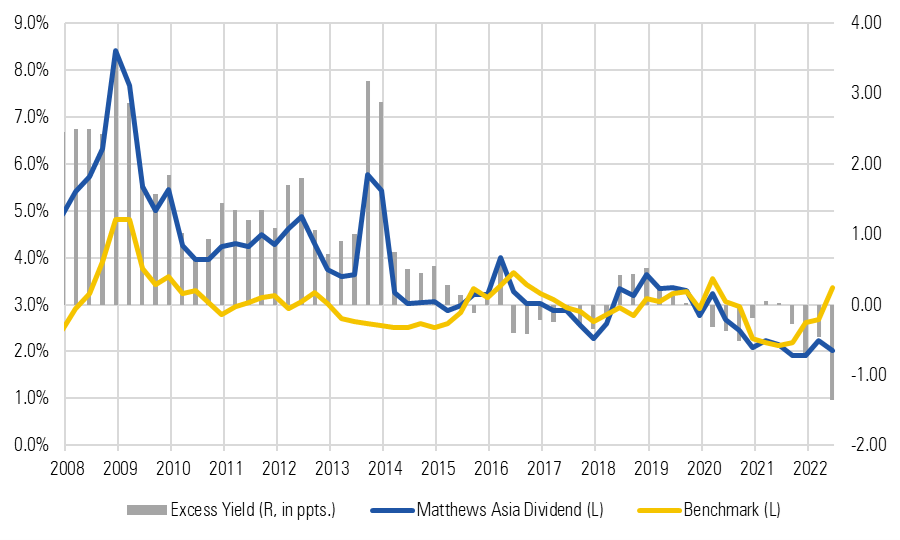

The average dividend yield of its portfolio companies now sits well below that of its prospectus benchmark, the MSCI All Country Asia Pacific Index (see Exhibit 1). Its average total yield (dividend yield plus share repurchases) of its portfolio companies also now underwhelms.

Exhibit 1: Average Forward-Looking Dividend Yields for the Fund, Index, and Their Differences

Source: Morningstar Direct and Author’s Calculations

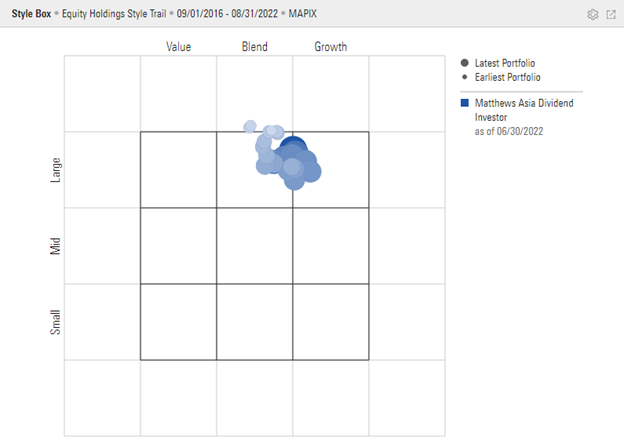

Prior to 2017, the fund’s risk profile was relatively mild. It routinely provided some resilience during severe market pullbacks and often lagged in euphoria-driven rallies. It would outperform when high-yielding Asian stocks were in favor but would otherwise post dull-looking results. Things have changed in recent years as the portfolio has tilted more toward growth stocks (Exhibit 2) and loosened its grip on companies with relatively high margins, juicy dividend yields, and modest debt.

For instance, in 2020’s second quarter it sold PT United Tractors Tbk (a value-leaning stock with an above-index dividend yield and price that has more than doubled since its sale here) and bought Tencent (a growth stock with a paltry yield that has lost over 20% since the fund’s purchase).

A solidly large-blend-oriented portfolio in 2016 (and value-leaning in preceding years), it pivoted decisively toward growth stocks under Yu Zhang’s sole leadership.

