Equities Start Month in Deeply Undervalued Territory After Latest Pullback

We expect sluggish economic growth and low inflation to provide the Fed with enough room to begin loosening monetary policy.

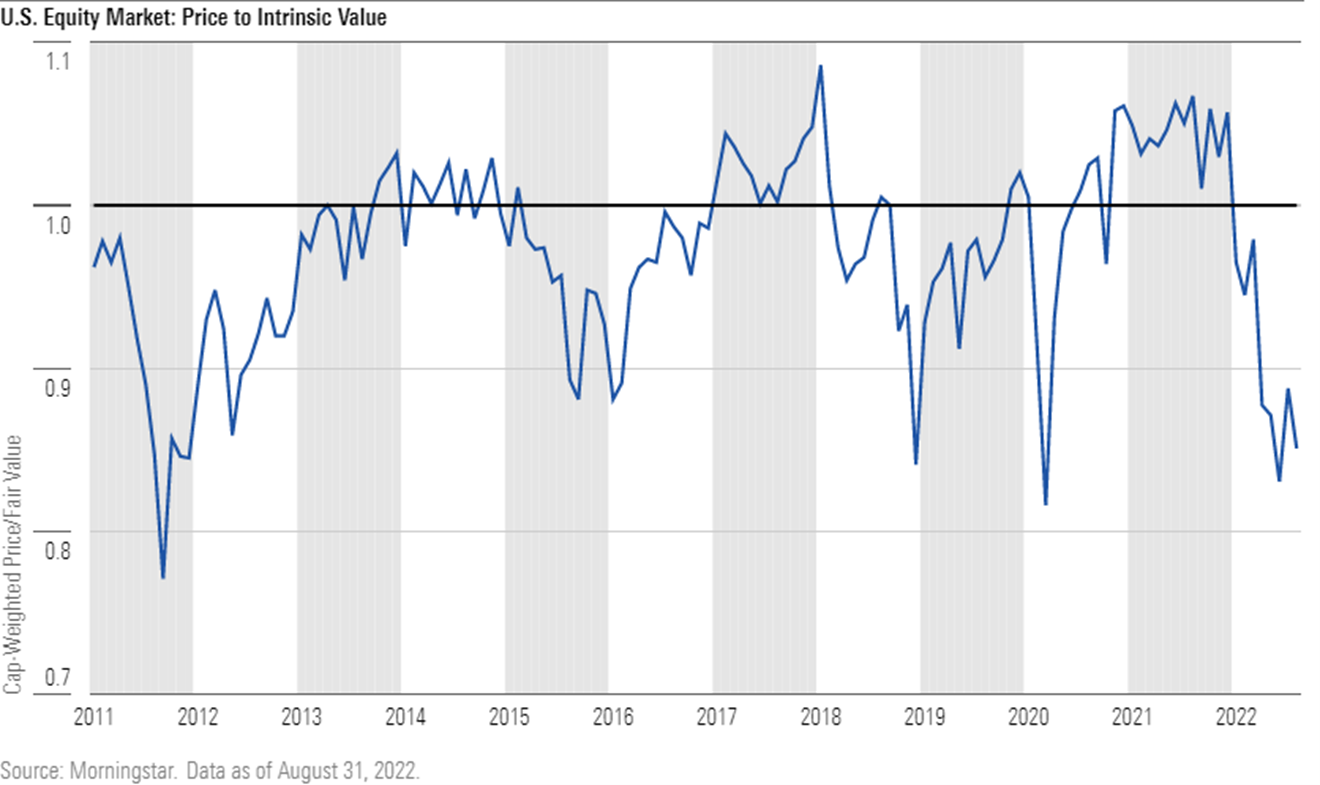

Stocks started September trading closer to their decade lows after falling deeper into undervalued territory at the end of August.

Equities are now trading 15% below our fair value estimate, an even greater discount than the 11% they were at to the end of July. Prices initially rose after better-than-expected news around second-quarter earnings but ended the month in retreat following a hawkish speech on inflation from Federal Reserve Chairman Jerome Powell at the Jackson Hole Economic Symposium.

Four Key Takeaways for the Stock Market Today

- Equities are trading at a 15% discount to our fair value estimate following the latest pullback in prices.

- Stocks are pricing in the federal-funds rate to be higher for longer following Powell's comments.

- Liquidity could become more constrained as the Fed's balance-sheet roll-off is set to double to $95 billion.

- Our updated economic outlook for 2023: We expect sluggish economic growth and low inflation to provide the Fed with enough room to begin loosening monetary policy.

