These Big Funds Are Suffering Big Headaches

When it comes to trading smaller stocks, these funds are in a tight spot.

A version of this article was published in the August 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Open-end funds have endured steady outflows as investors move to exchange-traded funds, collective investment trusts, and other similar vehicles that are often slightly cheaper. Now that we are in our second bear market in three years, more funds are seeing outflows accelerate.

I looked at flows and liquidity data to see which funds are under the most pressure.

We look at a fund's liquidity profile from a few angles. First, we stress-test the fund to see how long it would take to sell different-sized chunks of it under normal trading conditions. To keep this as close to the typical investment approach as possible, we try to keep the structural integrity of the fund's portfolio intact. (If it had a 5% of its assets in Amazon.com AMZN at the start of the sell-down, it will have 5% in it at the end—just fewer shares.) We then run a second stress scenario. Here, we model a fund needing to meet redemptions in short order and look to sell everything as quickly as we can. (If Amazon is the most liquid position, that 5% weight could be zero by the time the selling has finished.)

Usually, a fund has some very liquid holdings like cash, mega-cap stocks, Treasuries, futures, or ETFs that can be sold easily in most market conditions to meet redemptions. But as you go deeper into a fund's portfolio, you hit less-liquid names that would be costly to sell quickly. There are also times when liquidity disappears from the markets, so we test the portfolio's trading abilities using the latest, average, and worst-case historic liquidity for each stock owned.

We also look at how much of a portfolio is in names where the fund owns over 5%, 10%, or 15% of a company's total market cap, as we have found that the more a fund owns of a specific issue, the harder it is to sell without incurring a trading loss.

In dollar terms, the funds with the largest outflows in the first half of 2022 were Fidelity Contrafund FCNTX, T. Rowe Price Blue Chip Growth TRBCX, and American Funds EuroPacific Growth AEPGX, which shed $8.3 billion, $5.4 billion, and $4.4 billion, respectively.

These first two instances don't worry me. Those funds are heavily invested in the largest stocks in the world, and they boast huge asset bases, so the figures are not so dramatic in percentage terms. But look at the flows more closely, and you'll see there's less than meets the eye. These funds and many other giants are seeing money move from their open-end share classes to their CIT nearly identical versions; so the flows create no selling pressure. CITs have less transparency, and a different regulatory framework that enables them to charge a little less. But money flowing from a strategy's open-end format to its CIT would simply work as an in-kind transfer with no selling required. Also, some of these big funds would be better off if they were a little smaller. That means there's little flow impact, but the funds do still have to deal with asset bloat based on the total amount they run, regardless of whether it is in five vehicles or one.

For American Funds EuroPacific Growth, it's a more challenging position because foreign markets are less liquid, and it's an absolutely giant fund.