Exhibit 2: Matthews Asia Dividend’s Morningstar Style Trail

Source: Morningstar Direct

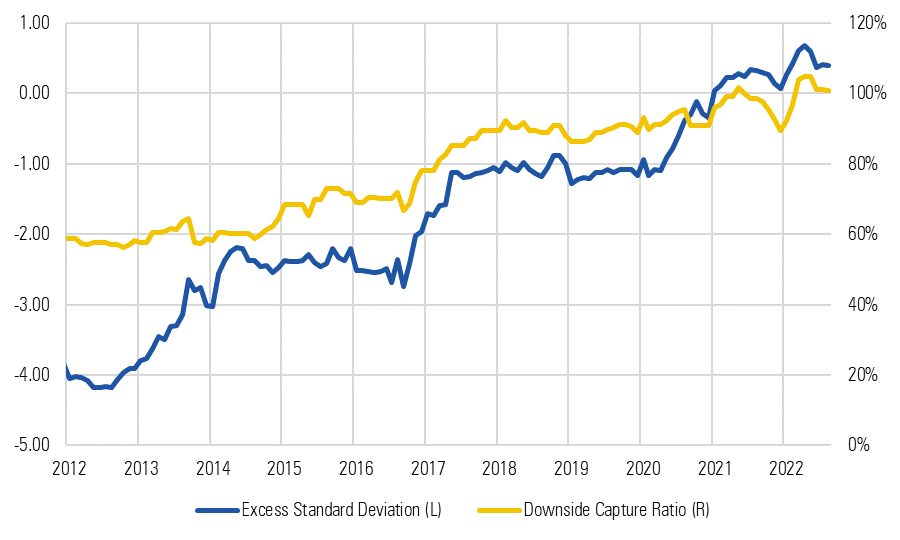

Since roughly the time Zhang became sole lead manager in April 2018, the fund’s total returns have become much bumpier—even more so than the index’s—and its downside protection has become less reliable. Rather than outpacing the market in environments favorable to stocks paying hefty dividends, it has instead fared better when dividend-light stocks have outperformed (see Exhibit 3).

Exhibit 3: The Fund's Excess Annualized Standard Deviation and Downside Capture Ratio versus the MSCI All-Country Asia Pacific Index Over Rolling Five-Year Periods

Source: Morningstar Direct and Author’s Calculations

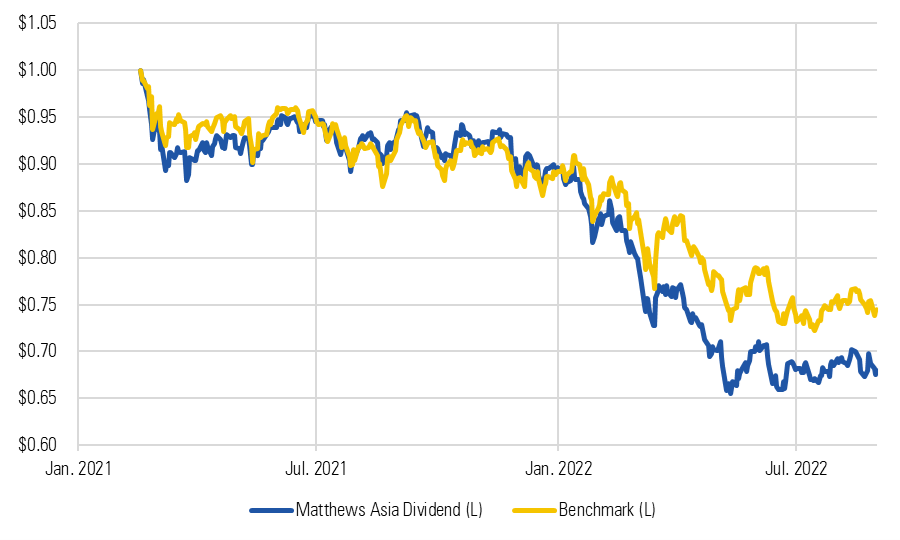

That posture has largely foiled the strategy’s resilience since Feb. 18, 2021, when the severe pullback in Asian stocks began and stocks with relatively high price multiples and growth rates suffered most. From then through Aug. 31, 2022, the strategy’s cumulative loss of 32% was much worse than the index’s 25.5% drop (see Exhibit 4).

Exhibit 4: Growth of $1 Invested in Matthews Asia Dividend and the MSCI All-Country Asia Pacific Index Benchmark

Source: Morningstar Direct

Rather than prioritize the fund’s overall yield, Zhang cares most about delivering benchmark-beating total returns, which he tries to source from a combination of “dividend-payers” (generally, companies with stable cash flow business models that pay as dividends a large portion of their earnings to shareholders) and “dividend-growers” (companies with low current payout ratios but with high potential for dividend growth). But it’s hard to see what is unique or advantageous about these kinds of stocks, given that the strategy’s investable universe overwhelmingly consists of dividend-payers.

The strategy sets reasonable goals that appeal to risk-conscious, dividend-seeking investors. But with few signs that it will renew its commitment to its stated objectives, its previous High Process rating warranted a downgrade.

We took the Process rating down one notch—to Above Average—which preserved the fund as a Morningstar Medalist to reflect our view that, despite many disappointments, the strategy still has ample potential to outperform going forward. It benefits from the collaborative vetting of stock ideas across Matthews International Capital Management, which is Asia-focused, has some talented portfolio managers, and has a long history of success investing in the region.

On the other hand, many investors that contributed to its success are now gone. While this strategy’s management team has shown some continuity in recent years, the broader investment team on which it relies for insights has diminished and looks much different than it did in 2017. Since then, its analyst team has been halved as many analysts left (including two who were previously dedicated to this strategy) and have not been fully replaced. Just two of Matthews’ seven analysts have been with the firm for three years or longer. Many of the firm’s talented portfolio managers have also departed. Given the mixed the track record of this strategy’s lead portfolio manager and the firm’s persistent personnel turnover, we downgraded the strategy’s People Pillar rating to Average from Above Average.