U.S. Stock Market at 15% Discount to Fair Value

Equity markets started August on a positive tone as earnings were better than feared. Yet, even more importantly, while management teams were cautious regarding their outlooks for the second half, they did not throw in the towel and make large-scale cuts to guidance. This was enough to send stocks higher until the market ran out of steam by the middle of the month. Stocks then gave back much of their earlier gains, which accelerated following Powell's remarks.

Typically, most commentary from Fed officials focuses on the balance that the central bank tries to strike between its dual mandate of maintaining price stability and maximizing job growth. However, Powell was surprisingly blunt in commentary that was singularly focused on reducing inflation.

He noted that tightening monetary policy will damp economic activity and hamper the job market. Within his speech several comments stood out. To combat inflation, “it is likely to require a sustained period of below-trend growth” and that in prior bouts of high inflation, “a lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation.’’

That caused markets to begin pricing in a heightened probability that the federal-funds rate will remain higher for longer than expected, which would result in weaker economic and earnings growth.

Following this pullback, according to a composite of the approximately 700 stocks we cover that trade in the United States, we see the market trading at a 15% discount to our fair value estimate. While this doesn’t bring the market all the way back toward its decade lows, it remains at a discount that the market has rarely traded at for very long over the past decade.

Morningstar’s chief U.S. economist recently published an updated economic outlook. We slightly reduced our forecast for real gross domestic product growth to 1.8% in 2022. Considering real GDP growth was negative in the first and second quarters, this projection assumes it will average an almost 3% annualized run rate over the second half of the year. For 2023, we expect that the impact of the Fed’s monetary tightening will take hold and that real GDP growth will slow to 1.2%.

We maintained our projection that inflation has already peaked and will moderate over the second half of 2022. As the economy slows in 2023 and supply constraints evaporate, we forecast inflation will drop to 2.1% next year. As such, the combination of weaker economic growth and low inflation will provide the Fed the room it will need to begin easing monetary policy in 2023.