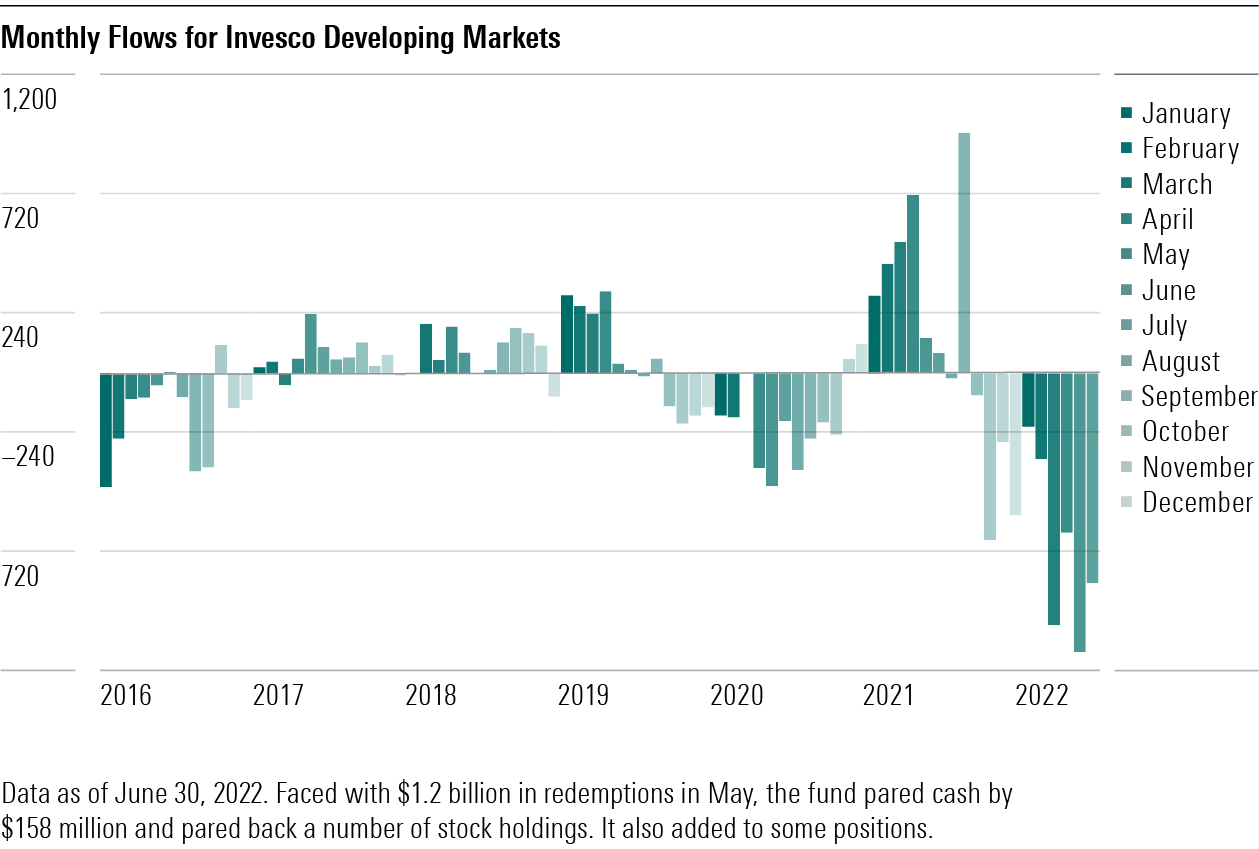

Things get more interesting at the fourth position on our list. Invesco Developing Markets ODMAX has seen $4 billion in outflows this year on a $29 billion asset base. Emerging markets have less liquidity than the United States and the major markets in Europe and Asia. From a liquidity perspective, the fund is in the bottom decile versus all equity funds and emerging-markets funds. In other words, it's vulnerable to big outflows.

Source: Morningstar.