It’s still a solid strategy but is harder to make a case for it as one of the best now than before.

Other August Ratings Activity

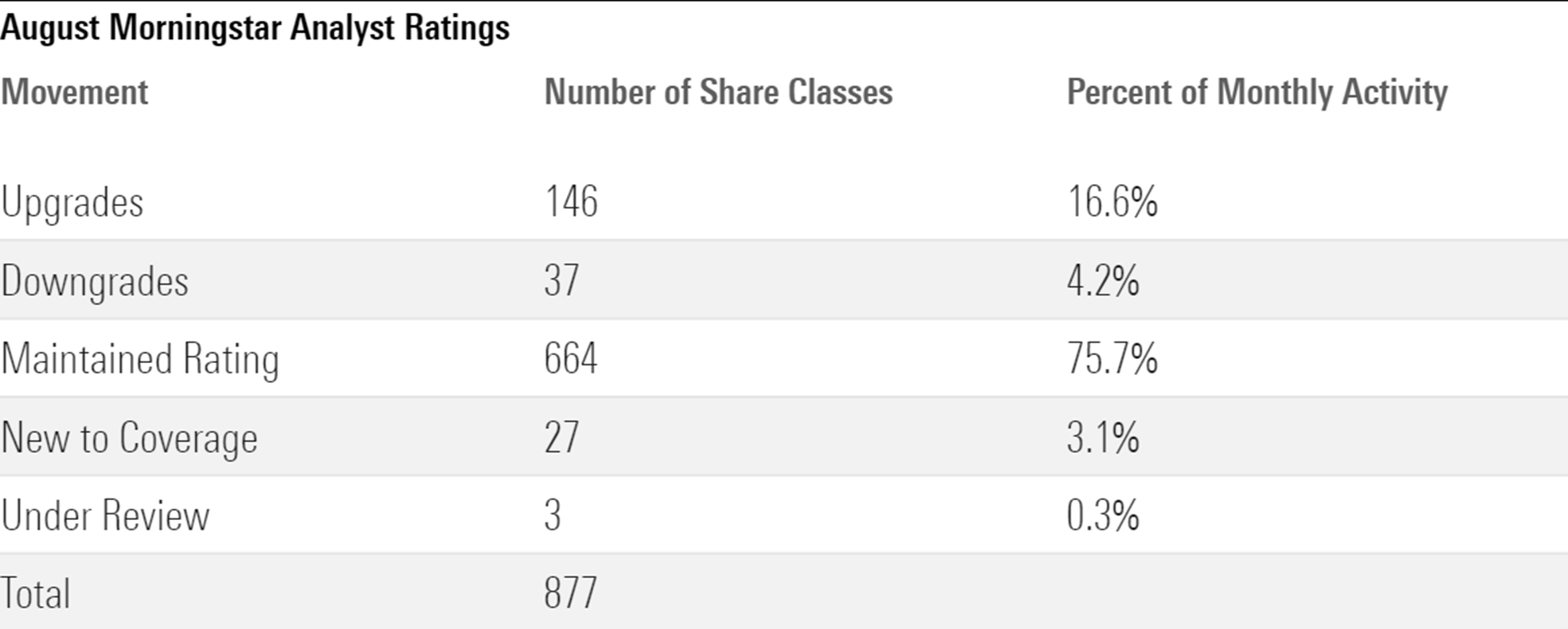

Morningstar updated the Analyst Ratings for 877 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios last month. Of these, 664 maintained their previous rating, 146 earned upgrades, 37 received downgrades, 27 were new to coverage, and three went under review owing to material changes such as subadvisor switches.

Looking through share classes and vehicles to their underlying strategies, Morningstar issued 184 Analyst Ratings during August. Of these, only two were new to coverage. And while a handful saw a rating change, the vast majority (85%) maintained their previous ratings. Below are some highlights of the upgrades, downgrades, and strategies new to coverage.

Upgrades

American Funds Growth and Income GAIOX earned a People Pillar rating upgrade to High from Above Average, owing to the firm’s dedication to growing and developing its personnel and resources. The pillar upgrade gave the fund’s cheapest share classes Morningstar Analyst Ratings of Gold.

Downgrades

A subadvisor change at Virtus Newfleet Short Duration High Income Fund ASHIX created enough uncertainty to trigger a Process Pillar downgrade from Average to Below Average, resulting in a Morningstar Analyst Rating of Negative on its pricier share classes.

New to Coverage

The JPMorgan SmartRetirement target-date series debuted with a Morningstar Analyst Rating of Gold on its cheapest share class. Its robust and time-tested investing process earn its pricier share classes Silver, Bronze, and Neutral ratings.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/38919e04-dfa7-44a4-8ae1-61a17026713c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/38919e04-dfa7-44a4-8ae1-61a17026713c.jpg)