Stocks Fall Into Undervalued Territory

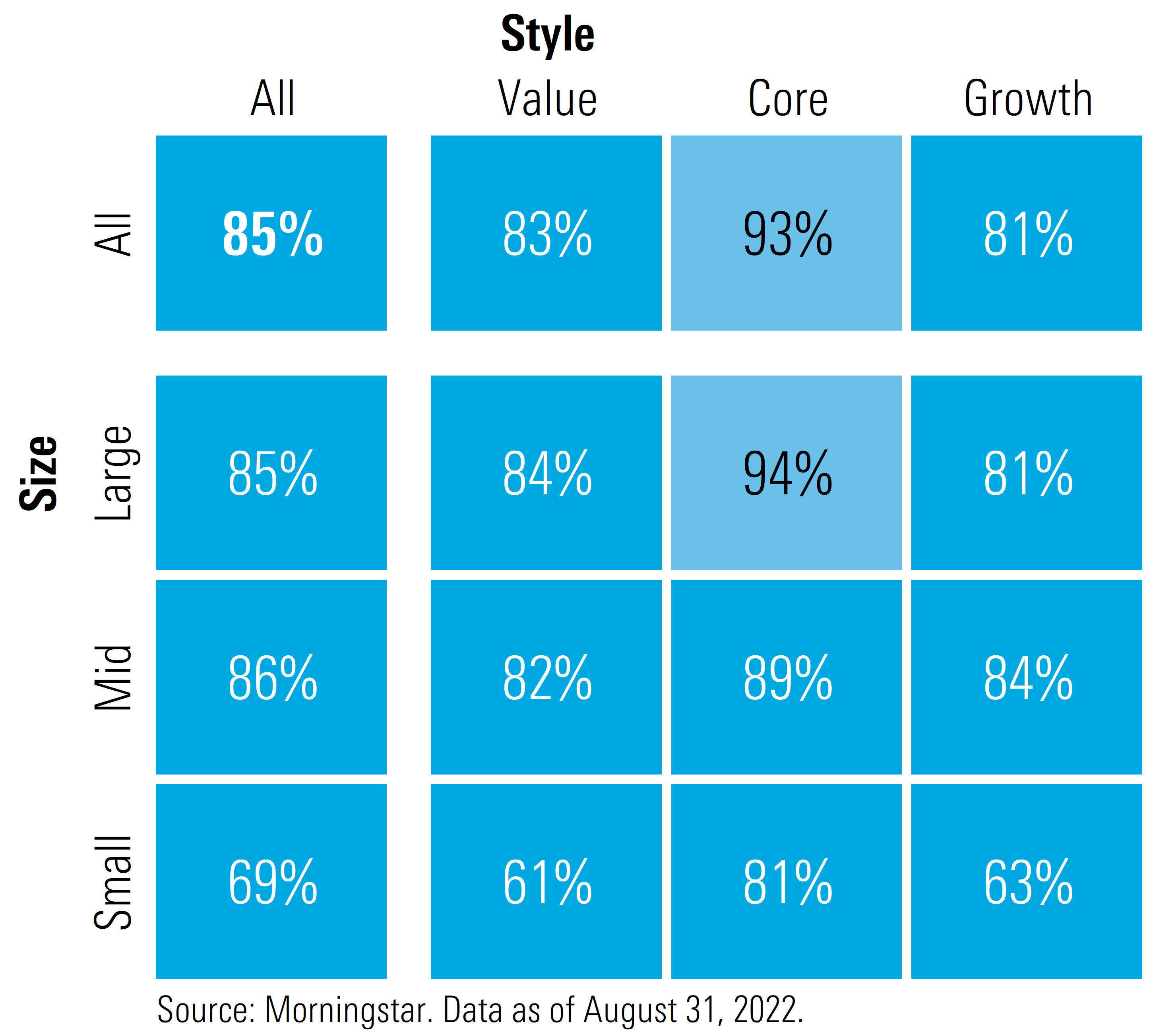

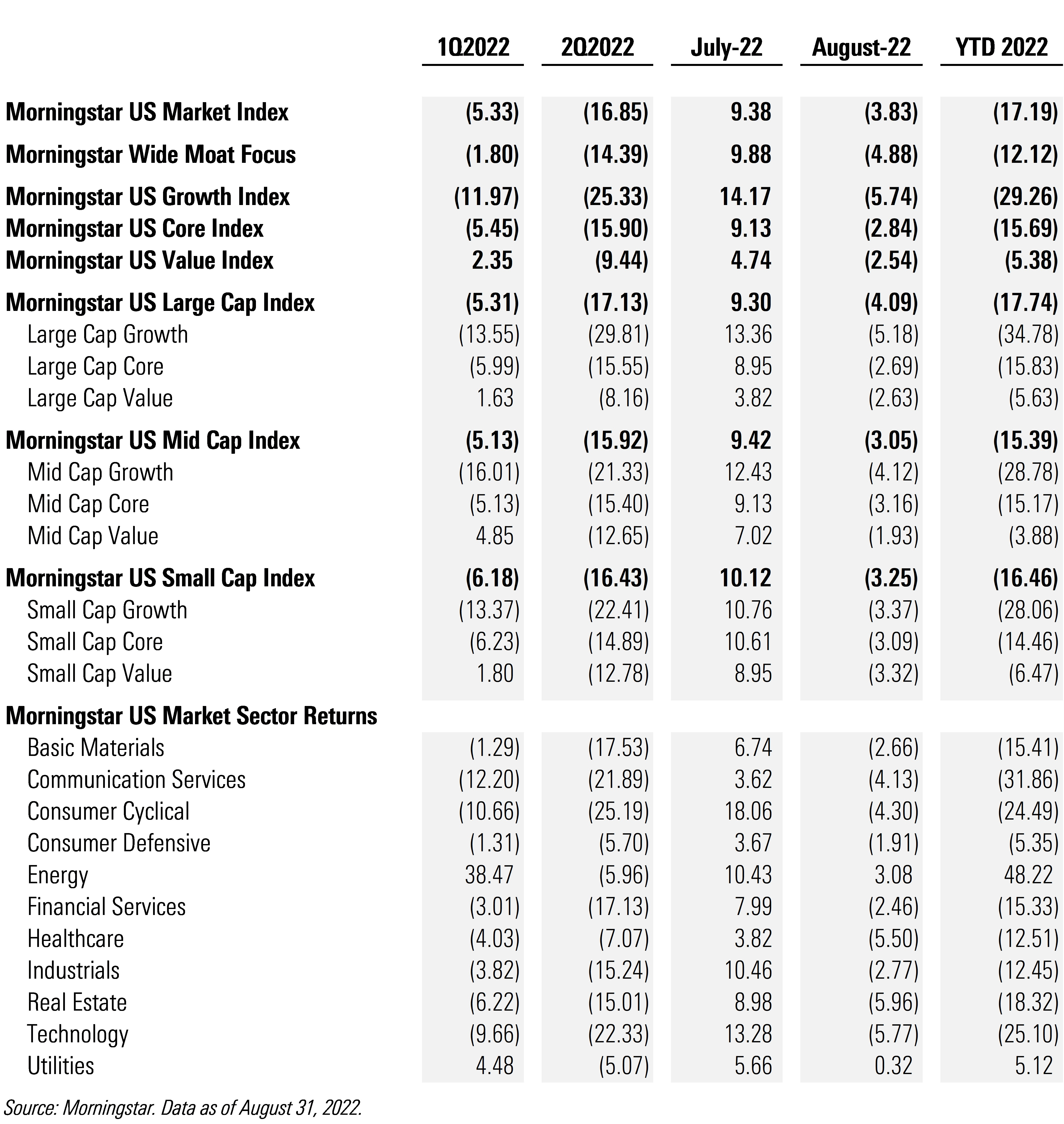

Growth stocks suffered the worst losses during August, dropping 5.74%, whereas value and core/blend stocks fell just 2.54% and 2.84%, respectively. By market capitalization, large-cap stocks fell the most at 4.09%, with