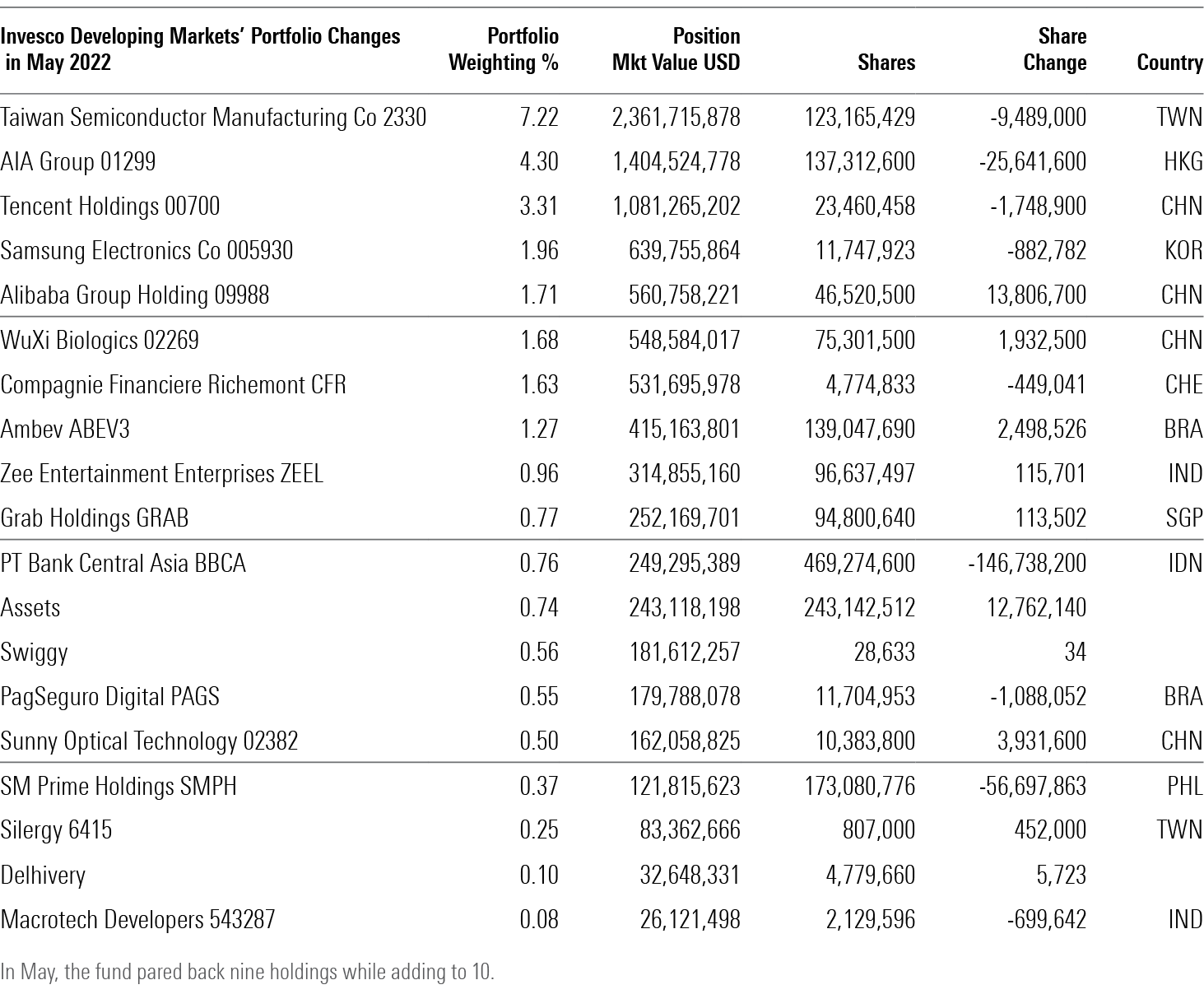

The fund has lost significantly more than its peers in 2021 and so far in 2022. That's largely due to Justin Leverenz's growth style rather than outflows. However, it might well be the case that the recent surge in outflows is adding fuel to the fire. The fund's hefty positions in Chinese and Indian names likely pose challenges amid outflows. In addition, the fund had a once-sizable stake in Russian companies, which cannot be traded at all. Besides managing outflows, a fund like this can paint itself into a corner by selling the liquid names, leaving it with an even greater stake in illiquid ones. But as the most recent portfolio changes show, the fund is still able to add to positions like usual and doesn't seem to have reached an extreme stress point.

Source: Morningstar.

The rest of the top 10 in outflows are large-cap funds for which the outflows shouldn't be too much of a problem.

How do inflows impact a liquidity-constrained strategy? It has more options than do one facing outflows. Managers can reduce the trading costs of putting those inflows to work by watering down their favorite names and buying more stocks than they would otherwise. Or they can build cash, use futures, or buy ETFs. All reduce trading costs but depart from the strategy that added value in the past. These options also have the benefit of making it easier to handle future drawdowns.

Or the managers can do what they've always done but accept that trading costs will increase as they push up their purchase prices as their ownership weights increase. But they are building future liquidity headaches should they get redemptions (or decide to rotate into different assets) at a later date.

Among our 10 funds with the highest inflows, two stand out. David Samra's Artisan International Value ARTKX has taken in $2 billion in 2022 and $4 billion over the past 12 months. The fund closed to new investors in June 2021, but that didn't stop inflows. That was the third time that Samra and Artisan had closed the fund, so clearly they are willing to slow inflows to preserve the integrity of the strategy. However, because the all-cap fund includes some smaller companies, its $22 billion asset base lands in the most liquidity-challenged decile of peers and overall. I hope that closing it will help flows taper off in the second half.

American Funds Smallcap World SMCWX has taken in $2.3 billion so far this year and $4.2 billion the past 12 months. With $69 billion in small caps, the fund can look pretty bloated. It ranks in the top 5% for liquidity challenges among peers and overall. Foreign small caps tend to have less liquidity than U.S. small caps. Capital Group handles this by having an array of independent managers and groups of analysts run sleeves of the portfolio. That helps, but the same groups of analysts are feeding ideas to the same managers, so there are clearly some bottlenecks. Moreover, it's very rare for American Funds to close a fund to new investors.

Given the diffuse portfolio at this fund, it doesn't look like a potential blowup. Rather, it's size is more of an anchor that will modestly curtail alpha over time.

Liquidity-Constrained Funds

Now let's look at funds with liquidity constraints that would make management challenging day to day whether they are getting inflows or outflows.

One of the most liquidity-constrained portfolios is the hefty Fidelity Low-Priced Stock FLPSX. Fitting $24 billion into a small/mid-cap strategy is no easy feat. Managing a portfolio with such large ownership weights in so many underlying names carries a high degree of risk. Manager Joel Tillinghast has been up to the challenge, thanks in part to his unique ability to analyze and remember hundreds of stocks. Tillinghast, however, has announced his retirement, and Fidelity is wisely having two seasoned investors take his place. Even with two at the helm, running this portfolio will be a real challenge, and it's possible shareholders will exit, forcing the new pair to contend with outflows.

Lazard Global Listed Infrastructure GLFOX has a problem. There aren't that many publicly traded infrastructure stocks. It has $14 billion to fit into a 28-stock portfolio. That's awfully cozy. The fund is in the tightest decile of its Morningstar Category and broad fund group. The managers have stuck to their strategy, which is good, but it does come at the price of greater trading costs.

Matthews India MINDX and Matthews Asia Dividend MAPIX are not that big at $600 million and $2.9 billion, respectively. But they invest in markets that are not so liquid. On the plus side, Matthews has shown a willingness to close funds, so I'm confident that the firm won't let things get out of hand.

American Funds EuroPacific Growth, one of the funds with the largest outflows, also is on the list of liquidity-constrained funds. Unlike most of the funds on this list, this one invests in a very deep pond, but even that has its limits. Investing $136 billion in the large caps of Europe and Asia is no easy task, even for a deep team like this one.

The closed T. Rowe Price International Discovery PRIDX is another example of limited liquidity in foreign markets. The fund is closed and spread out over more than 200 names. Yet, here it is on the list of most liquidity challenged.

Royce Small-Cap Special Equity RYSEX is a bit of a surprise. I know Charlie Dreifus' quest for cheap stocks and clean balance sheets leads him to smaller, less well-known names, but it's still surprising to see the fund here now that it is less than $1 billion. Royce has closed the fund in the past, so I’m confident the fund won't lose its character even if it enjoys a spurt of popularity.

Conclusion

The best fund companies design their funds with liquidity challenges in mind and are willing to close them when necessary. That’s something to keep in mind when shopping for small-cap and emerging-markets funds.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)