Wanted: Low ESG Risk, High Sustainable Impact, and a Moat. We Have Three Companies.

We highlight a trio of promising climate-action stocks.

Sustainable investing can be a fraught endeavor, especially if you want to reduce environmental, social, and governance risk while achieving a high societal impact.

Finding a company with low ESG risk, high sustainable impact, and that scores well on investment metrics is rare—but not impossible.

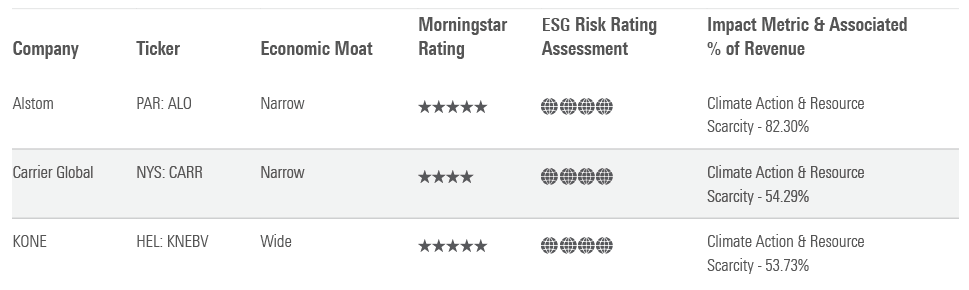

In my recent study that compared and contrasted the two kinds of sustainable investing, and how to measure them, I identified three companies that meet this criteria.

You can find the entire report, which explores risk-related trade-offs facing investors that are looking to own companies aligned to positive societal change, on Morningstar’s Investable World site. Investors’ differing motivations warrant different approaches, each with its own opportunities and trade-offs.

How to Navigate Standard Investment and ESG Risk Analysis

Morningstar and Sustainalytics offer a rich set of ratings and classifications to help investors navigate the menu of potential choices. These include measures of fundamental equity analysis—like the economic moat, fair value estimate, and company-level star ratings—alongside sustainability measures like the ESG Risk Rating and Impact Metrics.

Morningstar’s Impact Metrics measure how companies’ revenue aligns with various impact themes. But even ones that align closely can sometimes do poorly on ESG risk metrics.

Tesla TSLA is a poster child for this discrepancy. An estimated 86% of its revenue is tied to the Climate Action impact theme, but it holds a Medium ESG Risk Rating owing to weak product governance and other social and management concerns. These aspects are worth considering if an investor is focused primarily on driving positive impact, but also wants to consider risk management to drive a competitive return.

Valuation is also a critical component to successful long-term investing; paying too much for an otherwise great company can lock in years of disappointing returns. At Morningstar, we also look at moats, which are sustainable competitive advantages.

I’ve got news for you: If a company faces low ESG risk and generates revenue that is strongly aligned to UN Sustainable Development Goals, that doesn’t automatically build a durable competitive advantage.

Case in point: The wind and solar industries are fiercely competitive, with suppliers competing primarily on cost, and offering low barriers to entry attracting new competitors. Advantages can be competed away over time, unless we can identify barriers to entry that align with one or more of our five moat sources: intangible assets; cost advantage; network effect; customer switching costs; or efficient scale.

Fortunately, I was able to find opportunities with low ESG risk and solid impact revenue alignment—and that also enjoy economic moats.

3 Climate-Action Stock Picks

Carrier (CARR)

Price/Fair Value: 0.86

Morningstar Uncertainty Rating: High

Morningstar Moat Trend Rating: Stable

Morningstar Capital Allocation Rating: Standard

Industry: Building Products & Equipment

Spun off from United Technologies in April 2020, Carrier is a high-quality franchise with leading brands across most of its product portfolio, supporting its narrow economic moat. Its HVAC segment in particular—its largest at approximately 60% of sales—has the strongest long-term growth potential due to its commercial HVAC market exposure.

We project the commercial HVAC market will grow above gross domestic product owing to increased demand for energy-efficient and indoor air quality solutions. This segment also supports Sustainalytics’ estimate that more than half of company revenue supports the Climate Action impact theme, given its focus on green buildings.

Although the near-term outlook for residential end markets is less sanguine—we expect industrywide residential HVAC shipments will contract in 2023 and 2024 amid a maturing replacement cycle—shares of the firm offer a sizable margin of safety for long-term investors, in our view.

KONE (KNEBV)

Price/Fair Value: 0.7

Morningstar Uncertainty Rating: Low

Morningstar Moat Trend Rating: Stable

Morningstar Capital Allocation Rating: Exemplary

Industry: Specialty Industrial Machinery

The world’s fourth-largest supplier of elevators and escalators, Kone has built a wide moat on an established record and solid reputation, alongside cost advantages from a wide servicing network that would be difficult for new entrants to replicate.

While shuttling people between building floors may not seem like an obvious area to drive sustainable impact, Sustainalytics estimates that more than half of Kone’s revenue is tied to Climate Action, as the company helps its customers achieve eco-efficiency goals in building life cycles, offering energy-regeneration technology for elevators with up to 70% energy-savings.

While China COVID-19 lockdowns have hampered business recently (China contributes 35% of Kone’s revenue and is its largest market for new equipment), markets outside China drive more of the maintenance revenue and continue to show solid demand. We expect the business to show signs of recovery in the near term, and broader supply chain issues to ease in the next couple of quarters, supporting our fair value estimate.

Alstom (ALO)

Price/Fair Value: 0.57

Morningstar Uncertainty Rating: Medium

Morningstar Moat Trend Rating: Stable

Morningstar Capital Allocation Rating: Standard

Industry: Railroads

We expect rail infrastructure will be a major beneficiary from ongoing global efforts to address environmental concerns. As a key international player in the railway equipment and services industry, Alstom has carved a narrow moat, in our view, stemming from intangible assets in the form of customer relationships in the group’s core markets, and switching costs found in the services business.

Moreover, Sustainalytics identifies more than 80% of Alstom’s revenue is tied to Climate Action—notably green transportation such as railway infrastructure, trams, and metro manufacturing. Admittedly, ongoing inflation and supply chain challenges will likely continue to weigh on the firm’s near-term financial performance, and medium-term targets are not guaranteed to be achieved given many ongoing projects and the integration of fellow rail transport firm Bombardier, which was acquired in early calendar 2021.

Nonetheless, we believe the market is overly concerned with these risks, and the stock trades in 5-star territory.

Not all investors will have the same set of preferences, exclusions, or expectations. But understanding the interplay between ESG risk and impact alongside more-traditional analysis can provide a rich set of options for investors looking to optimize their individual portfolios.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)