mid- and small-cap stocks down 3.05% and 3.25%, respectively.

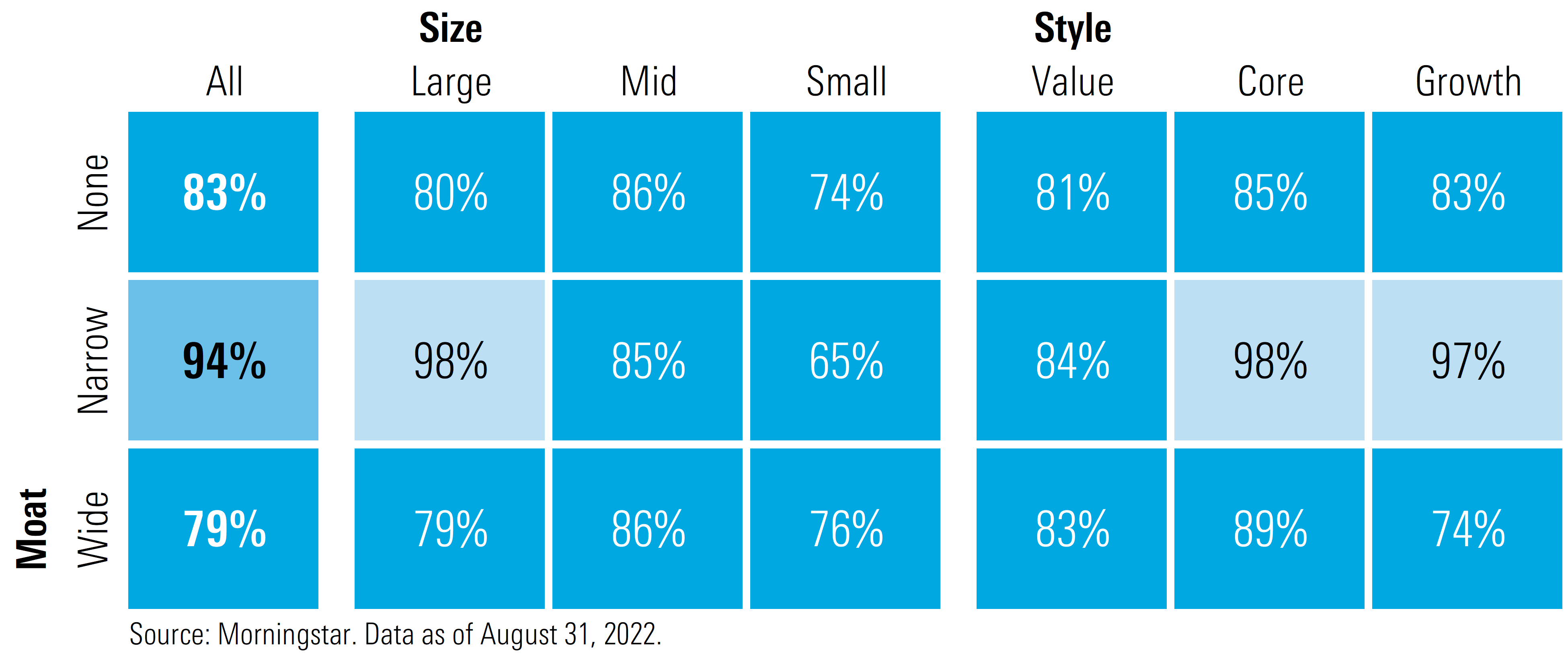

According to our valuations, both the growth and value Morningstar Categories are more attractive on a relative value basis than core. By market cap, deep value can be found in the small-cap space, especially in the value and growth categories.

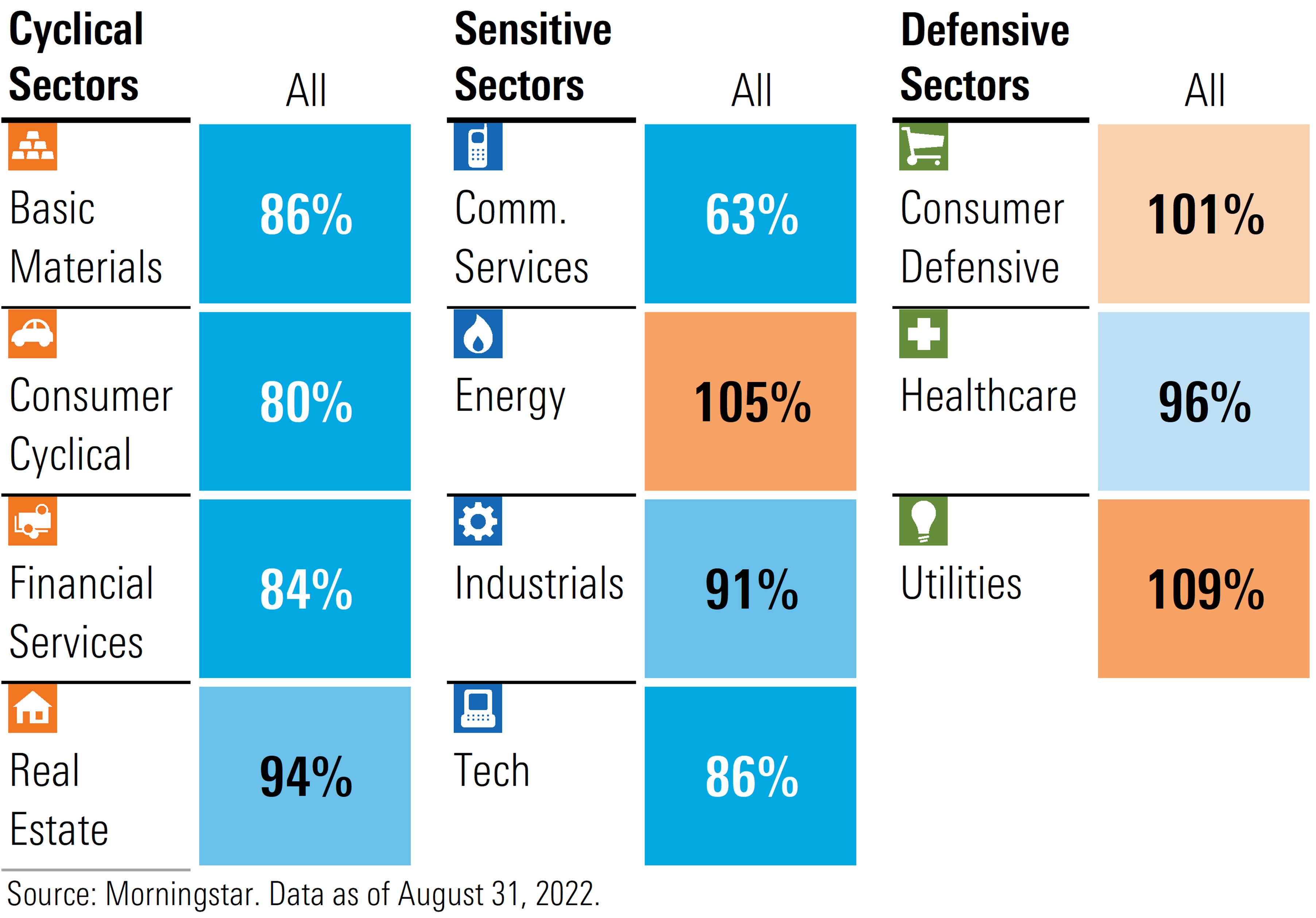

Cyclicals, Economically Sensitive Sectors Most Undervalued

With investors concerned that rates will stay higher for longer and the economy looking weak next year, growth stocks pulled back the most over the past few weeks. However, in many cases, we think the market is being overly pessimistic and extrapolating short-term weakness too far into the future. Those sectors that are the most economically sensitive have some of the most attractive valuations. The communications sector, which is skewed by Meta Platforms META and Alphabet GOOGL, is by far the most undervalued.

Defensive sectors have held their value better to the downside, but we think investors are paying too high a price for many of these stocks. In particular, the utilities sector has risen 5.12% this year, resulting in the sector trading at a 9% premium above our fair value. While we expect inflation to moderate, this is the sector that would be hit the hardest if inflation were to remain hotter for longer.

Energy was the most undervalued sector coming into 2022 and has moved higher. In the year to date, the Morningstar US Energy Index has risen 48.22%. Although oil prices have gone up, we have held our midcycle oil price forecast steady at $55.00 per barrel for West Texas Intermediate crude. According to our valuations, we think the energy sector is trading at a 5% premium over a composite of our fair value estimates.

Stocks With Wide Economic Moats Deeply Undervalued

Companies that have wide Morningstar Economic Moat Ratings are those that we forecast will be able to generate returns on invested capital well in excess of their weighted average cost of capital for at least the next 20 years. To keep rivals from eating into those returns, these companies must have durable, long-term competitive advantages that can withstand the stress of competition. According to our valuations, the market is undervaluing these advantages, and we see a significant amount of value for long-term investors in wide-moat stocks.

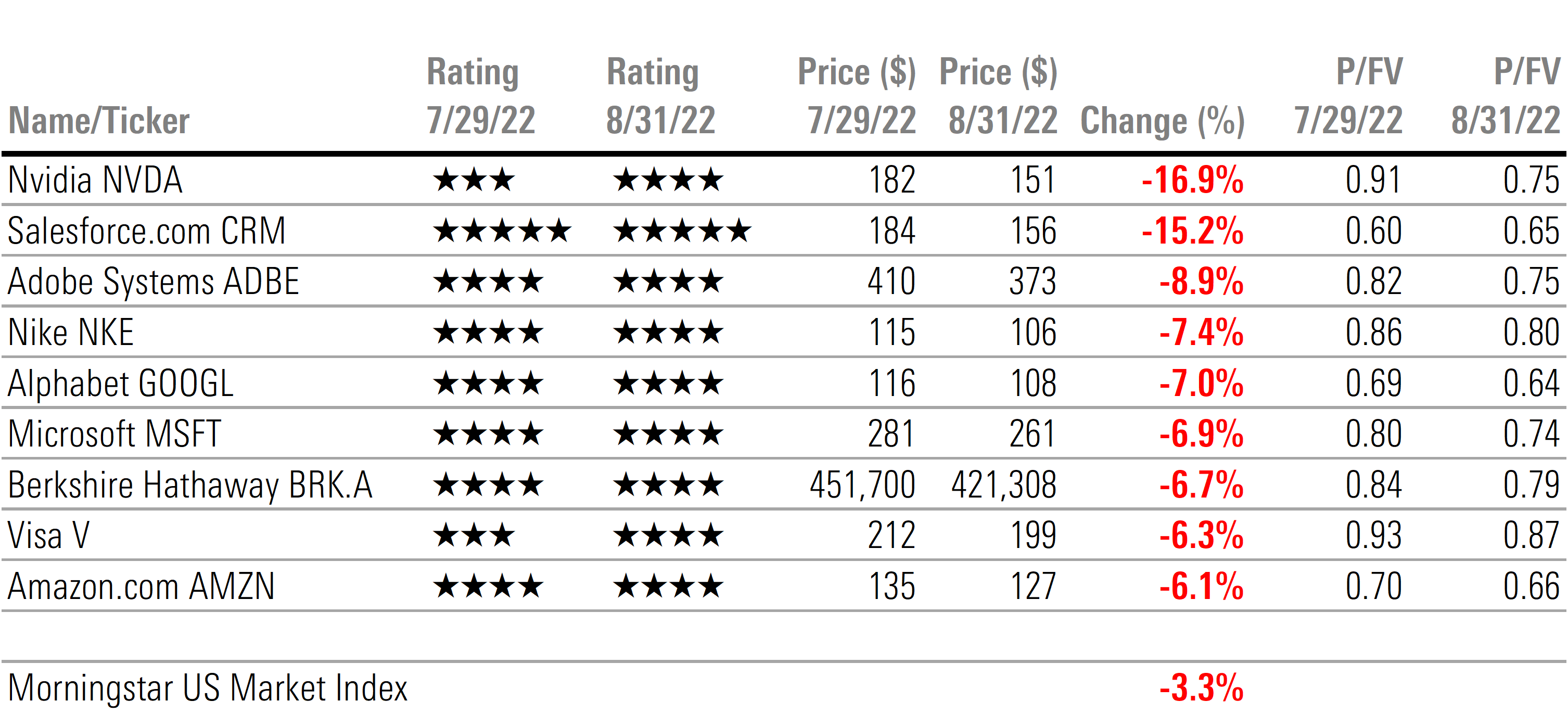

Wide-Moat Stocks With the Largest Price Drops in August

As we have seen in other pullbacks this year, wide-moat stocks have fallen more than the broader market. In August, the wide-moat stocks that sold off the most were mainly large-cap growth companies, which had fallen out of favor.

In August, Morningstar’s Wide Moat Composite Index dropped 5.00% versus the Morningstar US Market Index, which fell 3.83%. As a result, wide-moat stocks have become even more undervalued compared with the rest of the market. The wide-moat stocks with the greatest price drops are listed below.

The Four Headwinds Begin to Abate

In our outlook for 2022 we noted that coming into the year the market was overvalued and there were four main headwinds the market will have to contend with: slowing rate of economic growth, tightening monetary policy, rising interest rates, and inflation running hot.

With less than four months left in the year, we think the headwinds that were a cause of concern for us are beginning to abate:

- Economic growth: Average real GDP forecast is 1.8% for 2022, which means we need to see an average annualized growth rate of 3% for the remainder of this year.

- Tightening monetary policy: We expect the Fed will stop raising interest rates by the end of the year.

- Rising interest rates: We think most of the interest-rate increases in the long end of the curve have already occurred.

- Inflation: We see inflation as having already peaked, and it will moderate for the rest of 2022.

Over the next few months, volatility will remain high. The markets will be closely watching economic and inflationary metrics. Any sign of further economic weakening and/or that inflation will remain hotter for longer would likely put renewed downward pressure on stocks, whereas signs that economic activity is picking up and inflation is cooling will propel markets higher.

We continue to view the broad U.S. equity market as materially undervalued but fully expect that even at the current level of undervaluation, long-term investors should brace themselves and expect volatility to continue over the next several months.

Risks to Market Outlook

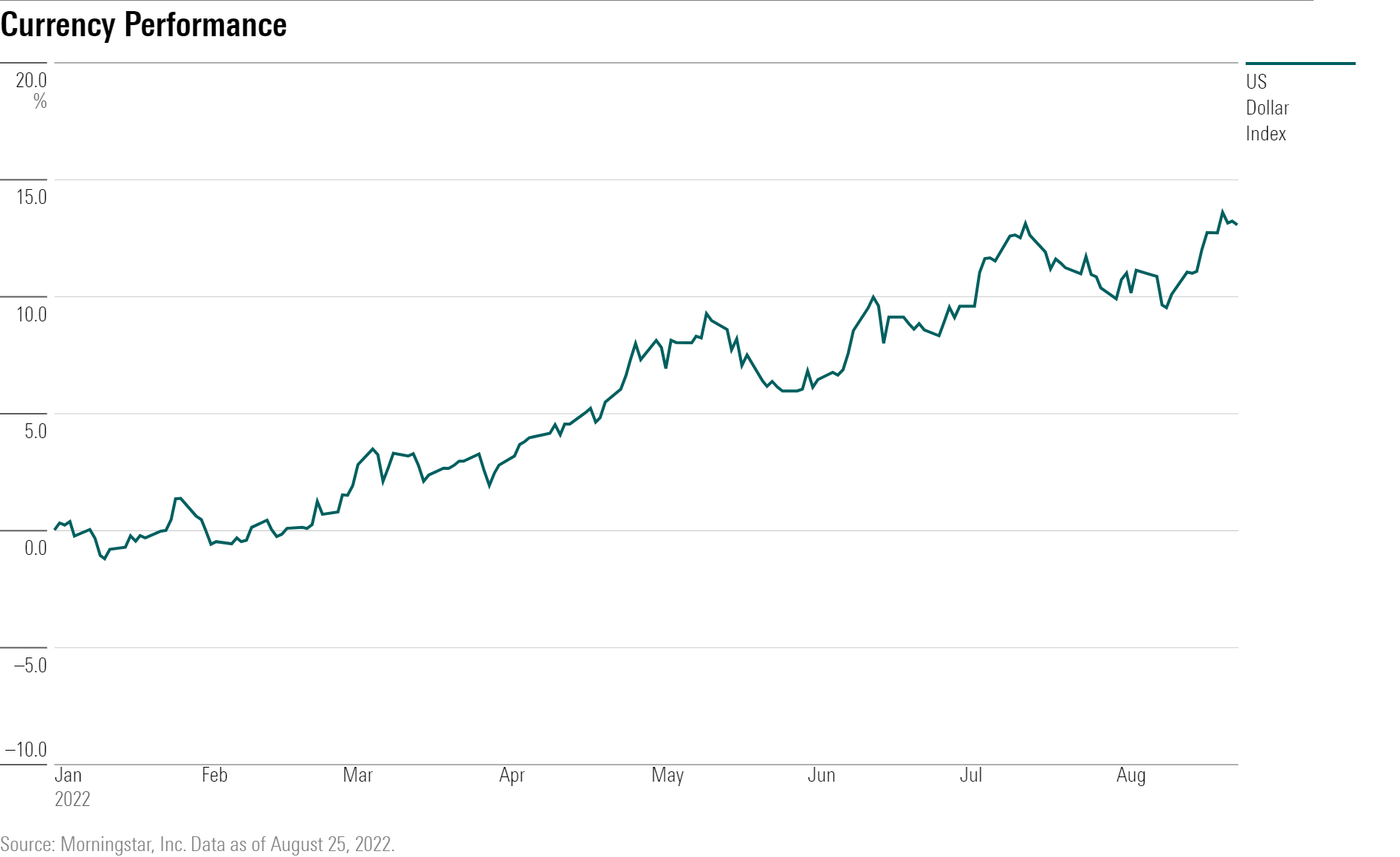

While the headwinds may be starting to abate, we are keeping an eye on other emerging risks. For example, the appreciation of the U.S dollar compared with other currencies will be a drag on on third-quarter earnings growth for companies with a high percentage of international sales.

While appreciation of the dollar will result in lower short-term earnings growth, that in of itself typically won’t have a meaningful effect on long-term intrinsic valuation. However, the key for investors will be to discern which of those companies will not see a material effect on their moats from the rising dollar, and which will see a decrease in their underlying business fundamentals.

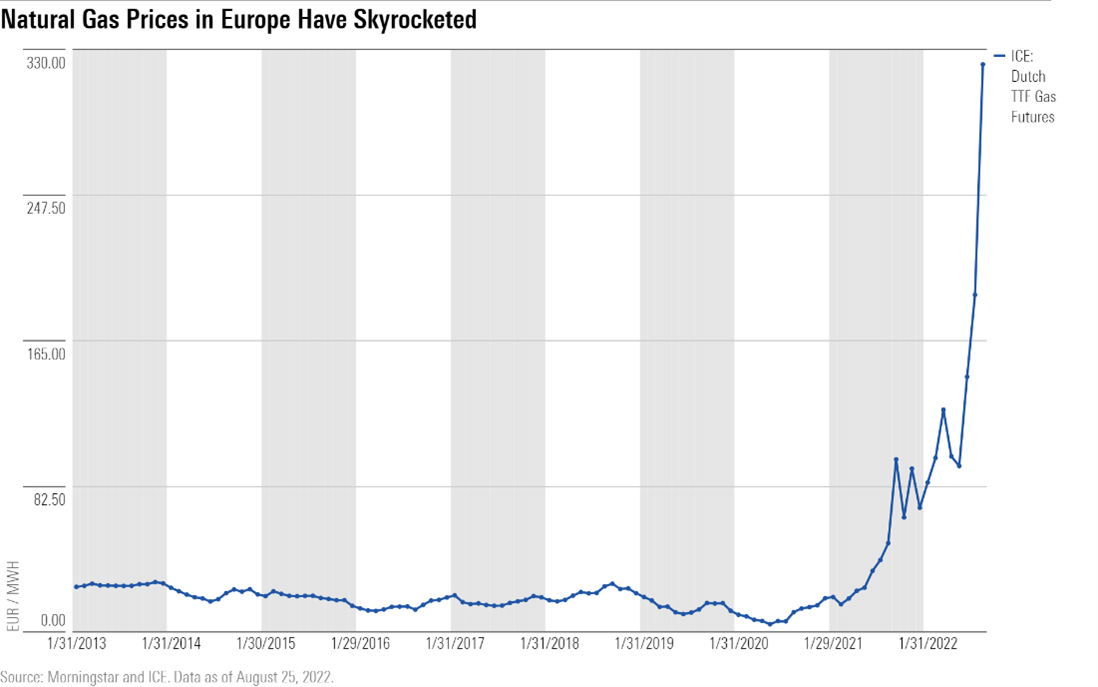

The outlook for Europe appears particularly daunting, as surging energy prices are likely to wreak havoc across the region.

As the conflict in Ukraine drags into its seventh month, price increases, particularly for natural gas, are expected to have an outsize negative impact on industrial production, especially in Germany. It will also disproportionately affect lower-income consumers, who have less of an ability to absorb higher heating costs.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)